syahrir maulana

Now might not seem like the best time to be considering small-cap companies.

After all, it was only last week when the markets were crashing and burning. And sure, we’ve had some intensely successful bullish moves since.

But who actually trusts those upturns?

If you want to see some serious amounts of skepticism, look no further than comments on sites like Yahoo Finance. One particular article that caught my attention there on Tuesday afternoon read “… Stocks soar as October relief rally intensifies.”

And here’s what just one person, “marty,” posted on it:

“This happened before starting on June 15 after the Fed raised its rate by 0.75 points. The long bonds began to rally and the 10-yr yield dropped from 3.48% to 2.6% as the equity markets rallied by some 17% until mid-August. The ‘hope’ was that the Fed would back off and begin to ‘pivot.’

“That was quashed by Powell at Jackson Hole on Aug. 26 and the market essentially began another sell-off leading to the Sept. 22 Fed rate hike of another 0.75 points and further hawkish Powell comments. The 10-yr actually touched 4%, its highest point in 15 years before backing down once again as the ‘pundits’ have come out in force egging on the Fed to ‘pivot.’

“So we have the employment numbers on Friday… another inflation report next week, then one more employment report before the Nov. 8-9 Fed mtg. Look for continued tug-of-war action in the weeks ahead.”

I couldn’t have summed up the situation better myself.

Not the Peppiest of Sentiments

Really, “marty” was one of the more optimistic of readers who commented on the article.

“Joe” wrote, “Since March 2009, the only thing that matters is Fed failure, i.e. money printing. This rally is an oversold bounce. We saw the same thing in Q4 2008… and each bounce was dumped hard.”

In case he didn’t make himself clear enough there, he added, “We are in a recession. Inflation hasn’t stopped soaring even with gas prices dropping.”

So, not the happiest outlook on the markets. Neither was Miami Rebound, who wrote, “Yeah, this is a temporary bounce based on emotion.” Or James, who really went full bear with:

“If you aren’t already into cash, now is the time to sell. The only stocks I hold are longer-term dividend stocks that I am not playing the up and downs trying to time the market, I got into cash early. I may have missed some of the upside but I missed the downside as well, so I am way ahead. The worst is yet to come, if you are young and dollar cost average, ups and downs don’t matter so much, but if you are near retirement or in retirement get enough cash to last for a few years and some cash to put back in at the bottom, which this is not.”

I can’t say I’m that pessimistic. Not even close. After all, I’m writing this article. Just like I was writing articles on what to buy last week.

However, I do get the sentiment. There’s not a lot of macroeconomic analyses to feel peppy about these days.

These Small-Caps Could Be Promising Anyway

On the international stage – in the Very Much Affecting the Rest of the World category – China is still locking down entire cities whenever there’s a hint of Covid. And Russia and Ukraine are still at enormous odds.

Meanwhile, on the U.S. side of the equation, Florida just got hit by one of the most destructive hurricanes it’s ever faced. California is having to pay people to live there, offering inflation relief checks of up to $1,050.

Inflation across the entire country is still inexcusably, debilitatingly high. Supply chains remain disrupted. And tensions continue to rise in certain key employment areas of the economy.

The railroad strike, for instance, could still pop up again far too easily.

So why in the world am I talking about small-caps in this kind of environment? Am I crazy?

Sometimes, yes. But not in this regard. Because I’m not recommending just any old small-cap. As I’ve written before, this isn’t the time to get cute.

So no speculating allowed. Not on my watch.

But it could very well be the time to cash in on excellent opportunities that are priced incredibly low.

The three small-cap real estate investment trusts (REITs) I’m recommending below all have intensely high occupancy. They rent out to quality (or otherwise stable) tenants. And they’re well-placed to weather whatever storms are still coming our way.

I can’t guarantee that, of course. And I’m not saying any of them have hit their individual price-point bottoms. But…

Check out the details below, and tell me that you’re not at least a little interested…

Small Cap REIT #1: Alpine Income Property Trust (PINE)

Small-cap REITs, despite their size, can still pack a serious punch. So they’re worth holding in most pre-retirement portfolios.

