ilkercelik/E+ via Getty Images

Is DocuSign Doing a Lot of the Right Things?

It’s been a rocky year for DocuSign, Inc. (NASDAQ:DOCU) and shareholders. The electronic signature and contract lifecycle management (“CLM”) leader dumped former CEO Dan Springer in the middle of Q2 FY ‘23, following a collapse in the shares that began back in 2021.

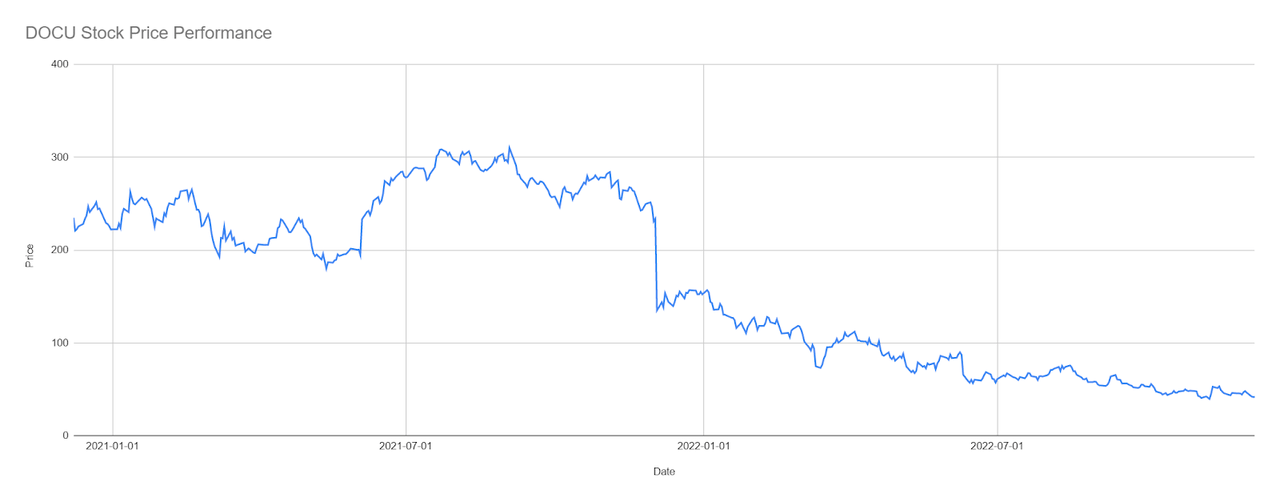

Figure 1: DOCU Stock Price Performance (Yves Sukhu)

Notes:

-

Data as of market close December 7, 2022.

Prior to today’s Q3 FY ‘23 earnings results, which have sent shares nearly 11% higher in after-hours trading as I write this and which I’ll get to in a moment, many DOCU investors have seen their long positions decimated year-to-date (“YTD”).

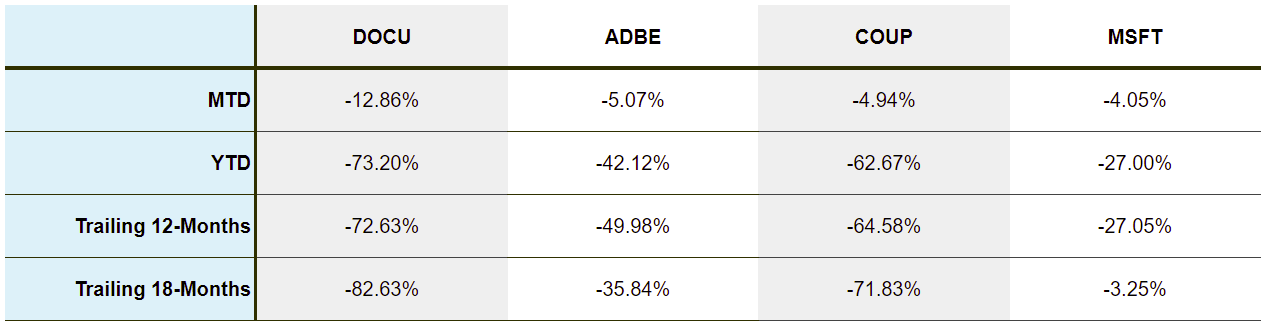

Figure 2: DOCU and Selected Competitor Performance (Yves Sukhu)

Notes:

-

Data as of market close December 7, 2022.

