maybefalse/iStock Unreleased via Getty Images

Investment Thesis

In just over three weeks, the COVID situation in China has worsened dramatically. What started as a “more controllable” outbreak in Shenzhen has spiraled into full-blown lockdowns in Shanghai. As a result, China’s manufacturing capacity and supply chains have been thrown into disarray. It has already affected its leading automakers, including Tesla (TSLA). The world’s leading EV maker has suspended production at Giga Shanghai since the end of March, potentially losing 40K production units. But, Tesla was also reported to be resuming production from April 17 using a “closed-loop” system. However, full production cadence is unlikely to continue just yet.

Therefore, Alibaba (NYSE:BABA) has also been impacted. As a result, investors have turned fearful again, despite BABA stock’s attractive valuation. In addition, the continued COVID lockdowns have affected supply chains and also crimped consumer spending. As a result, BABA’s FQ4’22 (ending March 2022) would likely underperform. The Street also issued several downward revisions of BABA consensus price targets (PTs), which turned even more cautious of an H2’22 recovery.

Consequently, the dire COVID situation and worsening macroeconomic environment have spurred the Chinese government into action. China has promised to leverage targeted monetary policy actions and other measures to stimulate the economy. As a result, the Chinese Central Bank (PBOC) cut its reserve requirements (RRR) by 25 bps following its 50bps reduction in December. It’s on top of a broad range of measures to bolster the economy.

Given the current challenges, we concur that our previous thesis of an H2’22 recovery looks increasingly unlikely. Therefore, we believe that Alibaba’s malaise could extend by six to twelve months before bottoming.

As a result, the stock has also reacted accordingly, as BABA stock has fallen below $100 again. But, we believe that it’s unlikely to revisit the $70+ levels in the near term. Therefore, we encourage investors to use the consolidation to add exposure in phases. As such, we reiterate our Buy rating on BABA stock.

China Resumed Its RRR Cut. But, Will It Be Enough?

Economists were expecting an RRR cut and a policy rate cut. However, the PBOC did not cut the policy rate while lowering the RRR by 25 bps. Still, the PBOC communicated that the RRR cut would unleash about $83B of “long-term liquidity into the economy.“

Notably, the 25 bps cut was also markedly lesser than the 50 bps cut in December. Therefore, the PBOC could be making more measured moves to maintain some leeway for further cuts if necessary. However, economists believe the interest rate hikes in the US have hindered the PBOC’s ability to engage in more aggressive RRR reduction. Moreover, the central bank also accentuated that liquidity remains ample. Therefore the challenge is to deal with the near-term supply constraints impacting the economy now. Pinpoint Asset Management articulated (edited):

The main challenge the economy faces is the Omicron outbreaks and the lockdown policies that restrict mobility. More liquidity may help on the margin, but it doesn’t address the root of the problem. – Bloomberg

Therefore, China also instituted further policy measures to reduce borrowing costs. The PBOC urged its banks to cut their deposit rates by 10bps to reduce their commercial lending rates. Furthermore, the central bank also urged banks to continue lending to logistics companies hampered by the supply chain snarls to keep essential credit flowing.

Therefore, we are assuaged by the series of policy moves made by the government to support the economy through its worst COVID outbreak since March 2020. It’s still too early to determine whether they would be effective. However, we think the government would continue to enact more measures if necessary.

Housing Decline Has Also Slowed Down

Keen Alibaba investors should be aware of the massive impact of weak consumer discretionary spending over the past year. In addition, the real estate market clampdown had significantly affected consumers’ confidence as the government sought to rein in market speculation. However, the government has sought to ease the restraints on the property market, given the effectiveness of its policies. Therefore, it should be reassuring to learn that the effects of the policy easing have been felt meaningfully. Bloomberg reported (edited):

China’s home prices fell at a slower pace in March after authorities took further steps to prevent a worsening of a prolonged downturn in the real estate industry.

New home prices in 70 cities, excluding state-subsidized housing, slipped 0.07% last month from February when they dropped 0.13%. Values in the secondary market declined 0.19%, the slowest pace in six months. – Bloomberg

Furthermore, another report also demonstrated the government’s commitment to counterbalance the weak housing market with massive infrastructure investments. The government has reportedly approved “nearly 70%” of infrastructure investments based on 2021’s pipeline. Thus, we believe that the Chinese government is strengthening policy support broadly to spur its economy.