Now, when someone mentions REITs as a category, the first thing in-the-know investors think of is Realty Income Corporation (O). And rightfully so. That company has been the gold standard in the net-lease REIT subsector especially for a while now.

However, Alpine Income Property Trust, Inc. – a small-cap opportunity – happens to share a lot of similarities with O and other high-quality net-lease REITs. It’s just that PINE has a market cap of $220 million, which is well below Realty Income’s $36 billion.

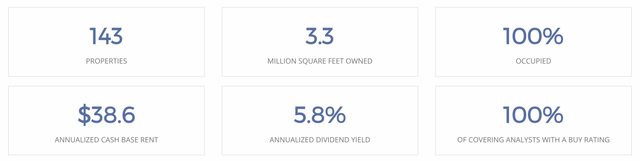

Alpine flashed onto the public markets only a few years back, debuting in the public markets in 2019. Its portfolio consists of 143 properties amounting to 3.3 million square feet. And, as of Q2, it boasted a 100% occupancy rate.

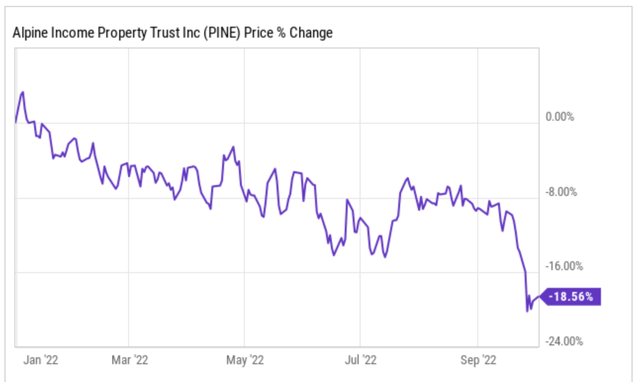

Year-to-date, shares are down nearly 20%, which isn’t surprising considering the larger market actions. Though, in Pine’s case, much of the pressure has come over the course of the past 30 days.

So let’s talk risk.

There’s no question that small-cap REITs could pose a lot of questions and concerns – especially if the economy falls into a recession. However, it could provide a lot of opportunity and upside… especially considering how management appears to be focusing on portfolio growth.

Moreover, as problematic as a recession would be, it could also set PINE up nicely for long-term success. In essence, a downturn would allow it to acquire even more properties at stronger cap rates.

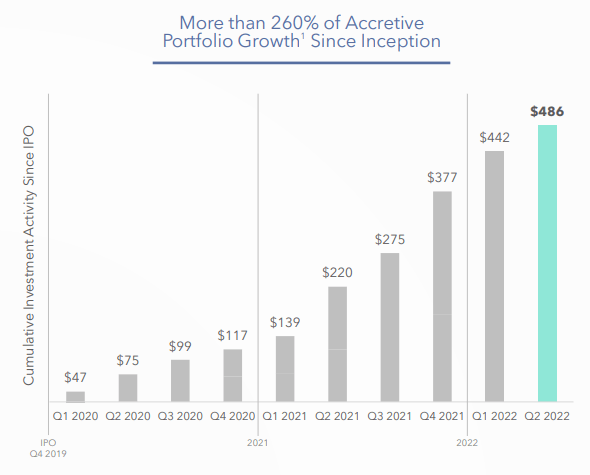

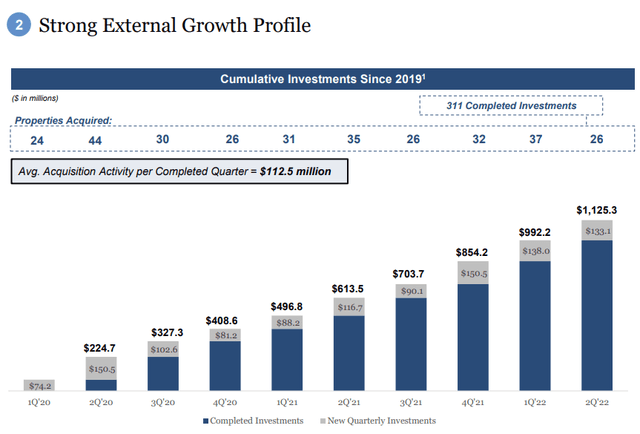

As-is, here’s a look at how its portfolio has grown over the years.

