gorodenkoff

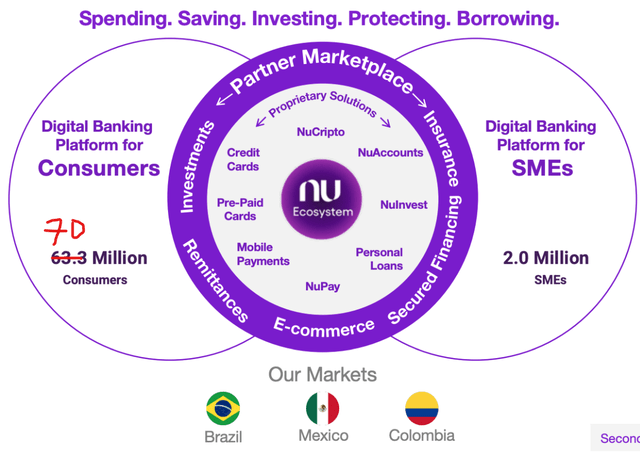

Nu Holdings (NYSE:NU) also known as “Nubank” is the largest fintech bank in Latin America and the sixth-largest financial institution in the region. The company has just announced a record quarter with revenue growth of over 170% year over year. In my previous post on Nu Holdings, I outlined the opportunity for this stock to “bank the unbanked” in Latin America. Since that post, the stock has popped by ~14% in premarket trading after this outstanding quarter. As an extra datapoint, Warren Buffett’s investment conglomerate Berkshire Hathaway purchased $1 billion worth of stock in the first half of 2022, at an average price of ~$9.38 per share. The stock is trading cheaper than this price at the time of writing. Thus, in this post, I’m going to break down the company’s third-quarter financials, and valuation. For details on the company’s business model you can check out my prior post, the image below also helps to give you an idea of what this financial “super app” does. I have updated the consumer customer column to 70 million, as the business is growing rapidly.

Nubank Business model (Investor Day Presentation )

Solid Third Quarter

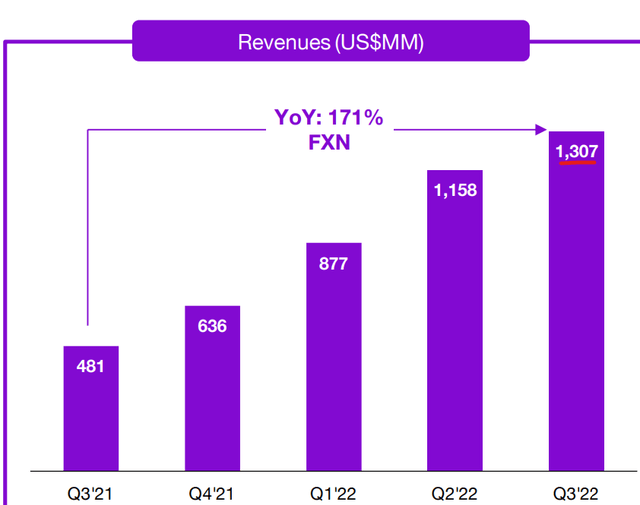

Nu Holdings generated solid financial results for the third quarter of 2022. Revenue was $1.3 billion, which increased by a blistering 171% year over year and beat analyst estimates by $120 million (FX Neutral).

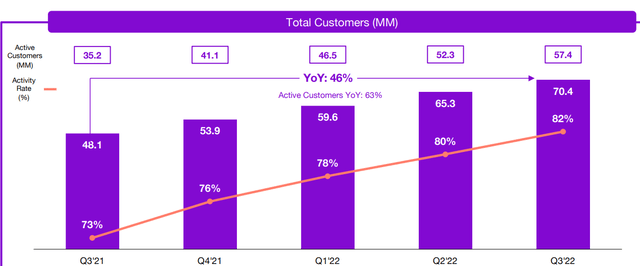

Top-line revenue growth was driven by two main factors; customer growth and average revenue per user growth. The company added 5.1 million customers quarter over quarter and increased its total to over 70 million, up 46% year over year. The beautiful thing about this growth in customers is it has been achieved mainly through organic channels, thus achieving a rock-bottom customer acquisition cost. This isn’t unprofitable growth like you see at many growth companies when they will overpay for user acquisition in the hope of generating profit long term. Nu Holdings is also seeing faster growth in countries such as Mexico and Colombia, with those countries driving 500,000 new customers in the quarter.

