Kwarkot/iStock via Getty Images

[Please note that all currency references are to the Canadian dollar except if indicated otherwise.]

Canadian Apartment REIT $44.25 (Toronto symbol CAR.UN; OTC:CDPYF; Residential REIT; Units outstanding: 176.2 million; Market cap: $7.8 billion; www. capreit.com) is an owner and manager of multi-family residential properties located in Canada and western Europe. The trust commenced trading on the Toronto stock exchange in 1997 and has the largest market value of all residential REITs in Canada.

The share price of Canadian Apartment REIT (“CapReit”) declined sharply over the past few months as investors started to factor in the impact of rising bond yields on the real estate market. Nevertheless, the REIT owns an enviable portfolio of quality assets, has a sound track record of profitable growth, and offers a fair valuation. Profits and distributions should continue to grow at a moderate rate offering a 5%-10% annual return over the long run.

A few definitions to keep in mind

Net operating income (“NOI”): This includes all rental revenues and other supplementary property income minus all direct property expenses such as property taxes, wages, and utilities. Stabilized NOI includes only the operating metrics for properties that have been held for the full measurement period. Funds from operations (“FFO”): This is a measure of the cash flow generated by the REIT and adjusts net income for non-cash items such as fair value adjustments of investment properties, remeasurement of investments, amortization and depreciation, and deferred tax expenses.

Direct capitalization: A primary valuation method used for properties held under fee simple or land lease arrangements. A capitalization rate is applied to the stabilized net operating income to determine the value of the property.

A landlord of note

CapReit owns and manages about 60,000 units in apartment buildings, townhouses, and manufactured home communities in Canada. Properties located in Ontario contribute most (44%) of the net operating income (“NOI”), followed by Quebec (15%), and British Columbia (12%).

CapReit also holds a 66% interest in the European Residential REIT (Toronto symbol ERE.UN). This REIT owns 6,545 rental units in the Netherlands, Belgium, and Germany and contributed 14% of the NOI. CapReit provides management services to ERE and earns a fee for providing this service.

CapReit also owns an 18.7% interest in the Irish Residential Property REIT (Ireland symbol IRES) but no longer provides management services to this REIT.

Excellent business operations

CapReit has a solid record of growing all important metrics for the business.

The REIT has expanded significantly over the past decade. The residential units under management have doubled, net operating income has trebled, and the market value has grown five-fold.

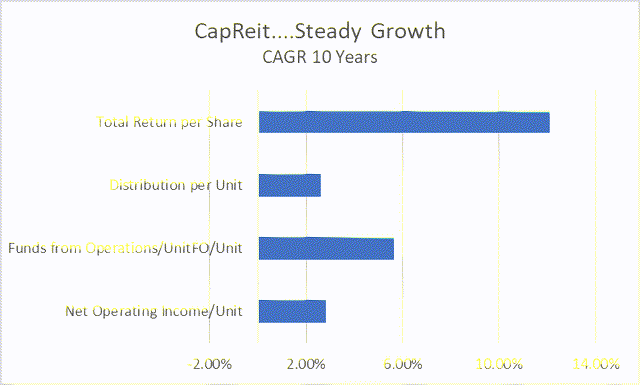

As with most other REITs expansion is financed with debt and the issue of additional units. But despite the three-fold increase in the units, NOI, FFO, and distributions per unit compounded at between 3% and 6% per year over the decade (see graph).

Eikon and contributor’s calculations

Despite the rapid expansion, CapReit has also managed to run a tight operation. Occupancy levels averaged 98.1% for the past 10 years and rents increased by 1.5% per year. Net operating margins averaged 61.5% and increased every year for the past decade.

Unsurprisingly the units have performed well with a total return of 12.1% per year beating the overall Canadian market and the REIT index by a country mile.

Modest growth prospects

CapReit grows organically by renovating units, raising rents, keeping vacancies low, and keeping a lid on expenses. But, the REIT also grows by acquisitions and undertakes the development of vacant land or redevelopment of existing properties.

The acquisition of additional properties occurs frequently, and the total acquisition cost has averaged $690 million per year (for an average of 3,900 units) over the past decade. The trust also divests, on occasion, older non-core assets.

Over the long term, the REIT believes that it can generate modest rental growth, maintain its occupancy at or near full capacity, and increase ancillary revenues – this should result in moderate growth in the stabilized net operating income. A resumption of Canadian immigration, the return of international students, and the normalization of office work are medium to long-term tailwinds for the REIT.

The market environment

Most of the areas where CapReit owns and manages residential units have at least some measure of rent controls in place. During the Covid-pandemic the provincial governments in Ontario and British Columbia also froze rent increases for 2021 and introduced rent increase caps of 1.2% and 1.5% respectively for 2022. The Dutch government introduced similar measures.

This hampers the ability of the REIT to increase rents, except on suite turnover, despite strong demand for rental units in most of its markets. However, rent controls also serve to discourage new rental developments as expected returns may not meet the minimum required investor returns.

The Canadian housing market was buoyant in 2020-21 as low mortgage rates encouraged potential homeowners to buy rather than rent. However, the frenzy seems to have calmed down and with mortgage rates now sharply higher, many potential home buyers may return to the rental market.

Corporate governance

The Chair of the board of trustees is Dr. Gina Cody, a former corporate executive, and principal of an engineering firm. The board currently has eight members of which seven are considered independent. Collectively the trustees and executive officers own 0.6% of the CapReit’s units.

