kim willems

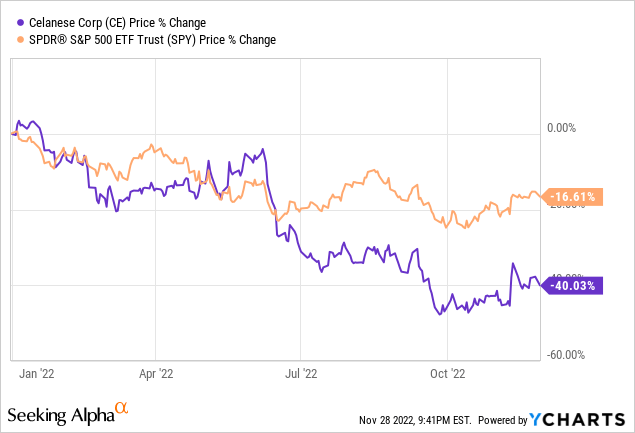

When Celanese (NYSE:CE) posted third-quarter results on Nov. 3, 2022, markets had a delayed reaction. CE stock fluctuated in the $91 range to a high of around $110 by Nov. 11, 2022. The company declared a quarterly cash dividend of 70 cents a share, a 3% increase. This alone would not explain the stock’s recent volatility.

Investors may ignore the noise that is inherent in companies in the basic materials (chemicals) market. Celanese will realize a full benefit from both Santoprene, an engineered materials polymer, and Korea Engineering Plastics Co. In the latter case, the company completed the restructuring of KEP Co. on April 1, 2022.

Santoprene Production Rebound

In the Q3/2022 conference call, Chief Executive Officer Lori Ryerkerk said that the company will get the full benefit from Santoprene. It expects to return to previously forecasted levels. This fiscal year, the company will reach an adjusted EBITDA of around $800 million. It could exceed estimates as it reaches full utilization. For example, in the automotive sector, the company benefits from an increase in 5G applications.

Celanese has the opportunity to maximize margins by raising prices for Santoprene. In addition, the company will realize a bigger addressable market in the medical industry. It has medical-grade thermoplastic vulcanizates. This offers customers superior performance and benefits. Customers have overall cost savings compared to the use of thermoset rubbers (or TSRs).

Mixed Third-Quarter Results

In the third quarter, Celanese posted adjusted earnings per share of $3.94. Net sales fell by 7% from the prior quarter to $2.3 billion. Volumes declined, while an unfavorable currency impact also hurt results. In addition, customers reduced their inventory. In Europe and Asia, the company navigated through falling demand.

Celanese completed its acquisition of Mobility & Materials from DuPont (DD) on Nov. 1. This will broaden its portfolio of engineered thermoplastics and elastomers. Although the company said M&M will add to its cash flow, the acquisition cost it $11.0 billion in cash.

In Feb. 2022 when it announced the deal, the stock traded at around $160. But by June, when the S&P 500 (SPY) resumed its downtrend, CE stock fell with the market.

The company could convert its debt denominated in U.S. dollars into lower-rate currencies. If it converted the debt to the euro, yen, or yuan, that would lower its borrowing rates.

In 2023, the company will look across its newly acquired M&M unit and legacy portfolio to cut costs. Depending on demand-supply dynamics, Celanese could pause its projects to reduce costs.

Opportunity

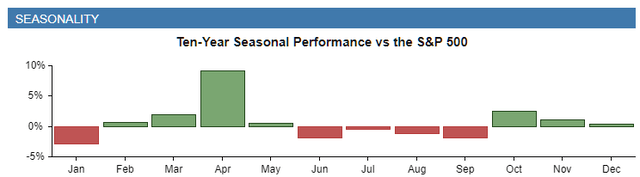

According to StockRover research, Celanese’s stock entered a seasonally strong period in October.

