alvarez

Introduction

Sempra (NYSE:NYSE:SRE) consists of San Diego Gas & Electric Company, Southern California Gas Company, and Sempra Texas Utilities. They focus on the supply of electricity and natural gas, as well as LNG infrastructure.

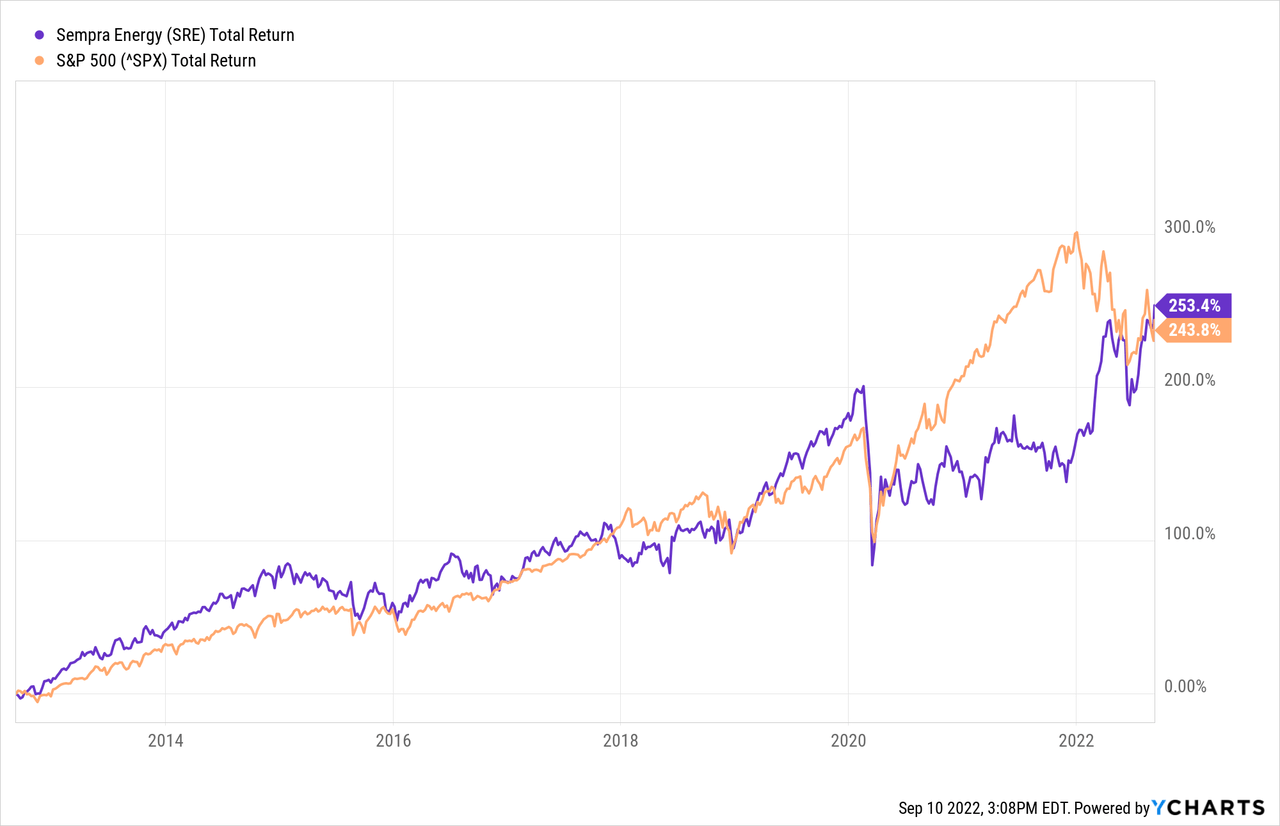

Sempra’s stock price has risen sharply over the past 10 years and has achieved roughly the same return as the S&P500.

Utilities stocks are generally a defensive investment in times of economic recession. Investing in utilities also offers good protection against high inflation because they can pass on energy prices.

Recently, Russia has completely closed the natural gas tap of Nord Stream 1, Europe will no longer receive Russian natural gas. Sempra sees this as an opportunity and has now signed 3 contracts with European companies to transport LNG across the Atlantic Ocean.

I see this as a very strong catalyst for Sempra’s growth. UBS holds the stock at its highest conviction stock for the remainder of 2022. The stock is a strong buy.

Russia stops supplying natural gas to Europe

European gas prices are up 40x from mid-2020 as Russia continues to tighten Nord Stream 1 gas taps. Recently, Russia has completely stopped supplying natural gas to Europe due to European sanctions. This has major consequences for companies that depend on natural gas, such as the chemical industry, but utility companies are also experiencing problems. The German energy company Uniper SE (OTCPK:UNPRF) has been promised €9 billion in credit lines to meet its obligations.