With new CEO, and former Google advertising executive, Allan Thygesen taking the helm in September, DOCU is obviously hoping to change the direction of the company.

If Q3 FY ‘23 earnings results are any indication, management is doing a lot of the right things to get the business back on track. Here are a handful of highlights from today’s earnings call:

-

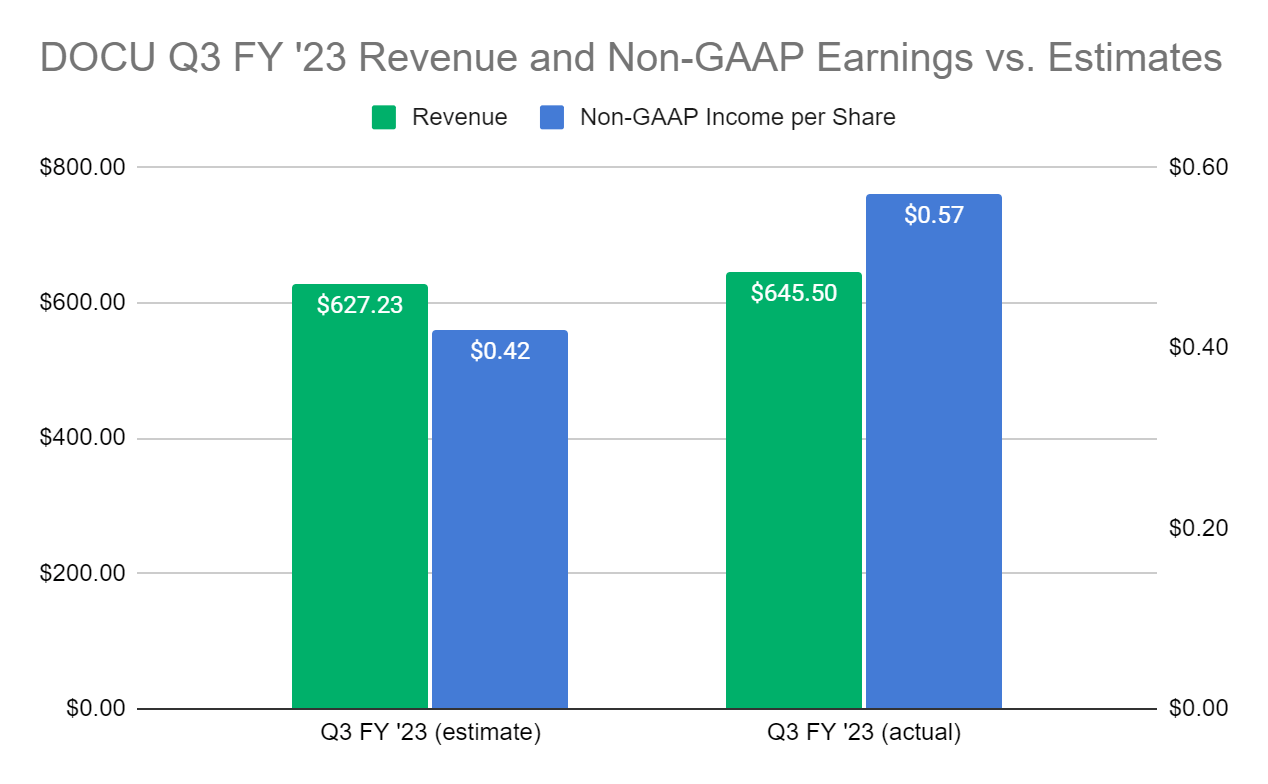

Total revenue of $645.5M, increasing 18% growth versus the prior period. Professional services revenue was ~3% of total sales at $21.4M, but increased 27% YoY. Subscription revenue, which also grew 18% versus the prior period, grew to $624.1M. Sales performance was impacted slightly with currency effects introducing a ~(200 bps) headwind. For comparison, total revenue in Q2 FY ‘23 stood at $622M, reflecting 22% YoY growth.

-

Billings increased 17% YoY to $659.4M. For comparison, billings growth in Q3 FY ‘22 was 28%.

-

Non-GAAP net income came in at $0.57/share. Non-GAAP net income in the prior period was $0.58/share. GAAP net loss was ($0.15)/share versus ($0.03) in Q3 FY ‘22.

