Pgiam/iStock via Getty Images

While preferred stock and baby bond issues ($25 liquidation values) took a mighty 4% bounce higher last week, there remains a target-rich environment in issues that remain extremely attractive for the long-term investor. Now is the time to begin to buy select issues or to add to current positions if you haven’t already done so.

There will always be the debate as to whether interest rates have peaked or not, but if one is waiting for 100% surety for an answer to this question you may be waiting a long time.

Just like common shares, most issues of preferred share and baby bonds outstanding have taken a huge shellacking this year thus far as I outline below.

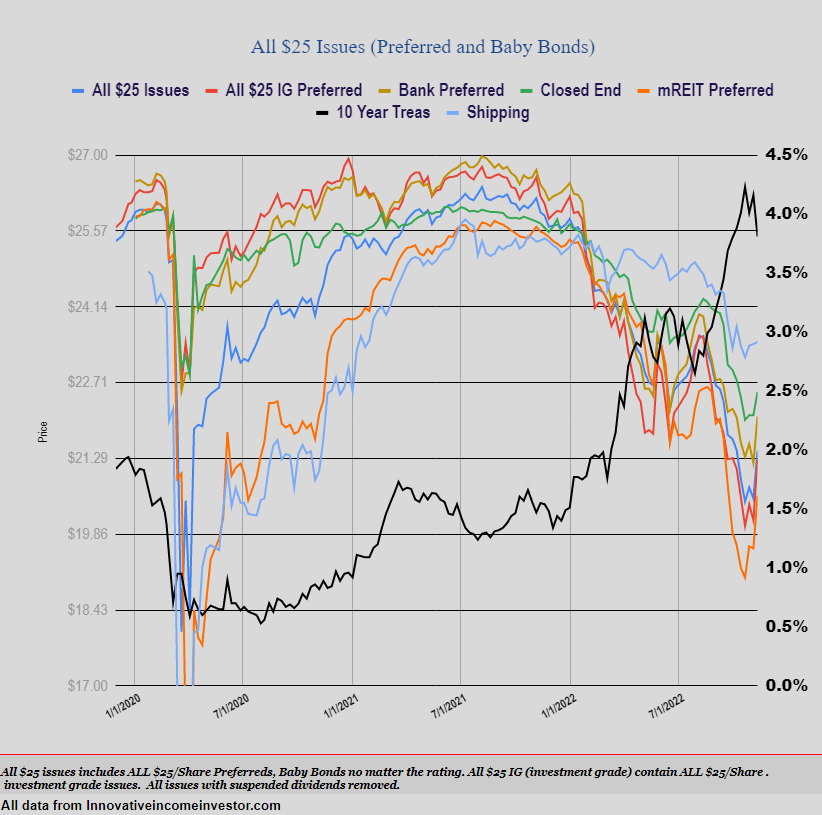

Below is a chart showing the extent of damage done in various sectors of the preferred and baby bond universe. This particular chart shows-

-

All $25 preferreds and baby bonds (suspended issues removed)

-

Investment grade issues

-

Banking issues

-

mREIT issues

-

Closed-end fund (CEF) issues

-

Shipping issues.

The right-side axis is for the 10-year treasury yield, which is depicted on the chart by the wide black line. Note the massive 4% bounce in all sectors last week as the 10 year treasury fell from 4.16% to 3.81%

Innovativeincomeinvestor.com

It is fair to say that these issues are just as volatile as common stock issues and that wealth can be destroyed holding these issues just as in common stocks. Of course, the investor can take some comfort in receiving a generally safe dividend or interest payment 4 times a year which may serve the needs of the investor looking for immediate income (wanting a current income stream), but the pain of capital losses remains severe

The chart above shows that the average $25/share issue was down $5/share since the end of December a loss of 20% until last week’s rally. But averages don’t tell the whole story- low coupon, high quality issues have been lambasted much more severely. For instance the shares of CMS Energy Corporation (CMS) 4.20% perpetual preferred (CMSA) fell from a high of around $25 at the start of the year to as low as $16 last week–a giant sized loss of 36%–little comfort is brought that the investor will receive a $1.05 in dividend payments for the year.

So we have reached a point where income investors need to begin to minimally “nibble” on some lucrative income issues – whether interest rates have peaked or not is not knowable by anyone (irrespective of claims one way or the other by some “smart people”), thus pricing could become even more favorable. Below I cover some issues, which includes my favorites from Affiliated Managers Group, Inc. (NYSE:AMG) that I think are ripe for at least a nibble.

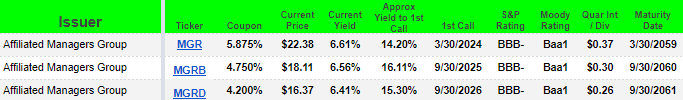

1st I want to put the spotlight on the baby bonds of asset manager Affiliated Managers Group. This is a stellar company with assets under management of about $645 billion. The company has maintained solid income in spite of the fall in market values (thus a modest reduction in assets under management). With current yields of 6.4% to 6.61% and yields to 1st call all over 14% these are great buys. Once again the odds of issues with coupons under 5% being called anytime soon is low but there remains that potential in the next couple of years.

