ArtistGNDphotography/E+ via Getty Images

Retail investors tend to overlook and dismiss reports from institutions since they sometimes have proven to be overblown in their outlook (in both the bullish and bearish sense). As the year ends, retail investors have continued to exit U.S. equity markets while institutional reports have grown increasingly prescient over the past year and instrumental in understanding the mechanics of market behaviour. In other words, market behaviour continues to rationalize.

Now, the output of these institutions tend to be close-distribution reports and cannot be shared in their entirety on a platform. Graphics and information being shared herein are largely in agreement with data seen in reports from other institutions as well.

The Spending Problem

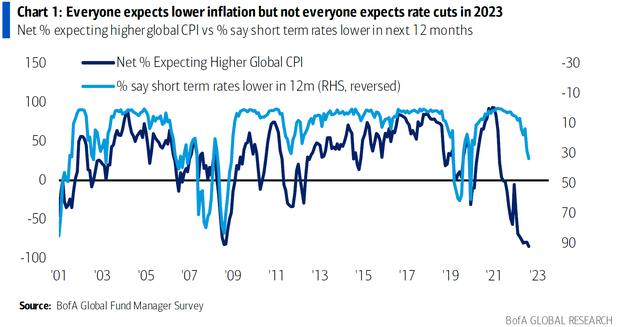

In November’s results of Bank of America’s monthly Fund Manager Survey, wherein 272 participants managing $790 billion in Assets Under Management (AUM) participated in the “Global Survey”, a majority of respondents indicate that they expect inflation to go down over the course of the next year but they don’t expect lower short-term rates.

Source: Bank of America

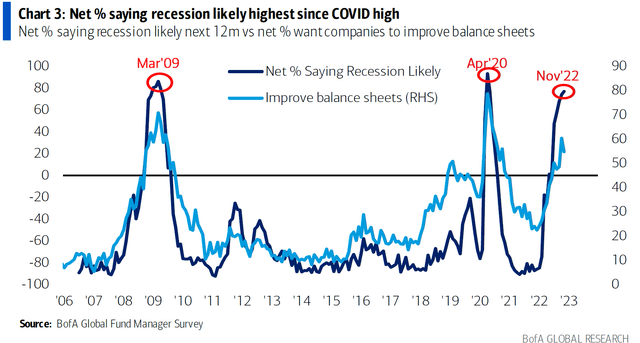

Of course, for lower inflation to become prevalent, one means is a recession. Survey respondents show the highest conviction since the COVID-derived highs in April 2020 that a recession is likely with convictions on the possibility of companies improving their balance sheets showing a slight dip.

Source: Bank of America

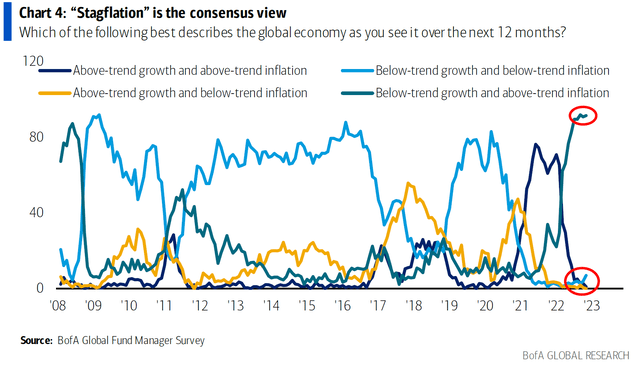

Therefore, the consensus view among the survey respondents is that there will be “stagflation”: below-trend growth tied with above-trend inflation.

Source: Bank of America

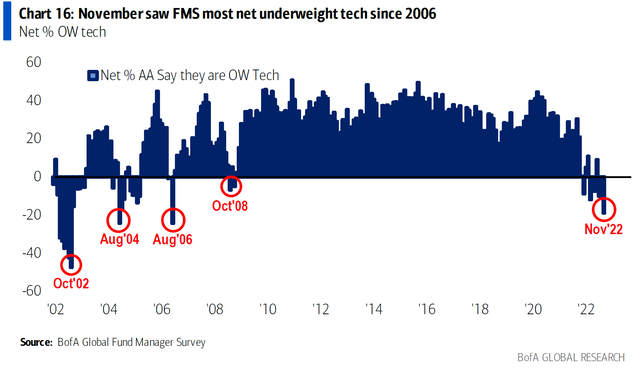

Cash levels, i.e. the percentage of Assets Under Management held ready to be disposed off for loss reduction remains above 6% but tech stocks. The tech sector – the largest beneficiary of breakneck price growth in an era awash with money – were reported as being the least favourite among the survey respondents, who indicate that November has tech being the most underweight of choice since 2006.