PINE Q2 Investor Presentation

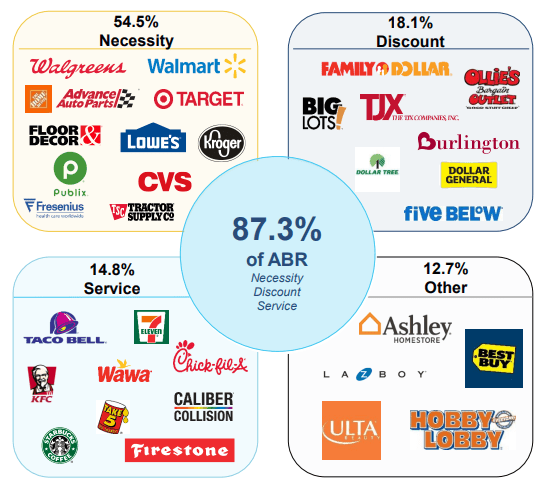

There’s also portfolio evolution that needs to be pointed out. At IPO, 43% of the company’s annualized base rent (ABR) came from office properties. Fast-forward to today, and that category doesn’t exist at all anymore.

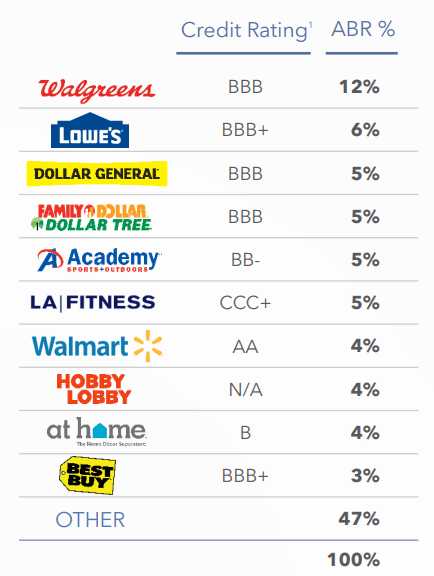

PINE has moved away from the asset type completely. Instead, here’s a look at its top tenants by ABR.

PINE Q2 Investor Presentation

Those companies – which are all well-established, investment-grade entities – make up 53% of ABR. Which brings me back to PINE’s similarities to some of its peers.

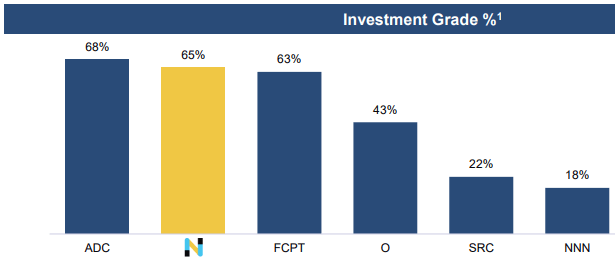

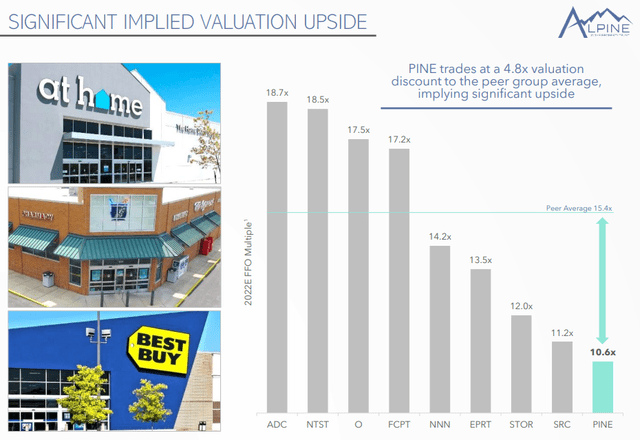

Check out the graphic below.

