Liudmila Chernetska

Bear markets are wonderful because it’s when the world’s best high-yield blue-chips get thrown out with the bathwater, and can offer life-changing safe yields.

I’m talking about rich-retirement yields such as:

- 12% for EPD in 2000

- 11% for O in 2000 and 2009

- 17% for EPD in 2020

- 43% for MPLX in 2020

- 15% for MO in 2008

If you buy a world-class ultra-yielding blue-chip in a bear market you can achieve market-beating long-term returns from income alone.

Do you know what we call someone who bought the above blue-chips in those bear markets? Already retired.

But guess what else sells off hard and fast in a bear market? Low quality crap.

If the market is throwing out the baby with the bathwater, you want to be darn sure you’re not buying the bathwater just because it looks outrageously cheap. Value and yield traps are cheap for a reason and built to stay that way.

So let me show you the difference between a high quality ultra-yield bear market opportunity and a low quality yield trap to avoid like the plague.

I’ll use Diversified Healthcare Trust (DHC) and Highwoods Properties (HIW) as examples to show you how to recognize yield traps to ignore, and wonderful ultra-yield values potentially set to soar.

Diversified Healthcare Trust: The Quintessential Yield Trap

You might think that a healthcare REIT would make a wonderful high-yield recession-resistant choice for retirees.

Theoretically yes, but the devil is in the details.

DHC just slashed its dividend from $0.60 to $0.04, a 93% reduction.

iREIT’s Brad Thomas has long been warning against not just DHC but all the RMR managed REITs.

RMR is an asset manager that set up and externally manages several REITS including several famous value trap REITs such as:

- DHC (formerly Senior Housing Properties Trust)

- Government Properties Income Trust (GOV)

- Select Income REIT (SIR)

- AlerisLife (ALR) (formerly Five Star Quality Care (FVE) then Five Star Senior Living Inc.)

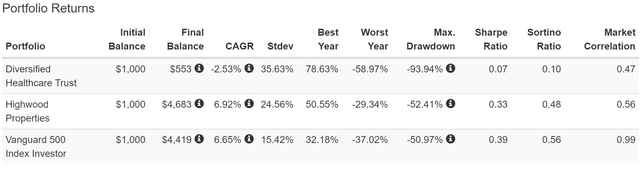

Total Returns Since 1999

(Source: Portfolio Visualizer Premium)

RMR REITs are famous for delivering terrible dividend safety, even worse returns, and basically lighting shareholder cash on fire.

That’s not to say REITs as a sector haven’t suffered some wild crashes, including a 70% decline in the Great Financial Crisis.

But DHC is truly a cut above in terms of sucking. It’s fallen as much as 94% and has delivered -1% annual returns over the last 22 years (and -2.5% CAGR total returns since inception).

Yes, including dividends, investors in DHC have lost their shirts. And if you adjust for inflation? Things look even worse.

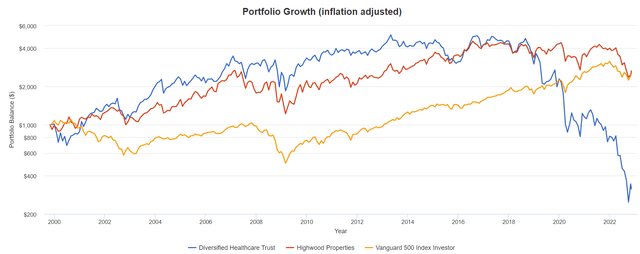

(Source: Portfolio Visualizer Premium)

Inflation-Adjusted Total Returns Since 1999

| Stock | Ticker | Inflation-Adjusted Return Since 1999 | Annual Real Return Since 1999 |

| Diversified Healthcare Trust | DHC | -69% | -4.9% |

| Highwoods Properties | HIW | 164% | 4.3% |

| S&P 500 | SPY | 150% | 4.1% |

(Source: Portfolio Visualizer Premium)

Even with dividends, investors have lost 69% of their money with DHC over the last quarter century.

This is what a classic yield/value trap looks like, and it’s a stock you should avoid no matter how cheap its valuation looks.