CE stock has strong seasonality (Stockrover.com)

In January, markets usually punish the stock in anticipation of the company’s seasonally slower fourth quarter. The M&M unit has similar seasonal performance headwinds. The weakness in Europe will compound weak demand. Still, Asia could help lift results thanks to a stronger automotive sector.

M&M has a large take-or-pay contract in place for its raw materials for nylon. After building its inventory, both M&M and Celanese could negotiate favorable take-or-pay contracts at the start of the New Year.

The combined firm has bigger cross-selling opportunities ahead. Celanese has the flexibility to re-price its goods. For example, it might reduce the price of its standard-grade products. This will sustain its sales volume. Conversely, it could maximize its margin by cross-selling its products.

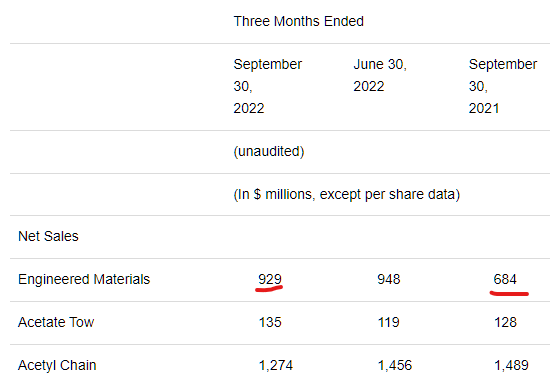

As shown in its financial highlights below, net sales from Engineered Materials grew to $929 million:

Celanese Q3/2022 press release

As mentioned previously, growing 5G applications will lift the EM segment. Liquid Crystal Polymer (“LCP”) and ultra-high molecular weight polyethylene will drive margin expansion for the EM business.

Risks

Softer macroeconomic conditions are an ongoing risk, Investors can only watch CE stock fall whenever markets grow increasingly fearful of a severe global recession.

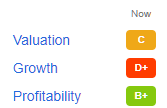

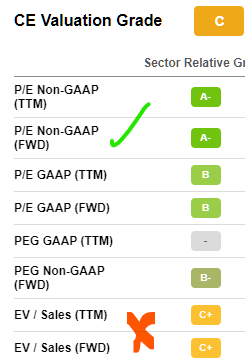

Long-term investors cannot time the best entry price on Celanese stock. Furthermore, the stock has a strong grade on only one of the three factor grades.

seekingalpha premium

Celanese trades at an unfavorable valuation. Despite having a strong price-to-earnings multiple, the weak EV/sales ratio hurts its overall value score:

seekingalpha premium

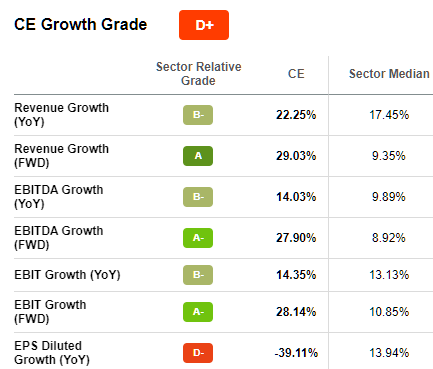

Similarly, the company’s growth score is lower because of the poor diluted EPS growth:

seekingalpha premium

When demand dynamics rebound, expect the growth grade to quickly reverse to a B+ or an A.

Your Takeaway

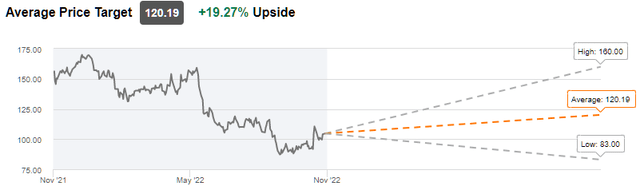

Celanese is not on the radar for most investors. The lack of buying interest creates a better stock price for value investors. Analysts have a price target that averages $120. This implies an upside of almost 20%.

With a dividend that yields 2.78%, the total return is 22.05%. Celanese is one of the few specialty chemical firms that investors should consider at current levels.

Be the first to comment