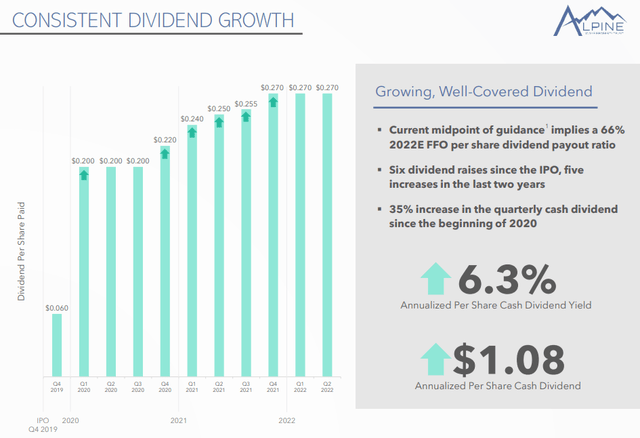

In terms of the dividend, PINE recently increased its dividend by 2% to an annual $1.10. This equates to a dividend yield of 6.8%.

That’s a dividend that keeps rising too. Six times in all since 2019, and in the face of shutdowns and slowdowns and other pandemic issues, too.

Naturally, due to its smaller size, the REIT trades at a discount to many of its competitors. But perhaps the size of that discount needs to be addressed…

Shares currently have a 10x price to adjusted funds from operations (p/AFFO). That’s much lower than Realty Income’s 17.5x, National Retail Properties’ (NNN) 14.2x, and STORE Capital’s (STOR) 12x.

As such, PINE does look intriguing, which is why iREIT on Alpha rates it a “Spec Buy.” If you’re willing to wait for the strategy to play out – and can handle any further volatility that comes its way – this could become a portfolio-boosting pick.

Small Cap REIT #2: NETSTREIT Corp. (NTST)

Next up is NETSTREIT Corp. Based in Dallas, Texas, it specializes in acquiring single-tenant net-lease retail properties nationwide.

The company currently has a market cap of $930 million.

NTST is led by seasoned commercial real estate executives who aim to generate consistent cash flows and dividends for its investors – despite its size. To accomplish that, it owns high-quality properties leased to e-commerce resistant tenants with healthy balance sheets.

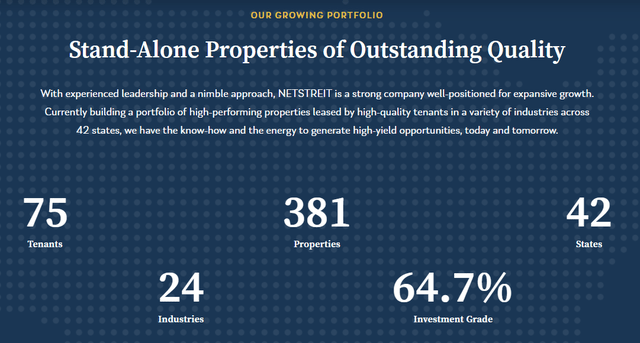

And it’s expanding that portfolio. Here’s a look at how NTST has continued to grow through acquisitions over the years.

At last check, it owns 381 properties leased out to 75 tenants across 42 states.

Similar to that of PINE, NTST boasts an occupancy rate of 100%. It even went public during a global pandemic but was still able to maintain that perfect number all the way through.

I want to go back to growth, though, because NTST is accomplishing that in a safe manner. Not only is it looking for high-quality properties, it’s also seeking some of the strongest tenants in the market today.

As a result, of the company’s entire annual base rent, over 80% comes from investment-grade businesses.