Innovativeincomeinverstor.com

Many articles are available on AMG on Seeking Alpha here for further due diligence. The company’s latest 10-Q quarterly report can be found here.

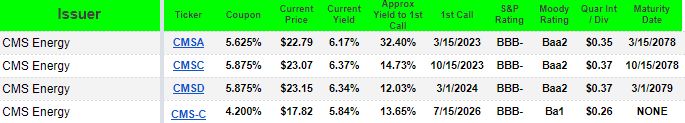

Next I am highlighting the baby bonds and 1 preferred issue from Michigan based utility CMS Energy. These issues are all investment grade rated and all sport a current yield in the 5.89% to 6.37% range with yields to 1st call in the annualized range of 12% to 32%. I am not predicting any of these issues will be called anytime soon, but since all issues are under $25/share there is substantial potential for returns beyond current yields.

Innovativeincomeinvestor.com

For those wanting to do more due diligence on CMS, you can see a number of newer articles and opinions on Seeking Alpha here. The 10-Q quarterly report filed recently with the SEC can be found here.

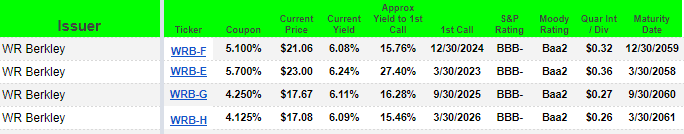

Also on my list of investment grade issues that I believe are great buys right now are the baby bonds of insurer W. R. Berkley Corporation (WRB). WRB is a very well-managed insurance company with annual revenues in the $9.5 billion area. The company has increased earnings in the most recent quarter by about 15% over the same 2021 quarter, with earnings up a giant 35% for the 1st 9 months of the year (to 9/30/2022). The baby bonds have current yields of 6.09% to 6.24% and all issues are investment grade. Note that the tickers for WRB issues are correct, but unlike most baby bonds they use a hyphenated ticker (similar to preferred stock issues).

Innovativeincomeinvestor.com

For those wanting to do more due diligence on WRB, you can peruse a plethora of articles and opinions on Seeking Alpha here. Further to see the company’s latest reported financials you can review the 10-Q (quarterly report filed with the SEC) here.

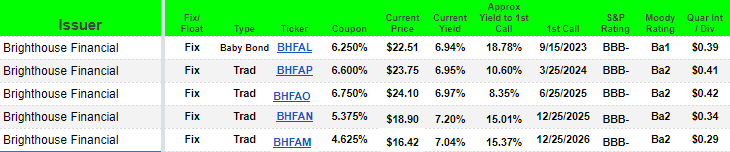

Lastly, for now, I am going to highlight 1 baby bond and 4 traditional perpetual preferreds from annuity provider Brighthouse Financial, Inc. (BHF). BHF recently announced a large loss for the quarter ending 9/30/2022, which has been somewhat of a trend amongst most insurance-related companies as they hold large portfolios of stocks and bonds and we all understand what has occurred in the marketplace. All of these issues are “split” investment grade – meaning investment grade from Standard and Poor’s but a notch or 2 below investment grade from Moody’s. Because of the slightly lower credit rating as compared to the 1st 3 companies I highlighted, one receives a larger current yield – from 6.94% for the baby bond (BHFAL) up to 7.20% on their 5.375% perpetual preferred. Yields to 1st call dates range from around 8.35% to almost 19%. Again there are low odds that issues will be called on the 1st optional redemption date. But trading under $25 liquidation value means there is potential for future capital gains.

Innovativeincomeinvestor.com

Articles on Seeking Alpha (which are minimal in number) can be found here. The company’s most recent 10-Q earnings filing can be found here.

So to summarize.

-

Quality preferred stocks and baby bonds are available now at current yields and yields to 1st call dates at levels we haven’t seen for many years.

-

While no one can predict whether interest rates have peaked, it is a fair assumption that the worst of the selloff in income issues may be behind us.

-

Prices of preferred stocks and baby bonds bottomed in the last week or two, and some have moved sharply higher off the bottom.

-

Long term investors should begin to “‘nibble” on solid issues or risk being left behind. Multiple purchases of a given security best ensures an investor will participate at a solid average price.

- My favorite issue from those mentioned above is the 5.875% baby bond (MGR) (which I own) from asset manager Affiliate Managers Group.

I hope to write another article soon in which I will review some of my “junky” preferred and bond picks.

Note that the pricing and data in this article are from the week ending 11/11/2022.

I own CMS-C, BHFAO and MGR. I anticipate purchasing shares in one of the WRB issues this coming week.

Be the first to comment