-

42,000 new customers. DOCU ended Q3 FY ‘23 with 1.32M total customers. For comparison, the firm added 44,000 new customers in Q2 FY ‘23, exiting that quarter with 1.28M total customers.

-

1,052 customers with annualized contract value (“ACV”) of $300K+. DOCU’s high-value customer bucket grew 34% YoY.

-

Net retention rate (“NRR”) of 108%. For comparison, NRR in Q2 FY ‘23 was 110%.

Overall, it was a nice performance from the business, which beat on both lines.

Figure 3: DOCU Q3 FY ‘23 Performance versus Estimates (Yves Sukhu/Seeking Alpha)

Notes:

-

Revenue and earnings estimate data from Seeking Alpha.

-

Revenue in $millions.

Management also articulated some of the steps they are taking to improve the business and create shareholder value including:

-

Improved focus on strategic deals, namely customer workflows running on DocuSign Agreement Cloud, in part via a better-aligned-to-the-market sales team.

-

Cost containment, including the possibility of additional “tactical” layoffs in certain parts of the organization following the firm’s broader layoff of ~9% of employees earlier in the year.

-

Continued share buybacks with CFO Cynthia Gaylor noting that DOCU “…[has] approximately $137 million in remaining buyback capacity.”

-

Enterprise-wide ERP implementation to better manage, streamline, and automate internal processes.

With Q3 FY ‘23 results in hand and Mr. Thygesen’s comment today that he “…didn’t join [DOCU] to run a low or mid-single-digit revenue company”, can long investors look forward to a substantial recovery in shares?

A Leader in a Good Market Heading into 2023

DocuSign has built itself a remarkable brand through its legacy in electronic signature technology with “…more than a billion users in over 180 countries.” Moreover, as they look to continue transforming the business into one that provides the software and underlying infrastructure to manage business workflows – namely contract-related workflows – they are recognized as a leader.

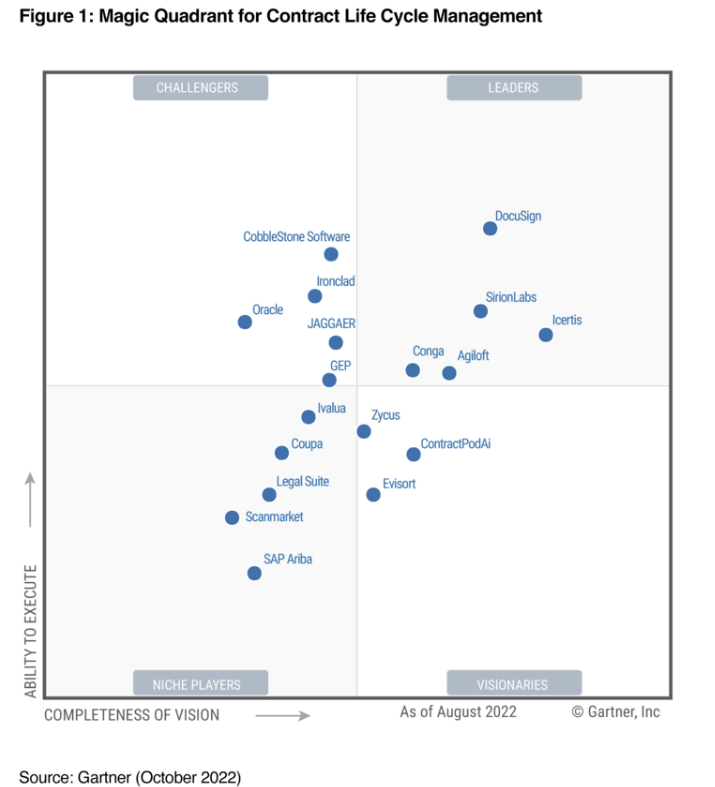

Figure 4: Gartner Magic Quadrant Contract Lifecycle Management Q4 2022 (Gartner)

I am struck by how low (relatively-speaking) Oracle (ORCL) and SAP (SAP) are ranked as compared to DOCU in Figure 4 – particularly SAP. ORCL and SAP each have their own business process management (“BPM”) solution sets. In fact, I sold ORCL’s BPM stack years ago, as well as the stacks for competitors. These technologies are very powerful; and can, in theory, do much of what DOCU does from a workflow management standpoint. But, the amount of required customization, and therefore investment, often makes them cost-prohibitive. I think all of this must speak to a certain “accessibility” of the DocuSign Agreement Cloud in the sense that customers are able to do quite a lot “out-of-the-box”.

If 2023 does indeed turn out to be a rough year economically speaking, it would seem DOCU is well positioned. If companies are going to invest their IT dollars, it would be logical for them to seek out solutions that will help them reduce costs by streamlining their businesses, eliminating manual processes, etc. The opposite side of the coin is equally valuable whereby any technologies that help them conduct business faster – i.e. to sell and capture customers faster – will make economic sense even during a downturn.

Further, DOCU’s unique customer diversification allows them to better absorb a downturn in a given customer segment. For example, if the transactional part of their business were to suffer – say, due to a severe downturn in the real estate market which readers know is one of DOCU’s key customer segments – they might compensate with increased spend among their mid-size and large enterprise customers.

Maybe 2023 could in fact be DOCU’s year…do I hear $300/share calling again?

Before You Backup Your Bulldozer to Scoop Up DOCU Shares

Management was quite clear on today’s call that they are seeing a slowdown in the market, echoing the dynamics seen by many other tech vendors. Ms. Gaylor specifically cited:

-

Smaller deal sizes.

-

Increased customer scrutiny over IT budgets and priorities.

-

Slowing rates of expansion with existing customers.

These conditions are reflected, in part, via DOCU’s NRR trend which dropped to 110% in Q2 FY ‘23 and 108% in Q3 FY ‘23 (as mentioned in the introduction), with both metrics below the firm’s historical range of 112% – 119%.

Still, and to management’s credit, they provided some broad FY ‘24 guidance during today’s earnings call:

-

Investors should expect a slower start to the FY ‘24 fiscal year.

-

High-single digit growth in revenue.

-

Low-single digit growth in billings.

-

Targeting 20% operating margin, thereby at the low-end of their 20% – 25% target range.

So, investors should not expect any kind of blowout performance in FY ‘24. Although, management could, of course, be setting the bar deliberately low; and guidance will be updated following Q1 FY ‘24 results.

Moreover, management’s forecast for Q4 FY ‘23 and the full-year is bullish, but not “out-of-this-world”.

-

Total Q4 FY ‘23 revenue is expected in the range of $637M to $641M in Q4, reflecting growth of ~10% YoY. Subscription revenue is expected between $624M to $628M during the fourth quarter representing growth of 11% versus the prior period.

-

Total FY ‘23 revenue is expected in the range of $2,493B to $2,497B reflecting growth of 18% to 19% YoY. Subscription revenue is expected between $2,423B to $2.427B for FY ’23, or growth of 19% YoY.

-

Billings for Q4 FY ‘23 are expected between $705M to $715M, reflecting growth of 5% to 7% YoY; and $2,626B to $2,636B for FY ’23, reflecting growth of 11% to 12% YoY.

Notably, management noted that Q3 FY ‘23 results were characterized by a number of early renewals which will impact billings growth in Q4.

So, despite today’s after-hours performance, it’s not all rosy. The following points consolidate the broad risks that I see near-term and long-term:

1. Tepid FY ‘24 outlook.

2. NRR has been trending down. Not only has NRR been trending down, now the business is heading into a fiscal year that is expected to be soft. Moreover, an idea was introduced during today’s earnings call that some DOCU customers who overbought during the pandemic (when it seemed as if everyone was going to be stuck working from home for a long time) may have reduced their licensing allowance, but may now present an opportunity for re-engagement. That dynamic, if it exists, is naturally bullish for the company. But, it is also possible that there is a pool – possibly a large pool – of customers who are still over-provisioned following the pandemic and may seek to reduce their licensing commitment in FY ‘24.

3. A new CEO = risk. Mr. Thygesen deserves a lot of credit for his candor and transparency during today’s call. That being said, any new executive introduces risk for shareholders. However, investors should at least consider his pedigree versus the task at hand. While his advertising-related experience at Google selling both to SMB and large enterprise may serve him well relating to DOCU’s diverse customer base, he does not have a background in the workflow management space. That’s certainly not to say he can’t succeed. But, if DOCU is looking to push more into the strategic workflow management/automation market, I do wonder why the Board was unwilling and/or unable to attract talent with experience closer to that space. It could be, arguing against myself, that the Board may have deliberately sought a leader with a fresh perspective.