Here’s a look at how that compares to some of its peers…

NTST Q2 Investor Presentation

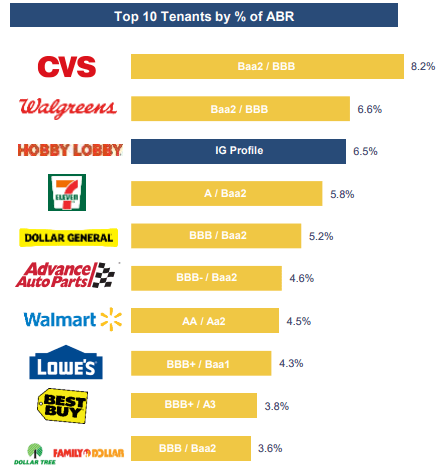

The portfolio – which has a weighted average remaining lease term of 9.5 years – is dominated by these top 10 tenants (by ABR):

NTST Q2 Investor Presentation

Once again, you’re seeing some definite similarities to PINE. So, yes, all the companies listed above are very stable businesses.

It’s a diverse list too, all told, with the following industry exposures:

- Drug stores and pharmacies: 14.9%

- Home improvement: 13.7%

- Discount retail: 9.3%

- Grocery: 9.3%

- Dollar stores: 8.8%.

I really like the makeup of this REIT given its defensive nature and less risk to the threat of e-commerce.

NTST Q2 Investor Presentation

NETSTREIT pays an annual dividend of $0.80, which amounts to a 4.5% yield. Admittedly, growth in that regard has been largely non-existent. But considering how new this REIT is and when it debuted, that’s fairly excusable.

For now. Rest assured, I’ll be monitoring the situation.

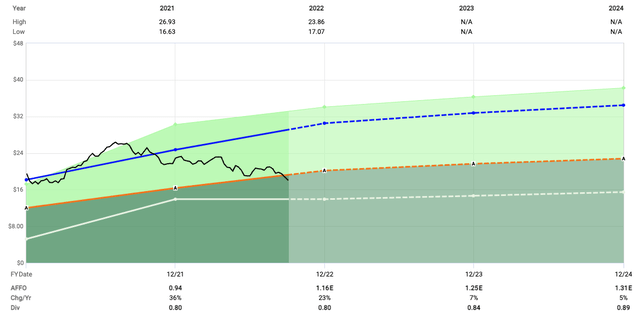

Given the growth we’ve seen from NETSTREIT, it shouldn’t be surprising that shares trade at the highest multiple of our three REITs today.

Currently, shares trade at an adjusted funds from operations (“AFFO”) multiple of 16x. And analysts are looking for growth of 7% in 2023 and 5% in 2024.

NTST is currently followed by 9 analysts, which all rate the stock a “Buy.” They give it an average 12-month price target of $25, implying 25+% upside from current levels.

As for iREIT, we currently rate the stock a “Strong Buy.”

Small Cap REIT #3: Postal Realty Trust, Inc. (PSTL)

Our final small-cap REIT today is very different from the first two.

Postal Realty Trust has a market cap of $336 million and rents properties to the U.S. Postal Service. In fact, PSTL is the largest owner of buildings leased to that entity.

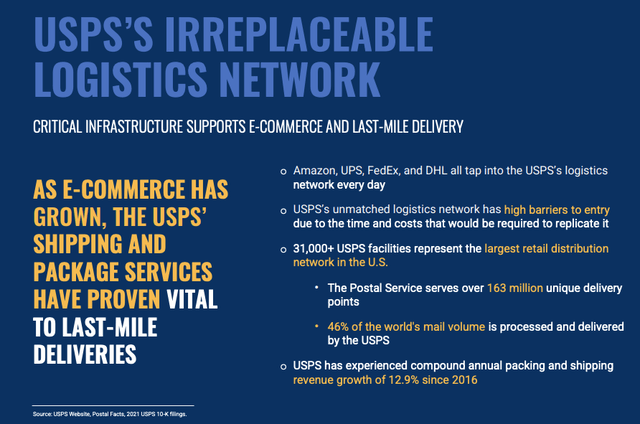

Logistics is a huge part of America, and a play on PSTL could be a play on the continued growth of e-commerce. Much of the expected e-commerce growth was accelerated during the global pandemic, as many consumers were confined to their homes.

