Justin Sullivan/Getty Images News

This year, it’s the more boring, forgotten tech stocks that have shone in the market while their flashier, high-flying counterparts have shed billions of market value. HP Inc. (NYSE:HPQ), the famed maker of PCs and printers, has outperformed tech peers this year for the first time in many years, as investors favored value over growth and followed Warren Buffett/Berkshire Hathaway’s lead into buying this earnings-rich cash cow.

While I’m a value-oriented investor myself, I still have difficulty buying into HP’s bullish thesis. To put it nicely, HP is basically just playing defense: it’s sitting on two legacy businesses, computer hardware and printing, and the latter – which is responsible for the lion’s share of HP’s margin – is stuck in a secular decline. While HP has been a fortuitous investment this year, I’m unsure if the stock has much upside left.

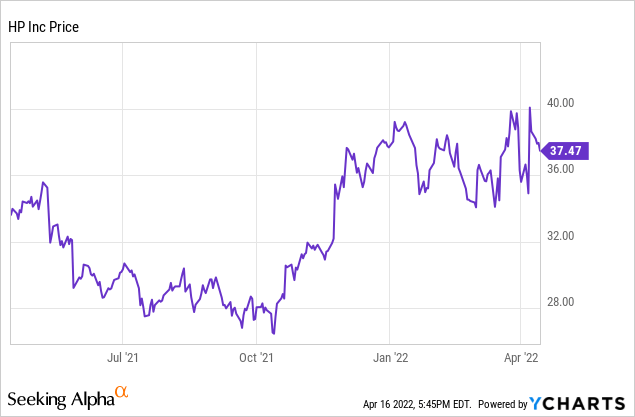

I’ll give HP one thing: its principal appeal rests in its valuation, which is perpetually cheap (though not as cheap as in the past, after the stock’s relative outperformance this year). At current share prices near $37, HP trades at just an 8.8x forward P/E multiple against the company’s $4.18-$4.38 pro forma EPS guidance in FY22:

HP FY22 outlook (HP Q1 investor presentation)

This, plus a ~2.7% yield, makes HP a salivating opportunity for value-conscious buyers. That being said, there is a reason HP is trading cheaply. A shortlist of these issues includes the inherent decline in HP’s core businesses, an EPS growth trend that is heavily reliant on share buybacks (which may be harder to come by this year due to HP’s more expensive share price and a recent large acquisition), and continued supply-chain woes that are driving down margins.

The bottom line here: I remain neutral and on the sidelines for HP. If the news of a significant Berkshire stake (~12%, disclosed in late March) was only enough to push HP to the ~$40 level, I’m not sure there are any more meaningful catalysts in the near-term horizon to drive significant gains here on out.

PC units are down, as is supplies revenue

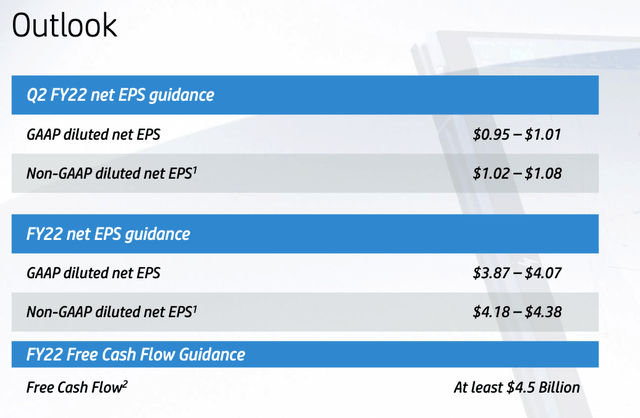

Let’s start with the business fundamentals. HP’s largest revenue-generator, its PC division, is enjoying revenue growth, but primarily from ASP expansion. Unit sales, meanwhile, are down – especially on the consumer side, comping against a difficult pandemic period when many buyers upgraded their at-home hardware.

HP PC division results (HP Q1 investor presentation)

In Q1 (HP’s most recent earnings quarter, released in late February), the company’s PC division generated 15% y/y revenue growth to $12.2 billion. Unit sales, however, fell -6% y/y. The majority of the expansion came from commercial revenue growth, up 26% y/y while the consumer business was roughly flat.

We all know that companies are starting to recall workers back to the office. After a two-year slump in commercial revenue, what HP could be experiencing now is a catch-up in enterprise/commercial demand that may not necessarily last. In addition, the ASP growth that is the other driving factor behind the PC business’ revenue jump is largely a function of HP raising prices to pass on rising component/logistics costs to consumers – segment margin performance at 7.8% is only slightly higher than 7.1% in the year-ago quarter, and it is more than offset by the margin slip in the printing business.

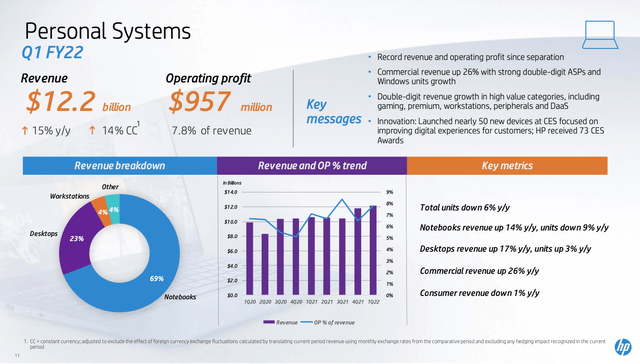

Which brings us now to printing: which, although representing only one-third of the company’s revenue, brought in 55% of operating income in FY21. Printing has continued its years-long decline, with revenue down -4% y/y to $4.8 billion in Q1 (one point worse at -5% y/y on a constant currency basis).