- 2.9X FFO vs 9.0 5-year average

- cheap for a reason and built to stay that way

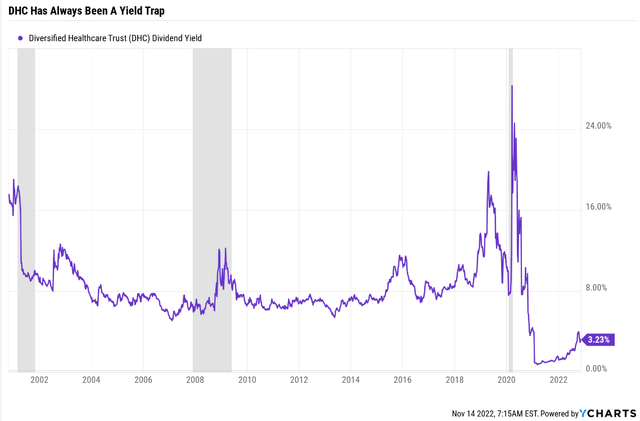

In fact, DHC’s yield has been luring in unsuspecting income investors for decades. Its peak yield hit almost 30% back in the Pandemic. Now a 30% yield might seem obviously too good to be true, but notice how often it’s yielded over 15% over the years.

In the comment threads, owners of DHC (and SNH before it changed its name) often said things like:

Even if they cut the 15% dividend in half 7.5% yield on cost is still excellent”.

The trouble with this logic is that it forgets that a dividend cut of 50% is typically followed by a 50% decline in the stock price.

And as we’ve seen with DHC in the Pandemic, with a 96% dividend cut, or Lumen Technologies (LUMN), formerly CenturyLink (it just suspended its dividend entirely) an unsafe dividend can go to zero in a hurry.

Why DHC Is Such A Terrible Yield/Value Trap, Always Has Been, And Always Will Be

DHC’s “diversified” name is a lie. After the Pandemic it sold off its life sciences and medical office building properties and focused almost entirely on senior living facilities.

This has been a part of the healthcare sector that’s suffered for years from falling occupancy due to overbuilding and oversupply.

But the real reason DHC has been such a terrible investment for so long? It was designed to fail from day one.

RMR is famous for terrible externally managed REITs.

Under our senior living management agreements, we assume the operational risks and fund the operations and capital and maintenance requirements for our senior living communities. As a result, we are required to maintain sufficient funding for these purposes. Further, any funding we maintain for these purposes will not be available for other business purposes, which may limit our ability to pursue other business opportunities and could limit the amount of distributions we can pay to our shareholders.” – DHC 10K (emphasis added)

In 2020, DHC (which changed its name from SNH in 2019) became a pureplay senior living REIT but one that had to pay the operating expenses of its facilities rather than just collect rent from tenants.

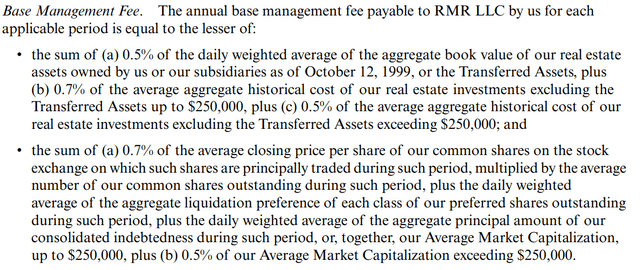

On top of that DHC investors pay management exorbitant management fees.

- 1.7% of book value per year

- 1.2% of market cap per year

- 3% total base management fee

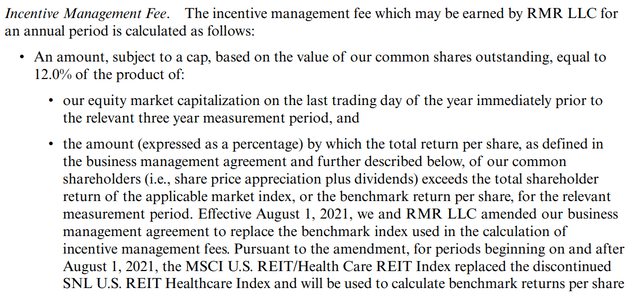

There’s also a 12% incentive fee based on market cap.

In other words, DHC is a 3% and 12% hedge fund that exists to make management rich and no one else.

Well, in fairness to RMR (RMR), their shareholders have done well over the last six years, thanks to those very high fees.