However, investors should note that these measures take time to percolate into the economy. But, markets are forward-looking. Therefore, we believe these measures should afford investors adequate confidence that BABA stock is unlikely to revisit its February/March lows.

But, Alibaba’s Return To Profitability Could Be Further Delayed

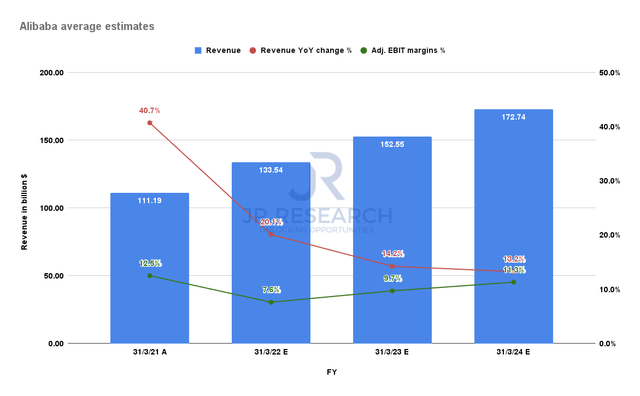

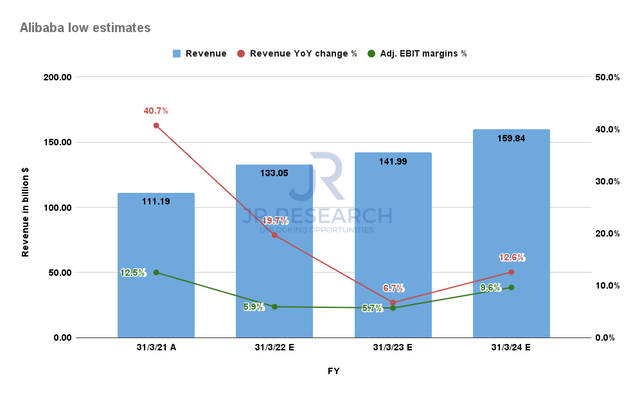

Alibaba consensus estimates (S&P Capital IQ) Alibaba low estimates (S&P Capital IQ)

Consequently, we weren’t surprised as the Street downgraded Alibaba’s estimates further. Analysts were justifiably concerned with the recovery of consumer discretionary spending. Before the resurgence of the series of lockdowns, we were confident that the recovery could see decent momentum from H2’22. However, given the recent circumstances, we think it’s reasonable to expect a six- to twelve-month delay.

Notably, Alibaba’s revenue and profitability estimates also vary widely, as seen above. The main contention over the estimates lies in FY23’s metrics. The most conservative estimates suggest that Alibaba’s adjusted EBIT margin could reach 5.7%, on revenue growth of 6.7% YoY. However, the average estimates suggest its adjusted EBIT margins to come in at 9.7%, on revenue growth of 14.2%. Notably, both estimates consider BABA exiting its bottom from FY23, with recovery continuing through FY24.

Is BABA Stock A Buy, Sell, or Hold?

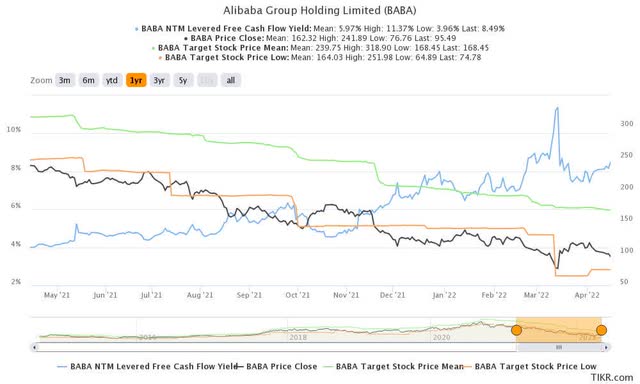

BABA stock NTM FCF yield % and consensus price targets (TIKR)

Investors can refer to the above chart and observe the “irrationality” of the market over BABA valuation. Street analysts have de-rated BABA stock consistently over the past year, but BABA stock’s NTM FCF yield has continued to improve markedly. It last traded at an FCF yield of 8.5%, which reached an incredible 11.4% at the recent bottom.

Therefore, we can surmise that the fear in Alibaba stock is still at a high level, given its FCF yield. We think investors who have patience with BABA stock would find the current price levels highly attractive. Furthermore, we believe that the Chinese government will continue to support the economy if the COVID situation worsens.

As such, we reiterate our Buy rating on BABA stock.

Be the first to comment