CiydemImages

Co-produced with Treading Softly

Recently, I have been very active in buying what others are selling. I don’t buy solely to flip and sell for a profit. I buy future income. As prices rise and opportunities to move from one income-generating position to another arise, I will take action to lock in unrealized gains but my primary focus is to buy income and enjoy it as it arrives.

I especially love monthly income-paying investments.

Few things in life need to be paid annually, or quarterly. Most expenses in life are monthly – it’s daily when it comes to food!

So when the opportunity arrives to buy what others are selling to lock in future income, I am happy to do so.

Today, I want to share two funds that I am buying up heavily for their strong future income output, as well as knowing I’ll get paid by them next month, and the month after, and so on!

Let’s dive right in.

Pick #1: XFLT – Yield 12.5%

XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) is a closed-end fund (“CEF”) that invests in floating rate loans. Their bread and butter are corporate “leveraged loans.” These are loans that are senior in the capital structure to all other debt and are the first lien secured by substantially all of the assets and cash flow of the company. Typically, these loans are issued to companies with a B/B+ credit rating and are originated by banks. If you are looking at a borrower’s balance sheet, the loan will generally be called a “term loan.” (Source: XFLT Website)

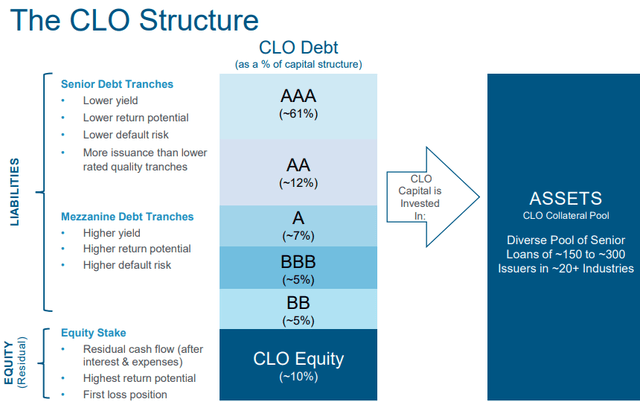

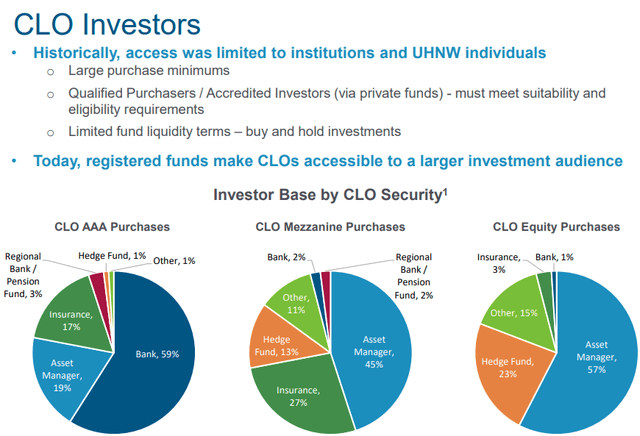

XFLT invests in these loans in two ways. Directly investing in them or owning an interest in a collateralized loan obligation, or “CLO.” A CLO is a company that buys up leveraged loans and then securitizes them. Very conservative institutions like banks or insurance companies will pay a hefty premium to be first in line and ensure they get paid first.

The CLO collects interest and principal payments and then passes that along to investors in a “waterfall” structure. This means that the top tranche gets paid in full first, then the next tranche lower is paid, and so on. The CLO equity tranche keeps whatever is left getting the highest return for being last in line. Here is a look at a typical CLO structure. (Source: XA Investments CLO Equity Presentation.)

