gchapel

It’s been a painful couple of months for investors in the Gold Juniors Index (GDXJ), with the ETF sliding more than 40% since its April highs, underperforming the S&P 500 (SPY) year-to-date. This is partially attributed to metals price weakness but also the low quality of many names in the ETF, which have been more than halved, like Argonaut Gold (OTCPK:ARNGF), Iamgold (IAG), Coeur Mining (CDE), and Great Panther Mining (GPL).

Unfortunately, despite the solid operating performance, Calibre Mining (OTCQX:CXBMF) has been caught up in the selling pressure, finding itself nearly 60% off its all-time highs at its recent low. This is even though it is one of the better organic growth stories sector-wide, set up to grow production by nearly 40% from FY2022 levels and reported record production last quarter. With the stock still well above key support, I don’t see it as a Buy just yet. However, I would view pullbacks below C$0.78 as buying opportunities.

Calibre Operations (Company Video)

Just over two months ago, I wrote on Calibre Mining, noting that while it was one of the best values among the producers, it wasn’t sitting in a buy zone, given that it had recently broken a key support level. In addition, I noted that the stock’s prior support at C$1.26 [US$0.98] was likely to become new resistance. Unfortunately, this was the case, with Calibre reversing sharply after rallying back to its broken support level. Since then, Calibre has shed over 30% and has dipped beneath a $400 million market cap, a dirt-cheap valuation for a mid-tier producer with growth in the wings. Let’s take a closer look below:

Q1 Production

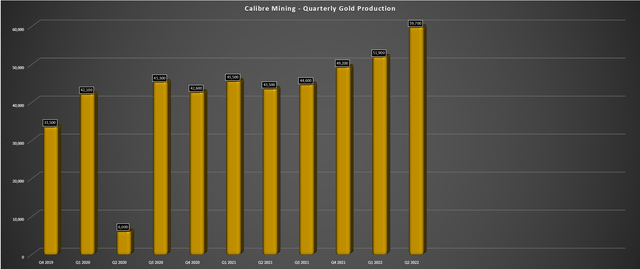

Calibre Mining released its Q2 production results this week, reporting quarterly production of ~59,700 ounces, a 37% increase from the year-ago period. This was partially attributed to the acquisition of Fiore Gold and its operating Pan Mine in Nevada. However, even on an organic basis (ex-Pan), production increased 12% to ~48,800 ounces. These are phenomenal results, with the Pan Mine contributing ~10,900 ounces and Limon and Libertad combining for just shy of 50,000 ounces in Q2. As shown below, this represented a record quarter for the company by a wide margin.

Calibre Mining – Quarterly Gold Production (Company Filings, Author’s Chart)

The good news is that more records appear to be on deck, with higher grades expected in H2 and the company already tracking at 49% of its guidance mid-point (~228,000 ounces). This suggests that we could see a 60,000-ounce plus quarter in the back half of the year and that Calibre could easily beat its guidance mid-point. In a sector where many mid-tiers are inconsistent, it’s nice to see a company that can consistently under-promise and over-deliver. The ability to consistently meet or beat targets also gives investors the confidence they can rely on Calibre’s recent medium-term guidance, which points to growth to 300,000 ounces per annum in 2024.

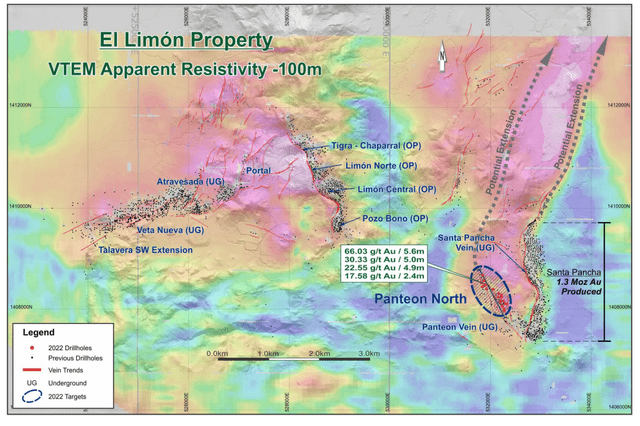

While the operating results were solid, the company also had a strong quarter from an exploration standpoint. This included high-grade results from Panteon North at its smaller Limon Complex (7.3 meters at 17.8 grams per tonne gold, 3.9 meters at 9.72 grams per tonne gold, 2.4 meters at 12.75 grams per tonne gold). Calibre followed this up with 5.6 meters at 66.03 grams per tonne gold, 5.0 meters at 30.33 grams per tonne gold, and 4.9 meters at 22.55 grams per tonne gold at Panteon North.