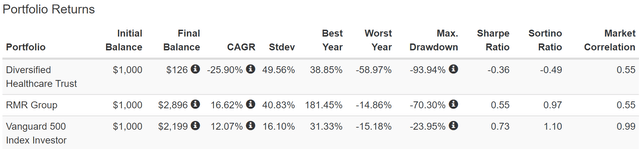

Total Returns Since 2016 (Including Dividends)

(Source: Portfolio Visualizer Premium)

Externally managed REITs are almost always a terrible idea, because they create the incentive to jack up management fees in unsustainable ways.

- take on debt and issue shares to buy new properties and expand assets

- even if FFO and AFFO and NAV/share all decline

- and take the share price with it

Add to that DHC being responsible for operating costs of its struggling senior housing facilities (which are low quality), and you get a classic value trap I wouldn’t recommend my worst enemy touch with a 10 foot pole.

Highwoods Properties: An Ultra-Yield REIT You Can Trust

Further Reading

- Highwoods Properties: Nothing Could Be Finer Than This REIT In Carolina

- full investment thesis, growth outlook, and risk profile for HIW

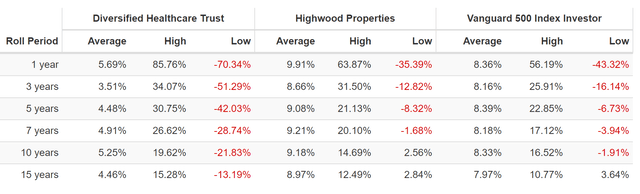

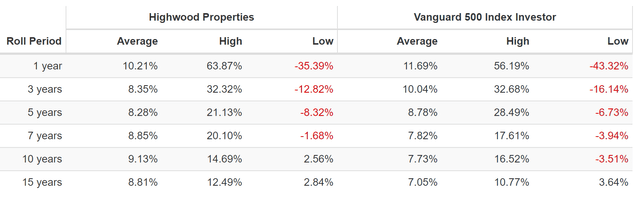

Average Rolling Returns Since 1999

(Source: Portfolio Visualizer Premium)

The simplest way to tell a value trap from a good deep value opportunity is with long-term historical rolling returns.

DHC’s average 15 year rolling return has been half that of HIW’s, which have consistently outperformed the S&P 500 by a modest amount.

HIW Rolling Returns Since 1994

(Source: Portfolio Visualizer Premium)

HIW’s average annual return for 28 years has been a solid 10.2% CAGR, which is what analysts expect in the future. Its average long-term (10 and 15 year) rolling return has surpassed the S&P 500’s as well.

Reasons To Potentially Buy HIW Today

| Metric | Highwoods Properties |

| Quality | 84% 12/13 SWAN (Sleep Well At Night) REIT |

| Risk Rating | Medium Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 227 |

| Quality Percentile | 55% |

| Dividend Growth Streak (Years) | 6 |

| Dividend Yield | 6.6% |

| Dividend Safety Score | 84% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.85% |

| S&P Credit Rating |

BBB Stable Outlook |

| 30-Year Bankruptcy Risk | 7.50% |

| LT S&P Risk-Management Global Percentile |

53%, Average, Medium-Risk |

| Fair Value | $48.19 |

| Current Price | $30.29 |

| Discount To Fair Value | 37% |

| DK Rating |

Potential Very Strong Buy |

| P/FFO | 7.8 |

| Growth Priced In | -1.4% |

| Historical PE | 13 to 13.5 |

| LT Growth Consensus/Management Guidance | 4.2% |

| 5-year consensus total return potential |

16% to 19% CAGR |

| Base Case 5-year consensus return potential |

18% CAGR (2.5X the S&P 500) |

| Consensus 12-month total return forecast | 11% |

| Fundamentally Justified 12-Month Return Potential | 66% |

| LT Consensus Total Return Potential | 10.8% vs 10.3% S&P |

| Inflation-Adjusted Consensus LT Return Potential | 8.5% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.26 |

| LT Risk-Adjusted Expected Return | 6.99% |

| LT Risk-And Inflation-Adjusted Return Potential | 4.70% |

| Conservative Years To Double | 15.31 |

(Source: Dividend Kings Zen Research Terminal)

HIW is trading at 7.8X FFO, an anti-bubble valuation pricing in -1.4% CAGR growth while analysts actually expect 4.2% long-term growth.

It’s 37% historically undervalued, a potential very strong buy that’s just 3% above its potential Ultra Value Buffett-style table-pounding “fat pitch” buy price.