Source: Bank of America

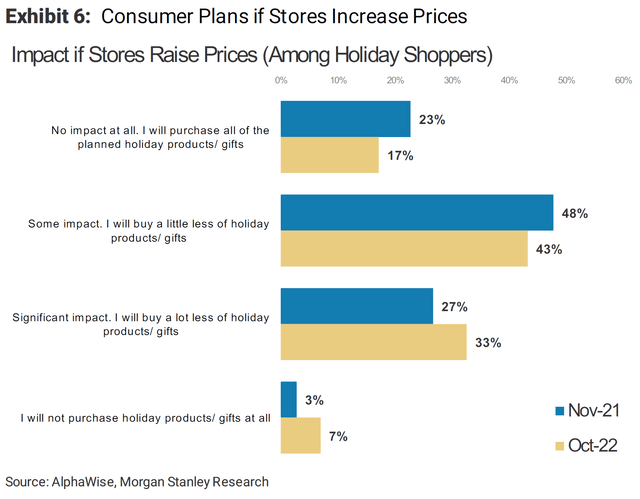

In a report released by Morgan Stanley in October, surveys analyzing shoppers’ tendencies indicated that most shoppers won’t be buying during the holiday season if prices were to increase.

Source: Morgan Stanley

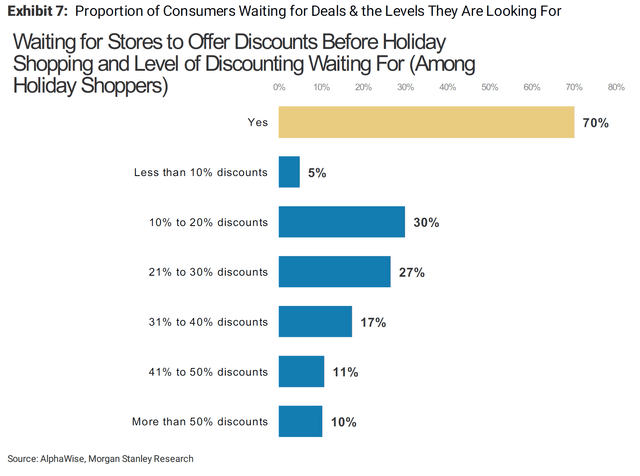

However, over 65% of the respondents indicated a willingness to buy if there were discounts over 20%

Source: Morgan Stanley

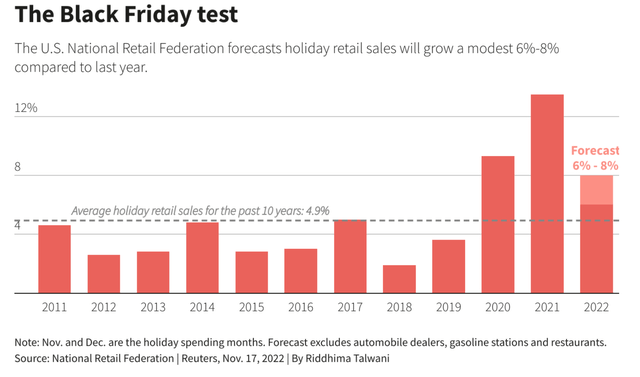

As a result, the U.S. National Retail Federation expected a modest rise of 6-8% in sales which, when accounting for inflation, would have meant lower sales by volume.

Source: National Retail Federation/Reuters

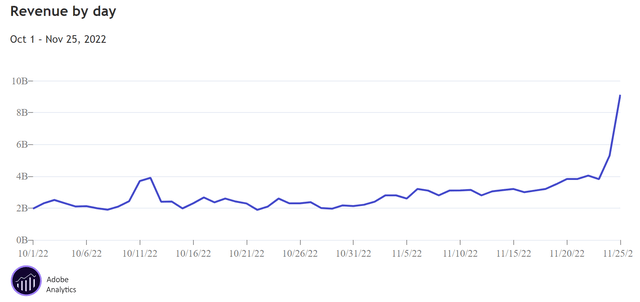

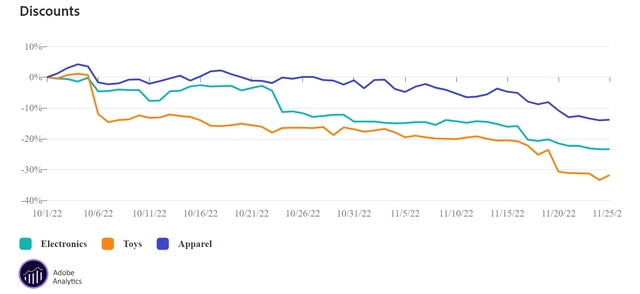

While traffic to malls may have been thinner than expected according to Reuters, web traffic remained robust. According to Adobe Analytics, shoppers in the U.S. spent a record $9.12 billion on Black Friday sales online.

Source: Adobe Analytics/SeekingAlpha

However, the analytics indicated that it was steep discounts that drove sales to a year-on-year (YoY) gain. Mostly, electronic goods and toys were scooped up by shoppers after heavy discounts were applied.

Source: Adobe Analytics/SeekingAlpha

This explains why FMS survey respondents were so wary about companies being able to improve their balance sheets: with discounts come lower profit margins.