This zone is located just 1 kilometer northwest of its producing Panteon Mine and suggests some upside to the current Limon Complex resource base. It’s important to note that this discovery was not included in its medium-term growth outlook, but the grades here could certainly augment its production profile. Looking at the below map of the El Limon Property, the VTEM resistivity low/high contact has been traced for 6 kilometers to the northeast, suggesting the potential for mineralization, suggesting this might be just the tip of the iceberg. For now, Panteon North remains open down plunge and along strike to the northwest.

El Limon Property – Geophysical Survey Map (Company News Release)

Meanwhile, in Nevada, Calibre reported several impressive intercepts from its Gold Rock Project, a development project that lies south of its Pan Mine that’s currently in operation. Highlight intercepts from Gold Rock included 45.7 meters of 2.01 grams per tonne gold, 38.1 meters of 1.45 grams per tonne gold, and 35.7 meters of 1.74 grams per tonne gold from the North Pit Zone. As for the Central and South Pit, they each delivered impressive intercepts as well, which included the following:

- 18 meters at 2.94 grams per tonne of gold

- 35.1 meters at 1.26 grams per tonne of gold

- 18.3 meters at 1.53 grams per tonne of gold

- 18.3 meters at 3.10 grams per tonne of gold

- 27.4 meters at 1.40 grams per tonne of gold

While the above intercepts might not seem all that impressive compared to the high-grade hits at Panteon North in Nicaragua, it’s worth noting that these grades are more than double the average grade of 0.66 grams per tonne of gold at Gold Rock. Besides, when it comes to material that’s amenable to heap-leaching, even 0.50 gram per tonne of gold material will make the cut, and anything above 1.0 gram per tonne of gold is exceptional. For those unfamiliar, SSR Mining (SSRM) is actively mining in Nevada with an average grade below 0.50 grams per tonne of gold.

Based on the 2020 Preliminary Economic Assessment [PEA] completed at Gold Rock, the project appeared capable of producing ~56,000 ounces per annum with all-in sustaining costs of $1,000/oz. This was based on an average reserve grade of 0.66 grams per tonne of gold. If we saw a lift in grades to 0.75 grams per tonne of gold, this would dramatically improve the project economics, lifting average annual production and lowering costs. So, while I still expect costs to come in above $1,050/oz when incorporating inflationary pressures, a grade improvement would certainly be a plus for this project.

Medium-Term & Long-Term Growth

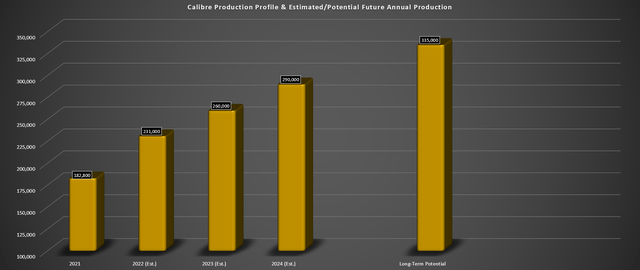

If we look out medium-term, there’s lots to like about the Calibre story, with the company recently unveiling firm guidance to grow production to 250,000 to 275,000 ounces in 2023 and 275,000 to 300,000 ounces in 2024. Importantly, Calibre’s path towards growth is quite simple, unlike other companies with growth plans that require considerable capex that are exposed to potential cost overruns and may not be able to finance this growth without dilution. This is because the company already has the infrastructure to meet its production targets, with the bulk of this growth utilizing excess capacity at its Libertad Mill.

