by Martin Nancekievill/iStock via Getty Images

Popular opinion is bullish on Cabot Corporation (NYSE:NYSE:CBT) in the face of an economic Doom loop. We are bearish. There are three significant risks, and we do not envision a potential opportunity warranting any bullish recommendation. Cabot appears to us to be a black swan.

The Buzz

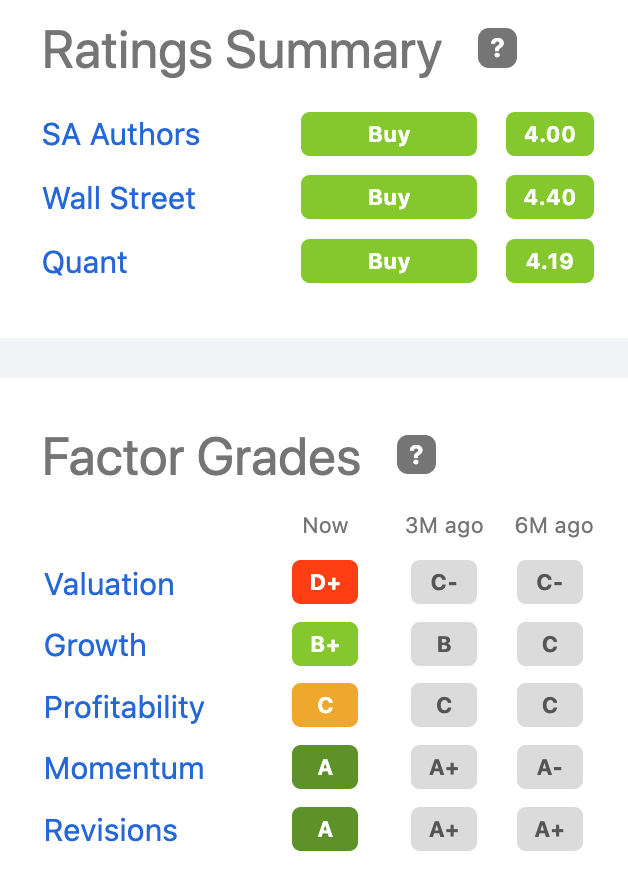

There is a buzz in financial quarters about chemicals stocks and Cabot Corp. shares are thought to be oversold. Seeking Alpha ranks Cabot Corp 3 out of 27 in the commodity chemicals industry. It is in the top 10% in the Materials Sector. The Quant Rating is pushing towards a “strong buy” at 4.19. That is past the hold range using metrics weighted for their predictive solid value. A +27.47% uptick in Cabot’s share price this past year bolsters speculation about higher valuations.

We see forecasts that the average price for Cabot over the next year will bounce 33% to 90% higher from the current $63.89. One investment site issued a buy signal last week. UBS Group (UBS) issued an alert earlier in the year. UBS claims comeback conditions in the chemicals sector this year are setting the stage for higher stock prices.

We believe persistent risks will stymie the shares of Cabot Corporation; the share price will hover around $65, moving slightly up or down depending on world news and market agitation. Cabot’s shares are uncomfortably volatile. The Beta rating is 1.26. Shares are up a mere 10.8% over the last five years.

Quant & Factor Ratings (Seeking Alpha)

A Viable Niche Company

We were bullish in previous articles. After all, Cabot is a 140-year-old legacy company underpinning the industrial base of America’s expansive economy. Cabot’s commodity chemicals and specialty additives are essential ingredients used across industries in every modern economy.

Their specialty chemicals enhance the performance of products, reinforce materials, and are purification solutions. Cabot’s products are found in adhesives and sealants, consumer rubber products, coatings, construction materials, electronics, and energy storage, food and beverage, inkjet technology, oil, gas, and mining solutions like subsea pipelines, industrial insulation, and in consumer goods including pharmaceuticals and personal care products, plastics, tires, printing, and packaging.

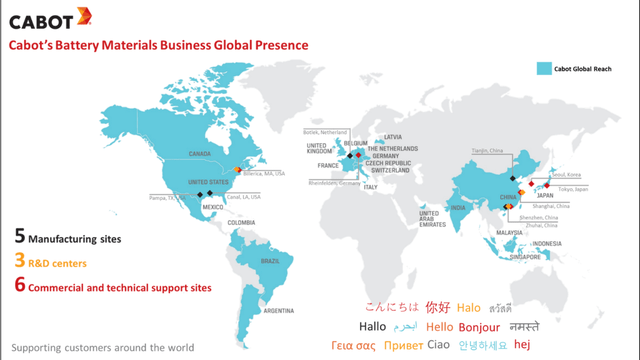

Cabot is a relatively small but novel niche player in the sector. Its Market Cap of $3.6B pales in comparison to Dow Inc.’s (DOW) Market Cap of $31.55B. Cabot’s R&D, manufacturing, and sales footprint is in the U. S., Europe, and China. Cabot owns subsidiaries and operates, some as joint ventures, a dozen major facilities in China.

On March 1, 2022, Cabot Corp announced the completion of the acquisition of the Chinese Tokai (Tianjin) Carbon Co., Ltd. This move gives Cabot extra manufacturing capacity for its Battery Materials production. China is the world’s largest producer of carbon black. The acquisition gives Cabot expanded capacity to produce 50,000 metric tons each year.

Rosy Picture

The Q3 ’22 Results Call on August 9, 2022, painted a rosy picture. Management reported the company’s third-quarter record-level financial performance by focusing on high-growth vectors, especially Battery Materials, while successfully navigating “pandemic lockdowns in China, continued logistics constraints, and higher energy and raw material costs.” Cabot’s Reinforcement Materials and Performance Chemicals segments turned in record results in Q3.

