USD/JPY ANALYSIS

- Fed’s March 2023 peak rate falls.

- Options strikes could give Yen short-term support later today.

- Ascending triangle ominous for JPY.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen held firmly below the 145.00 threshold with the help of U.S. ISM manufacturing data for September as well as Fed repricing. Looking at the table below, money markets are now pricing in a peak rate of 4.38% in March next year, down from its highs around 4.60% suggesting traders exercising caution on an ultra-aggressive central bank. The dollar has continued it’s decline today but the fact that the Yen is weaker against the greenback emphasizes the loose monetary state that the Japanese economy finds itself.

FEDERAL RESERVE INTEREST RATE PROBABILTIES

Source: Refinitiv

From an option perspective, key strikes for the New York cut are shown below, which could see USD/JPY edge lower as expiry looms. The general rule of thumb is that price tends towards strike prices as it gets closer to expiry – usually applies for large strikes.

142.00 (445M)

143.00 (200M)

144.50 (417M)

Recommended by Warren Venketas

Get Your Free JPY Forecast

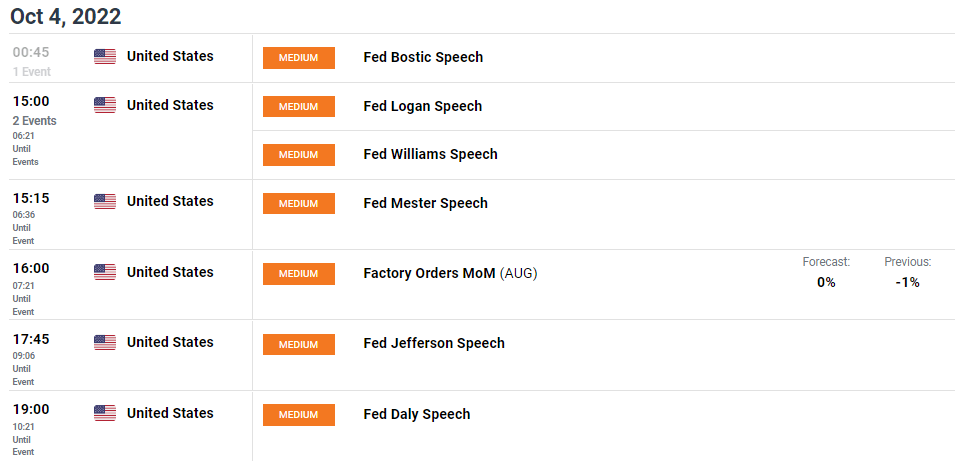

The economic calendar (see below) is relatively light today with Fed speakers dominating proceedings. It will be interesting to see whether or not some speakers tone down their prior hawkish outlook which may see the Yen bid.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

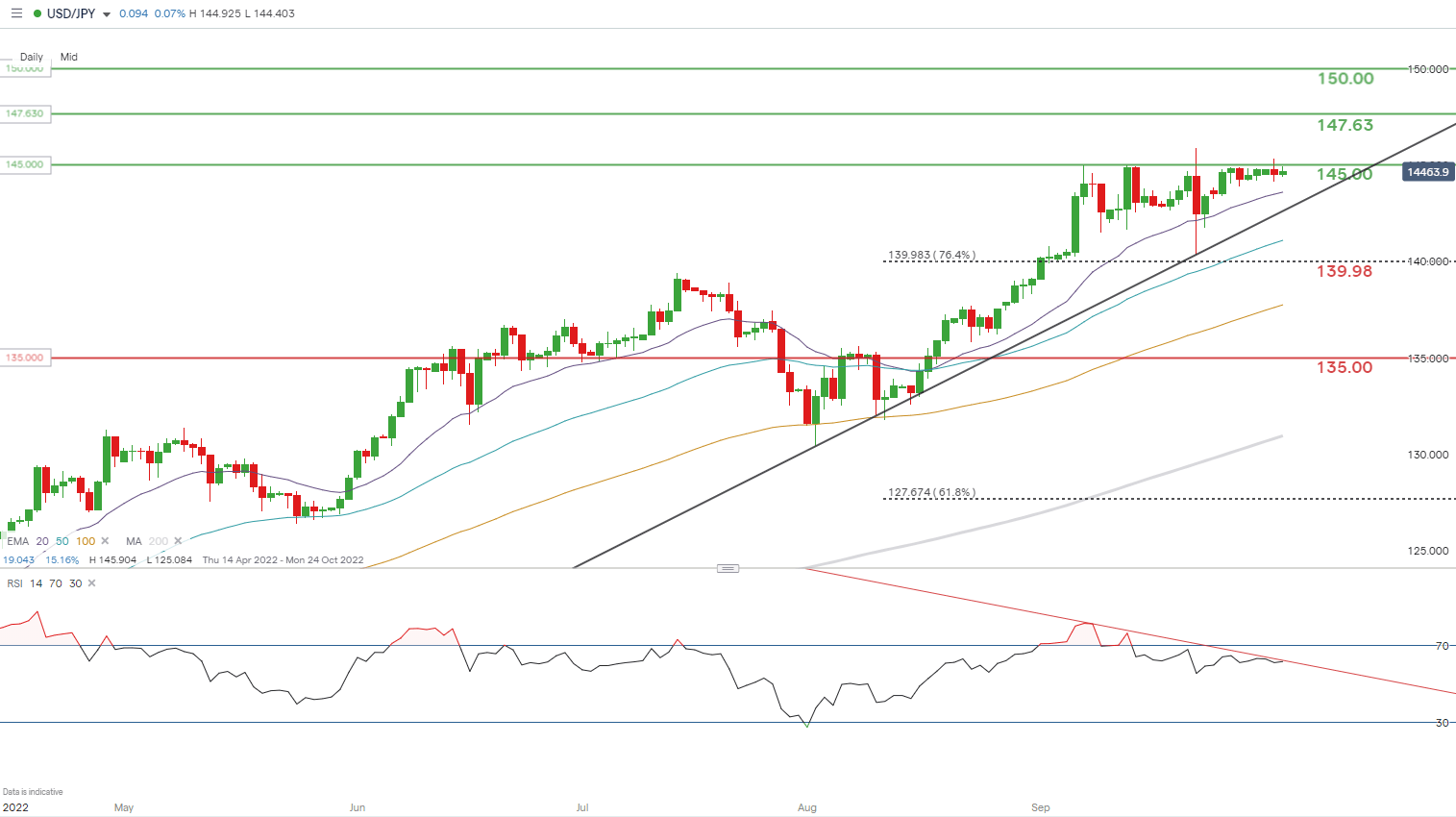

TECHNICAL ANALYSIS

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

The 145.00 resistance level plays an integral role for JPY traders but the constant barrage by bulls at this level would traditionally point to an impending breakout to the upside. Although the BoJ has already implemented FX intervention, the fundamental headwinds facing Japan can only lead to further weakening of the local currency against the USD. Without any policy shift I expect the pair to push higher towards subsequent resistance in line with a developing ascending triangle chart pattern.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT POINTS TO SHORT-TERM UPSIDE

IGCS shows retail traders are currently net SHORT on USD/JPY, with 80% of traders currently holding short positions (as of this writing). At DailyFX we take a contrarian view on sentiment, suggestive of a bullish bias.

Contact and followWarrenon Twitter:@WVenketas

Be the first to comment