Mastercard’s SpendingPulse forecasted a 15% jump in sales on Black Friday overall, led by an 18% rise for in-store retail sales. Net sales were below these estimates at 12% and 14% respectively. Overall, crowds in the malls have been thinner and the driving force of sales have been discounts. This highlights the weakness in the consumer discretionary sector.

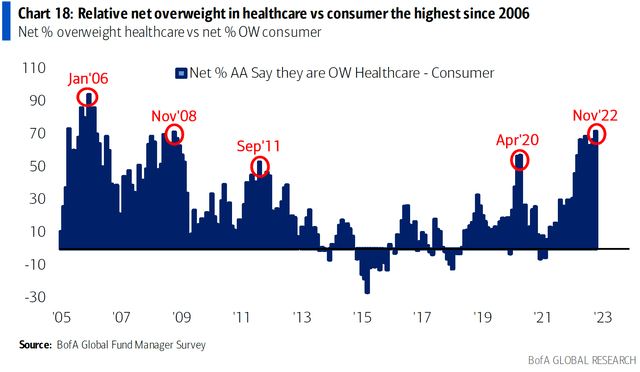

This was highlighted in the Fund Manager Survey as well. Between the standard defensive sectors – healthcare and consumer – respondents indicated that they were overweight in favour of “healthcare” over “consumer”.

Source: Bank of America

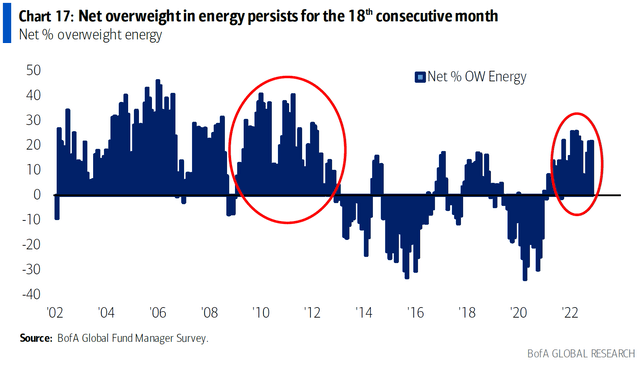

For well over 18 months, respondents have been overwhelmingly overweight in the energy sector.

Source: Bank of America

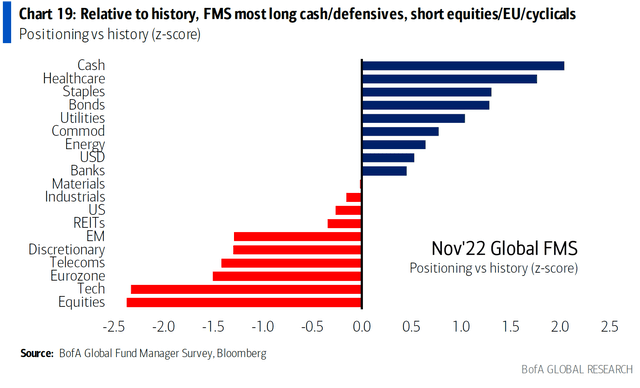

This is evident in net positioning as well: cash, i.e. a readiness to divest, and healthcare are on top while consumer discretionary and tech are being considered with a heavily bearish outlook:

Source: Bank of America

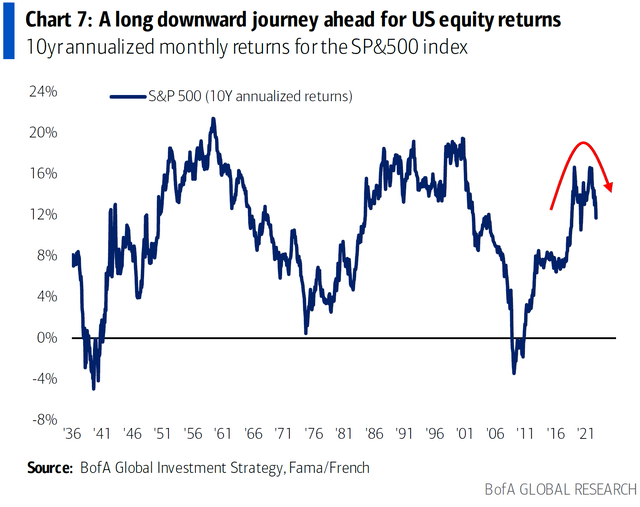

Overall, given the high weightage for tech and consumer discretionary stocks (which interplays with investor preference in a virtuous/vicious cycle), the S&P 500 is being estimated to continue to have a jagged bearish trajectory for some time, with an erasure of 10-year annualized returns in the S&P 500 (SPY) already taking it back several decades.

Source: Bank of America

A large portion of sales in this holiday season is estimated to be for the purposes of inventory reduction as retail stores and e-commerce companies improve their balance sheets: both Amazon (AMZN) and Shopify (SHOP) have laid off staff in the past couple of months. News reports indicate that Amazon intends to cut a further 10,000 jobs with recent “workplace optimization” programs in their India office attracting the ire of the government for improper termination, i.e. without cause and/or adequate compensation. Legal notices have been sent; if found guilty, the consequences can be severe.

Note: Amazon’s regulatory/compliance problems in India – where it was welcomed with great fanfare – have been discussed in an article nearly a year ago.

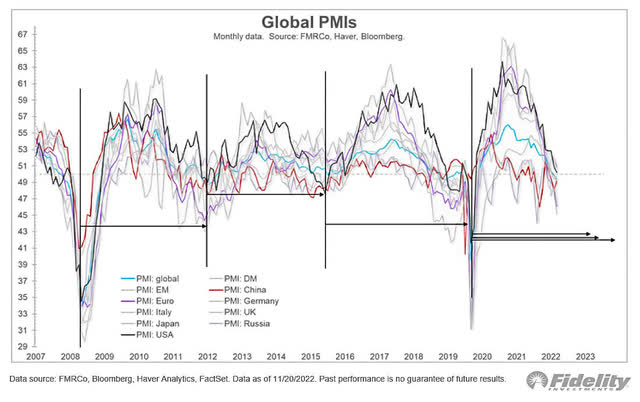

Overall, the Purchasing Managers’ Index (PMI) – a key factor in the determination of economic productivity – has a net forward outlook trending downwards with rising wealth levels in Emerging Markets (EM) giving their PMI a slight push upwards.

Source: Fidelity Management Research

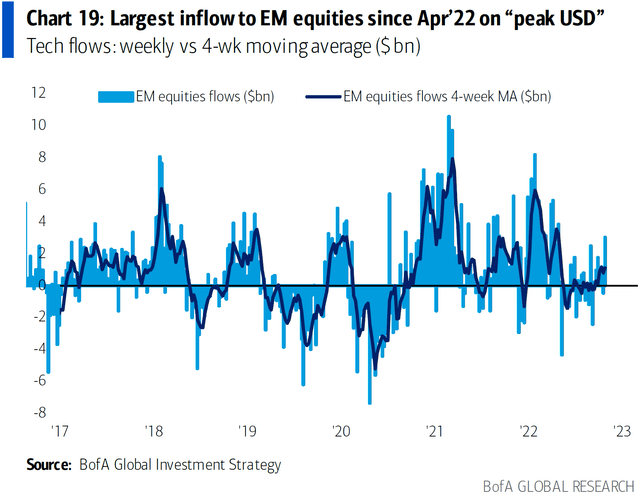

The overall health of Emerging Markets hasn’t gone unnoticed by banks’ private clients. As we near the end of 2022, flow to EM equities seen a surge.

Source: Bank of America

However, this doesn’t necessarily mean China.

Other Pillars of the Economy

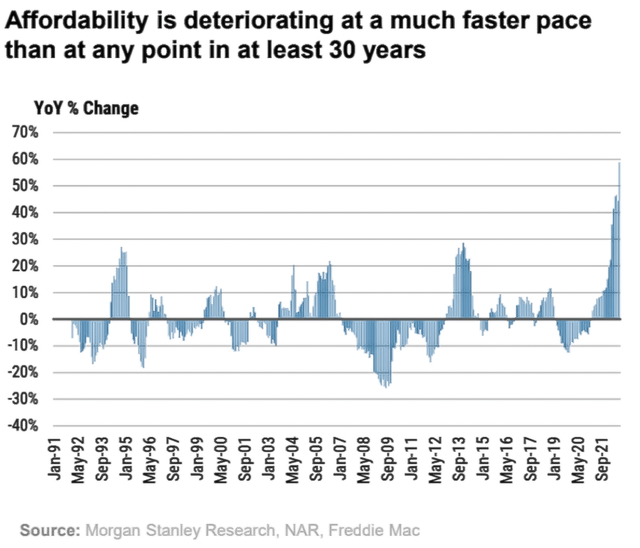

The US housing market is facing enormous headwinds: as of the end of October, the affordability measured in Year-on-Year (YoY) terms, has deteriorated by almost 60%, which was a faster change than in the past 30 years:

Source: Morgan Stanley

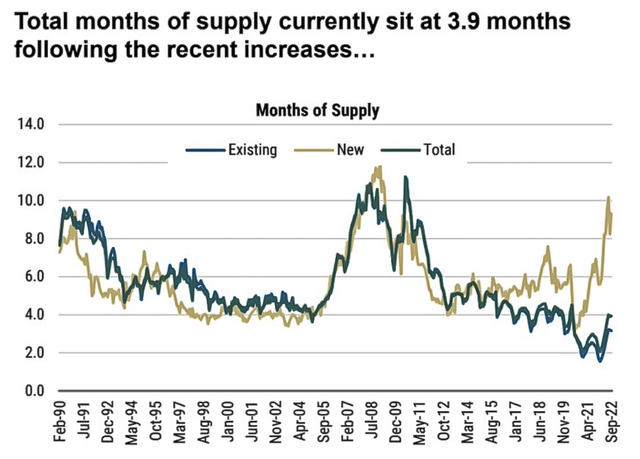

As of the end of September, nearly 10 months’ worth of supply of new homes are lying in inventory while the listing of existing homes also faced a sharp spike in time across Q3.

