bjdlzx/E+ via Getty Images

Continental (NYSE:CLR) is currently generating a large amount of free cash flow and is strengthening its balance sheet through debt reduction. The stock appears relatively cheap based on current earnings but it is not clear how sustainable these will be. Recent weakness amongst oil and gas stocks is likely a reflection of growing expectations of demand destruction and a recession.

Aside from macro conditions, which will likely dominate performance in the short-term, Continental’s performance will be dependent on their ability to diversify production away from the Bakken, where breakeven costs are relatively high and the inventory of high-quality acreage is declining.

Expenses

Like most shale producers, Continental have focused on improving profitability in recent years and claim to have reduced the company wide cost of supply by 30% since 2015 and improved capital efficiency by 50% over the same period. While some of this likely reflects genuine improvements, a substantial proportion also likely comes from high-grading inventory and depressed service prices.

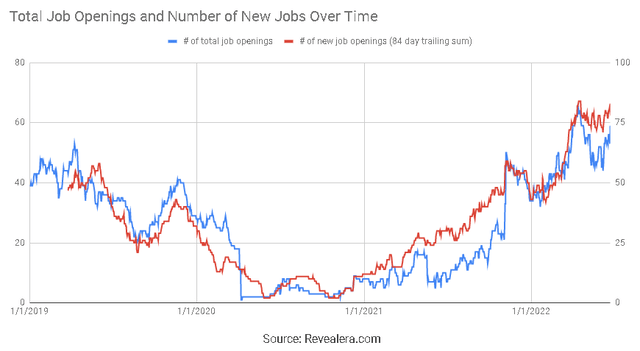

As E&P activity begins to pick up, service prices are likely to increase significantly which will erode some of these gains. Continental have allocated an additional 100-125 million USD this year to deal with inflationary pressures of up to 20% versus 2021. An example of this is tubular goods which increased in price by approximately 6.4-7% in March alone. Continental are also seeing rapidly rising fuel and labor costs. In many cases, service companies have pointed towards greater cost increases, but this is not particularly important to Continental’s margins with current oil and gas prices.

Figure 1: Continental Hiring Trends (source: Revealera.com)

Operating companies have a number of options to increase or maintain production (workovers, refracs, new drilling), which will help them to deal with inflationary pressures. Continental have pointed to workover costs of slightly less than 1 USD per bbl and as a result this is a focus area for them. In the first quarter Continental completed 301 workovers in the Bakken, which typically result in an additional 50-55 bbl of oil production.

Assets

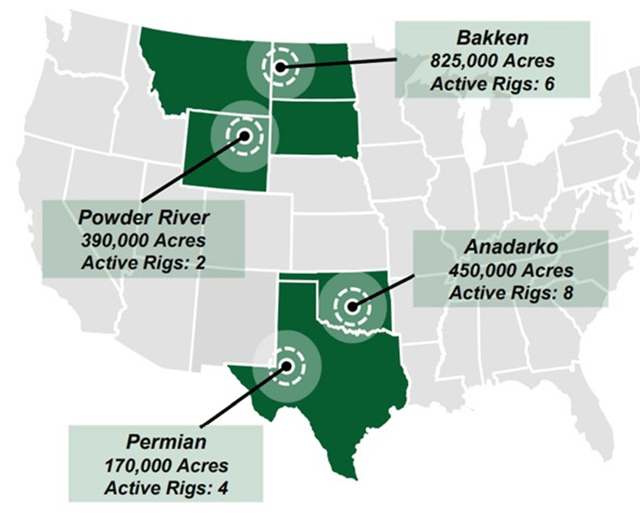

Continental believe they have a sizeable inventory of high quality acreage in the Bakken, Anadarko, Powder River and Permian basin. The geographic diversity of this acreage provides optionality as pipelines or services in area become constrained. Continental is the number 1 producer in the Bakken and Anadarko plays, the number 2 leaseholder in the Powder River Basin and the number 10 leaseholder in the Permian Basin.

Continental have stated that their cost of supply is approximately 35 USD per bbl. They also believe their existing inventory can grow production at 5% per year for the next 10 years while maintaining this cost of supply. If shale production in the US as a whole grew at this rate though it would likely meet the increase in demand globally.

Continental is currently dependent on the Bakken in terms of acreage and production but there are questions about the quality of remaining inventory there. Continental’s inventory of proved undeveloped drilling locations in the Bakken totaled 1,254 gross (701 net) wells at the end of 2021. This is potentially driving Continental’s acquisition of acreage in other areas.

In the past 18 months Continental have added over 600,000 net acres to their portfolio. Part of this effort is likely targeted at increasing natural gas production as Continental have stated they believe natural gas fundamentals are improving. This includes adding acreage in the Delaware basin, which still contains a large amount of high-quality acreage. Continental recently stated that they were pleased with the initial results of a 10 well unit targeting the third Bone Spring and Wolfcamp A reservoirs, which is flowing 15,300 BOE per day. Continental are basing their activity in the Permian Basin on off take capacity for gas in the area.

The Powder River basin is another focus area for Continental and they expect to drill over 100 wells there in the next 2 years, with roughly 90% of these wells targeting the Niobrara and Frontier/Turner formations. Continental has 19 new wells there that are producing an average IP30 of 1,151 BOE per day.