XA Investments CLO Equity Presentation

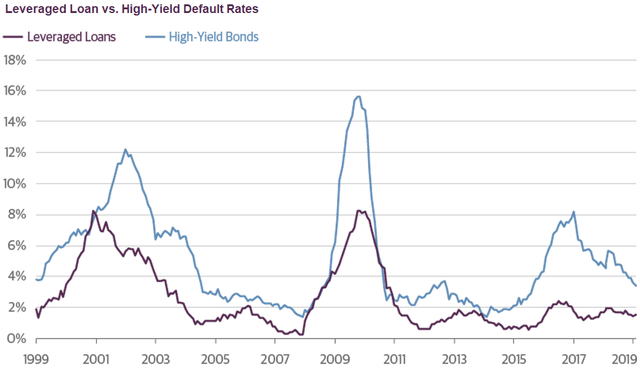

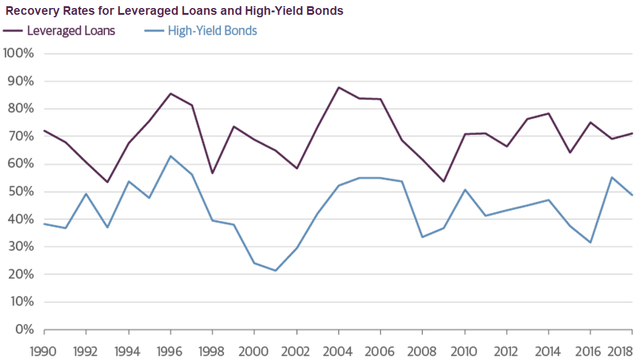

Historically, default rates on leveraged loans have been very low, and recoveries have been much higher than you see with bonds. You would expect this because leveraged loans are higher in the capital stack as the most senior debt.

One common criticism of CLO equity positions is that it is “highly leveraged.” This is true. For every $100 in par value, the CLO equity position might be $10 and is the last to get paid. In effect, every 1% in debt that defaults and does not recover results in a 10% reduction in how much the CLO equity position recovers. However, remember that the CLO equity position has to be paid 100% before a corporate bond collects a penny.

With debt, the relevant question is always whether the reward you are being paid is in line with the risk. CLO equity positions have cash yields well north of 20%, and if historical default rate averages prevail, they will have effective yields in the 15-16% range. Meanwhile, junk bond ETFs like (JNK) are yielding only 5%. If you find a bond yielding 15%+, it is almost certainly C or even D-rated.

CLO equity is risky compared to CLO debt tranches. No A-rated CLO debt tranche has ever defaulted. Over history, leveraged loans have enjoyed materially lower defaults than bonds.

Below is a chart that compares the default rates of Leveraged Loans to High-Yield Bonds.

That is while also enjoying much higher recovery rates:

So why are CLO equity positions yielding so much more than even lower-rated corporate bonds? The answer is liquidity. CLO equity is not publicly traded. It is a buy-and-hold until maturity style investment that is not widely available to most investors. CLO equity positions rarely trade, and when they do it is often at very unfavorable pricing for the seller (which means it is favorable for the buyer!). (Source: XA Investments.)

CEFs like XFLT are making this market sector available to retail investors for the first time. We get the added benefit that XFLT is very liquid. We can buy and sell as we please.

CLO equity is woefully undervalued. Is it leveraged? Yes. Does being last in line create risk? Of course. Does the potential reward make up for that risk? Absolutely. If leveraged loan default rates are anywhere close to in line with historical averages, then XFLT is an absolute bargain. Providing a double-digit yield that would normally require investing in distressed companies. As it is, the rating agencies like Fitch are projecting that leveraged loan defaults will remain well below historical averages for the foreseeable future, even if there is a recession.

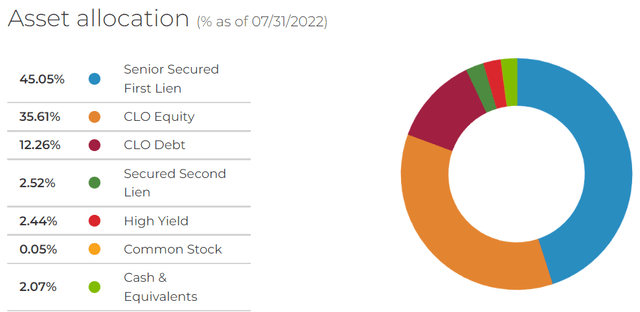

XFLT takes a balanced approach. With direct investment in leveraged loans, CLO debt positions, and CLO equity positions. Corporations are more likely to pay their bills than not. That is the bet you are making with XFLT, and you are very well compensated for it.

Pick #2: RQI – Yield 6.5%

Cohen & Steers Quality Income Realty Fund (RQI) is one of our favorite CEFs in the real estate investment trust (“REIT”) sector. One of the features we love about CEFs is their ability to produce high yields from high-quality investments that generally don’t have dividends that meet our income goals.

