ngkaki/iStock Editorial via Getty Images

Investment Thesis

Box’s (NYSE:BOX) integrated content cloud ecosystem generates consistent, sustainable revenue. The company is accelerating its top line growth from existing customers. I like the long term prospects of the business.

However, the company has high stock-based compensation expenses. After adjusting for these, I feel the stock’s current valuation is too expensive.

Net Retention Rate

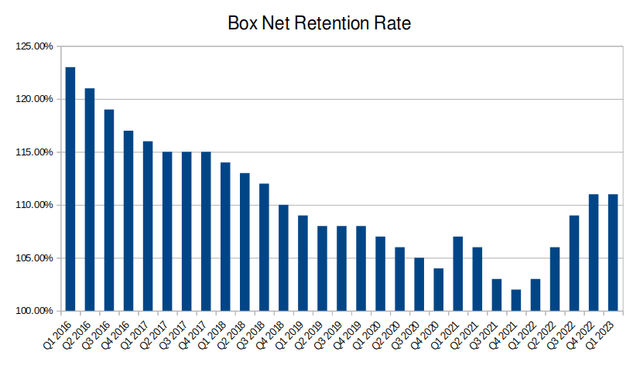

One of Box’s key metrics is its net retention rate. This is the percentage of its annual revenue retained from its existing customers. This measures the company’s effectiveness at expanding its revenue per client. As the company detailed on its Q4 earnings call, roughly 70 to 75% of its bookings are coming from existing customers.

Created by author using data from 10-K and 10-Q filings

Box’s NRR had been falling for some time, but it appears to have hit an inflection point. On its last 10-Q, the company reported its highest NRR in the past four years. The company expects to sustain this rate throughout the rest of the year. I think this is extremely bullish for Box’s revenue and earnings growth.

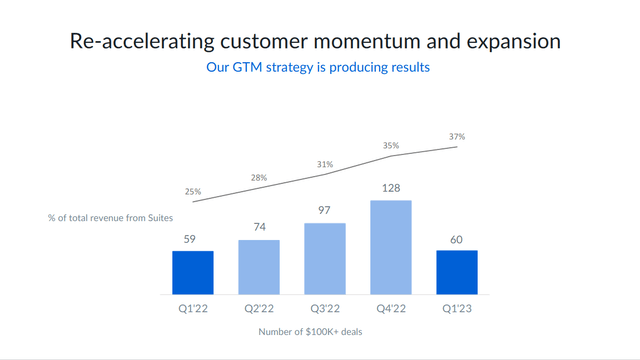

Box Suites growth (Box Q1 earnings presentation)

A lot of this appears to be driven by the company’s Suites strategy. By bundling its products, the business drives more revenue and brings users further into its ecosystem. 37% of Box’s revenue is now made up of revenue from Suites. I expect this to make top line growth more consistent over the next few years.

Growth and Guidance

Box’s business model is simple but strong. The company brings in annual recurring revenue from its users. The nature of Box’s content cloud makes this revenue even more stable. Customers store their content and workflows on Box’s cloud. This makes it difficult to cancel and switch to a competitor. Box’s leadership understands this well. They make it easy to enter their ecosystem with migration services such as Box Shuttle. Then, they retain customers with Box’s diversified lineup of services.

Box’s content cloud features (Box FY23 Analyst Day presentation)

This helps the company grow its top line by selling customers extra products. The company’s ecosystem is its competitive advantage in saturated markets like e-signatures. This means that Box can even benefit from a pullback in corporate spending. When a business is consolidating its IT spending, it will likely prefer integrated suites of services over single-purpose subscriptions.

The company’s guidance from its last earnings call reflects this stability. Box expects to generate $992 to $996 million in revenue during the 2023 fiscal year. This represents an almost 14% increase year over year, which is similar to Box’s results for the past few years. The company guided for $1.11 and $1.15 in EPS, up nicely from $0.85 last year. But I am concerned about the company’s GAAP EPS estimate, which is actually slightly negative.

