KanawatTH

By Vivek Bommi, CFA

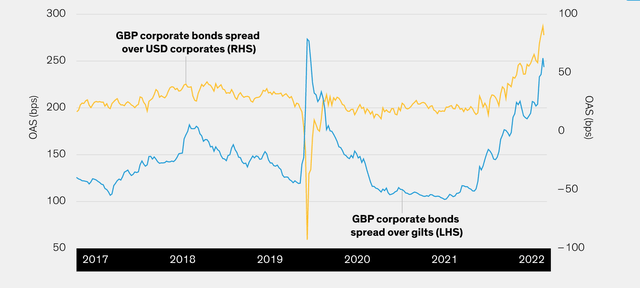

Sterling Corporate Bonds Are Looking Very Cheap Compared with History

Spreads over Gilts Are the Widest Since COVID-19 and Spreads Over US Dollar Corporates Are the Widest in Years

Historical and current analyses do not guarantee future results. As of October 18, 2022 (Source: Bloomberg US Corporate Total Return Unhedged USD Bond Index, Bloomberg Sterling Corporate Bond Total Return Unhedged Index)

UK bond prices have plunged recently after a sharp sell-off in government bonds (gilts) was compounded by forced selling from distressed UK pension funds. Year-to-date, the worst-hit parts of the gilts market have given up 15 years of gains. Sterling-denominated corporate bonds have also fallen sharply and are looking very cheap by historic standards (Display, above).

With the whole sterling market selling off, two categories of corporate bonds look particularly good value:

- bonds from US issuers with global operations that are less sensitive to the UK and European growth outlooks, and

- issues from companies in less cyclical industries that are better placed to ride out economic fluctuations

Can sterling bond spreads stay this wide? We think they have already peaked.

For now, some forced selling remains as UK-defined benefit pension funds strive to meet margin calls on the leveraged interest-rate hedging strategies they instituted as part of liability-driven investing (LDI) programs. These pension trusts have struggled to raise cash collateral, particularly as their holdings in private markets and property cannot be liquidated promptly. This has exacerbated selling pressure on the pension funds’ saleable assets – notably, UK gilts and credit.

But we think UK bond markets are set to stabilize. The UK government has already substantially rowed back on the unfunded tax-cutting policies that called the country’s financial stability into question. And the Bank of England has acted promptly, temporarily suspending its quantitative tightening program in order to act as a buyer of last resort for distressed pension funds. Bank governor Andrew Bailey has sent a strong message that pension trustees have only a short time to get their strategies in order and that the bank’s support program would end promptly last week. So we expect the forced selling dynamic to fade, and we have already seen the first signs of stability at the longer end of the credit market.

UK pension funds’ distressed-selling losses from the crisis have been estimated to total £150 billion. That’s a tidy sum. But it highlights the extent of the opportunity for buyers on the other side of the trade.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment