Leonidas Santana/iStock Editorial via Getty Images

Thesis

MercadoLibre (NASDAQ:MELI) is sucking people into its ecosystem at a rapid pace and receives tailwinds from the rapid eCommerce growth in Latin America (LATAM). After serious multiple contractions and historically low valuations, MercadoLibre is a buy here.

MercadoLibre is operating an ecosystem of digital services in Latin America, ranging from eCommerce to fintech and software.

In the following article, I will show why its continued investment in developing the ecosystem and sucking people into it will pay off handsomely over the long term and why MercadoLibre represents 5% of my stock portfolio.

Macro tailwinds from a developing market

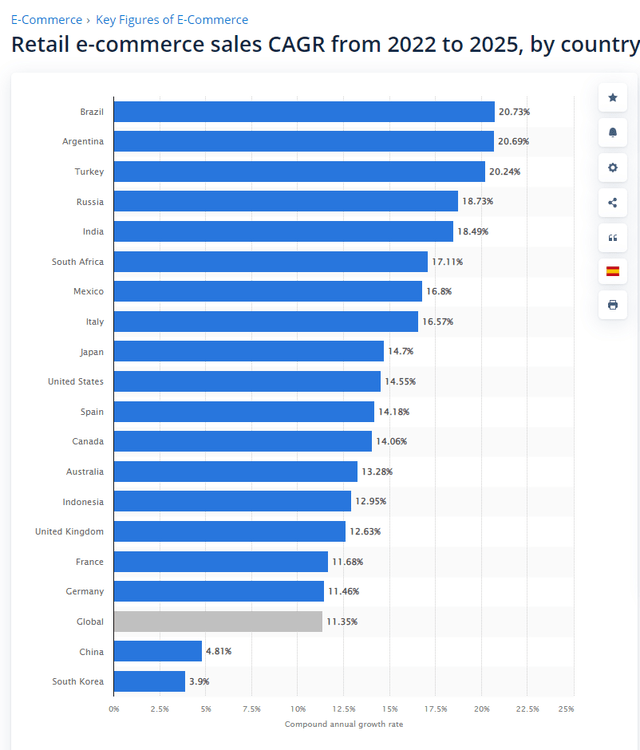

Ecommerce is on the top of mind for many people ever since the pandemic started. Even though the pandemic accelerated eCommerce adoption, there are still massive tailwinds ahead. MercadoLibre is the leading eCommerce player in the fast-growing LATAM region. As you can see in the graphic below, LATAM is leading the chart. Brazil (55.3% of MELI revenue) and Argentina (21.7% of MELI revenue) both are expected to grow at a 20% CAGR. Mexico (16.6% of MELI revenue) also ranks high in the list with an expected 16.8% CAGR.

Fastest growing eCommerce markets (Statista)

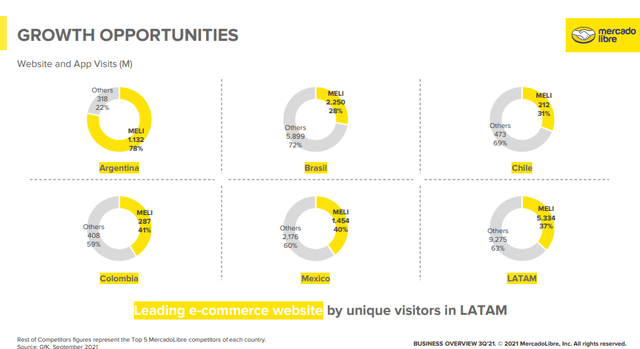

MercadoLibre already has a massive 78% market share in Argentina, their home market. The other fast-growing markets have higher competition, but MELI has the market leadership in both cases: 28% in Brazil and 40% in Mexico. On a consolidated basis, the company currently has a 37% market share in LATAM.