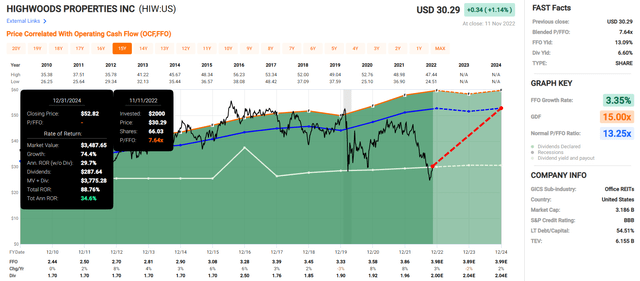

Highwoods Properties 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If HIW grows as expected and returns to historical market-determined fair value, it could almost double in two years, delivering Buffett-like 35% annual returns.

- about 3X more than the S&P 500

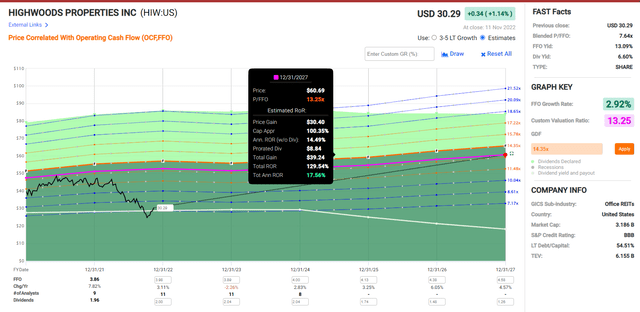

Highwoods Properties 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If HIW grows as expected over the next five years and returns to mid-range historical fair value, it could deliver 130% total returns or 18% annually.

- 2.5X more than the S&P 500

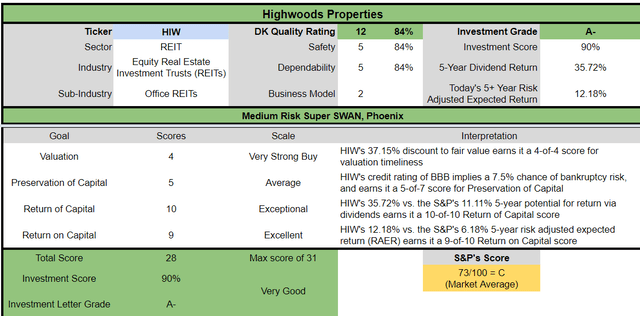

HIW Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

HIW is a potentially very good anti-bubble ultra-yield REIT opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 37% discount to fair value vs. 3% premium S&P = 40% better valuation

- 6.6% very safe yield vs. 1.8% (more than 3X higher and safer)

- approximately equal consensus return potential

- about 2X higher risk-adjusted expected returns

- 3.5X the consensus income potential over five years

Bottom Line: One Of These REITs Is Trash, The Other A 7% Yielding Treasure

A yield that’s not safe isn’t worth owning, it’s that simple. If you can’t count on the dividend remaining safe and even growing in a recession, it’s a yield trap.

And historically speaking, yield traps tend to be value traps, delivering terrible or even negative total returns. Not just for a few years, but potentially for decades.

Trash REITs like DHC are the kind of value trap you should avoid, regardless of price.

This REIT is cheap for a reason and built to stay that way.

- 2.9X FFO vs a five year average of 9.0X

DHC, unlike most senior housing REITs, has to pay the operating expenses. On top of that, its 3% and 13% management fees are as bad as hedge funds.

- worse, because hedge funds average 4.5% long-term after fee returns

DHC has generated -5% annual real returns for almost a quarter century.

That’s a mighty high fee shareholders are paying management to incinerate their wealth.

In contrast, HIW owns some of the highest quality office REITs in the country’s most thriving southern cities.

Those properties are lent out to some of the best tenants in the country, including Bank of America and the US government.

And HIW’s skilled management, which works for shareholders, not itself, has proven it can adapt to even the most extreme and challenging economic and industry conditions.

That’s why it’s been beating the market for 28 years, and is expected to continue generating solid double-digit returns for years or even decades to come.

In a bear market, almost everything is on sale. So avoid trash and buy bear market ultra-yield bargain treasures like HIW.

That’s how you sleep well at night in all economic conditions.

It’s how you build long-term wealth and income.

It’s how you make your own luck on Wall Street.

And most importantly, it’s how you retire rich and stay rich in retirement, no matter what the stock market does in the future.

Be the first to comment