vasantytf

Thesis

Barrick Gold Corporation (NYSE:GOLD) stock has recovered remarkably since we upgraded it to Buy in September, encouraging investors to ignore the bearish sentiments back then.

Notably, the Fed’s rapid rate hikes have emboldened gold bears, as the Dollar Index (DXY) surged toward its September highs. However, the DXY has since pulled back sharply from those levels as the market anticipated a moderation in the Fed’s hawkish cadence, culminating in the bottoming process of the S&P 500 (SPX) (SP500) at its October lows.

However, last week’s robust employment report has stirred some bearish sentiments. As a result, hawkish commentators have returned to taunt buyers that the Fed’s likely terminal rate needs to go toward the 6% zone.

Our analysis of GOLD’s price action suggests that the market forced weak holders/bearish investors into an astute bear trap at its recent November lows.

Accordingly, GOLD has recovered nearly 35% (in price gains) toward its November highs. Relative to its 5Y and 10Y total return CAGR of 5.7% and -5.4%, the easy money appears to have been made. Also, we noted that its valuation has normalized toward its 10Y averages, as Wall Street analysts turned increasingly pessimistic after its Q3 earnings release.

We believe GOLD’s reward/risk profile seems more well-balanced now. Given its recent sharp recovery, we believe the market has likely reflected its near-term optimism.

Moreover, we believe the risks of the Fed staying hawkish for longer than anticipated have risen with last week’s employment report. As such, we urge investors to be patient and wait for a pullback in GOLD before assessing the next opportunity to add more exposure.

Revising from Buy to Hold for now.

GOLD: Management Sees Lower Energy Costs Ahead

Barrick has faced multitudinous headwinds in 2022 as the global economy weakened, coupled with record-high inflation. Also, energy costs have risen significantly, which impacted the company’s cost guidance for 2022.

As such, management highlighted at its recent Investor Day that it expects an average of $90 for WTI crude oil (CL1:COM) for its updated 2023 modeling, well ahead of its 2022’s starting guidance of $65.

However, management articulated that it penciled in lower CL1 levels through 2025, as it expects the energy costs headwinds to abate after 2023.

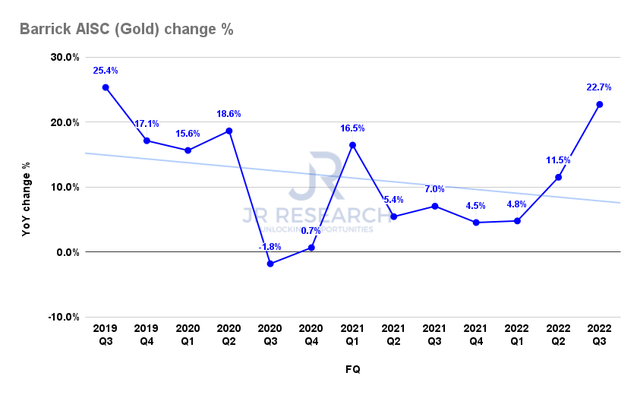

Barrick AISC (Gold) change % (Company filings)

As such, it should help to drive down its all-in-sustaining-costs (AISC) for its gold production over the medium term. The company’s updated modeling suggests an AISC of slightly under $1K by 2026.

Note that the projected moderation is constructive for GOLD holders, as the company’s AISC surged by nearly 23% in FQ3, reaching $1.27K.

Also, despite the tight supply/demand dynamics that emboldened the WTI oil buyers to intensify their recent bets, oil price action has weakened considerably from its June highs, as discussed in a recent Energy Select Sector ETF (XLE) article.

While we expect oil bulls to defend the current levels vigorously, we assessed that the momentum has shifted in favor of the oil bears over the past few months. Therefore, CL1’s price action augurs well with management’s commentary, suggesting the worst of its energy costs headwinds are likely over.

Is GOLD Stock A Buy, Sell, Or Hold?

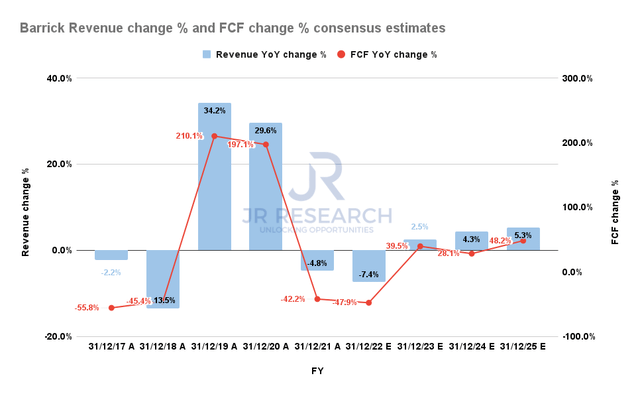

Barrick Revenue change % and FCF change % consensus estimates (S&P Cap IQ)

The downgraded consensus estimates suggest that Barrick should return to free cash flow (FCF) growth from FY23 after a challenging 2022 as its costs surged.

The company also expects to lift its production cadence over the next five years, which augurs well with a recovery in gold spot prices and lower energy cost headwinds. Hence, we think the worst seems to be over for GOLD holders.

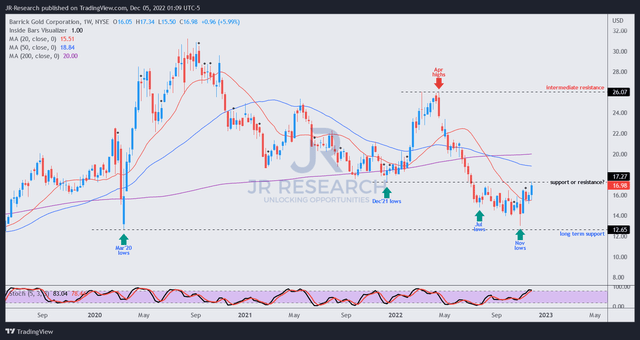

GOLD price chart (weekly) (TradingView)

As such, we postulate that GOLD’s November lows should hold robustly, as it nearly re-tested its COVID lows.

However, the sharp recovery has also sent it into its previous December 2021 support zone. Therefore, we deduce that GOLD needs to retake this level decisively to recover its medium-term bullish bias.

Notwithstanding, we expect some near-term digestion of its recent recovery, which should help improve the reward/risk profile for patient investors.

Revising from Buy to Hold for now.

Be the first to comment