HP printing division results (HP Q1 investor presentation)

Again here, commercial revenue is up 9% y/y – but this could largely be one-time demand from offices reopening. The way I view it, our office behaviors have changed entirely. Instead of bringing paper packets and presentations into meetings, we now view PDFs and slide decks from WebEx and Zoom screens. Many offices have embraced the “hybrid” format – which means some team members will be working on-site and others remotely, forcing the use of digital materials rather than paper. HP’s critical supplies revenue, which represents two-thirds of its printing revenue and towers over hardware from a margin perspective, is down -2% y/y – and I don’t think this business will ever be in growth mode again.

Driven by the revenue decline in the margin-rich supplies business, Printing’s operating profit fell -12% y/y and lost 160bps of margin. Some further detail from CFO Marie Myers’ prepared remarks on the Q1 earnings call:

Supplies revenue was $3.1 billion, declining 2% year-on-year, consistent with our outlook that we provided at our Analyst Day. The decline was driven primarily by further normalization in home printing, as expected, partially offset by the gradual recovery in commercial […]

Print operating profit was $879 million, declining $119 million and operating margin was 18.2%. Operating margin decreased 1.6 points, driven primarily by a tough prior year compare and higher costs, including commodity and logistics costs. This was partially offset by pricing, including currency and improved performance in industrial graphics and 3D.”

Earnings growth relies on share buybacks

Another key point we need to raise: HP has consistently boosted its EPS, but much of that growth accrues to diminishing share counts rather than improved fundamentals.

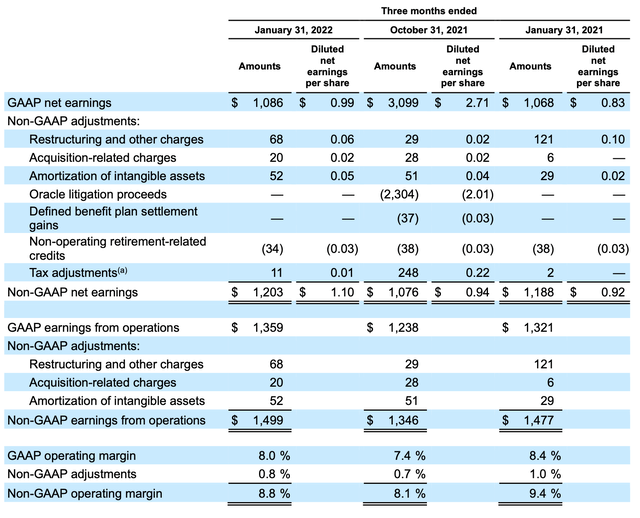

Take a look at Q1 results. Pro forma net earnings of $1.20 billion are actually flat (+1% y/y) versus Q1’21 earnings of $1.19 billion. Pro forma operating margins, meanwhile, fell 60bps to 8.8% versus last year – driven by the declines in printing.

In spite of this, pro forma EPS of $1.10 is up 20% y/y. The big driver here is the share count: down to a weighted average base of 1.09 billion shares this quarter, -15% y/y versus 1.29 billion in the prior year.

HP earnings breakdown (HP Q1 earnings press release)

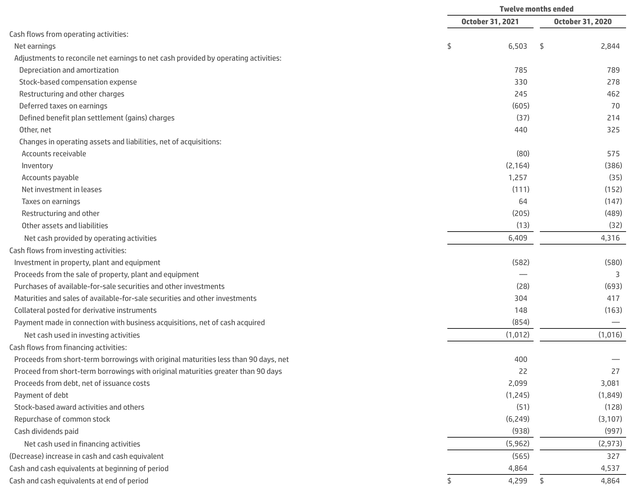

But HP had a great year for share buybacks in FY21. Here’s the cash flow statement for FY21: the company generated $5.73 billion in free cash flow, and spent $0.94 billion on dividends and $6.25 billion in share buybacks. In other words, the company took on debt and spent more on shareholder returns than it brought in.

HP FY21 cash flows (HP Inc. Q4/FY21 earnings release)

This practice, of course, is unsustainable – and even more so in FY22. The company’s free cash flow guidance for the year is “at least $4.5 billion”, implying a decline in FCF, while it also spent $3.3 billion in cash to acquire workforce solutions company Poly in March. HP is unlikely to slice its dividend, so share buybacks are certain to take a hit this year (which is probably the right thing to do, as the stock is now up double-digits versus the same time period last year) and hamper earnings growth.

The slowdown in EPS growth may hamper HP’s valuation multiple and stymie the investor confidence that the company had worked hard to build up.

Key takeaways

I continue to view HP as a value trap. Though attractive on paper with its low P/E and fairly aggressive dividend yield, HP is sitting on declining legacy businesses and its recent earnings growth has been largely achieved by spending more on buybacks than the company earns in free cash flow. Approach this stock with caution.

Be the first to comment