Source: Morgan Stanley, National Association of Realtors

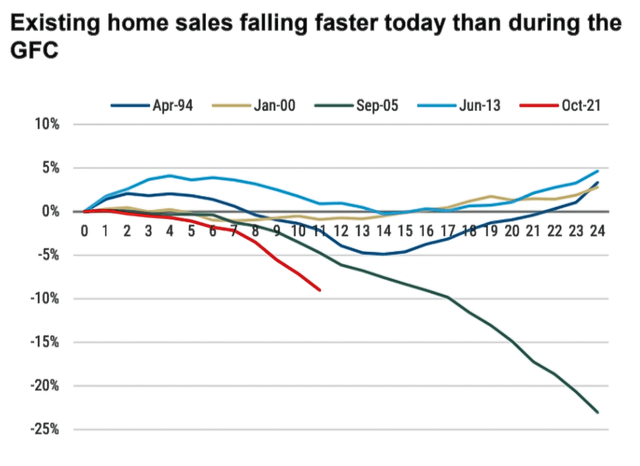

Sales of existing homes, that tend to lie in relatively established in-demand areas, have been falling harder than it ever has in the last 30 years.

Source: Morgan Stanley, National Association of Realtors

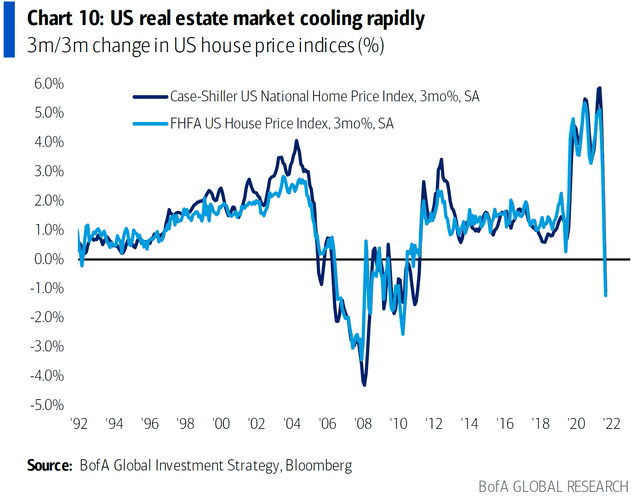

This is also borne out by the steep fall in housing indices in the U.S.

Source: Bank of America

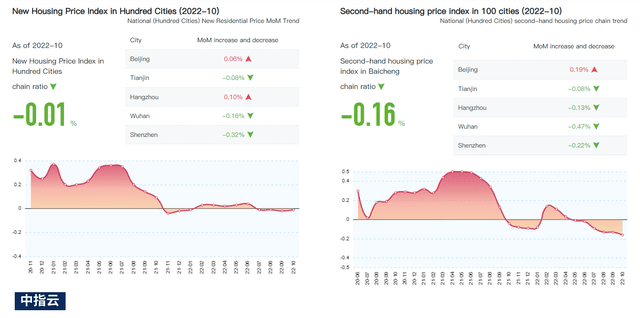

Meanwhile in China, it has been estimated that sales of new homes as of end of October have flatlined while the sales of existing homes have been falling faster and faster in the Year to Date (YTD):

Source: China Index Academy

Earlier this year, Citi’s researchers had already indicated that non-performing loans in China’s real estate market have been ratcheting, with total implied non-performing loan ratio at almost 30%, with privately-owned enterprises (POEs) bearing the brunt of this downward pressure at nearly 48%.

This has grave consequences for the Real Estate Investment Trust (REIT) market, which typically tends to be a source for capital flight during market downturns. In this case, be it Chinese or US REITs, it is an open question if this is a better market than equities in the current environment.

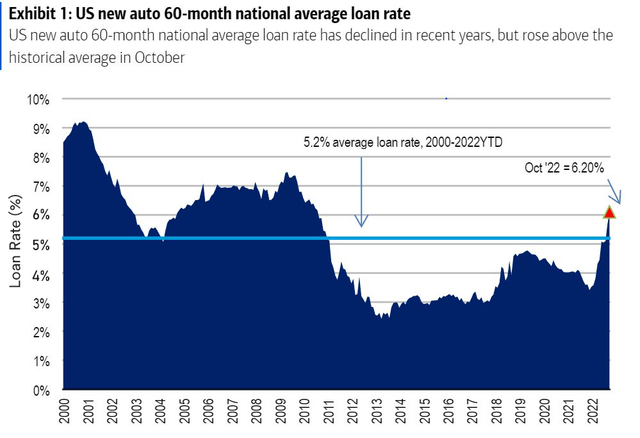

With regard to auto loans in the U.S., loans for new automobiles are at 5-year highs at a time when car sales have been in a steady downward spiral for a little over 10 years now.