Market share opportunity (MercadoLibre institutional investor presentation)

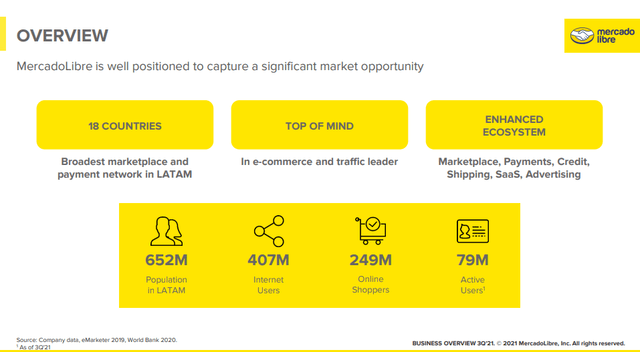

A major reason why the LATAM region is expected to have such rapid eCommerce growth is that the general internet penetration is relatively small compared to more developed regions. According to the company, only 62% of the population are internet users. That leaves a massive 245 million people opportunity in the coming years with more and more people gaining access to the internet. 38% of the population are online shoppers and 12% of the LATAM population are active users in a part of MELI’s ecosystem, be it eCommerce or Fintech.

LATAM market opportunity (MercadoLibre institutional investor presentation)

One ecosystem to rule them all

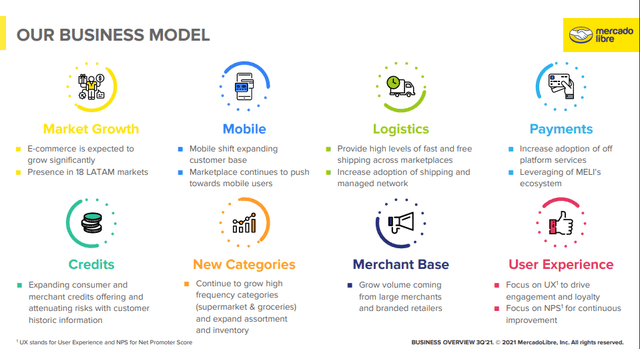

As we saw in the previous section, the LATAM market offers a lot of opportunities. The strategy of MercadoLibre at this point is to capture as many people in their ecosystem as possible and bind them to the ecosystem for life.

Let’s take a look at how MercadoLibre defines its strategy and how they are looking to leverage its ecosystem.

How MELI leverages its ecosystem (MercadoLibre institutional investor presentation)

A trend in LATAM is the fast adoption of mobile shopping. MercadoLibre set the improvement of the mobile experience and a focus on continuous NPS improvement as two of their goals.

By 2024 75% of e-commerce purchases in Latin America will be done with a mobile device.

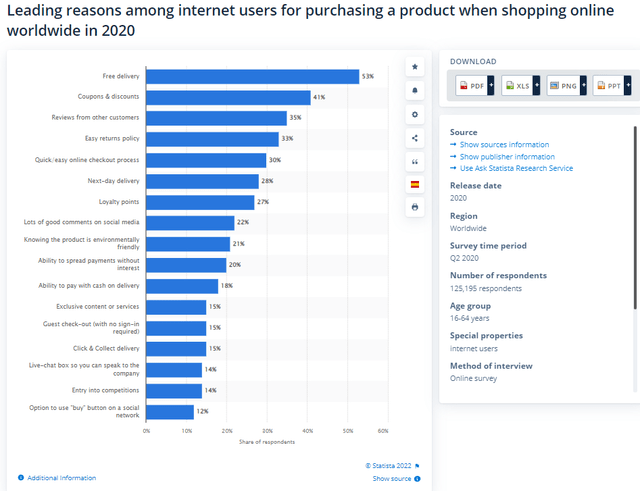

If we take a look at the survey below, we can see that among the leading reasons for users to shop online we have free delivery, easy return policy and next-day delivery. All of these can be accomplished via its Mercado Envios logistics solutions.

