Peopleimages

What is a Redwood Trust?

For you 99.876% of Americans who have never heard of Redwood Trust, Inc. (NYSE:RWT), it is an REIT that invests in and originates residential mortgage debt. A few key facts about Redwood’s investment business:

- It owns about $11 billion of residential mortgages. Through securitizations it sold off interests of about $10 billion, leaving it with a net investment of $1.2 billion.

- While Redwood transfers the great bulk of the interest rate risk through its securitizations, it retains most of the credit risk.

- About half the mortgages are single-family loans. They are typically “non-conforming”, meaning that Fannie Mae and Freddie Mac can’t insure them. What makes them non-conforming is either they are too large (“jumbo” loans) or they have some feature not within Fannie/Freddie’s underwriting guidelines.

- The other half of the mortgages are “landlord loans” – to owners of apartment buildings and single family homes for rent.

And here are some facts about Redwood’s origination business:

- Redwood originates the kind of loans it invests in. But many times, it finds that selling the loans outright rather than securitizing them makes more economic sense.

- When it sells the loans it transfers all of its interest rate and credit risk.

Redwood’s two massive discounts to par

Discount #1: By management. Because Redwood retains the credit risk on its investments, it initially values the loans on its books at below their par value. I’ll let management put numbers to this, from their Q3 ’22 conference call:

“Our securities portfolio was held at an aggregate $458 million discount of principal value, or just over $4 per share at September 30. This translated to a weighted average holding price of approximately $0.69 on the dollar on our balance sheet.”

If the loans have no losses, it obviously gets repaid par and the $458 million is recorded as earnings. Defaults losses incurred reduce that $458 million of potential income.

Discount #2: Mr. Market. Redwood’s current market cap of $819 million is nearly $300 million below the company’s current book value, meaning that investors discount those loans by even more.

Adding up the two discounts implies that Redwood is going to sustain about $750 million of default costs on its $11 billion of gross loans. Is that a reasonable assumption? I strongly say “No”.

Redwood’s credit protections

Oddly enough, Redwood doesn’t just randomly make loans. It has underwriting standards. Here are the highlights of its home mortgage credit risk:

- Its jumbo loans have an average loan-to-current home value (LTV) of 44%. Yes, that’s right, 44%, because their average seasoning is 4½ years and home prices are up 45% over the past 4½ years. And the borrowers are solid – average FICOs of 767. Will any of these loans default?

- Redwood also invested in so-called “reperforming loans” that were restructured after the borrowers ran into trouble during the Great Recession. That’s right, the average age on these loans is 16 years. Their LTVs average 43% (home prices up 65% since origination), and their average loan size is only $159,000. They are messy borrowers – 10% are delinquent at present – but they’ve muddled through for 16 years. Will year 17 bring that much bad luck?

And here are some details on the landlord loans:

- Their average LTV is 67%.

- The average cash flow of the properties is 150% of their loan payment due to Redwood.

- A lot of the single family rental homes are cross-collateralized with other homes.

- From management – “Over 90% of our bridge lending supports a sponsor strategy of acquiring and stabilizing single or multifamily real estate, rather than traditional shorter-term rehab and sales strategies.”

Those are conservative lending standards. The housing market will have to get awfully bad to seriously dig into that $750 million of losses the market expects. Could another ’08 housing market just blow this conservative underwriting out of the water?

Why this ain’t ’08

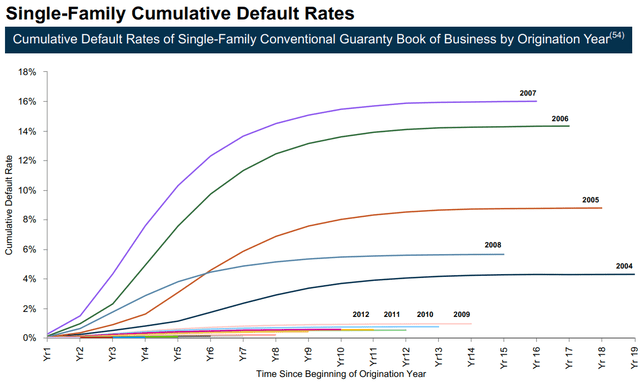

The next three pictures just give you a lot of confidence about that assertion. The first picture puts investors’ $750 million of assumed losses in perspective. $750 million is about 7% of Redwood’s loans owned. How bad is 7% of residential loan losses? Pretty disastrous, if Fannie Mae’s Great Recession experience is any guide. Here are Fannie Mae’s cumulative defaults from those ugly ’04-’08 loans:

Cumulative “defaults” did average about 10% on the ’04-’08 loans. But some money is recovered by the lender when the foreclosed home is sold. Assuming a low 50% recovery rate, Fannie lost 5%. But Fannie’s loan quality was far worse than Redwood’s, from LTV’s to FICOs to loan terms.