Source: Bank of America

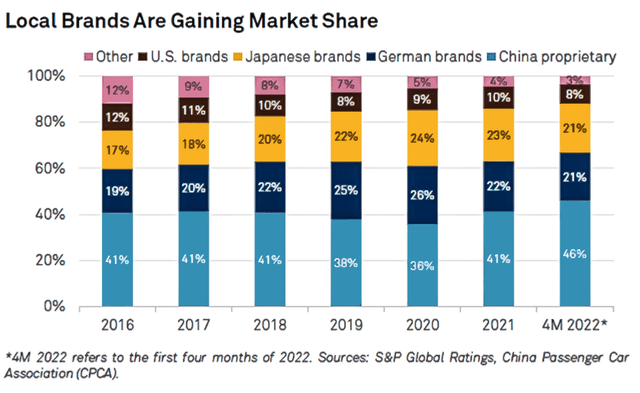

Similar figures don’t exist in China but it has been noted that, by the middle of Q2 this year, sales of Chinese brands – which tend to be a little cheaper and attract subsidies than more expensive foreign brands – have seen a substantial increase in market share.

Source: Standard & Poors, China Passenger Cars Association

Now, Fitch Ratings reported that as of 2020, roughly about 50% of buyers obtained vehicle financing for their purchases. Early in 2021, the Chinese government launched a support initiative to increase credit support to boost the penetration rate and growth of auto financing. This involved asking auto captive loan financing business to lower their down-payment requirements, interest rates and tenors, which the agency warns could have an adverse effect these providers’ asset quality and capitalization. Immediately after this announcement, there was some deterioration in the managed portfolios of Asset-Backed Securities (ABS) issuers specializing in auto loans, which was characterized by higher Loan-to-Value (LTV) Ratios and longer tenors on the loans. Given the argument that the growth in sales of cheaper Chinese brands have increased, it could also be argued that Chinese spending on automobiles have also deteriorated and being propped up by cheap loans.

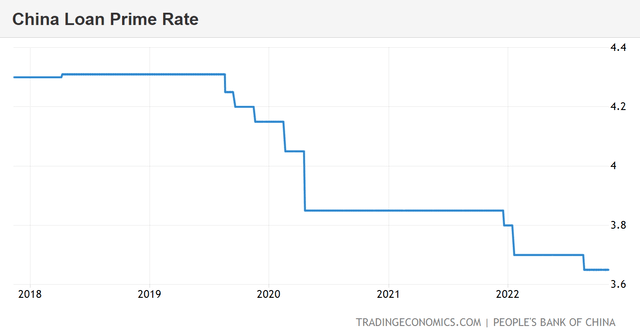

The Chinese government’s boost on spending is also reflected in the steady fall of the bank loan prime rate, which saw a precipitous fall in early 2020 and have continued to fall since.

Source: TradingEconomics, People’s Bank of China

This implies that spending has been getting tighter for quite some time now.

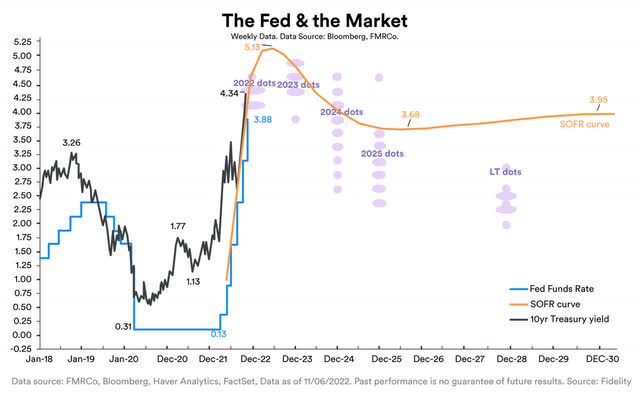

Meanwhile in the US, consensus expectation from institutional market players going into October shows that Fed rate hikes will continue, which implies that valuation downturns in U.S. equity markets will likely continue at least in the near future.

Source: Fidelity Management Research

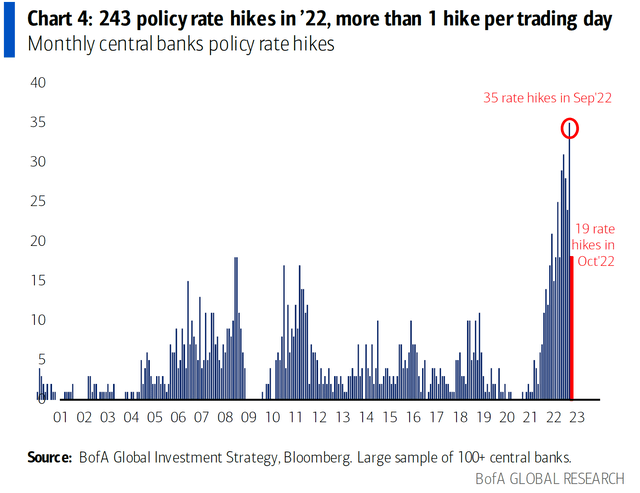

The Fed rate hike cycle have left banks scrambling hard to keep up with policy rate hikes further affecting cash flows into investments.