Nu Holdings focuses on driving up the “activity rates” for users as inactive users don’t really generate much cash flow for the business. The company has achieved an upward growth trend in its activity rates which has increased from 73% in Q3,21 to 82% by Q3,22, [orange line below].

Users Nu Holdings (Q3,22 report)

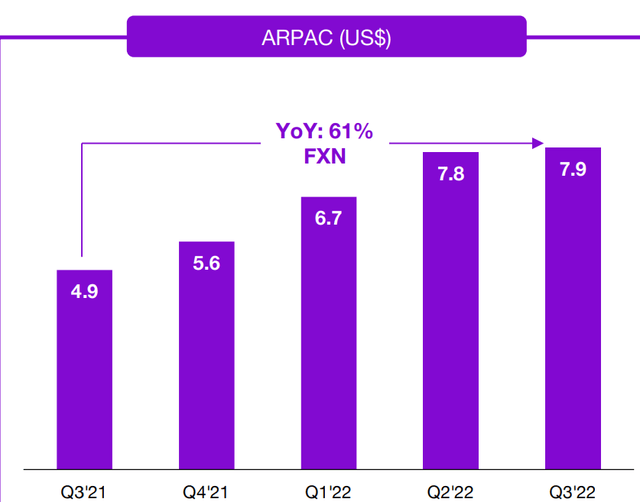

Nubank accomplishes this growth in activity through its ecosystem of products that help users to “spend, save, invest, protect and borrow”. This also helps to increase the Average Revenue Per Active Customer [ARPAC] which has increased by 61% year over year to $7.9. Its active customers are also divided into different cohorts and using a “land and expand” approach the company has grown its ARPAC for its mature cohorts to $22 which is astonishing. This ARPAC can be further expanded with partner programs and increased cross-selling across both credit and non-credit products.

Nubank’s card business has seen a major boost in purchase volumes which have increased by a rapid 75% year over year to $21.2 billion [FX-Neutral]. The vast majority of its credit card customers come from existing customers which Nubank then upsells, as discussed prior. Nubank has calculated that after a customer has been with the bank for 24 months, their average credit card spending usually triples, which is astonishing.

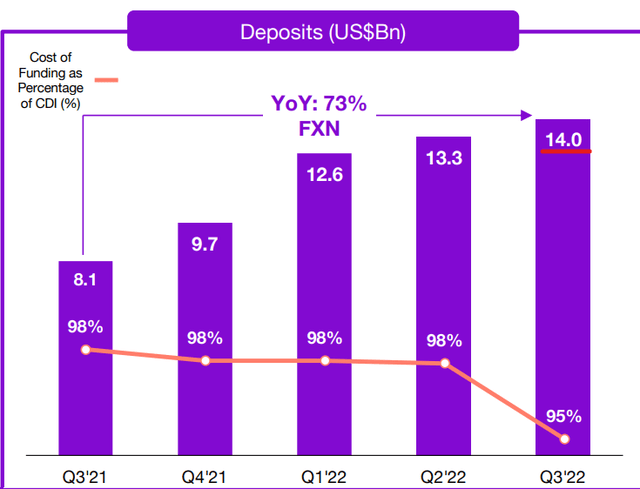

The company’s consumer finance portfolio which compiles both credit cards and personal loans, increased by a rapid 83% year over year to $9.7 billion. Total deposits increased by a rapid 73% year over year to $14 billion, as the consumer increases its savings with the bank, mainly due to customer increases, the macroeconomic environment and new deposit products.

For example, Nubank launched “Money Boxes” an investment targeting tool that aims to create customized deposits tied to goals. The product launched in mid-September and had a massive 1.7 million customers sign up in the first 2 weeks. Given Nubank has a customer base of over 70 million, the product could boost deposits across the entire customer cohort over a longer period.

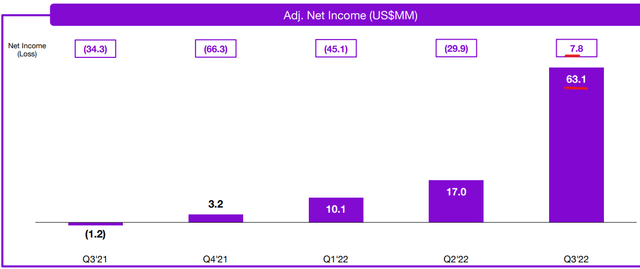

The company has gradually increased the efficiency of its platform, thanks to economies of scale benefits. This resulted in Net income going from negative $34.3 million in Q3,21 to positive $7.8 million by Q3,22. On an Adjusted basis Net Income has increased from negative $1.2 million in Q3,21 to positive $63.1 million by Q3,22.

