Michael Blann/DigitalVision via Getty Images

A few months ago, I wrote a cautious article on National CineMedia, Inc. (NASDAQ:NCMI), arguing the company had far too much debt for me to be comfortable recommending its common equity, despite the generous looking 9.5% dividend yield.

Fast forward a few months, and the dividend is no more as the company suspended it to conserve capital. With many players in the theatre industry struggling and on the brink of bankruptcy (or bankrupt, in the case of Cineworld), I continue to recommend investors avoid National CineMedia’s stock.

Brief Company Overview

A quick refresher for those who are not familiar with National CineMedia. NCMI is the largest U.S. theatre ad network, showing advertising in over 20,000 screens and 1,600 theatres. Its advertising network includes leading national chains such as AMC, Cinemark, and Regal.

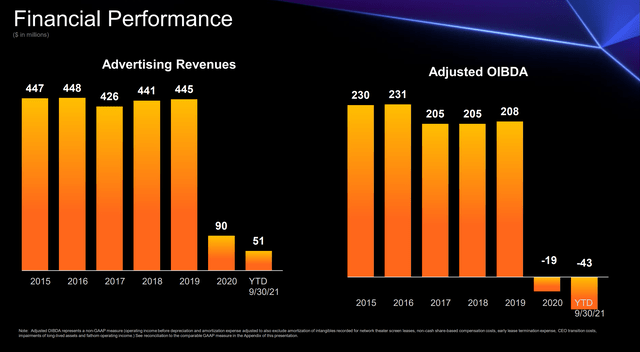

Historically, selling theatre ads was a stable and high margin business, as NCMI averaged over $440 million in advertising revenues and $215 million in Adjusted Operating Income Before Depreciation and Amortization (“Adj. OIBDA”) in the 5 years prior to the COVID-19 pandemic (Figure 1).

Figure 1 – NCMI revenues were stable prior to pandemic (NCMI 2021 Investor Day presentation)

This helped fund a generous dividend of $0.68 / share in 2019. However, National CineMedia’s business was hit hard by the COVID pandemic, as theatres were shut down. Without foot traffic, there were no ads to sell. Advertising revenues fell from $445 million in 2019 to $90 million in 2020.

Today, although almost all COVID restrictions have been lifted, NCMI’s business still haven’t recovered to pre-pandemic levels.

Latest Quarterly Results Highlight My Concerns

In my prior article, I had three main concerns on the National CineMedia story: 1) a new normal in box office, 2) a heavy debt load, and 3) a shrinking dividend. Unfortunately, all three concerns had negative developments in the quarter.

Revenues Still Far From Pre-Pandemic Levels

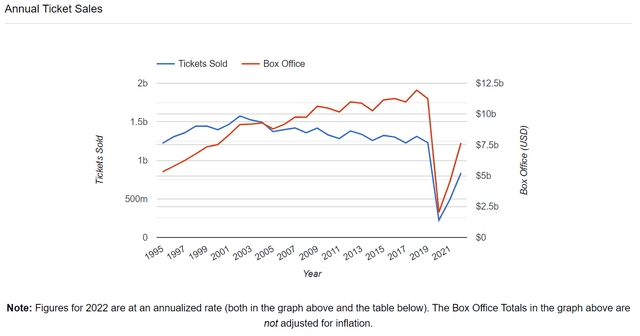

First, on the revenue front, my bearish thesis is that despite the industry’s best efforts, theatre box office may be stuck in a new normal. While domestic box office for blockbuster films like Top Gun: Maverick and Jurassic World: Dominion have more or less recovered to pre-pandemic levels, overall box office is only tracking to ~70% of pre-pandemic levels (Figure 2).

Figure 2 – Box office tracking at ~70% of pre-pandemic levels (the-numbers.com)

Increasingly, non-blockbuster films are released directly to streaming platforms, sidestepping theatres altogether. This is problematic for National CineMedia, as its ads business requires lots of foot traffic and eyeballs.

In the third quarter, although NCMI recorded a 72% YoY gain in revenues to $54.5 million, it was still 50.7% less than pre-pandemic Q3/2019’s revenue of $110.5 million.