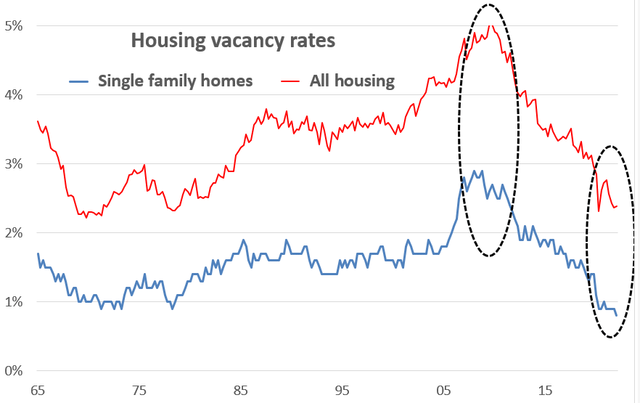

The second picture compares housing vacancy rates now and then. Vacancies are a good measure of the supply/demand balance. Here it is:

’08 was an all-time vacancy rate high, the present an all-time low. Then there were 2 million extra homes sitting on the market. Now there is an over 1 million shortage. Home prices have to fall far less now for the market to regain balance. And Redwood’s landlord borrowers have a dramatically better chance of meeting debt payments because of low rental vacancy rates.

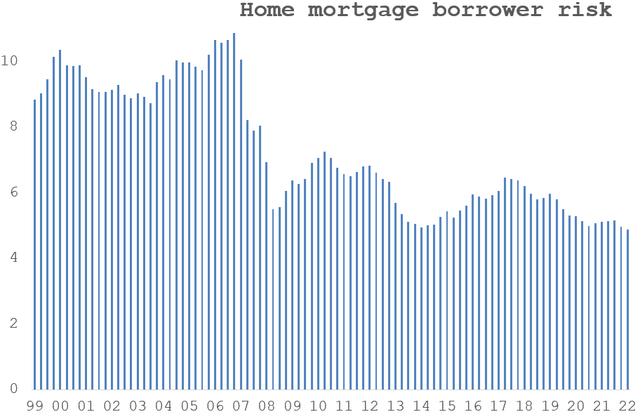

Third and finally, there is borrower loan quality:

A dramatic improvement. That means today’s housing market has far fewer financially shaky homeowners who could be forced to foreclose in a recession.

Wrapping it up – Redwood is cheap, and highly volatile.

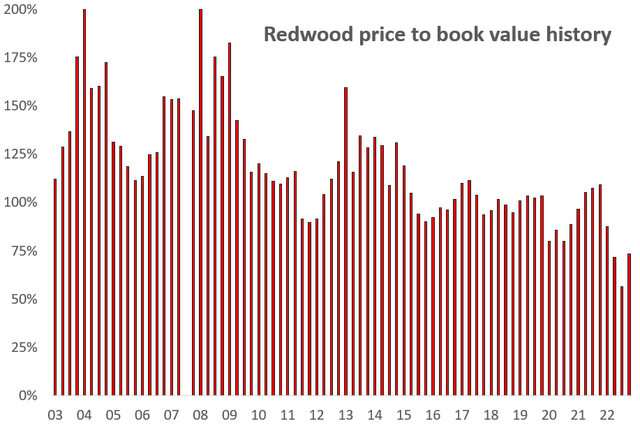

Two more charts to close this out. First, Redwood’s historic price-to-book ratio, up to date through late last week:

The stock has just bounced off its lowest price-to-book ever, a book value marked down for investors’ housing fears. Redwood’s management is taking advantage of the market’s fear:

“Our analysis shows a compelling opportunity to invest in our own publicly traded shares…We’ve already expressed this view by repurchasing close to 60 million of common stock over the last five months. We anticipate doing much more in the near to medium term and have ample capital to do so.”

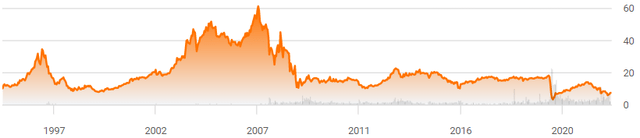

This last chart simply shows Redwood’s stock price history:

What I find interesting is that four times during Redwood’s 25-year history its stock price has more than doubled. This is a panic-or-frenzy stock. We’ve just had another panic. Is a frenzy down the road? I think Redwood is at least a $10 stock, and $12 is certainly reasonable. In the interim, you have a good chance of clipping a 13% dividend yield.

Be the first to comment