benedek

Apartments continue to be a fascinating area for investment as headwinds and tailwinds collide making for an uncertain but potentially strong forward environment. BSR REIT (OTCPK:BSRTF), despite being on the smaller side of apartment REITs, is making waves with their definitive stance. As most of the other apartment REITs equivocate in a form of paralysis by analysis, BSR declares with perfervid conviction that the Texas Triangle (Austin, Dallas, Houston) is going to be a fantastic market.

So far, they have been right, and with how leveraged they are to 3 key Texas submarkets they could come out far ahead of the pack if they continue to be right. This article will examine the various headwinds and tailwinds to Texas multifamily and discuss the risk/reward to investing in BSR.

BSR’s all-in bet on the Texas Triangle

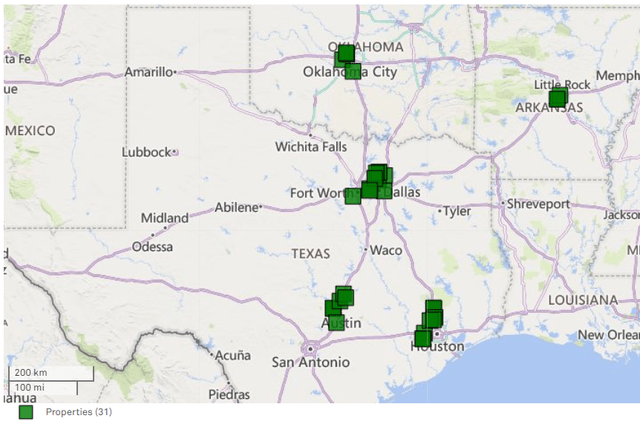

BSR is a Canadian-domiciled REIT with all U.S. assets and its headquarters in Arkansas. A few years back, the majority of its properties were in secondary or even tertiary markets clustered around Arkansas and Oklahoma. However, they then developed a viewpoint that the Texas Triangle was a superior place to own multifamily. They began a transformation in which they sold the majority of their small town assets and used the proceeds to buy newer, higher quality properties in the 3 Texas cities. Here is their portfolio as of today.

S&P Global Market Intelligence

The image is a bit deceiving because the green squares overlap. Arkansas and Oklahoma are quite minor exposures with nearly 90% exposure to Texas.

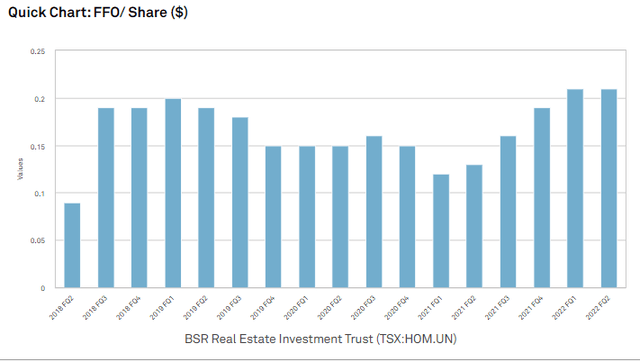

Such a transition was costly. Small town apartments sold at significantly higher cap rates so in selling these to buy low cap rate primary market properties there was an immediate hit to FFO/share which can be seen in the trough below.

S&P Global Market Intelligence

You may also note that FFO/share has surpassed the pre-trough levels.

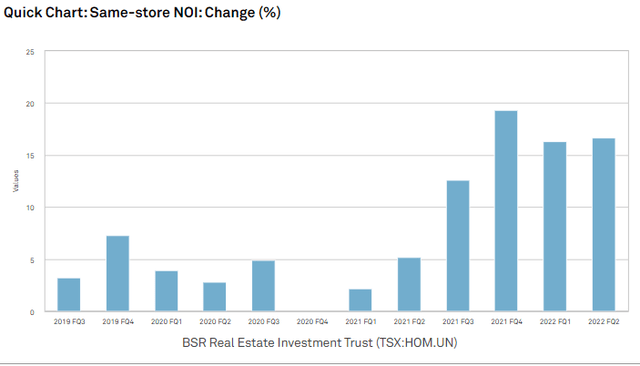

It recovered quickly from the initial hit essentially because management was correct in their call. The Texas properties performed phenomenally, putting up truly impressive same-store NOI growth.

S&P Global Market Intelligence

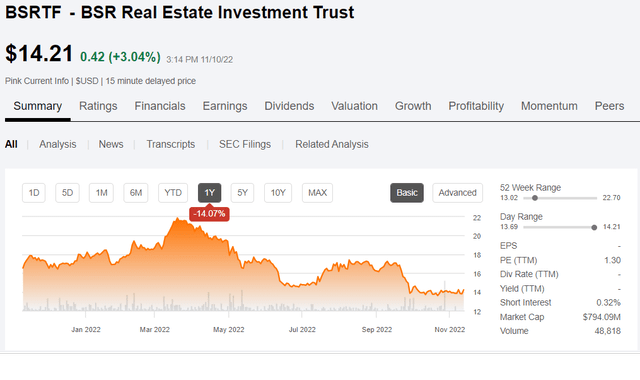

The stock performed well, even making gains through April of 2022 when the rest of the market was crashing.

Since then, however, the narrative shifted. Reports came out from reputable firms like CoStar (CSGP) and RealPage Analytics suggesting there was a substantial supply glut on the horizon. Multifamily quickly went from the darling of the market to a pariah and Texas has a particularly ample supply outlook. BSR fell from almost $22 down to the $14s where it sits today.

This dramatic fall makes BSR once again an intriguing investment. Whether it is a value or a value trap lies in the outlook for their geographically concentrated portfolio.

Huge demand AND huge supply: Which is the dominant factor

Demand is not really in dispute. Jobs and population are consistently flowing into these particular submarkets.