Struggling To Pay Debts

Prior to the pandemic, NCMI had $950 million of long-term debt and leases versus $167 million in 2019 EBITDA (5.7x Debt/EBITDA). While the debt burden was high, it was not a major concern as the theatre advertising business generated lots of free cash flows (2019 FCF of $130 million) to support the debt and pay attractive dividends. However, with revenues reduced due to COVID and the new normal in box office, NCMI’s debt burden is increasingly hard to carry.

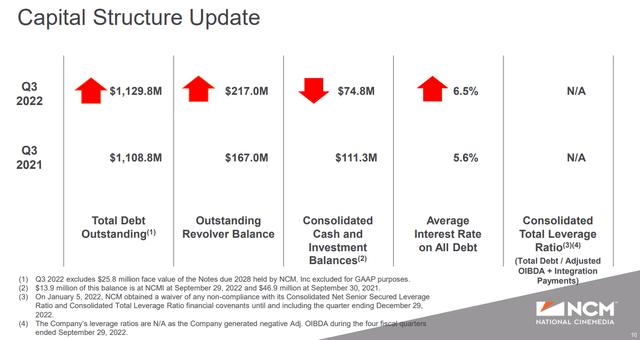

As of September 29, 2022, NCMI’s total debts have increased to $1.13 billion while its cash and investments have fallen to $75 million (Figure 3). Worryingly, the average interest rate on all debts have been creeping up, from 5.6% to 6.5% YoY, as the revolver accrue floating rate interest.

Figure 3 – NCMI capital structure (NCMI Q3/2022 Investor Presentation)

In fact, National CineMedia recently had trouble paying interest on its secured notes due 2028, dipping into a 30-day grace period before ultimately paying the amount.

I suspect the company will increasingly struggle to pay its debt obligations in the coming months, as the company only has $64 million (management mentioned this amount on the earnings call) in cash, versus over $73 million in annual interest payments (6.5% on $1.13 billion) alone.

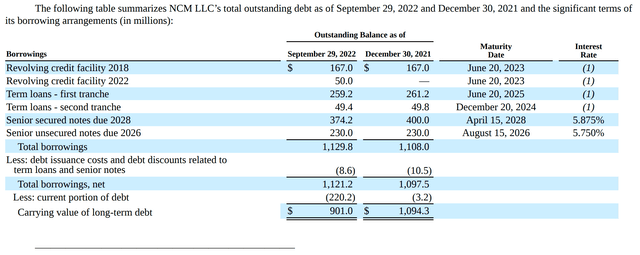

Moreover, NCMI has lots of debt maturing in the next few years. The most pressing is the $217 million in revolving debt that matures in June 2023 (Figure 4).

Figure 4 – NCMI have lots of debt maturing in the next few years (NCMI Q3/2022 10Q Report)

Dividend Cut To Zero

Finally, in a bid to conserve capital, National CineMedia’s board decided to suspend the company’s quarterly dividend to “to prioritize financial flexibility and liquidity”. I had highlighted this risk in my prior article:

While NCMI’s current dividend of $0.12 / share looks attractive at a 9.5% forward yield (current price of $1.26), with the staggering debt load mentioned above, it may make sense for the company to eliminate the dividend altogether and direct free cash flow to reduce the debt load. At $0.12 per year, cutting the current dividend could save the company ~$10 million.

Legal Battle With Regal

To top off a tough quarter, NCMI also disclosed in its quarterly report that it is embroiled in a legal dispute with one of its largest partners, Regal Cinemas. Here is an excerpt from the CEO’s prepared remarks on the matter:

I wanted to make a few comments about our delayed bond interest payment and long-term partnership and exhibitor services agreement, or ESA with Regal. As has been previously disclosed in court filings, Cineworld filed a motion indicating an intent to reject the ESA and also stated that Regal currently plans and engaging with us regarding advertising services. NCM LLC filed a lawsuit to enforce our non-compete and exclusivity agreements. As the litigation with Cineworld is ongoing, it would be premature for us to comment any further on this call.

– CEO Tom Lesinski prepared remarks on Q3/2022 Earnings Call

It is unclear how the dispute with Regal will impact NCMI’s revenues and earnings, as Regal operates approximately 500 theatres in the U.S.

Conclusion

In summary, I continue to recommend investors avoid National CineMedia’s stock. As can be seen in the quarterly developments above, things are going from bad to worse. While NCMI may have staved off defaulting on its debts this quarter, the situation is becoming increasingly precarious. I believe National CineMedia may have to restructure its debts in the near future.

Be the first to comment