Source: Bank of America

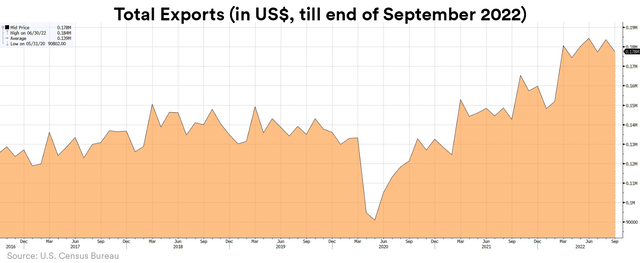

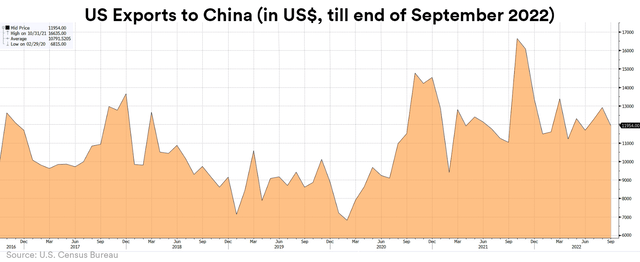

Next, let’s consider exports. The US is the world’s largest consumer of products virtually across the board while China is the world’s largest producer across the board. Both countries are among each other’s list of top trading partners. Overall exports from the US, largely helped by rising gas prices and increased exports to the European Union, have helped boost the value of exports all the way till the end of September.

Source: U.S. Census Bureau

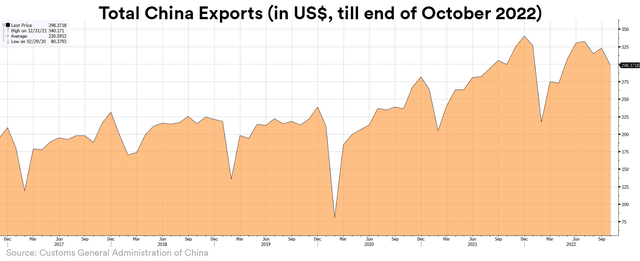

As of end of October, China’s total exports have seen a 3-month decrease, with the devaluation of the yuan in order to boost exports not playing a significant role in propping this value.

Source: Customs General Administration of China

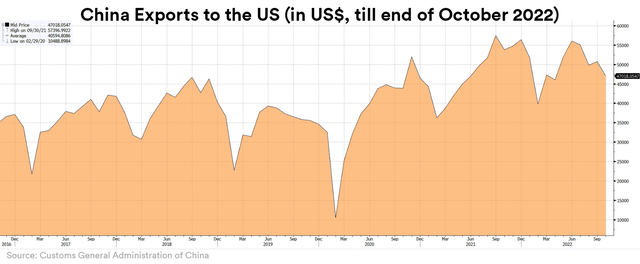

China’s exports to the US, in terms of unit volumes, typically tend to be the likes of consumer goods, components and raw material. Over the 5 months leading to October, this has seen a steady downward trend. This supports the idea that the holiday season will see an inventory reduction program being implemented by retailers to improve their balance sheets, likely in preparation for a lean year ahead.

Source: Customs General Administration of China

The US principally exports machinery and natural resources to China. These have been going strong but it did witness a sudden downturn starting from the end of August.

Source: U.S. Census Bureau

The consumer-producer interplay is problematic for China, which counts exports as one of its economic pillars. With flagging domestic demand – as evidenced by the initiatives to boost domestic spending – and crumbling growth rates in infrastructure (another economic pillar), higher export volumes would be needed. With flagging consumption in the Western Hemisphere, this becomes another avenue that will weigh down its economic goals.

Many investment managers consider investing in Chinese markets to offer adequate diversification from their exposure to US markets. As a result, Chinese equities received heavy volumes and higher valuations. As present circumstances indicate, this notion isn’t necessarily a robust one. There’s every expectation that any downward pressure on US equities (which is being expected) will also lead to downward pressure on the Chinese economy, which already have a number of points of concern – including present protests that are being called (at least by a portion of the Western media) as a challenge to the State. Time will tell if this sentiment will prevail among the masses.

The Funding Problem

The Committee for a Responsible Federal Budget (CFRB), a bipartisan U.S. public policy organization/think tank, warned in June 2022:

“The Social Security and Medicare Trustees released their annual reports on the state of the trust funds today. The Trustees find that Medicare’s Hospital Insurance trust fund will be insolvent by 2028, Social Security’s Old-Age and Survivors Insurance trust fund will run out of reserves by 2034, and the theoretically combined Social Security trust funds will be insolvent by 2035. Upon insolvency, Social Security benefits will be reduced across-the-board by 20 percent under current law while Medicare Hospital Insurance payments will be reduced by 10 percent.”

and added that the assumptions above from the CRFB were released before the last four 75 basis points rate hikes. This is germane from a budgetary standpoint: mandatory entitlements and interest comprised 70% of the U.S. budget in 2022. Medicaid, the Children’s Health Insurance Program (CHIP), and Affordable Care Act (ACA) marketplace health insurance subsidies together accounted for 26% (or close to $1.5 trillion) of the U.S. budget in 2022. Half of this amount, $740 billion (14%), went to Medicare, which provides health coverage to around 80 million people, either citizens aged 65 and older or those with disabilities. In 2023, $5.6 trillion of marketable debt and $2.6 trillion of government debt held by Social Security (23%) matures. In 2024, more than $3 trillion of debt matures.