European energy ministers met on Friday 9 September to propose the introduction of a price cap for Russian gas. Consumers feel high gas prices in their wallets. They speak of an inevitable recession.

Major Catalyst: Sempra Supplies LNG To Europe

The US has become the number 1 exporter of LNG and Sempra sees the opportunity to help Europe in this energy crisis. I cite from BNN Bloomberg:

US LNG exporter Sempra Infrastructure is in preliminary discussions with European companies to sell the fuel from the next phases of its plant in Texas, the company’s president Dan Brouillette said in an interview at a conference in Milan. Sempra is also considering joint ventures and partnerships to build LNG import terminals in Europe and elsewhere, he said, as the energy crunch presents an opportunity “to help our friends and allies.”

Sempra has signed 3 contracts with European LNG customers to supply Europe with American LNG:

- An agreement to sell 3 million metric tons of LNG per year to PNGiG, Poland’s state-run gas company.

- A proposed partnership with German Utility company RWE to deliver 2.25 million metric tons per year of LNG over a 15-year period overseas.

- A non-binding 20-year agreement with UK-based INEOS to deliver 1.4 million tonnes of LNG per year across the Atlantic.

Sempra is well on track to continue developing the Port Arthur project in Texas to export LNG to Europe. I cite from their transcript of their third quarter earnings:

Just as a reminder, we have a FERC order and a DOE expert permit in hand and the permitting and design work are highly advanced for the initial phase of the project. The key remaining work streams involve finalizing of the EPC contract with Bechtel to include updated pricing and signing definitive offtake arrangements.

There is continuous demand from European buyers and Sempra expects to see positive developments as Europe moves further away from Russia. These projects will greatly benefit Sempra’s future profits. I see this as a major catalyst for the growth of Sempra.

Strong Earnings And A Raised Outlook

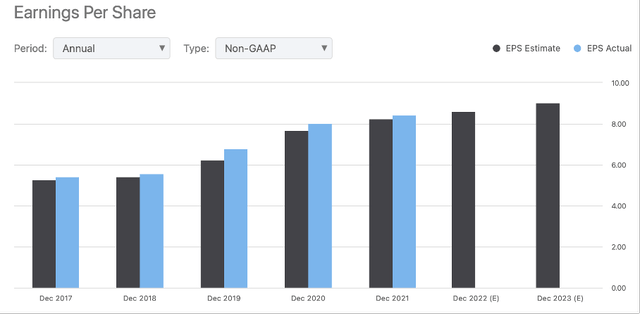

The second quarter was a strong quarter, revenue was up 30% year over year to $3.55 billion, and non-GAAP EPS was up 21%. Sempra also raised its non-GAAP EPS guidance for the full year 2022 by $8.10 to $8.70, and expects EPS in the range of $8.60 to $9.20 in 2023.

Heat waves are currently active that contribute positively to Sempra’s revenue and profit. The heat wave across the state of California has led to temperatures exceeding 110 degrees Fahrenheit and is threatening the power system to its limits. California Independent System Operator CEO Elliot Mainzer expected a shortfall of 2-4 MW, a shortfall of nearly 10% of usual energy demand. High energy demand is beneficial to the San Diego Gas & Electric business. The recent Texas heatwave is also beneficial for Oncor Electric, in which Sempra has an 80% stake, which will contribute positively to earnings per share.

Stock Valuation Is In Line With The Market

Non-GAAP EPS grew an average of 12% year-over-year over the past 4 years. More than 10 analysts have positively revised Sempra’s earnings and expect Sempra to show 5% EPS growth in 2023 and 7% growth in 2024. Strong growth is expected and heat waves are positively contributing to their earnings growth.

Sempra EPS

The valuation of the share is comparable to that of the market. Sempra’s PE ratio is currently 20, as is the S&P500’s.

Their EPS is expected to rise further and as a result, Sempra will be valued more cheaply in the future. Due to the strong catalysts of Sempra (the export of LNG to Europe), and the fair share valuation, Sempra is a strong buy.

Conclusion

Sempra provides both natural gas and electricity in select areas of Southern California. Sempra also offers natural gas infrastructure.

Recently, Russia announced that it has completely shut down Nord Stream 1’s natural gas tap until European sanctions are lifted. This offers strong growth opportunities for Sempra. They have already signed 3 contracts with European companies to transport LNG across the Atlantic. The development of this project is in full swing and Sempra will provide updates on the progress in the coming quarter. I see this as a very strong catalyst for further growth of Sempra.

Recent quarterly results are strong, revenue grew 30% year over year and non-GAAP EPS grew 21% year over year. Sempra raised its expectations for both 2022 and 2023 and sees a bright future ahead. The stock valuation is in line with the current market. Earnings per share are expected to rise in the coming years and analysts have revised their expectations upwards. The stock is a strong buy.

Be the first to comment