El Limon Drill Core (Company Presentation)

Calibre’s plan to achieve this growth is based on exploring the excess ~1.0+ million tonnes of milling capacity at its Libertad Mill, with plans to truck ore from Pavon Central (a high-grade open pit) and Eastern Borosi (high-grade open-pit). The combined grade of these two opportunities is above 6.0 grams per tonne of gold, which will spike the mill’s average feed grade of ~2.7 grams per tonne of gold on a trailing twelve-month basis. It’s worth noting that this growth to 275,000 to 300,000 ounces by 2024 does not include Gold Rock, it does not include the Volcan discovery (Libertad Complex), does not include Tranca (Libertad Complex), and does not include Panteon North (Limon Complex).

Calibre Mining – Estimated Annual Gold Production & Long-Term Potential (Company Filings, Author’s Chart)

Looking at the chart above, I would not be surprised to see the company produce 231,000 ounces this year (26% growth) and follow this up with 260,000 ounces in FY2023 and 290,000 ounces in FY2024. This would translate to 58% growth from FY2021 levels, making Calibre one of the highest-growth producers sector-wide. However, long-term, I see the potential for the company to produce 330,000+ ounces with the addition of Gold Rock. Therefore, for investors looking for growth in the sector, Calibre continues to be a unique opportunity, especially given that it does not require any share dilution to meet these goals (~$90 million in cash and modest capital requirements).

Valuation & Technical Picture

Based on ~490 million shares and a share price of US$0.75, Calibre Mining trades at a market cap of ~$368 million and an enterprise value of ~$275 million. This is a dirt-cheap valuation, with Calibre trading at less than 2.5x trailing-twelve-month operating cash flow and less than $200.00/oz on mineral reserves or $138.00/oz on M&I resources (operating assets/advanced assets only – Nicaragua/Pan).

If Calibre were a no-growth producer with no development pipeline, this valuation might make some sense. However, with Calibre having a solid development pipeline and a path to 300,000+ ounces per annum, the stock is heavily undervalued at current levels. Even assuming a conservative cash flow multiple of 4.0 and FY2023 cash flow of $155 million translates to a fair value of more than 60% above current levels (US$1.26). Let’s take a look at the technical picture:

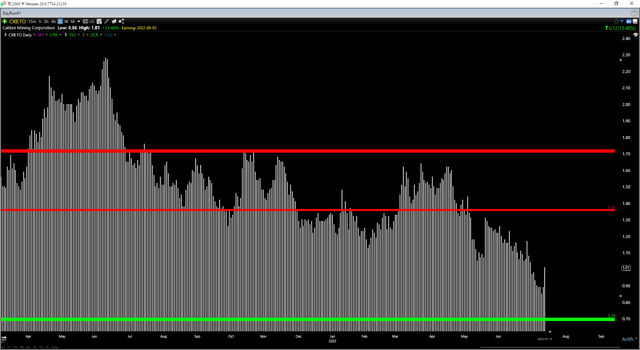

CXB.TSX Daily Chart (TC2000.com)

While Calibre is significantly undervalued, the stock is near the middle of its support/resistance range, with no strong support until C$0.70 [US$0.55] and a new resistance level at C$1.36 [US$1.07]. From a current share price of C$1.01, this translates to a reward/risk ratio of 1.13 to 1.0, which is not ideal for starting new positions. Instead, I prefer a minimum reward/risk ratio of 6.0 to 1.0 for small-cap stocks, which would require a dip below C$0.78 [US$0.61]. Obviously, Calibre may not reach this level, but this is where the technicals and fundamentals would line up and create a low-risk buy point, with the stock closer to key support.

Summary

For investors comfy with exposure to Tier-3 jurisdictions (Nicaragua), Calibre is one of the most attractive growth stories sector-wide. Most importantly, it can achieve this growth without share dilution due to its strong balance sheet. This is a great position to be in during a tough market environment, with other producers raising capital by selling equity at the worst possible time, like Argonaut Gold. However, while the stock is undervalued, it does not have any strong support until C$0.70 [US$0.55], suggesting that there’s a possibility that the stock could see lower prices before its final low is reached. For this reason, I believe patience is the best course of action, and I continue to focus elsewhere for the time being.

Be the first to comment