Matt Winkelmeyer

Right now, as the markets prep for a year-end rebound (helped along by some further clarity from the Fed’s Jerome Powell that the central bank will be mindful of recession as it accelerates the pace of rate increases), the best way to beat the overall market is to lean in heavily on beaten-down growth stocks that are trading at really attractive valuations.

One little-known candidate here is Canada Goose (NYSE:GOOS) – a very recognizable fashion brand in the wintry parts of the country, but very rarely discussed as an investment opportunity. The maker of high-end parkas has navigated successfully through a challenging pandemic and is seeing signs of very strong demand from customers.

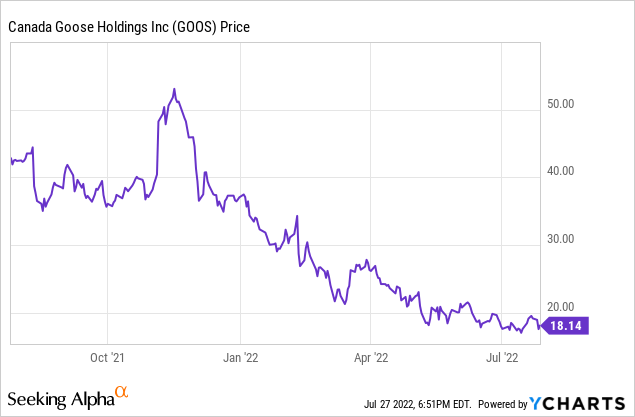

Year to date, Canada Goose has lost more than 50% of its value, rendering its stock at very buyable levels:

Though Canada Goose has been a painful investment over the past year, I don’t think there’s a better time than now to go long and ride out the rebound here. Canada Goose is looking ahead at a strong fiscal 2023 (which is the year ending in March 2023) while also trading at a very attractive valuation.

There are a number of reasons, in my view, to be bullish on Canada Goose for the long term. The key points to know are:

- Huge untapped global luxury market. At the moment, Canada Goose is very popular in its home markets of the U.S. and Canada. It’s expanding aggressively into Mainland China, which is the world’s biggest consumer of luxury goods; and it’s still largely new in Europe. The opportunities for global expansion here are unparalleled.

- Category expansion. Evolving from being just a parka brand, Canada Goose has made significant strides in expanding into other categories, most notably footwear. The company also has a lineup of accessories like scarves and gloves, as well as a full kids selection.

- Incredibly rich gross margin profile. Canada Goose’s high-60s gross margin puts the company more akin to a tech stock than a consumer products manufacturer. Canada Goose’s incredible brand moat has also allowed the company to increase prices to offset inflationary pressures, actually even leading it to expand its gross margin profile.

- Tailwinds from COVID normalization still ahead of us. Right now, Canada Goose’s sales in China (its biggest growth market) is still constrained by closed storefronts due to a dynamic COVID situation in the country. As we approach normalization, reopenings in China could unleash a wave of pent-up demand.

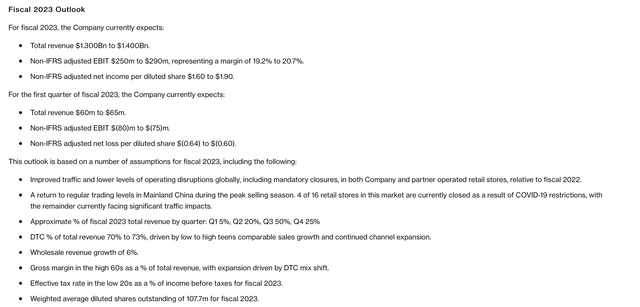

We also have a rosy FY23 outlook to look forward to. For 2023, the company has guided to C$1.30-$1.40 billion in revenue, representing a healthy 18-28% y/y growth range – and with the midpoint of that range five points ahead of Wall Street’s C$1.30 billion consensus.

Equally important, the company is also affirming that it will be able to maintain “high 60s” gross margins consistent this year, with pricing and direct channel mix shifts helping to offset cost-inflation pressures (not every consumer products maker is singing the same tune here, by the way).

Canada Goose FY23 outlook (Canada Goose Q4 earnings release)

Valuation wise, Canada Goose also remains quite attractive. At current share prices near $18, Canada Goose trades at a $1.92 billion market cap. After netting off the $287.7 million of cash and $370.0 million of debt on the company’s most recent balance sheet, its resulting enterprise value is $1.84 billion.

Against the midpoint of the company’s FY23 adjusted EBIT range of $250-$290 million (representing 55% y/y growth versus FY22!), Canada Goose trades at just 6.8x EV/FY23 adjusted EBIT. On a simple pro forma EPS basis, the stock at $18 trades at a 10.5x FY23 P/E based on the midpoint of the $1.60-$1.80 pro forma EPS guidance.

