Jose Gabriel Velazco Figueroa/iStock via Getty Images

Introduction

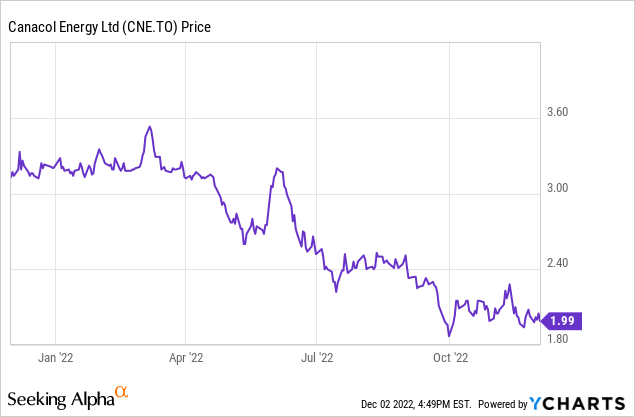

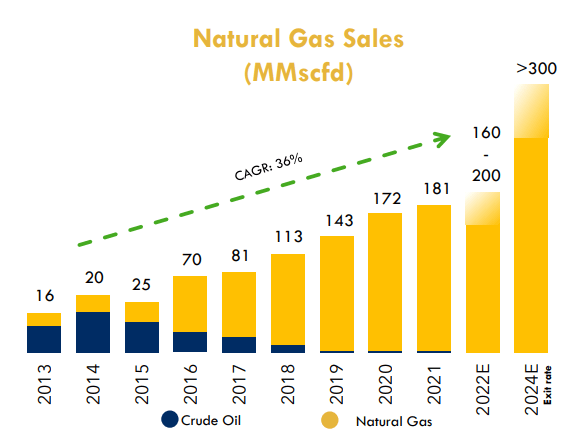

Canacol Energy (OTCQX:CNNEF) (TSX:CNE:CA) is a Canadian company focusing on the production of natural gas in Colombia. That was a brilliant move as the average natural gas price in Colombia was pretty high and stable in the mid US$5 range due to the limited domestic production The downside of a relatively stable natural gas price is that the local gas price hasn’t been as volatile as the North American natural gas price. So while the visibility is excellent, Canacol has been underperforming virtually all of its North American peers this year and its share price is actually down by almost 40% on a YTD basis.

The third quarter confirms the strong cash inflows

Canacol is still not producing at its full capacity as it is throttling its production rate based on the demand from its customers. While the company has take-or-pay contracts in place, Canacol has decided to not play hardball and work with those customers to fulfill their needs rather than pursuing damages for the breach of contract

In the third quarter of this year, Canacol produced just under 33,300 barrels of oil-equivalent per day. Although expressing the production numbers in boe is pretty standard, it’s important to know that in excess of 98% of the oil-equivalent production rate actually consisted of natural gas. Canacol produced just over 186,000 Mcf/day which was sold at an average price of US$4.76 per Mcf net of transportation expenses.

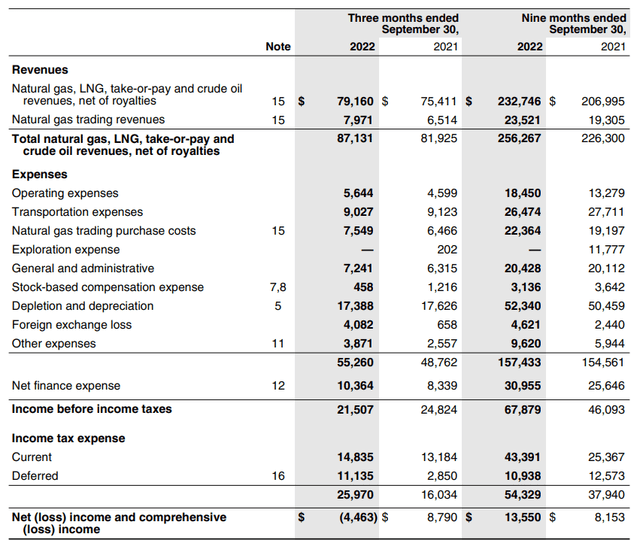

This resulted in a total revenue of just over US$79M (including the oil sales), including the royalty payments. Canacol’s total operating expenses came in at just over $55.3M, resulting in a pre-tax income of $21.5M.

Canacol Investor Relations

As the image above shows, a substantial portion of the operating expenses was related to the non-cash depletion and depreciation expenses which accounted for in excess of 30% of the operating expenses. Additionally, Canacol lost about $4.1M on FX changes and reported a $3.9M ‘other expense’ which it didn’t elaborate more on.

The reported net loss was $4.5M as the company recorded a $26M tax bill on a $21.5M pre-tax income. A substantial portion of the tax bill was deferred and related to the effect of the FX changes on the value of the tax pools. The pre-tax income is subject to the normal tax rate of 35%, and during the third quarter, about $6.5M in cash taxes was paid to the Colombian government.

So while a net loss looks worrisome, there’s more than meets the eye here and the cash flow statement will clear things up.