Leading reasons shoppers buy online (Statista)

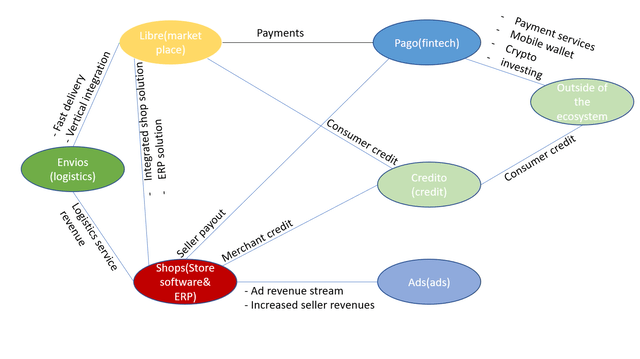

MELI’s ecosystem has six main components with many synergies that bind customers, improve the experience or have revenue synergies for MELI. In the graphic below I attempted to visualize these synergies.

Visualisation of MELI’s ecosystem synergies (Author’s model)

The PayPal of Latin America?

Especially interesting is Mercado Pago as a gateway into the ecosystem.

Mercado Pago started out as a payment solution exclusively inside of the MercadoLibre marketplace. Soon enough MELI opened Pago as a payment provider outside of their ecosystem. In Q4 21, the total payment volume(TPV) outside the ecosystem was $16 billion and $8 billion inside the ecosystem. TPV will continue to grow much faster outside of the ecosystem, with Q4 growth rates off the ecosystem (96%) being significantly higher than on ecosystem growth(32%). Mercado Pago wallet function currently has 19.3 million users (36% growth YoY), so there is a lot of room to grow and lead people into the ecosystem. Mercado Pago has the potential to become the PayPal of LATAM.

The crypto opportunity

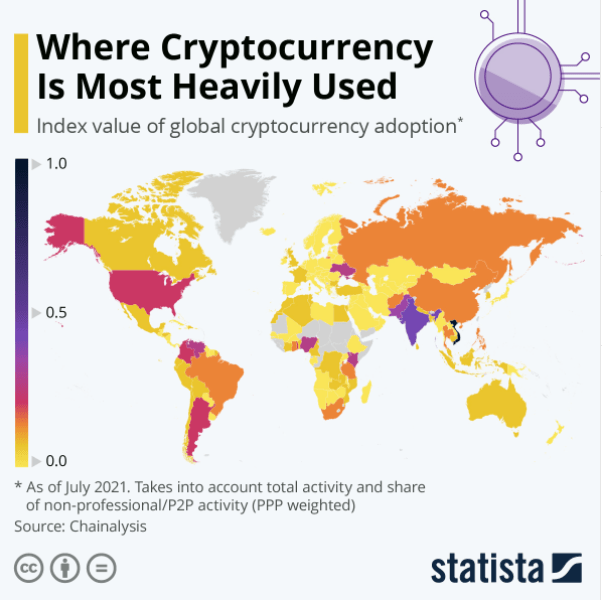

Cryptocurrencies are a global trend and rising in popularity, especially in developing countries and unstable regions. LATAM fits this description perfectly and as you can see in the graphic below, has a high adoption rate in many of the regions MercadoLibre operates in. Over the last years, the company continues to build a portfolio of crypto services with acquisitions and also put Bitcoin on its balance sheet.

Crypto adoption map (Statista)

Crypto is a natural fit into the Mercado ecosystem and a growth opportunity that MELI is trying to seize.

Mercado Shops is a great way to keep sellers

Mercado Shops is an underappreciated part of the ecosystem in my opinion. With the shop software and ERP system they give sellers a vertically integrated solution that helps them with inventory management, payments via Pago, logistics via Envios, advertisement via Ads and credit via Credito.