But still, it’s not as if online shopping is going away. Moreover, there’s trouble brewing at competitor FedEx Corporation (FDX), which could open up further opportunities for USPS… and PSTL as a result.

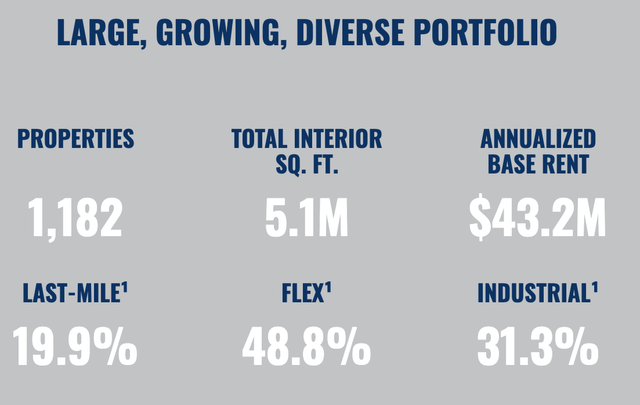

As-is, Postal Realty currently maintains a portfolio of 1,182 properties making up 5.1 million square feet.

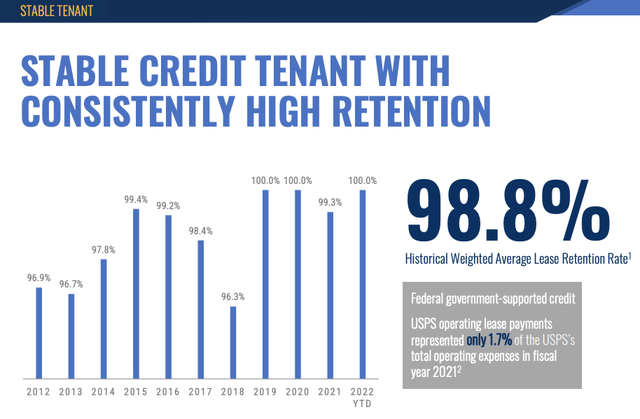

Moreover, its one-and-only client has never missed a rent payment. And it’s renewed its leases 98.8% of the time over the last decade.

Its current lease expiration schedule is very conservative, meanwhile. Less than 30% of its annual base rent is up for renewal before the year 2025. Though its weighted average lease term is rather short, standing at roughly four years.

Occupancy is also impressive at 99.7%, which isn’t quite as good as our previous picks… but so very close to perfect anyway.

When looking at valuation, however, this REIT isn’t getting much respect. Shares trade at a p/AFFO of 15x, which looks tempting.

iREIT rates the stock as a “Spec Buy.” At current valuation, it should at least warrant a second look.

In Closing

All three of the above-reference net lease REITs have market caps under $1 billion, and this means that there could be more volatility ahead.

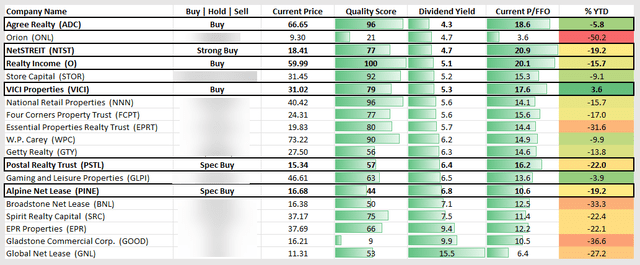

I own all three of these REITs; however, I consider Realty Income and Agree Realty (ADC) more attractive today, based on their valuation and fundamentals.

As seen above, there are now 19 net lease REITs in our coverage spectrum at iREIT on Alpha with an average dividend yield of 5.9%. Given the recent news related to STORE’s privatization (acquisition), we expect to see more M&A within the net lease sector. We suspect that there will be around 15 net lease REITs a year from now.

While we never consider M&A a catalyst of sorts, we believe that these 3 small cap REITs could become takeover targets in the future, especially PINE that is now trading at 10.6x, far below the peer average of 14.x0.

As always, thank you for reading and commenting!

Be the first to comment