RiverNorthPhotography

Bank earnings are wrapping up. It has been a mixed bag with some large names and regional players reporting a strong consumer while also building credit reserves should the economy take a leg down. One Midwest bank reported a slight bottom-line miss Thursday morning, but the stock remains a good value with a high yield.

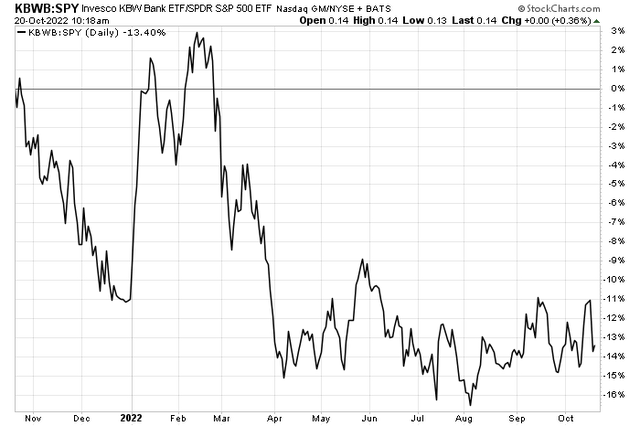

Banking ETF Flat Versus SPX Since April

According to Bank of America Global Research, Fifth Third (NASDAQ:FITB) is a large-cap regional bank with over $200 billion in assets that operates primarily in the Midwest and Southeast. The company’s lending portfolio focuses primarily on C&I, residential real estate, and auto loans.

The Ohio-based $22.8 billion market cap bank within the financial sector trades at a low 9.7 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.1% dividend yield, according to The Wall Street Journal.

The bank trades at a discount to its peers while earnings upside is likely in the coming quarters. The firm’s strong expense management is a valuable asset while it generally benefits from higher rates as the spread between what FITB earns on assets relative to what it pays out to depositors is strong. Downside risks include greater credit loss reserve builds amid the uncertain environment and weaker-than-expected loan growth should business activity weaken.

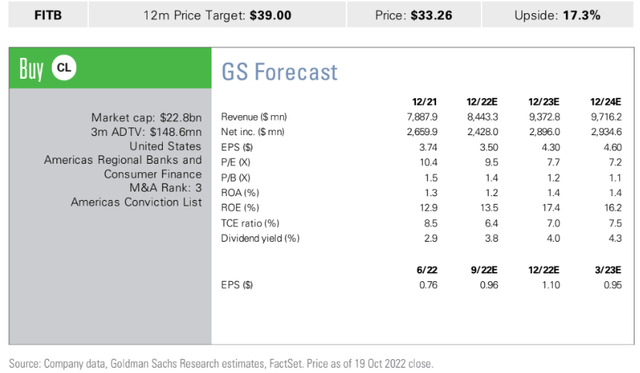

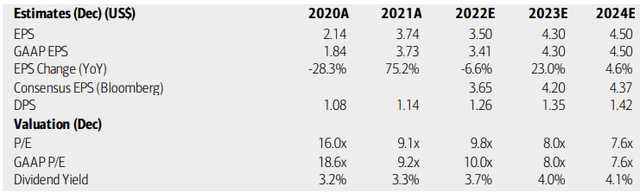

On valuation, analysts at BofA see earnings growing sharply next year after a 2022 dip. EPS for 2024 should normalize to a moderate growth rate level. The Bloomberg consensus forecast is about on par with BofA’s outlook. Dividends are seen as increasing through 2024 while the firm’s operating and GAAP P/E ratios are forecast to be low should the stock price hover here. Overall, the valuation is attractive.

Fifth Third Earnings, Valuation, And Dividends Forecasts

Following an earnings miss this morning, the stock is trading slightly lower. Goldman Sachs notes that results were decent in their view while the outlook was also better than expected. Goldman has a $39 price target which would be nearly 20% of upside from here.

GS Bullish on FITB

Goldman Sachs Investment Research

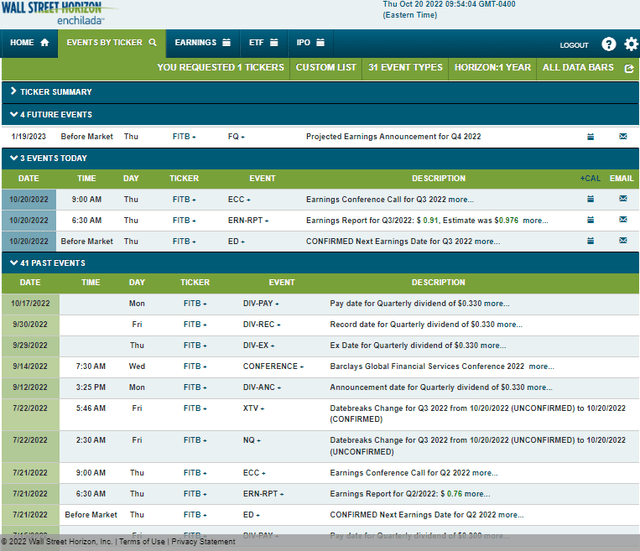

Looking ahead, Wall Street Horizon notes that FITB’s corporate event calendar is light until its next earnings report, which is projected for Thursday, Jan. 19.

Corporate Event Calendar

The Technical Take

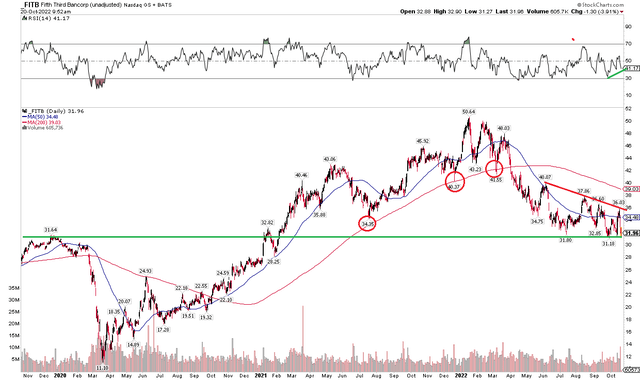

FITB is bouncing off support near $31 today after the mixed quarterly earnings report. I see a few interesting things on the chart. First, along with support in the low $30s, there’s a downtrend resistance line off the June peak that comes into play near $36. Next, the falling 200-day moving average was support on the way up on a few successful holds in 2021 into this year – keep your eye on that price level, currently at Goldman’s $39 target, on any rally. I also notice that there’s some modest bullish divergence between price and the RSI indicator up top on the chart.

Overall, I think being long here with a stop under $30, targeting a move to the mid-$30s is in play. A thrust above the 200-day would support a bullish longer-term trend reversal.

FITB: Bullish Divergence, Stock Holds Support

The Bottom Line

I think Fifth Third is a buy here based on a low valuation, better earnings growth next year, and a decent chart. While not yet in an established uptrend, there are defined prices off of which to trade. Long-term investors can be long and reap the rewards from FITB’s high yield, too.

Be the first to comment