Arnold Jerocki/Getty Images Entertainment

Investment Thesis

Warner Bros. Discovery, Inc. (NASDAQ:WBD) stock has suffered a massive decline of close to 50% at its June lows from the consummation of its deal in April. Therefore, the market has dealt WBD investors a no-confidence vote for the combined entity. The market parsed the valuation of WBD, given its markedly lower free cash flow (FCF) profitability estimates, coupled with slowing revenue growth projections.

We believe the hammering is well-deserved, as the market has been adjusting for a recessionary scenario on companies with ad-based exposure. Furthermore, WBD also spooked investors as it was reported in mid-June that it would slash 30% of its advertising sales team, highlighting potentially weaker ad spending by its customers.

Notwithstanding, we observed that WBD stock could be at a near-term bottom (but without a bear trap). It also absorbed the selling pressure from its cost-cutting measure report, indicating that the market could be in the early stages of accumulation. However, due to the lack of a bear trap (significant rejection of selling momentum), the bottom remains tenuous until proven otherwise. But, if WBD can continue consolidating constructively, we believe it’s helpful to stanch its bearish bias.

Our valuation model suggests that the market could have forced a capitulation move on pessimistic WBD investors/traders. Therefore, we believe that WBD looks attractive on a market-perform hurdle rate as it seeks to regain its bullish momentum.

Accordingly, we rate WBD as a Buy.

Why Has WBD Stock Been Dropping?

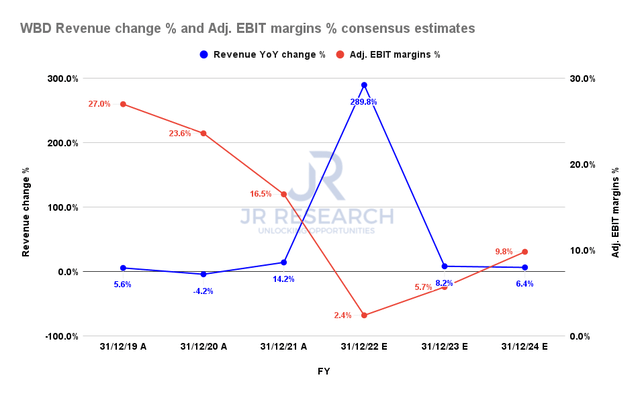

WBD revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

With the deal’s completion, WBD’s combined profitability looks worse than its pre-merger status, given WarnerMedia’s weaker margins. As a result, the consensus estimates (generally bullish) suggest an adjusted EBIT margin of just 2.4% in FY22, down markedly from its pre-merger 16.5% margin.

Coupled with worsening macros impacting the ad market, we believe the market has justifiably de-rated WBD stock.

Notwithstanding, the Street expects the company to lift its margins through FY24, despite decelerating revenue growth. Therefore, we believe it’s critical for WBD to realize the operational synergies in its execution of the combined entity for the stock to be re-rated.

Can Warner Bros Discovery Stock Rebound?

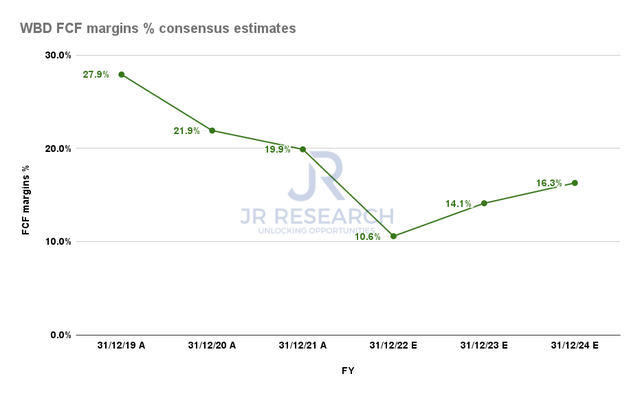

WBD FCF margins % consensus estimates (S&P Cap IQ)

The simple answer is it’s possible if it can improve its post-merger leverage well, which we believe is critical for a re-rating. Notably. WBD is also estimated to lift its FCF margins markedly through FY24 from its nadir of 10.6% in FY22.

Our valuation model also suggests that WBD could likely market-perform at its current levels, despite factoring in a discount from its FCF margins estimates.

| Stock | WBD |

| Current market cap | $34.58B |

| Hurdle rate (CAGR) | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 14% |

| Assumed TTM FCF margin in CQ4’26 | 13.5% |

| Implied TTM revenue by CQ4’26 | $57.36B |

WBD reverse cash flow valuation model. Data source: S&P Cap IQ, author

Applying a market-perform hurdle rate of 11%, we also used an FCF yield of 14%. Notably, the market formed a bull trap in April (deal completion week) at a yield of about 4%. The market resolutely absorbed the selling pressure in its recent June bottom as it traded at yields close to 17.5%. Hence, we believe a 14% yield requirement is appropriate to model the current market dynamics.

We then applied a TTM FCF margin of 13.5% (below the Street’s consensus). Therefore, we need WBD to post a TTM revenue of $57.36B by CQ4’26. It also implies a revenue CAGR of 4.82% from FY22-26, which we think is achievable.

Based on our model’s hurdle rate, WBD could likely retake its $20 level in less than four years.

Is WBD Stock A Buy, Sell, Or Hold?

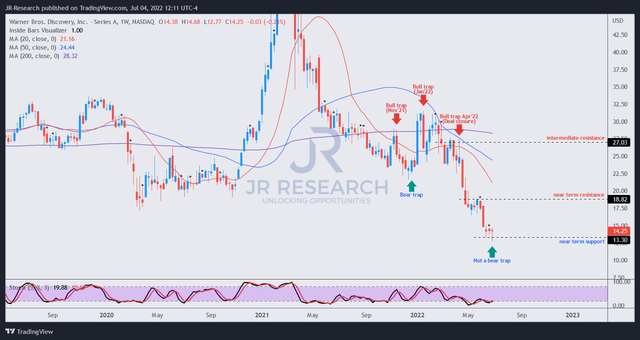

WBD price chart (TradingView)

WBD has been supported at its near-term support ($13.30) since mid-June. It also demonstrated its resilience, given the report that it will cut its ad sales team. Therefore, we believe the market could be in the early stages of an accumulation phase.

However, we must caution that without a bear trap price action, its bottom could be tenuous. Therefore, investors should consider applying appropriate risk management strategies to minimize potential outsized drawdowns if the bottom fails to hold.

It’s also critical for investors to note that WBD remains mired in a bearish bias. As a result, investors should be looking for potential lower-high bull traps (significant rejection of buying momentum) that could precede its subsequent steep sell-off.

Therefore, we believe it wouldn’t be an easy ride back to retake its $20 price level, as the market awaits the company to execute well.

Notwithstanding, we believe investors who have been biding their time to add exposure can consider layering in at the current levels.

The valuation seems attractive for WBD to at least market-perform, with potential for outperformance. Coupled with a near-term bottom holding well, we believe the risk/reward profile is reasonable.

Therefore, we rate WBD as a Buy but urge investors to monitor its price action closely, given its bearish tilt.

Be the first to comment