Because of rising interest rates, the U.S. government will likely have to spend hundreds of billions more next year just to service the debt, leading to expectations that the debt ceiling will have to be breached in June. Defense discretionary spending is 14% of the budget while non-defense is 16%.

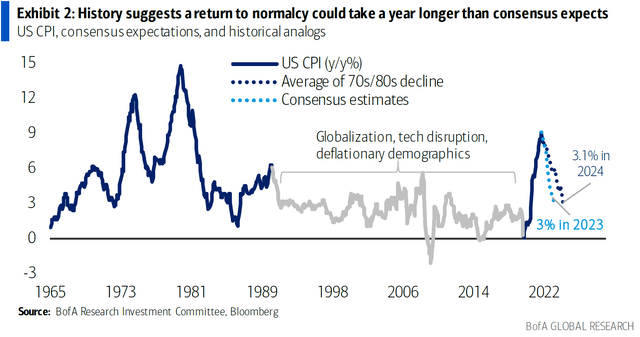

Several institutional reports have started bucking against the consensus opinion being broadcasted over economic recovery and are positing that economic recovery could take longer.

Source: Bank of America

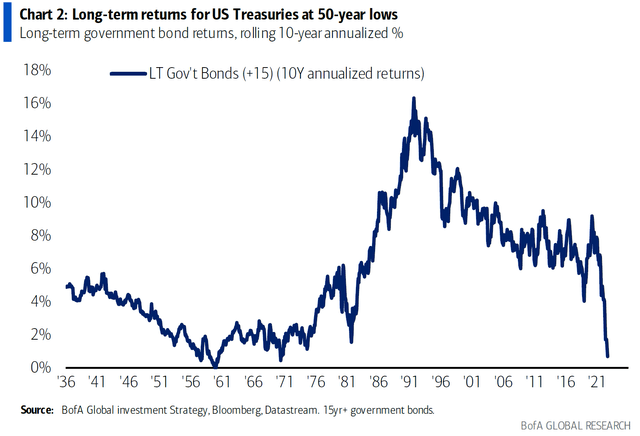

Partly due to U.S. Treasuries having a decreasing market share in investor preferences since the Global Financial Crisis of 2008 (to the point that it’s mostly institutional players such as insurance companies, foreign central banks, et al remaining the dominant players), the U.S. government bond markets haven’t seen a lot of support in prices. After a stated intention of Quantitative Easing (QE) measures winding down, long-term returns for US treasuries have been cratering:

Source: Bank of America

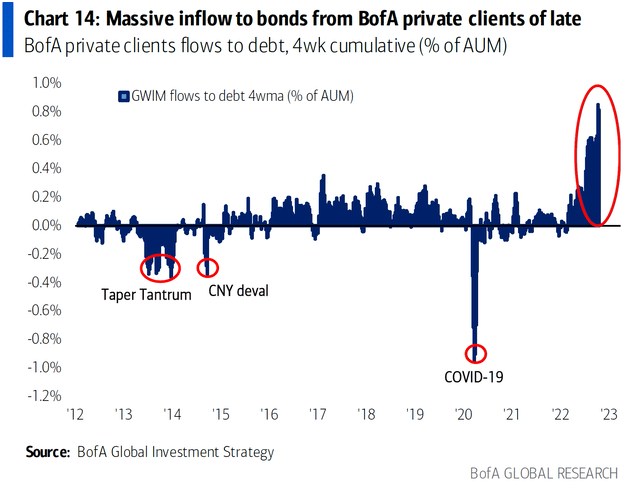

However, interestingly enough, private clients of major banks have been registering a significant inflows to bonds in general.

Source: Bank of America

This is largely driven by historical data that suggests that corporate bonds have lesser drawdowns than broad market indices and government bonds.

In Conclusion

Leading institutions are also increasingly hinting that “globalization” is being supplanted by “localization” (which is welcome to investors seeking true diversification and also estimated as plausible in an article a year ago). For instance, Bank of America has already indicated a return to “recession classics” in 2023: long government bonds and gold, short tech and banks in Western Hemisphere, et al. The interesting observation is “long China stocks” which, given current issues, would likely be a “remains to be seen”.

All in all, it’s a good to reconsider one’s investment philosophy and find means of leveraging the bearish outlook on tech and the broad market in tactical bursts. Long-term investors would do well to reconsider their portfolio mix while recent investments made by investors intending to hold over a longer period could do with a re-examination.

Be the first to comment