CEFs are required to distribute substantially all of their taxable gains – that includes dividend income, as well as capital gains. This allows us to apply our Income Method investing strategy, while also having exposure to some of the best companies in the world.

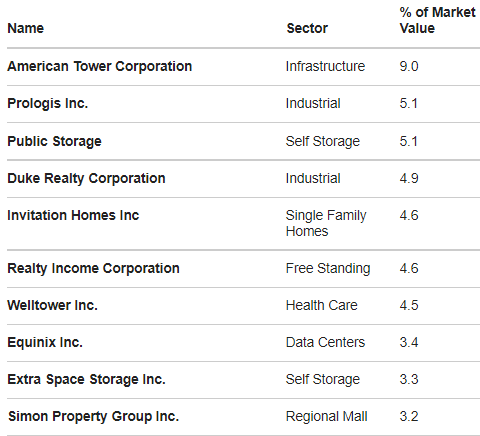

RQI’s top 10 holdings are a “who’s who” of blue chip REITs. (Source: RQI Website.)

RQI Website

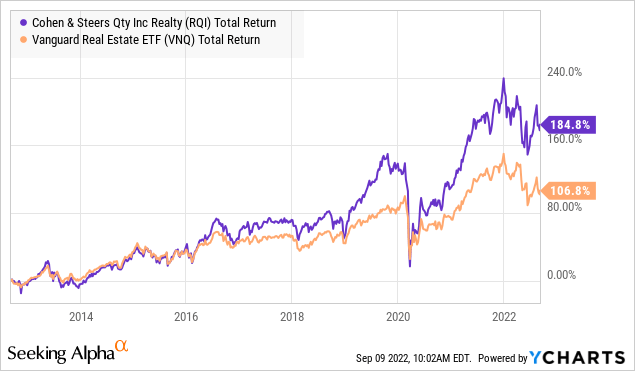

I’m sure you recognize most of the names. We’ve held a few directly in the HDO portfolio, like Realty Income (O) and Welltower (WELL). This focus on quality has allowed RQI to dramatically outperform the Vanguard Real Estate ETF (VNQ) over the past decade.

It is a unique period for REITs, their largest source of revenue is rent. Rents are rising thanks to the high demand for real estate along with inflation. At the same time, modern REITs have very little exposure to inflation-sensitive expenses. It has become common for bills like insurance, taxes, and maintenance to be the tenant’s responsibility in most commercial leases. As a result, most REITs are seeing same-store net operating income increase quickly.

On the expense side, the largest expense for your typical REIT is interest. Over the past two years, REITs with even a decent quality balance sheet refinanced as much debt as they could at historically low levels. The high-quality REITs that RQI holds were able to lock in low rates for 10+ years and few have any significant debt maturing before 2024.

As a result, REITs are experiencing the benefits of inflation immediately. Rents are going up right now. The trade-off of higher interest rates they will have to pay is an expense that won’t be realized for many years. REITs are experiencing rising revenues while expenses remain low. That is a fantastic combination for the sector and will lead to several years of strong fundamentals driving their cash flow, FFO, and higher dividends. RQI is a great CEF to take advantage of this strong sector.

Shutterstock

Conclusion

XFLT provides us a large sum of income monthly to reward us for the risks we take by investing in CLOs. Nothing is ever high-yield and entirely risk-free. The question becomes if you are adequately compensated for the risk you are taking on. In the case of XFLT, we think we are rewarded exceptionally well for the price of admission.

RQI provides us a route to gain exposure to a strongly supported sector -fundamentally speaking – while also getting more income than other routes available to us.

Both XFLT and RQI trade near their NAV, allowing us to gain exposure without excessive premiums.

In life, bills come monthly and must be met with cash to pay them. I get my cash monthly from these two funds. I get more than I need to pay my bills, which allows me to enjoy other opportunities, or simply reinvest back into these holdings to get more money next month. I love the quick feedback loop when reinvesting your income into these holdings, next month you see results already!

Money monthly. Large sums of income with no work required. Sounds great, doesn’t it? It should. That’s the joy of income investing!

Be the first to comment