4. No technologist on the leadership team. There are no “pure” technologists among DOCU’s senior leadership team which, personally, I see as a big red flag. Although, that may soon change…

5. Electronic signature technology may be becoming more and more of a commodity. DOCU pioneered the electronic signature market, but now finds itself competing head-on against Adobe (ADBE) and a host of smaller players. Management has already noted the lower-end of their market as being the most vulnerable suggesting that the transactional part of their business is wide open to disruption as it is probably not very difficult for a large swath of their customer base to switch to alternatives. That, naturally, puts more pressure on management to develop the workflow side of the business; but they have noted that will take some time. JPMorgan Chase (JPM) analyst Mark Murphy also remarked on today’s earnings call that “…Microsoft is conspicuously absent from this market in some ways in that perhaps they could end up offering [electronic signatures] as part of Office 365.” Now, he asked the question in the vein of this fact possibly presenting an opportunity to DOCU to work with Microsoft (MSFT), with whom DOCU established as an enterprise account in Q2 FY ‘23. However, MSFT must undoubtedly be perceived as a serious potential competitor were they to bring their own in-house electronic signature technology to market as part of the Office suite.

6. Sales & marketing expense will probably have to go higher. DOCU seems to be doing a better job in FY ‘23 managing their sales and marketing expense with a ratio to total sales of ~50% in both Q3 FY ‘23 and for the 9-months ended October 31, 2022. However, as the company tries to transform itself and push larger, more strategic sales, investors should expect the ratio to trend higher, pressuring profitability.

7. Professional services revenue is low implying low strategic adoption. As mentioned in the introduction, services revenue only comprised ~3% of total sales. As I’ve offered in other articles, services sales may be viewed as a proxy for management’s success closing strategic deals. In other words, the low percentage suggests they might have a lot of work to do. This is bolstered by management’s characterization of their high-value customers in a $300K+ ACV bucket. As readers know, most enterprise tech companies like to “brag” about their $1M+ ACV customer base and often provide the size of that metric, or even larger customer buckets, to investors. It would seem that DOCU does not have too many customers that exceed a $1M ACV which might be seen as a red flag.

If Gartner is right, DOCU has great technology in a good market that might be just what enterprise customers need in a bad economy. But, if my inferences are also right, they suggest the business may be a long way away from turning itself around which creates tremendous risk for long DOCU investors.

A Nagging Question

As I think about DOCU from 30,000 feet, it seems that they rightfully expanded to take advantage of the pandemic tailwinds that they enjoyed; but, this was done with limited focus on operational and strategic development of the business. As such, my take is that DOCU is in a bit of an operational mess at the moment.

The nagging question in my mind is:

How does this happen with a company that tells other companies (i.e. DOCU customers) that they need to be more operationally streamlined and automated? In other words, shouldn’t DOCU have been eating their own dog food over the last couple years?

I suppose I’ll have to leave the question unanswered for the moment. And, investors may be more interested to know that analysts generally recommend DOCU as a “hold”, inline with the average Seeking Alpha author rating.

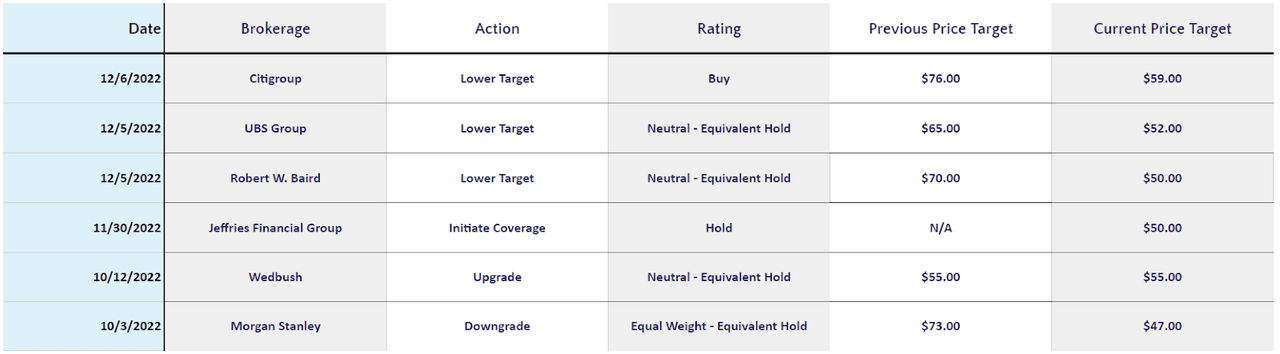

Figure 5: DOCU Selected Analyst Ratings (Yves Sukhu/MarketBeat)