The question is whether the magnitude of demand will be sufficient to absorb the supply growth which some are marking at somewhere around 20% of standing inventory. That is a massive amount of supply which could, if not matched by demand, tank occupancy and put power back in favor of tenants over landlords.

Well, BSR weighed in on the debate in their 3rd quarter conference call as an analyst asked about the supply/demand dynamic. The quote below is rather long, but there are quite a few key tidbits in there so I wanted to show the whole thing.

Khing Shan

So maybe if you could just talk about the Austin market. In the past there’s been a lot of supply, but demand seems to have kept up. But I just kind of wondered how you’re thinking about that market today?

Are we seeing any signs that maybe this time around, we’re not going to see it. We’re hearing a lot of type job losses, et cetera. So I wonder if you could just comment on Austin.

Daniel M. Oberste

Deliveries in Austin are a little bit shy of our expectations in the beginning of the year. And that makes a whole lot of sense. Some of the new deliveries that occurred in ’23, those projects were initiated in, call it, ’21, beginning of ’22.

It takes a while to build an apartment complex. And labor and materials costs, as we’ve discussed in the past, spiked during those periods. And I think what the developers chose to do is to stretch out their delivery time lines for that new product.

And so we saw a few less projects delivered on the market in Austin this year than we anticipated at the beginning of the year. net absorption in our view, remains fairly healthy. So we like those numbers. Now if we’re looking forward into ’23 and ’24 it’s a mixed bag.

So next year, if I’m looking at CoStar, CoStar is going to say that Austin has 17,422 units set to be delivered in ’23. Now one of the components of that CoStar delivery metrics are planned construction projects. And if those planned construction projects can ever get financed in this environment, they may get off the ground.

And if they can construct those projects and half the time it took them to construct projects in the last 3 years, they may deliver in 2023. That’s a big unknown right now. I think what we’re focused on is the continuance of net inflow migration and population growth and job growth and the healthy absorption we’re seeing in that market. So we’re still monitoring the deliveries.

I think the 1 hanging issue is — the interest rate increases are really forcing these developers to put pencils down on new developments. It makes — we talked about it last quarter and the environment hasn’t changed. A developer just simply can’t build a project and borrow enough money to float the development cost risk to initiate that project. So planned projects are breathtakingly large.

Essentially what he is saying is that:

- The measured supply number is not units under construction but rather permitted or planned developments.

- The 17,422 supply number is not really a 2023 number but rather multiple years’ worth of deliveries.

- Cost dynamics have made many of the planned developments no longer viable so they will be canceled and/or delayed.

In more normal environments that haven’t had both supply chain issues and rapid changes to cost of capital the CoStar measured incoming supply is much more accurate. These factors unique to the current environment make the supply look much larger than it really is.

I think there is some truth to Dan Oberste’s perspective. Supply will still be somewhat high, but nowhere near the level that the market is fearing. As such, there may still be a runway to keep putting up numbers like BSR’s Q3 2022 report.

Valuation

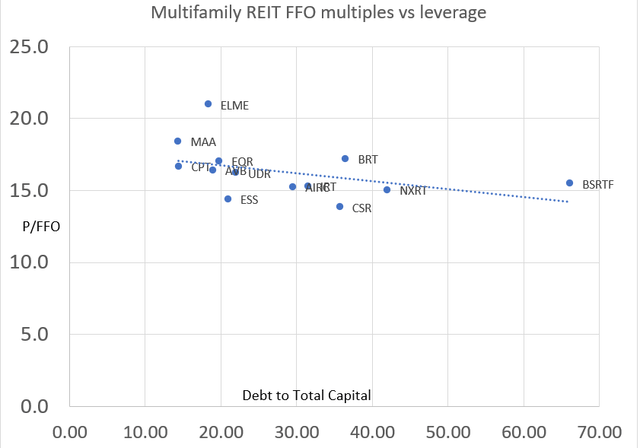

The multifamily REIT market has collectively gotten cheap, but it has also consolidated. As of now, there is quite minimal variance in valuation between the REITs. Most of them trade at healthy discounts to NAV.

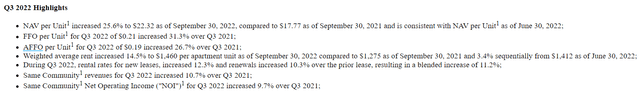

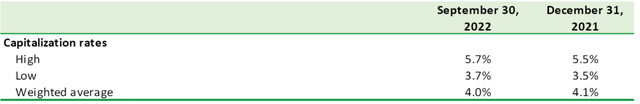

In its 3rd quarter earnings BSR reported NAV of $22.32 which makes its mid $14s price extremely discounted. I would, however, take this NAV with a grain of salt as it is based on a 4.0% cap rate.

The properties are high quality, but given where interest rates are I think 4.5% would be more appropriate. So BSR is discounted to NAV, but not by as much as it looks.

With regard to FFO multiple valuation here is how the sector stacks up.

BSRTF’s valuation is about in-line with peers so I don’t think it is particularly worth buying for valuation reasons. On a value basis, Essex (ESS) is the best right now.

That said, the gap in valuation is not that big so I view choosing stocks within multifamily as being more a matter of forward outlook.

- If one likes coastal class A properties, Essex is great.

- If one likes general job growth submarkets, Camden looks good

- If one likes the Texas Triangle, BSRTF gives highly concentrated exposure and will be the biggest beneficiary if the area does well.

There have been job cuts announced at many tech firms as of late and I think this will disproportionately hit the white collar coastal workers which tend to be the tenants of Class A gateway market REITs. When it comes to apartments, job growth is a huge factor, so I lean sunbelt and I lean Texas.

Be the first to comment