Profitability

At first glance, Box’s profitability profile looks great. The company reported its first significant profit in the 2021 fiscal year. Operating margins were 15% that year. Last year, the company reported 20% operating margins. Current guidance expects 22.5% for the next year. These margins are extremely healthy for a growing software company.

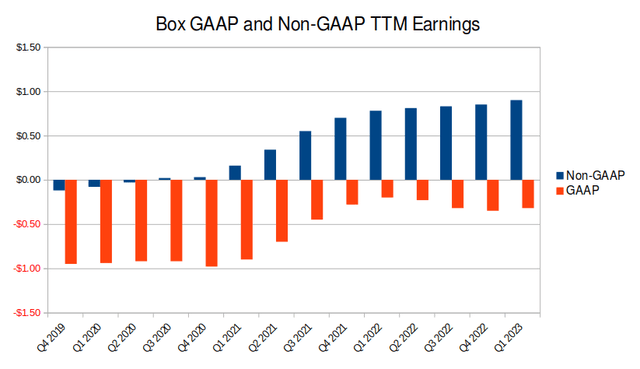

However, the headline earnings numbers reported by the company are adjusted, non-GAAP metrics. This is normally fine, but Box’s GAAP numbers paint a very different picture of the company’s expenses.

Created by author using data from 10-K and 10-Q filings

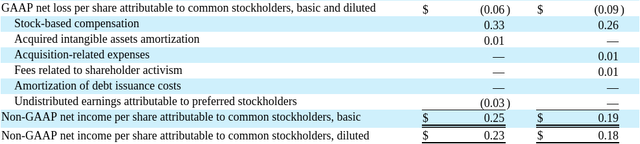

Box is only profitable after adjusting their earnings. Here is their reconciliation between their GAAP earnings and adjusted net income.

As you can see, the primary purpose of this adjustment is to remove stock-based compensation from the company’s results.

Stock-Based Compensation

Heavy stock-based compensation is my primary concern with Box’s earnings and valuation. The company paid out almost 25% of its operating expenses in shares last year. Box has never actually been sustainably profitable on a GAAP basis.

Stock-based compensation is a non-cash expense, which is why Box’s free cash flow numbers look so good. But Box’s stock-based compensation is a real, reoccurring expense used to pay for employees’ salaries. Box has decided to return money to its shareholders through share buybacks. This means that this dilution directly reduces the stock’s returns.

An analyst asked Box’s management about this on their most recent earnings call.

I would say that we do expect stock-based comp to trend down as a percentage of revenue pretty steadily in the coming years. The leading indicator of that is the equity burn rate, which did come down even over the past year by a little more than a percentage point. And so while the philosophy of cash versus equity is pretty consistent with what we have done in the past, would say that the overall more needed hiring growth and our focus on scaling in lower-cost locations are some of the drivers of what allows us to show that leverage.

It seems like management doesn’t believe stock-based compensation is a major issue. They want to mitigate their SBC expenses simply by increasing revenue. This makes some sense, but this cost should be accounted for in the company’s valuation.

Valuation

After adjusting for stock-based compensation, Box’s stock looks expensive. On a non-GAAP basis, the company trades at just under 23 times its EPS guidance for this year. I think this is fair for a company growing at a low double digit rate.

The valuation looks much worse after accounting for about $1.25 per share in stock-based compensation (using TTM expenses). This is unlikely to change soon. I’m going to discount analyst EPS estimates by this amount. This gives Box a premium valuation even after it becomes GAAP profitable. After making the adjustment, Box trades at almost 40 times estimated 2025 earnings. This is extremely expensive for a company that is only growing its top line by low double digits each year.

Final Verdict

Box has a successful suite of products and a solid business model. The company’s revenue growth is decent. Net retention rate metrics point to sustainable future growth.

But Box is encumbered with very high, reoccurring stock-based compensation costs. I don’t think the valuation makes sense after adjusting for these expenses. I don’t recommend buying or holding Box’s shares at their current price.

Be the first to comment