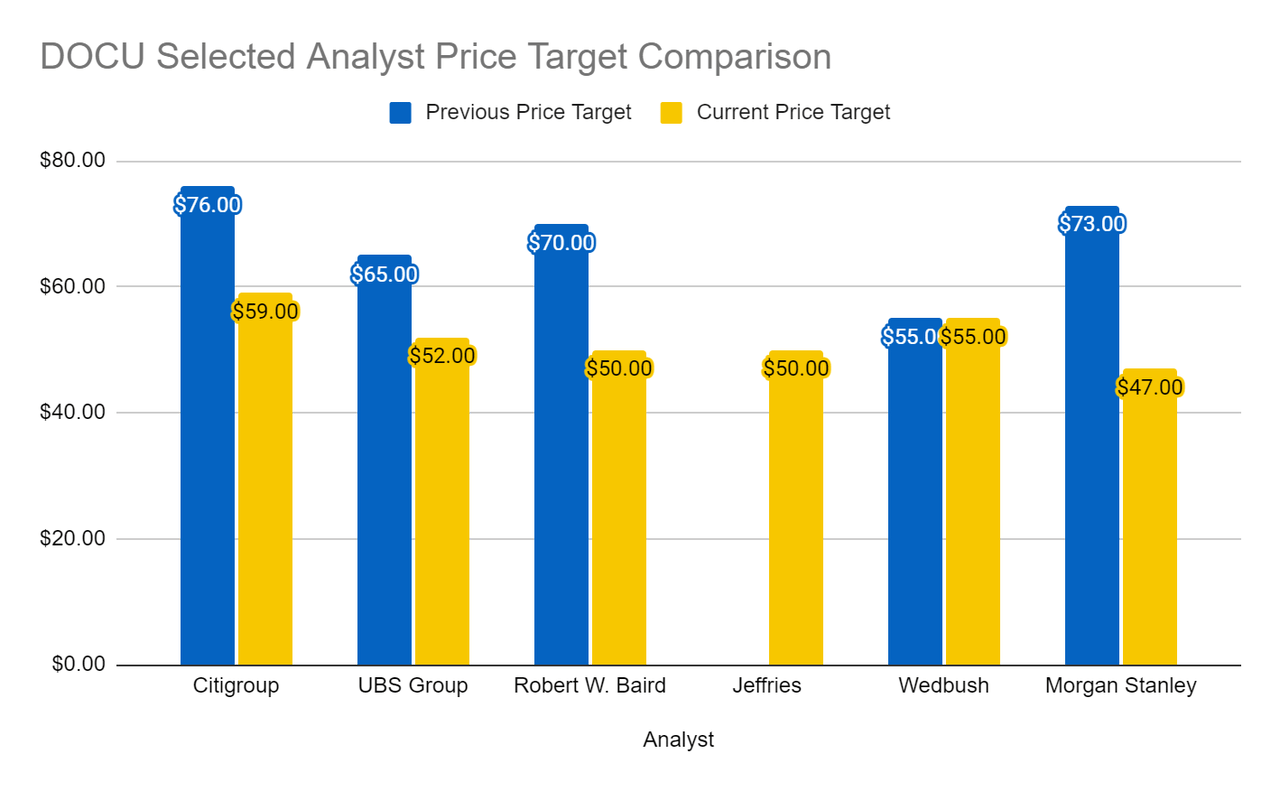

Notably, with the stock above $48/share in after-hours trading as I write this, it is not too far from the average of $52/share as reflected by the price targets of the 6 analysts I selected for inclusion in Figure 5 above. But, also keep in mind, many analysts have been lowering their targets.

Figure 6: DOCU Selected Analyst Price Target Comparison (Yves Sukhu/MarketBeat)

As I have experience within the BPM space, which might be considered an “umbrella” over the CLM space in some respects, I like where DOCU “is”. But, turnaround stories are always a risky bet. With anticipated softness in FY ‘24, I think shares are likely to give back what they have gained following the Q3 FY ‘23 earnings announcement. I recommend that investors sell.

Be the first to comment