Do the digging, get the dividends. damedeeso

With the rapid rise in interest rates (excluding the recent reversal), there is more interest (bad pun) in whether REITs are positioned to withstand higher short-term rates. The question is particularly important for short-term earnings growth rates (Core FFO and/or AFFO). We brought this question to the apartment REIT sector recently.

In preparation for providing updates on several apartment REITs, I wanted to compare how much of a headwind we should see in Core FFO and AFFO next year for apartment REITs.

The answer is: “probably not enough to justify preparing the model”.

Regardless, it is a sunk cost now and the model should still be useful for other types of equity REITs. It will be most relevant for those with more floating-rate debt or near-term maturities on fixed-rate debt.

Process

We pulled all the major debt statistics on each of the big six apartment REITs:

(AVB), (EQR), (ESS), (CPT), (MAA), and (UDR)

We established the amount of fixed-rate debt maturity for each year and the total amount of floating-rate debt. Since debt exposure is not dramatically different across these 6 REITs, we used the following assumption:

- Average interest rate on floating-rate debt for 2022 of 2.5%.

- Average interest rate on floating-rate debt for 2023 of 5.5%.

- All fixed-rate debt maturing is rolled over at 5.5%.

- Fixed-rate debt is rolled over on June 30th for each year. I would’ve used 1-month prior to actual maturity date (refinancing is rarely left to the last day), but some REITs provided less detailed information on the exact dates.

Given that the 5-year Treasury is 3.985% today and these REITs can usually borrow money at a spread smaller than 1.5% over Treasury rates, most likely the actual numbers will turn out a bit better for the REITs.

Results

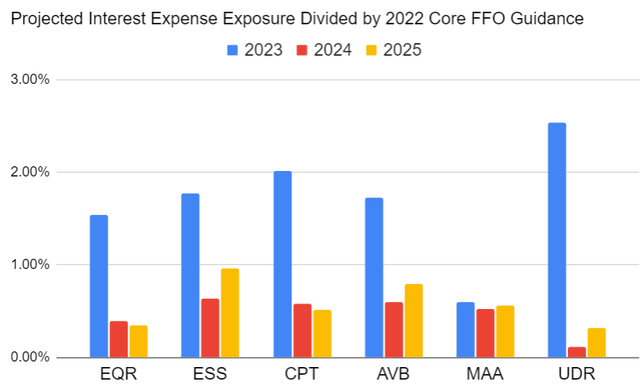

To make results easier to understand, we compared the increase in projected interest expense to Core FFO per share guidance for 2022. For instance, if interest expense would increase by $.10 per share but Core FFO per share guidance was $5.00, then the headwind would be 2%. We also modeled the headwind for 2024 and 2025. If we projected 2024 interest expense would be $.05 higher than 2023 interest expense, then the headwind for 2024 is 1%.

Since rates rose dramatically in 2022 and the majority of the exposure comes from variable rate debt, the headwind is largest for 2023. However, none of the REITs were facing a headwind as large as 3%:

UDR had the greatest exposure at 2.53%.

Other Opportunities

I focused on evaluating positions as of the end of Q3 2022. If the REIT refinanced a large portion of very cheap debt into more expensive debt during the quarter, part of that impact would be missed. If the debt that was refinanced was already around 4% to 5%, then it would be a minimal headwind as the rate would barely have increased. Some REITs actually refinanced expiring fixed-rate debts into cheaper fixed-rate debts during the year.

I would expect the net impact of controlling for those factors would be pretty small, so it doesn’t rank as a high priority today.

5 Thoughts About Interest Rate Impacts

Five things investors should know:

- Higher interest rates will most likely have some negative impacts on the private party value for apartment buildings. That’s okay since the REITs already trade at huge discounts to the projected net asset value.

- The recession caused by higher interest rates may reduce occupancy as more people seek roommates or live with family. That will be a negative impact on revenue.

- Higher interest rates will keep some people renting, as homes are out of reach, which will help to offset pressure from the recession.

- The direct impact to AFFO per share from higher interest expense is minimal. It hurts the growth rate a bit, but it’s just not that much. It can be the difference between 6% growth and 4% growth for one year. However, going into 2024 the remaining headwind would be minimal (unless rates continue to increase materially).

- The analysis here focuses on these 6 apartment REITs. There are many smaller REITs with far more leverage where the hit to AFFO per share should be far worse. For instance, GNL should get smacked by higher rates.

Conclusion

The impact of higher interest expense on the 6 apartment REITs we cover is minimal. The impact for 2023 is pretty small and the projected impact thereafter is even smaller.

The answer to our headline question is a resounding “Yes”.

Consequently, investors shouldn’t be remotely concerned about interest rates impacting dividend coverage. The biggest risk factor here is simply the impact to the economy from higher rates and the price impact as some investors favor bonds while the yields are closer. Some investors only see the dividend yield today without seeing the growth rate. We like the long-term growth in AFFO per share (which drives dividends), so we remain very interested in building our equity REIT positions.

For instance, our shares of ESS are paying a dividend yield of about 4%. However, they’ve also grown that dividend per share for more than 25 consecutive years. That includes growing dividends during the Great Financial Crisis. At that point, dividend coverage became dramatically weaker. However, the coverage today is excellent, which should make it easy for dividends to continue growing at a respectable rate.

Outlook: We are bullish on 6 all of the apartment REITs. Exact price targets are not included in the public article, but all 6 are bullish.

Technical factors in this sector remain terrible as 5 of the 6 recorded their lowest close of the last 52 weeks on 11/09/2022. Further, growth in AFFO will be falling significantly (from absurdly high values, which we warned investors about a year ago).

However, the REITs trade at unusually low multiples of AFFO per share. Even adjusting for higher Treasury rates, we find the valuation compelling. Further, throughout the sector the price-to-consensus-NAV (net asset value) ranges from .71 to .82. I expect those NAV estimates will still be reduced slightly further, but it’s rare to see discounts of this magnitude in the apartment REITs.

Investors buying into the sector should be focused on the underlying quality of the cashflows as we still expect to see some headlines about the plunging growth in rental rates. As we said a year earlier, you can’t compound rental rate increases at double-digit rates. Rental growth rates were in the mid-teens. Obviously, that could not last. Now the market is in the process of overreacting to something that was painfully obvious.

Bullish ratings on AVB, EQR, CPT, ESS, MAA, UDR. We are long AVB and ESS.

Be the first to comment