DNY59

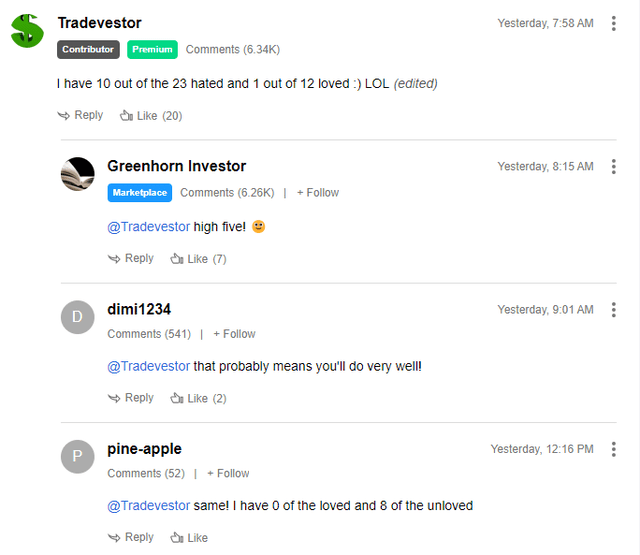

It is natural at this time of the year for investment firms and individual analysts to chew on the year that is about to go down and to look forward. Hence, there is nothing abnormal for news items like this to appear on Seeking Alpha. However, this one had one of the liveliest and passionate comments stream I recall in recent times.

What “triggered” SA readers to respond with comments like the ones below, including my own? Let us get into the details.

SA Comments Stream (SeekingAlpha.Com)

The “Desired Dozen”

This section looks at how the “desired dozen” performs in a few factors that may have played a role in them getting a place on this list.

- Is it the dividend? No. For starters, in the “desired dozen”, 4 don’t pay a dividend. That’s not a bad conversion rate that 8 pay a dividend, but the highest yield is from Wells Fargo (WFC), a company that has a history of slashing/eliminating dividends. The other 7 yields range between 0.36% and 1.23% as of this writing. Hence, it is evidently clear that an equal-weighted basket containing these 12 stocks will yield way less than 1%. If we get into the dividend pedigree of the companies in the “desired dozen” and the “forsaken 23”, things get uglier for the “desired dozen”. (Neither the Goldman analysis nor the SA news item called them the “forsaken 23”).

- Is it the valuation? No. The “desired dozen”, on average, have a forward multiple of at least 25. I am being generous here because stocks like Uber Technologies, Inc. (UBER) don’t even have a forward multiple as it continues to fight its losses. I’d be skeptical of paying close to 30 times earnings for most of the names in the “desired dozen” except maybe for rare exceptions like UnitedHealth (UNH). Especially when we get contradictory indications about inflation on a weekly, if not daily, basis.

- Is it the growth factor? Maybe. As quoted in the news item, “Consensus expects 15% profit growth for the median shared favorite in 2023, compared to 7% for the median S&P 500 stock.” Here too, I am too convinced with some names. For example, it is hard to explain Wells Fargo deserves a place in the “desired dozen” while JPMorgan Chase (JPM) is part of the “forsaken 23” when their key fundamental numbers like yield, forward multiple, and growth estimates aren’t too far from each other. If anything, most of the ratings on SA seem to favor JPMorgan as can be seen here.

- Is it the market condition? No, not convincing enough. While stocks like Visa (V) and Mastercard (MA) will benefit from increased spending if inflation slows, when you are positioning for inflation and rates to fall, you’d want exposure to stronger tech names than ServiceNow (NOW) and Workday (WDAY).

The Forsaken 23

Let’s now look at the 23 stocks in the other list.

- No individual stock is above criticism. But when you see a bunch of similar names (popular, generally profitable names that pay a dividend. 21 out of the 23 pay a dividend), the trend is clear. The recommendation is to avoid large, well-known names that pay a dividend. No wonder SA readers reacted as they did. It is no secret that dividend investors are one of the largest, if not the largest, groups on Seeking Alpha.

- To make things worse, in addition to being “underweight”, the Goldman analysis also indicated funds may be shorting some of these names. To many SA followers, shorting most of these name is like taking a saw to the branch you are sitting on.

- Stocks like Coca-Cola (KO), McDonald’s (MCD), Johnson & Johnson (JNJ) are revered dividend growth champions. The likes of AT&T (T), Intel (INTC), and Disney (DIS) may not have the same dividend pedigree but are still well-respected companies in the dividend community. Shorting any stock is risky as the upside potential for any stock in theory is unlimited. In addition, shorting dividend-paying stocks is a double-whammy as the “shorter” pays the quarterly dividend as well. In a market that still has many unprofitable stocks trading at lofty multiples, it is a head-scratcher that stocks like Coke are in a list being recommended to short.

Conclusion

That brings us to the elephant in the room. What to do with the implied recommendations from the funds? They “should” have a reason why they suggested these names, right? Sure.

First question to ask is, are these recommendations made for traders or investors? There is nothing wrong in being a trader. Some of these stocks may bring in quick profits if you time things right. There is no problem in making short-term profits. My problem is when traders suddenly turn into long-term investors because the short-term trade is going against them. That shows a lack of conviction on both the buy and sell decisions. If the primary reason for owning a stock is broken, sell. Do not look for alternatives to justify your decision and compound the problems.

Second. By the time the news comes out that a popular fund is buying a stock, the easy, quick money has likely been made. You don’t publicize the fact you are buying as you buy and end up paying more. You disclose only when there is a regulatory need after the fact and expect the “crowd” to chase your buys.

Third. This is a corollary to the second point. It is not an uncommon practice for a firm to publish a negative note (downgrade) on a stock or group of stocks only to turn around and go long after the stock has sold off following the downgrade. I won’t be surprised to see the stocks in “forsaken 23” upgraded should they sell off in the near term.

Fourth. And this may be the most important takeaway. Portfolio turnover is good for funds. They need to show action to their investors. Otherwise, what good is an “active” fund manager if he/she is passive? You and me, as individual investors, don’t have such demands to turn over our portfolio on an annual basis. How many billions would Warren Buffett have made on Coca-Cola if he was flipping on an annual basis vs. what he has made and is still making now? Granted, transaction costs are minimal or zero these days but do not forget taxes. And beyond those numbers, ask yourself a fundamental question. Is the stock doing what I bought it for? If the answer is yes, does the Gregorian calendar turning over to the next year a fundamental reason to sell?

Be the first to comment