Figure 2: Continental Acreage (source: Continental)

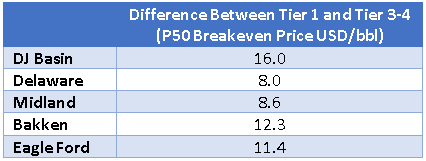

There is some concern regarding Continental given their large exposure to the relatively mature Bakken play. If Continental were to begin running out of tier-1 acreage their production costs would likely rise or they would be forced to acquire expensive new acreage. While this is a possibility, it should be noted that there are a lot of bad wells in tier-1 acreage and a lot of excellent wells outside of tier-1 acreage. Reservoir quality is variable and drilling and completion methods matter, making it somewhat difficult to generalize. The difference in breakeven prices between tiers has declined over time as operators have become better at delineating and high-grading tier 3-4 acreage, as well as improved drilling and completion methods.

Table 1: Difference in P50 Wellhead Breakeven Prices Between Tier 1 and Tier 3-4 Wells (source: Created by author using data from Rystad Energy) Table 2: Remaining Tier-1 Inventory by Play (source: Created by author using data from Rystad Energy)

Carbon Capture

Continental recently made a strategic 250 million USD investment in Summit Carbon Solutions, which is expected to be operational by 2024. The project is expected to capture and sequester 10-12 million tons of CO2 annually and will be the biggest project of its kind in the world. Continental expect to own approximately 25% of this enterprise. A number of other companies in the oil and gas industry are also beginning to look at environmentally friendly initiatives that leverage their core competencies (geothermal energy, carbon capture and storage, etc.). If this project is successful it may help to limit multiple compression for Continental’s stock going forward, as it diversifies the business and could reduce concerns for ESG focused investors. Carbon prices would need to rise significantly for this to be a significant contributor to Continental’s business though and the economics are not currently clear.

Capital Allocation

Like most operating companies, Continental is focused on strengthening their balance sheet and returning capital to shareholders. In the first quarter Continental reduced total debt by 264 million USD and if this continues throughout the year the company will be much better positioned to handle future downturns. Continental also have a stated target of returning over 40% of CFO to shareholders in the form of increasing fixed dividends and share repurchases.

Returning capital to shareholders is not even really a matter of discipline, it is an acknowledgement of the reality that at current prices if large E&P companies tried to invest more than a fraction of cash flows, they will inevitably oversupply the market and spike service prices. Smaller companies are less constrained by this reality though and are likely to invest more aggressively to increase production.

Valuation

Continental are guiding for full year 2022 free cash flow of 4.3-4.7 billion USD, due to a combination of high commodity prices and strong operational performance. Continental expect to exit the year with oil production of approximately 220,000-230,000 bbl per day and natural gas production of 1.1-1.2 billion scf per day.

While an extended war in Ukraine may cause oil and gas prices to remain elevated, it would be pertinent to base investment decisions on a return to sub 100 USD oil in case there is a resolution to the war or economic weakness. Continental are basing decision making around mid-cycle numbers (55 USD oil and 2.75 USD natural gas). Continental’s free cash flows under these conditions is likely to be in the 1-2 billion USD range, making the stock appear far more expensive.

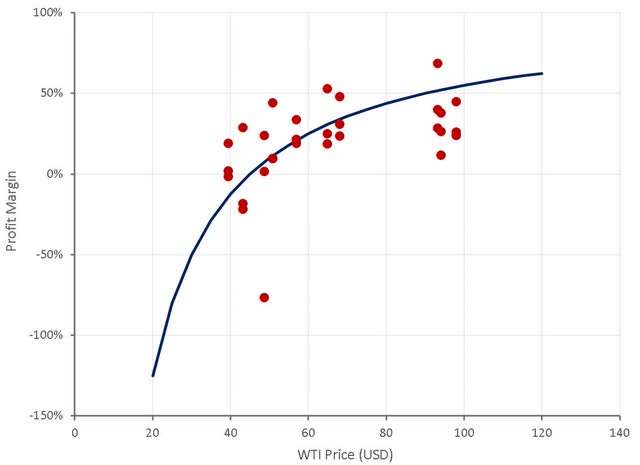

Figure 3: Example E&P Company Margins and Proposed Industry Average (source: Created by author using data from company reports)

Investors should not expect a rapid appreciation in oil and gas stocks just because they currently trade on low multiples. Given evolving societal attitudes towards fossil fuels it is likely that a risk premium will be required by investors to hold oil and gas stocks, similar to tobacco stocks. If this is the case, oil and gas stocks may be considered fairly valued with PE ratios closer to 10 rather than 20. This will not necessarily be bad for those willing to invest in the sector though as dividend yields would be attractive.

Conclusion

Oil and gas prices only need to remain at currently levels for a relatively short-period for investors to be handsomely rewarded. Despite this the specter of recession or an end to the war in Ukraine hang over the sector. Harold Hamm has offered to take the company private for 70 USD per share, which could cushion Continental’s stock if oil prices decline further. He must feel the stock is undervalued at that price which should also be reassuring for investors, although investors may miss out on upside if an agreement is reached and oil prices move higher.

Be the first to comment