The bottom line here: Canada Goose is still growing nicely, defending its rich margin profile, expanding its products and geographic reach, and producing handsome profits relative to its value. Don’t let this year’s irrational fear of growth prevent you from overlooking this stock as we look ahead to a year-end rebound.

Q4 download

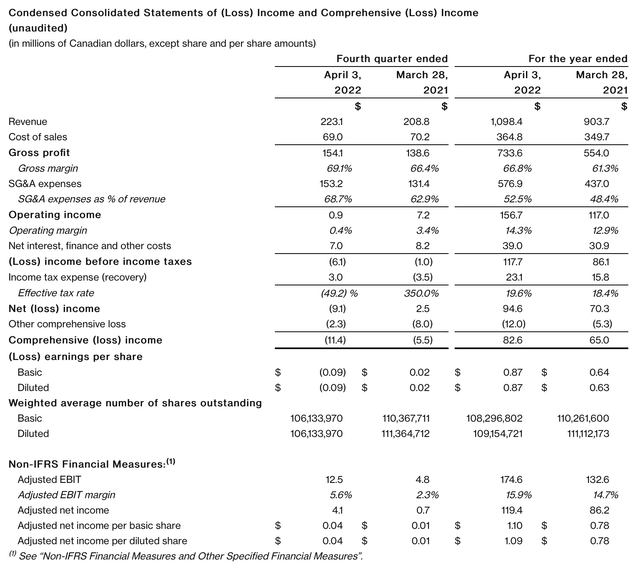

Let’s now cover Canada Goose’s latest Q4 results in greater detail, covering the March quarter. The Q4 earnings summary is shown below:

Canada Goose Q4 results (Canada Goose Q4 earnings release)

Recall Canada Goose’s revenue linearity: for FY23, the company has given the guidance that 5% of annual revenue will happen in Q1; 20% in Q2, 50% in Q3, and 25% in Q4. Q4 (January through March) is thus the second-heaviest quarter of the year, which makes sense for a winter-heavy company like Canada Goose.

This Q4, the company grew revenue 7% y/y to C$223.1 million. Note that there is an accounting headwind here, as due to the shift in Canada Goose’s fiscal weeks, the current quarter started and ended one week later than in FY21. In effect, the “winter benefit” of the earlier January week was lost in this quarter. The company reports that using the same timeframe in both compare periods, revenue growth would have been 24% y/y.

It was also another strong quarter for non-parka revenue, which grew 70% y/y. The company noted special strength for down vests and other non-jacket apparel.

Here’s some qualitative commentary from CEO Dani Reiss’ prepared remarks on the Q4 earnings call, detailing how sales are performing by geo as well as the company’s adept execution to ward off supply chain challenges:

From a geographic perspective, our retail performance in North America was the biggest driver of growth. Consumer confidence remains strong and shoppers have returned to pre-pandemic trends. We saw a similar environment in the U.K., which drove immediate increase. In the Rest of Europe, we saw softer local and international traffic trends. APAC was the only region that declined due to ongoing COVID restrictions, including store closures in Mainland China. The Chinese government has a strong track record of being very proactive in containing COVID outbreaks. We do not expect the prevailing circumstances to have a meaningful impact on results in our busiest season, which is reflected in our outlook.

Recently, many peers have pointed to continued production and supply chain challenges, as well as logistical delays. This was not a factor for us in the quarter, nor do we expect it to affect the year ahead. We continue to be uniquely insulated against supply chain issues due to our Canadian manufacturing, which accounted for 84% of our total units in calendar 2021. As I mentioned earlier, we marked a revenue milestone in fiscal 2022. We also laid the foundation to achieve our fiscal 2023 targets on our way to the next $1 billion in sales.”

The other main highlight worth calling out: Canada Goose’s gross margins expanded to 69.1%, rising 270bps over the prior-year Q4. This stands in stark contrast to many other consumer companies which are seeing margins hit by rising shipping costs and expedited materials. The company attributed the increase primarily to boosted pricing.

This gross margin lift also had a trickle-down effect on adjusted EBIT margins, which more than doubled to 5.6%. Adjusted EBIT in the quarter soared to C$12.6 million, up from just C$4.8 million in the year-ago Q4. The company also hit a record-high 15.9% EBIT margin for FY22, which it will handily surpass with its outlook for 19.2-20.7% margins in FY23.

Key takeaways

Canada Goose’s steep year-to-date declines have severely over-corrected this stock’s valuation to deep-value levels. What the market doesn’t seem to see is that Canada Goose is growing admirably in its key markets while retaining huge margins and delivering solid bottom-line results. Don’t miss this opportunity to buy this stock cheaply.

Be the first to comment