In a snapshot, The Boston-based company had Q3 net income of $1.69 per share. Earnings adjusted for non-recurring costs were $1.73 per share. Both exceeded Wall Street expectations. Cabot had a 14% increase in diluted EPS and a 28% increase in adjusted EPS Y/Y. Revenue of $1.15B in Q3 beat forecasts of $1.04 billion. Cabot expects full-year earnings of ~$6.10 per share. Discretionary free cash flow in Q3 reached $135M. The company holds $208M of cash. Total liquidity is $1.1B.

Cabot’s management expects its Battery Materials unit, Reinforcement Materials, and Performance Chemicals segments to outperform. Management makes a strong case for its sustainability plan in its Q3 report; staff is striving to reduce greenhouse gases and share excess energy from co-generation units. They plan to shift their transportation fleet to all-electric.

The Q3 report impressed and the financial buzz was positive. Altogether, we like Cabot Corp stock in a retail value investor’s portfolio. But we identify three risks that potentially create severe headwinds limiting any significant uptick in the share price over the next six to nine months. If the stock market plunge gets steam, CBT shares might fall into the $55 range.

Risks

The risks we foresee are in no particular order or event sequence. They dampen or at least forefend the swirling optimism with visions of much higher share prices.

- The Cabot-China Relationship

Cabot’s expanding investments in plant upgrades, acquisitions, and further collaborative relationships with Chinese companies (e.g., energy sharing) at this time of inimical diplomatic and military international relations is quizzical. “Friendshoring,” coined by Elisabeth Braw, a columnist for Foreign Policy, is the staunch trend of American companies. They are fleeing China. Cabot’s management seems to give short shrift to friendshoring. It has significant investments elsewhere in Asia-Pacific if the company might want to downsize in China but appears committed to expanding Chinese operations.

The Battery Materials segment might be a soft target if problems develop in China. Cabot’s sale of carbon additives to lead-acid and lithium-ion battery makers is a significant source of revenue and profits presently and in the future. Cabot is “delivering battery performance through particle technology expertise,” according to one senior business development manager at Cabot speaking with the Innovation News Network. China leads in battery development and production and Cabot has a footprint there. How long can that last?

Cabot’s Battery Materials Locations (Innovation News Network)

Two last points. Robert Castellano on SA describes the battery situation in these terms: “China dominates production at every stage of the EV battery supply chain downstream of mining…” The yuan is rapidly weakening and that might further affect Cabot’s future earnings.

The second risk is the downward trend in demand for chemicals and the falling stock prices of companies like Dow (-23.68% over one year).

Cabot Corp fared better than most other industrial, chemical, and materials sciences companies recovering from the COVID-19 economic fallout. Demand for aircraft and vehicle tires skyrocketed after falling 40% but is tapering. Battery demand in China is sputtering and production is nowhere near capacity. New energy vehicle demand is slumping this year. Prices for battery ingredients are dropping; this does not bode well for Cabot.

Global economists report much of South America, Europe and the U.S. are in a recession or it is at their doorsteps. China is facing a total economic collapse of confidence in the real estate market and that is negatively affecting household spending. In the second quarter of FY ’22, China contracted by 2.4% Y/Y and had a shocking -9.3% drop in consumer discretionary spending. These conditions are ominous portents for the chemicals sector.

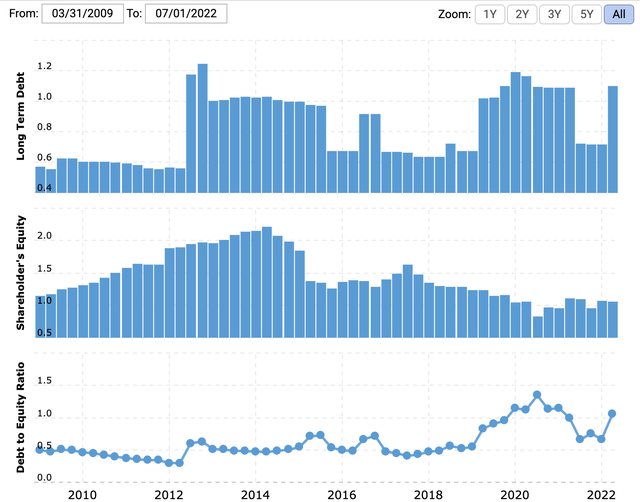

Our third risk worry is the downward trend of stocks. CNBC reports the S&P 500 Industrial Sector is -15.27% over the past 12 months. It is -21.72% so far this year. The Chemicals Sector is -13.34% over one year and -23.4% this year. Cabot Corp lost money in three of the last ten years. CBT shares topped $78 in the past year. The low was $49.59. Debt, higher interest rates, and dividends may not be well covered by cash flow. Debt-to-equity, long-term debt, and shareholder equity are trending in the wrong direction:

Our information is that corporate insiders sold more shares in FY ’22 than they bought. Hedge funds reportedly decreased their holdings by 15.2K shares last quarter. 21 funds held the stock in Q1 ’21 but only 13 owned shares by the end of Q1 ’22.

We forecast earnings per share to trend down from $1.73 in Q3 ’22 to ~$1.40 in two quarters despite greater revenue.

Black Swan

In our opinion, Cabot is a black swan. The Q3 earnings report caught the attention of investors and analysts because most other investments are gloomy. Cabot is not particularly financially strong, it has been profitable seven out of ten years, and gross and net margins are ok but not outstanding.

We see a potential opportunity for the share price to claw to $70 based on our assessments of historical multiples using PE and PS ratio with a price to free cash flow. The SA Factor Grades improved little over the last 3 and 6 months. Mark Twain cautioned, “Whenever you find yourself on the side of the majority it is time to pause and reflect.”

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today.

Be the first to comment