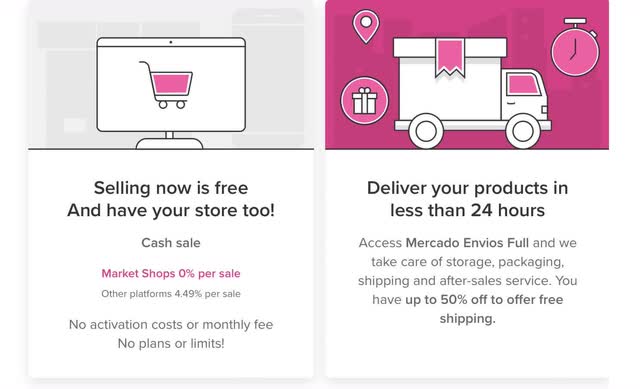

Right now they offer the shop solutions at unbeatable prices to lure people into the software and make it very hard for competitors to compete. Once people set up a store with Mercado Shops, it is unlikely that they will switch again, due to the high switching costs of managing your operations through one integrated solution. The current conditions are:

- 0% sales fee on the marketplace

- 4.49% sales fee outside, to encourage people to use their marketplace

- Discounted logistics services

- No setup or monthly fees

Mercado Shops offering (MercadoLibre website)

Right now Shops is mainly a tool to acquire and bind sellers to the platform and upsell them to the other services like Pago, Credito and Envios. In the future, once the marketplace is at scale they can increase/introduce fees and develop this segment into a cash cow.

According to Store Leads, in Q1 2022, 23,797 live stores were running on the Mercado Shops platform at a growth of 122% YoY.

I see big potential for a high-margin revenue stream here on top of the lock-in effect into the ecosystem and cross-selling with other products.

A list of risks

MercadoLibre is a risky stock and the company has a lot of risks to deal with. Here is a list of some risks to take into consideration:

- Currency risk, MELI operates in 18 different countries with currencies that often experience high inflation. That being said, they have operated in this environment for decades.

- Violence and crime, the LATAM region has a lot of crime and MercadoLibre has been the victim of that in the past and will be in the future.

- Corruption also is high in LATAM, but once again, MELI has operated in these conditions for decades.

- Competition risk.

- Valuation risk, even though I believe valuation to be attractive, there is always a risk when you have a company that isn’t highly profitable yet.

- Expansion of the LATAM internet penetration is a vital part of their growth runway that is outside of their control.

Valuation

MercadoLibre is reinvesting a lot into its business and doesn’t show high profits yet and most likely won’t for the next couple of years. They are spending now to build their logistics infrastructure and develop their marketplace. Fortunately, the company is Free cash flow positive and has $2.5 billion on the balance sheet. They won’t have to raise cash most likely and the EBIT margin of the company is currently at 6%.

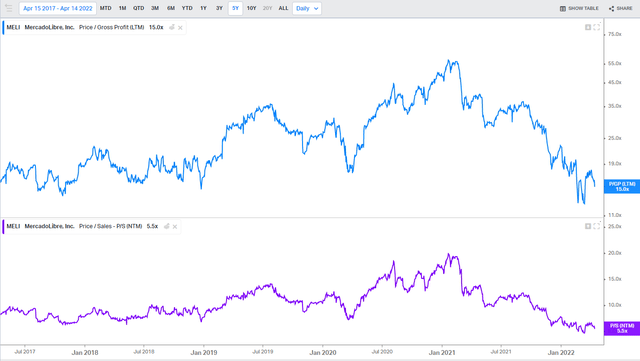

Because of the large reinvestments, I prefer to look at Price/Sales and Price/Gross Profit ratios, rather than Price/Earnings or Free Cash Flow Yield. MercadoLibre experienced great tailwinds since 2020 and that was noticeable in multiple expansions: Price/Sales went from an average ratio of 10 pre-pandemic to 17. Price/Gross Profit expanded from 20 times to 40 times.

With the sharp decline in most growth stocks, these multiples contracted again to reasonable levels of 5.5 and 15 respectively. These multiples are at the bottom of their 5-year multiple range, even though the market situation and MELI’s business improved vastly over the last 2 years.

Conclusion

MercadoLibre is a buy here, due to its sticky ecosystem and long-term strategy. Due to the recent multiple contractions, MELI is at an attractive valuation and it is a great way to invest in the fast-growing LATAM region and benefit from many secular trends, like eCommerce, mobile payments and SaaS. MercadoLibre represents 5% of my portfolio and I am a buyer at these levels.

Be the first to comment