RAND ANALYSIS

- Firm dollar open tames rand bulls.

- Rand-linked commodities open lower.

- Potential Omicron spread in China could hurt ZAR.

ZAR FUNDAMENTAL BACKDROP

After last week’s Non-Farm Payroll (NFP) miss on the headline figure, the greenback is trading marginally higher this morning as a deep dive into the data reveals a largely positive release for the U.S. labor market. Unemployment rate and wage data came in stronger thus favoring the hawkish slant from the Federal Reserve. This bodes well for the U.S. dollar however with markets backing dollar upside in recent weeks, the buildup in long positions are quite substantial which points to Fed hawkishness largely priced in; opening up rand reward should fundamentals allow.

Despite estimates that the Fed will hike rates with relatively high incidence (thus reducing the carry trade appeal), the South Africa Reserve Bank (SARB) has hinted that it would not sit idle should this play out. However, rising U.S. Treasury yields continue to support an appreciating dollar going forward.

Later this week (see calendar below), U.S. inflation could give yet another push for dollar bulls should actual figures come in higher than prior. Even if the core (Fed’s preferred measure) forecast is missed but remains higher than 4.9%, markets are likely to favor a stronger dollar.

USD/ZAR ECONOMIC CALENDAR

Source: DailyFX economic calendar

South African major commodity exports including gold, iron ore, platinum and coal are all under pressure in early trading giving no support to the local currency.

From a COVID-19 perspective, the possibility of shutdowns in China cannot be ruled out after mass testing is underway in the major port city of Tianjin. This could hamper global commodity prices and take away sustenance from Emerging Market (EM) currencies like the rand.

TECHNICAL ANALYSIS

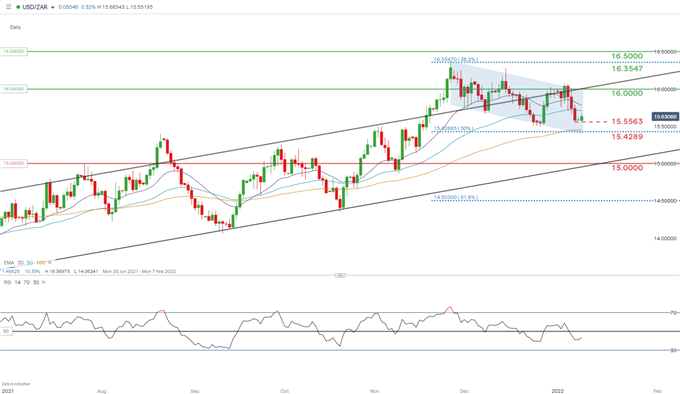

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

After hitting fresh 2022 lows on Friday, USD/ZAR found support at 15.5563. The bull flag channel (blue) lengthens this week and may be in play for some time before a breakout takes place. There remains room for further downside towards the key area of confluence around the 15.5000psychological level (coinciding with 100-day EMA and 50% Fibonacci).

Momentum backs USD/ZAR downside with the Relative Strength Index (RSI) well below the midpoint 50 level.

Resistance levels:

- 16.0000

- 50 and 20-day EMA’s respectively

Support levels:

- 15.5563

- 15.4289/100-day EMA

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment