Robert Daly/OJO Images via Getty Images

The rally accelerated on Friday, and the financial media all say big-cap tech is done

Not in a long shot. Exclaiming that Cloud Tech is done for and value stocks are now going to lead the market is a very convenient if lazy way to explain what is going on. In fact, the lower revenue reported by Amazon’s (AMZN) AWS, Microsoft’s (MSFT) Azure, and Alphabet’s (GOOGL) GCP, points to one of the great selling points of cloud services. Cloud service charges are consumption-based. Imagine the old way of bringing additional computing power and storage, and then paying for software licenses for the number of seats you think you need. We are talking about perhaps $100s of millions for hardware and software. Even $20M upfront for a divisional budget is quite a nut to cover. Now suppose Powell raises rates like he has been doing and at first it’s really slow, and Powell says inflation is transitory. You are the head of IT and you just signed off on that $100M budget, maybe it was only 3% more than last year, so no big deal. Guess what, it was no big deal in April but by now you are fired for blowing all that money when Mega-Corporation of America is laying off 10% of employees. Or in the case of Elon Musk, he is laying off 50% of employees at Twitter. What else will happen? NO ONE will be signing any IT contracts for the next 6 months. Instead, with the cloud, there’s no hardware, no systems software, no data center employees to fire, and no upfront licensing. So instead of being stuck with all this upfront cost and eating it the IT Director calls his AWS rep and says we are going to cut our usage by 25%. He’s doing this not because the demand has fallen off a cliff but because they want to cut costs quickly. The AWS guy says sure! In fact, we will work with you to cut where it’s easiest. Try doing that with your friendly computer manufacturer, you think they are going to take back the hardware they sold you? Fat chance. So what does this do? It means that when you need a little more storage you get more storage without any upfront cost. So why wouldn’t AWS help with cutting costs? AWS is constantly cutting costs, and adding capabilities to maintain its lead. They know that the demand will naturally go up. The move to the cloud is inexorable, a big part is how low-cost and easy it is to set up the platform to support applications. Keep in mind that these applications will make the enterprise more competitive, or more productive to drive down other costs like labor. Without it, they will not stand up to the competition. The Cloud is existential; period.

Cloud Computing is here to stay and will re-accelerate

Many analysts agree. Dan Ives, an analyst with Wedbush Securities, said this week in a note about Microsoft that “the shift to the cloud is still less than 50% penetrated.” Growth is slowing as inflation continues and the strong dollar outside the U.S. hits the revenue lines of many tech giants, causing many companies to pause their spending, but that is a short-term problem. When Dan Ives is talking about spending being less than 50% penetrated he is talking about old existing systems. These applications are stuck on some mainframe in code that can be 50 years old, written in a computation language that your grandpa thought was stodgy back in the 90s. The economics of maintaining these systems are extremely costly, when you add in the opportunity cost of adapting to the current challenges the cost might be existential.

So let me sum this all up for you; Powell scared the hooey out of CEOs this past quarter

So what did they do? They cut the easiest stuff to cut, like advertising, and the cloud. However, unlike advertising, Cloud technology usage might be slowed for a “minute”, but it is inexorable. The announcement that the Cloud is “over” or that cyclical companies will reign supreme is just lazy attention-getting financial journalism. When supposedly sophisticated money managers blithely dismiss the “tech titans”, I think it’s just sad. If you are a fast money trader maybe you decide to sell AMZN, GOOGL, or MSFT. Great, people who think like me will be buying. I have stated multiple times that I am looking to build positions in these names for the long haul. I consider this a great opportunity to pick up more shares. I believe that the price action in the last few days tells me that there’s a good chance we’ve already seen the bottom, in MSFT, GOOGL, and AMZN. GOOGL’s advertising revenue ballooned 50% in the past 2 years because of Covid. Eventually, advertising on YouTube, and in search will start growing again. Meanwhile, GCP performed rather well compared to Azure and AWS.

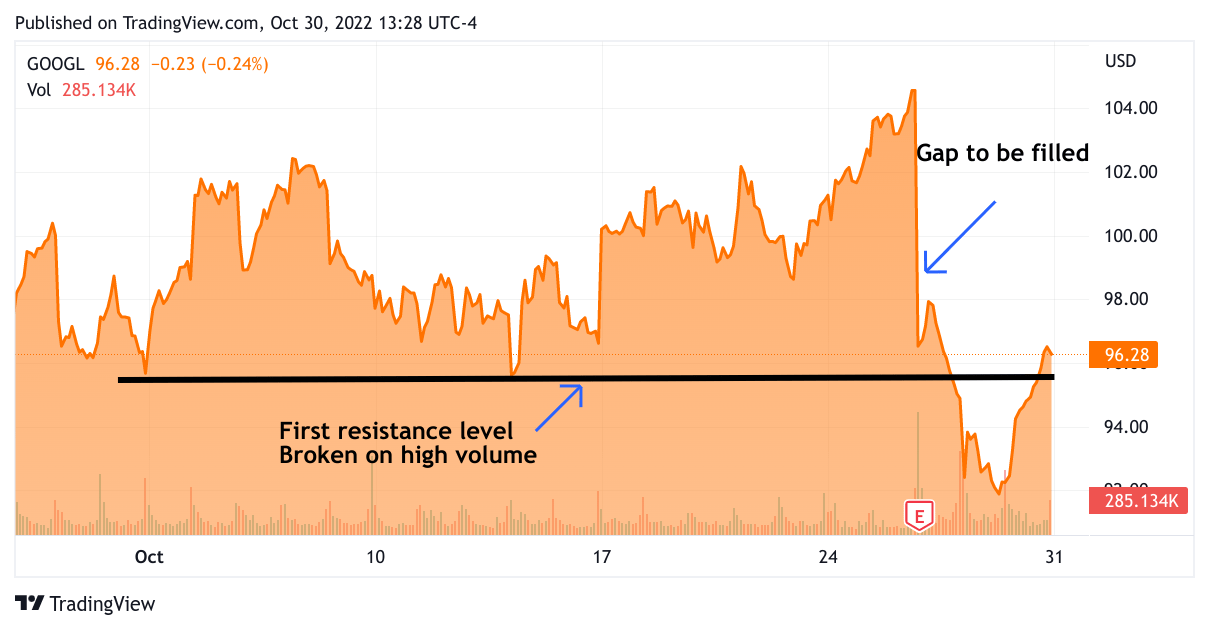

GOOGL 96.29 -4.07 -4.41%

Tradingview

At first, GOOGL fell as low as $88 in the postmarket, I was lucky to snag some at $91, and if the stock sells off further this week I will collect some more. The monthly chart of GOOGL above tells me that GOOGL easily broke through the first level of resistance. In charting gaps tend to be filled, so I believe in this case with the gap relatively near it will act like a magnet to pull GOOGL back into the low 100s. As this rally continues into year-end even if GOOGL follows the market average it will continue climbing. Once, cloud usage takes its natural course

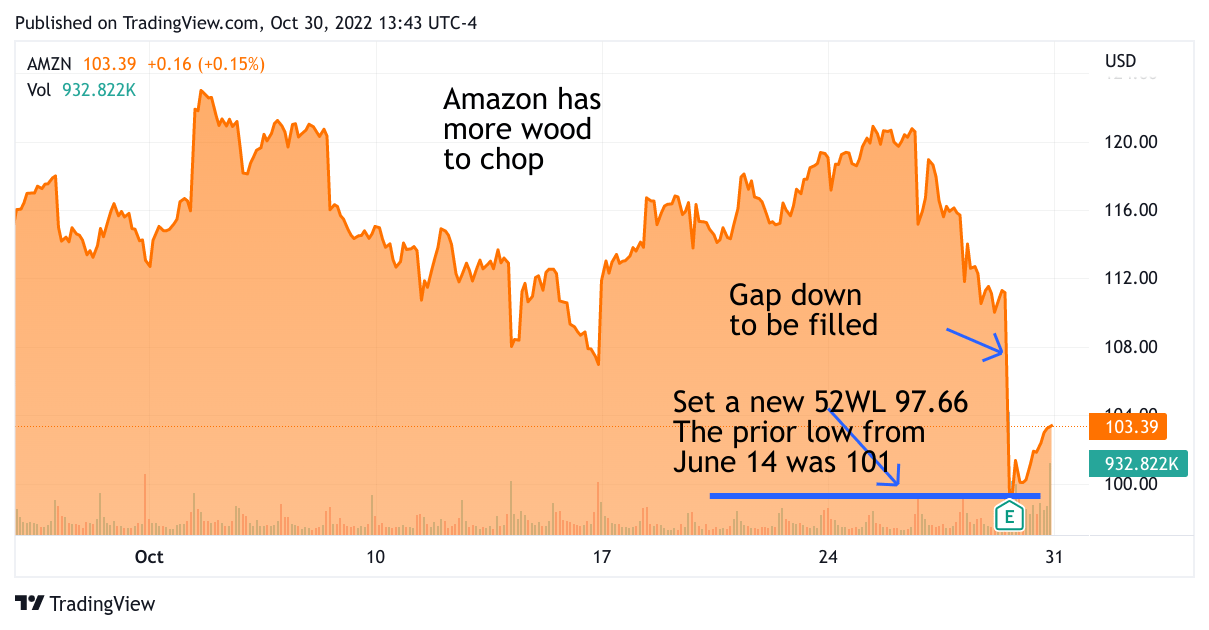

Amazon Avg 103.41 – 7.55 -6.8%

TradingView

AMZN is a very similar chart, it too has a gap to fill on the upside. Since I believe the slower growth of AWS will reaccelerate, especially since the dollar will fall back to a more moderate level. I have faith that Andy Jassy will be able to make the rest of AMZN perform much better. AMZN advertising is still growing strongly, Prime Delivery will eventually compete with United Parcel Service (UPS) and FedEx Corporation (FDX) and generate good profits. The best is yet to come for AMZN. That said AMZN may have continued volatility, I would love to pick up shares at lower prices. I am not indifferent to the obvious breakdown to a new 52WL.

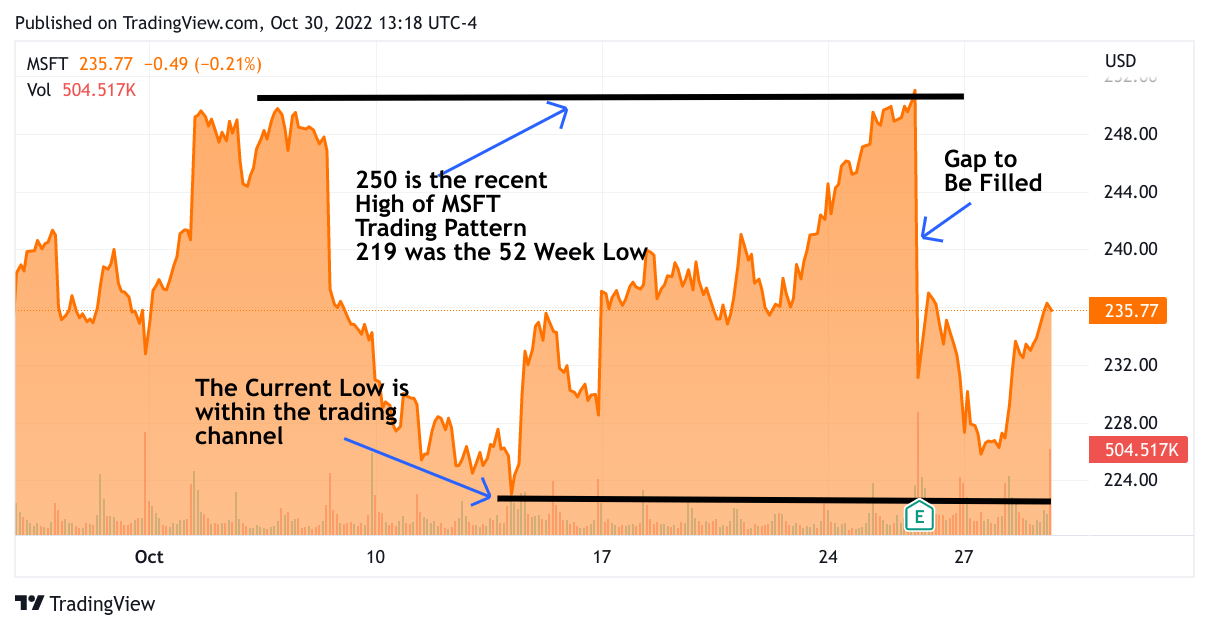

Microsoft $235.87 +9.12 +4.02%

TradingView

MSFT has the most optimistic chart of the 3. It didn’t break down anywhere near the recent 52WL of 219, the price action is intact. MSFT has been rising to 250 for a while now. Part of Dual Mind Research’s way is adhering to the Cash Management Discipline. As the stock rises toward $250, I will trim off the most expensive shares to lower the average share price.

My Trades

This week I added to my GOOGL, AMZN, and MSFT positions. I was able to pick up shares in some cases at lower prices than during normal trading hours. At Dual Mind Research community, we actually organize a community trading plan based on post-market trading, which we call “fishing”.

In addition to the above, I added an additional biotech name Jazz Pharmaceuticals (JAZZ), I also added to Biohaven (BHVN) shares. I hate to admit this but I started a trade in Meta Platforms (META). I started buying at $108, then added shares under $100, my average price is 105. I am going to keep this trade on a very tight leash. If it breaks under 90, I’m going to take my lumps and sell out. I am threading the needle I know, but I would add some more shares in the $90s this week to lower my average share cost. I am looking for META to break 115 before I take profits.

Be the first to comment