Nu Holdings is in a strong capital position with 4 times the minimum regulatory capital requirement in the countries it operates. In addition, the business has a loan-to-deposit ratio of 25% which is great. The business has $3.5 billion in loans, with total deposits four times this at $14 billion.

Advanced Valuation

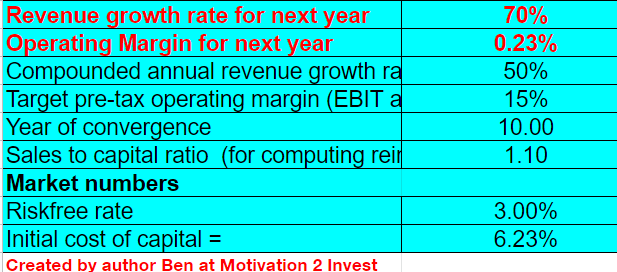

Valuing Nu Holdings is quite challenging as the business has become more complex thanks to its number of financial instruments. However, using my discounted cash flow model, I believe we can get a good idea of value. In this case, I have kept my revenue forecasts the same as my prior model. I have forecasted 70% revenue growth for next year and 50% revenue growth over the next 2 to 5 years.

Nubank stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the business to continue to increase its operating margin to 15% over the next 10 years. I expect this to be driven by continually high operating leverage, new products and increased cross-sells.

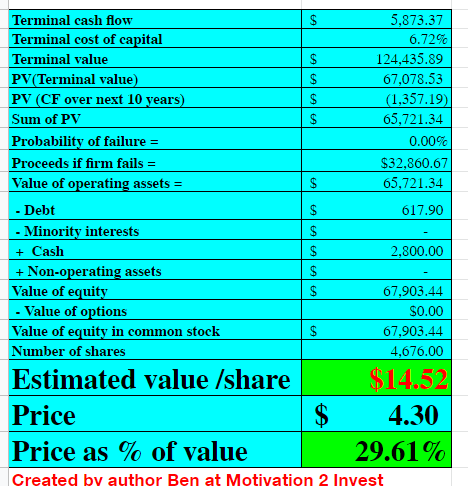

Nubank stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $14.52 per share, the stock is trading at $4.30 at the time of writing and therefore is deeply undervalued, by ~70%.

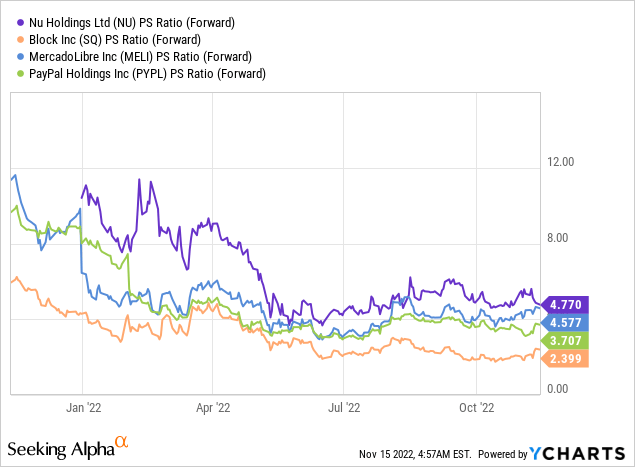

As an extra datapoint, Nubank trades at a Price to Sales = 4.77 which is cheaper than the levels in early 2022 of over 8. I did notice the company is trading at a slightly higher valuation than other fintech apps such as Block (SQ) (PS = 2.4) and PayPal (PYPL), PS = 3.7. However, these businesses are not growing revenue at anywhere near the rate Nubank is and also do not have as much exposure to the growing Latin American market.

Risks

Recession/Payments slowdown

Brazil has a fairly high inflation rate of 6.47%, this is on a downward trend after its central bank has raised interest rates over 12 times. However, many analysts are forecasting stagnant growth for Brazil and slowing exports for at least the next year. Generally, poor economic conditions results in lower consumer spending and thus lower revenue for fintech.

Final Thoughts

Nu Holdings is a tremendous company that is executing strong and growing rapidly. The business is increasing revenue, profits, customers and engagement while continuing to rollout new products. The stock is undervalued due to macroeconomic uncertainty and also fairly low profitability, although long term this looks to be a winner a Latin America.

Be the first to comment