Mr. Mark Kenney is the Chief Executive Officer. He has been with the REIT since 1998 and served as Chief Operating Officer before he was appointed CEO in March 2019.

The Chief Financial Officer, Scott Cryer, resigned early in 2022 after a 12-year career with CapReit. The formal search for a replacement is currently underway.

The executive officers receive a basic salary, and performance-based cash and equity rewards. The performance-based rewards are linked to the achievement of certain non-financial and financial performance measures, including FFO per unit growth targets. The CEO received total compensation of $4.3 million in 2021 which was 13% higher than in 2020.

The REIT is internally managed – so there is no potential for conflict of interests with an external manager.

Balance sheet in good order

The REIT had unitholders’ equity of $10.4 billion by the end of March 2022, and total debt of $6.8 billion.

Mortgages make up almost all of the debt; there are principal repayments amounting to 25% of the total debt that will come due over the next 3 years. By the end of March 2022, the weighted average mortgage interest rate was 2.53% with a term to maturity of 5.7 years. Over 99% of the mortgage portfolio carries a fixed interest rate.

Total debt to gross book value amounted to 37.6% while interest is covered 4 times by earnings before interest, tax, depreciation, amortization, and fair value adjustments while the total debt service cost (including principal repayments) was covered 2.0 times.

CapReit has a share repurchase program in place to buy 17.067 million units (about 10% of the issued units) until March 2023. Given the lower unit price, the REIT may decide that it is opportune to buy some of their own units in the market, but it is more likely that management will decide to step up the property acquisition program should attractive opportunities become available.

A reasonable start to 2022

The first quarter of 2022 delivered a reasonable result with increases in portfolio occupancy, average monthly rents, net operating income, and distributions. However, as the REIT had more units in issue, there was a small decline in the funds from operations per unit.

A highlight of the result was the 10.2% jump in rental uplifts on the turnover of tenants. This indicates strong demand and the potential for further rental growth as tenant turnover increases. Less positive was a sharp increase in operating expenses as higher energy prices pushed utilities cost up by 14%.

In the first quarter of 2022, the REIT acquired 1,015 suites for a total cost of $439 million. There were no dispositions in the last quarter.

Consensus forecasts indicate NOI growth of 7.4% for 2022 but with a lower margin as higher operating costs will negate some of the revenue improvement. FFO per unit is expected to come in at $2.36, slightly higher than 2021 although better growth is expected for 2023 and 2024. The dividend should be 3.5% higher than last year.

A regular dividend payment

CapReit pays a monthly distribution which has grown every year over the past decade. The current annual distribution amounts to S1.45 per unit with a payout ratio of 63% of the FFO.

Fair valuation but watch those interest rates

CapReit and its external valuers mostly use a direct capitalization rate method to estimate the fair value of its properties. By the end of March 2022, the weighted average capitalization rate was 3.69%, which was almost unchanged from the year-end rate. Based on these estimates the properties were valued at $17.5 billion. Including other assets and deducting liabilities, the net asset value per fully diluted unit amounts to $58.79.

Considering that interest rates have moved up sharply since the end of 2021, we can assume that the cap rates would eventually follow. The company estimates that the fair value of its property portfolio declines by $2.1 billion (or 12%) for every 0.5% increase in the capitalization rate. Valuations are less sensitive to changes in the NOI – for every 1% increase in NOI the valuation increases by 1.1%.

To illustrate – assuming that cap rates move higher by 0.75% over the next 12 months and NOI increases by 4%, the property values decline by $2.4 billion (-14%). Assuming the liabilities and the portfolio remain unchanged, the NAV drops to $44.90 which implies that the current unit price trades at a 1% discount to our expected NAV. This is right in line with the 20-year historical average which has mostly varied between a 10% discount and a 10% premium.

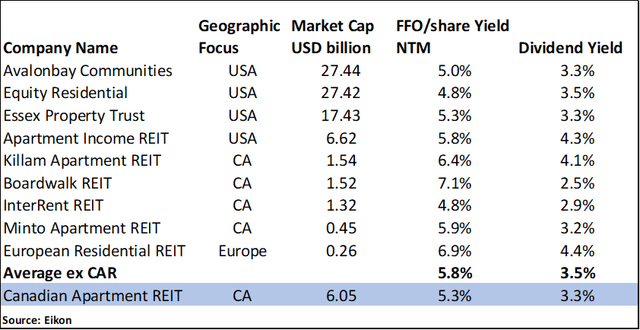

Other valuation methods that can be used to value the trust include the FFO yield and the distribution yield. Compared to the much larger U.S. residential REITs, CapReit looks slightly undervalued, but the valuation is right in line with the wider universe when both Canadian and U.S. REITs are considered.

Bottom line… sound business with a reasonable valuation

CapReit has done well over the past decade building up a quality portfolio of Canadian and European multi-family residential units. Higher interest rates will hamper further growth in net asset value, and rent controls will continue to dampen the REIT’s ability to increase rents. However, demand for rental accommodation remains strong in the REIT’s core markets and rental uplifts occur on tenant turnover.

The valuation is reasonable, and the dividend should continue to grow at a moderate rate likely offering a total return of 5%-10% per annum over the long term.

Written by Deon Vernooy, CFA, for TSI Wealth Network

Be the first to comment