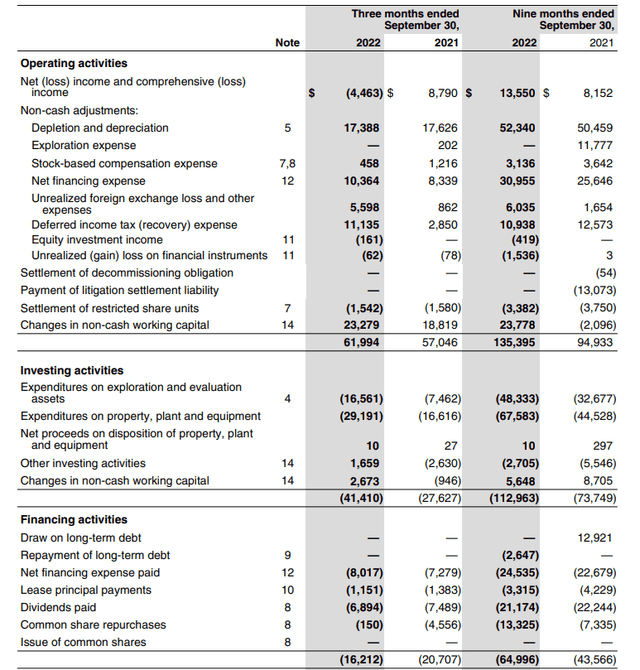

The company reported an operating cash flow of $62M during the quarter, which includes adding back $11M in deferred taxes) and after taking the working capital changes and lease and interest expenses into account, the adjusted operating cash flow was US$39M and actually US$49M if we take a normalized tax rate into account.

Canacol Investor Relations

The total capex was $46M which means Canacol was barely breaking even on the cash flow front.

This year’s capex will be very high and hopefully this will boost the reserve life index

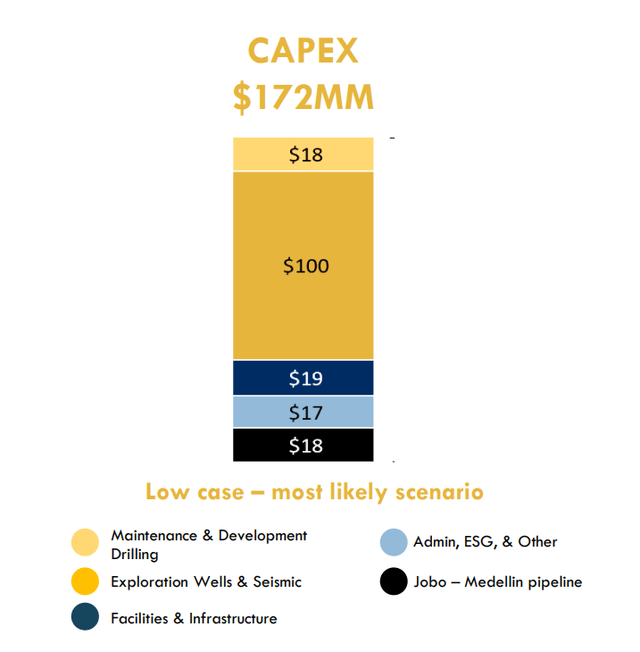

But as you can imagine, the situation isn’t black and white at all. A simple comparison between the capex ($46M) and the depreciation and depletion expenses ($17.4M) clearly indicates the total capex is almost three times higher than the depreciation expenses. Not only was Q3 a particular capex-heavy quarter, we see a similar evolution in the first nine months of the year with a total capex of $116M versus a $52M depreciation expense.

That’s entirely related to Canacol’s outsized exploration and development plans for this year as the company is aggressively stepping up its game. The uncertainty in the Colombian political landscape which I discussed in this recent article on Colombian oil producer Parex Resources likely contributed to this decision to aggressively ramp up its investments this year. Canacol estimates it will spend $172M which is approximately 2.5 times the depreciation and depletion expenses.

Canacol Investor Relations

While it is a pity this means it will take another year before the underlying strong cash flows will actually start to shine, I think it is a smart move to spend money on drilling as Canacol needs to replenish its reserves. As of the end of 2021, its reserve life index based on the 2P reserves was less than 9 years which is pretty low. And it is definitely too low if you know the company would like to hike its production rate by an additional 60% by the end of 2024.

Canacol Investor Relations

Canacol expects a Reserve Replacement Ratio of 200% for this year which means we can reasonably expect the reserve life index to increase to approximately 10 years by the end of this year. I do hope the 200% RRR is a conservative guidance from the company and this really is a case of ‘the more the better’ as I am convinced the low reserve life index is holding the share price back.

Investment thesis

This doesn’t mean Canacol is a lost cause. Based on the YE2021 reserve estimate, the after-tax PV10 of the cash flows is estimated at $1.23B. After deducting the $400M in net debt, the after-tax NAV is approximately $800M or US$4.67 (C$6.30) per share based on the current share count of 171 million shares. The updated reserve calculation should further increase this fair value per share so the fundamental value definitely is there.

Additionally, Canacol is paying a quarterly dividend of C$0.052. This costs the company less than C$9M per quarter and due to the low share price, this has pushed the dividend yield to in excess of 10%. And although the reported free cash flow is pretty low, it’s important to understand the sustaining free cash flow (excluding the investments in new pipelines and the reserve expansion on top of the normal replacement investments) is substantially higher than that dividend.

I already have a substantial long position in Canacol, but I will be adding to this position in the next few days.

Be the first to comment