Eddisonphotos/iStock via Getty Images

This article was first published to members of my service on 12/11/2022. NCZ-A and NCV-A are 99% identical, so all the logic of the article applies to NCV-A as well.

If we are to look at the preferred stock market, there are 2 main risks to care about in general(not including delisting here):

- Credit risk

- Interest rate risk.

If the first is concerned, there is a group of preferred stocks that are without a doubt the safest on the exchange. We are talking about closed-end fund (“CEF”) preferred stocks. If you ask any reasonable person in the world or even outer space, he/she will be able to come to the conclusion that risk and return should be correlated. This is usually obvious but has never been the case for the hero of our article today:

AllianzGI Convertible & Income Fund II 5.5 % Cum Pfd Registered Shs Series A: (NYSE:NCZ.PA).

NCZ-A biography

NCZ-A was born on 9/4/2018 with a 5.5% nominal yield carrying a AAA rating from Fitch at the time. It was and still is a part of the big CEF family. Being a member of this family comes with a lot of restrictions. CEFs are not allowed to carry leverage of more than 50% of assets, and there is a mandatory redemption obligation if this limit is not sustained. The 30-year treasury yield on the birth date of NCZ-A was 3.07%. This means that NCZ-A was issued at a spread of 2.43% to the 30-year notes. On the 14th of May 2020, just days after the market panic of 2020, NCZ-A got its credit rating downgraded from AAA to AA. The reason for the downgrade was mainly the unprecedented market volatility of the period. It was a wake-up call for the financial world. At the biggest market panic in March 2020, NCZ-A lost “only 25%” and it was a stock to bounce back easier than most exchange-traded stocks:

On the 19th of March 2020, just one day after the biggest drop, NCZ-A closed at 21.95, a price higher than today and a current yield at the time of 6.26%. The 30-year treasury at the time was at 1.78% so NCZ-A was trading at a 4.48% spread. After the market crash of 2020, the financial markets were easily fixed with a genius touch by US officials who decided to be innovative and use more efficient printers in a green effort to save the planet. This, of course, affected NCZ-A and it was once again pushed back above par where only convexity limited its upside. At the beginning of 2021, Fitch was already working on a new methodology of credit ratings for CEF-preferred stocks. It even decided that even though nothing specific happened to NCZ, the credit rating had to be downgraded to “A” which had no effect on the pricing of NCZ-A. At the end of 2021, NCZ-A had to be valued based on its yield to call and the possible redemption. BBB- financial preferreds were financing at yields close to 4% at the time and NCZ-A seemed like a certain redemption. Then all of a sudden at the beginning of 2022, the world realized that even the most efficient printers are not changing basic economic principles, and unfortunately, Elon Musk was not ready with a plan to save the world from inflation. Yields all over the yield curve skyrocketed, and NCZ-A attracted a never-ending seller:

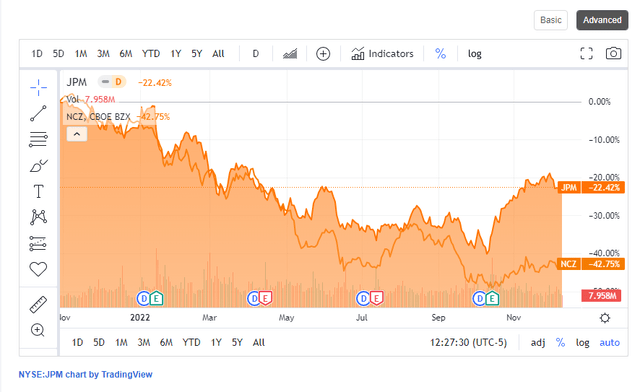

Price Chart 2 (Tradingview.com)

At the time of writing this article, NCZ-A has a current yield of 6.37% with the 30-year treasury at 3.57% or a spread of 2.8%. Based on the life story of NCZ-A, one can find it reasonable for this preferred stock to widen its spread to treasuries and it is very hard to judge what a certain spread should be. And as the saying goes, “everything is perceived in comparison.”

Comparison of NCZ-A with financial preferred stocks.

Before doing the comparison and without looking at credit ratings, it is very important to understand the large advantage of any CEF preferred stock vs any “real business” preferred stock. First of all, a CEF is not a company that hires 1000 people to create some product to sell to the public. It is a simple leveraged portfolio. Imagine your portfolio with a regulation T margin, this is a CEF. For example, “Interactive Brokers” gives way higher leverage to individual investors compared to the 1940 act leverage that CEFs are allowed to use. A CEF is way more simple compared to a bank and the only real risk a CEF preferred stock is facing is a sudden > 50% drop in the value of its assets. Even in this disastrous scenario, a CEF-preferred stock is way safer than a bank-preferred stock(The CEF will still have some liquidation value while the bank is most likely bankrupt on a 50% market shock event). There is no usual covenant that requires a bank to redeem its preferred stock based on some leverage criteria while a CEF is obligated to maintain its leverage ratio.

NCZ-A vs JPM-D

JPM-D was issued at 5.75% 13 days after NCZ-A( which makes it the perfect comparison) at 5.75% and a spread to a 30-year treasury yield of 2.62%. JPM-D was BBB credit rating at Fitch. At the moment JPM-D is rated BBB+ by Fitch and is trading at a 5.88% Current yield. Since the IPO of the 2 securities, their yield spread has widened from (-)0.25% to 0.5% in favor of JPM-D. Interest rate risk is equal for the two preferred stocks. For some reason, the market has decided that whatever is happening in 2022 it brings more risk to NCZ-A in comparison to JPM-D (JPM-D is used as an example and representative of a bank preferred stock). In fact, if one is to look only at charts to judge a company, he has every right to believe Mr. Market:

Virtus Convertible & Income Fund II (NYSE:NCZ) has lost 43%, while JPMorgan Chase & Co. (JPM) is down only 22% for the last year. If you compare 2 regular companies, this can be a reason to explain a widening credit spread between the 2. NCZ is not a regular company and NCZ-A’s credibility has nothing to do with how NCZ is performing. NCZ-A’s credibility depends mostly on the regulatory leverage, liquidity of assets of NCZ, and the willingness of NCZ management to obey the law. NCZ has been terrible in managing its leverage this year, and they had to delay and suspend their common stock distribution a few times (what a shame):

SeekingAlpha.com

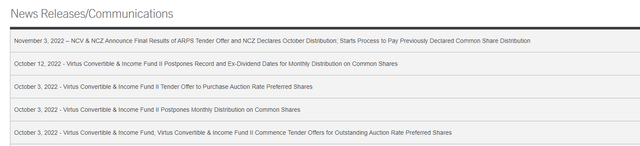

But even this cannot hurt the credibility of NCZ-A, because at the end of the day management must cure its balance sheet. And they did:

NCZ Press Releases (NCZ Website)

No money can be transferred to shareholders unless NCZ keeps its leverage lower than 50% of its assets. When NCZ triggers this level they have to cure it. In this situation, they are to either issue more common stock or sell assets but they have to keep up with the regulatory limit. This time they decided to lower their leverage ratio from 50% down to 42% by redeeming their auction rate preferred stocks and issuing some short-term debt.

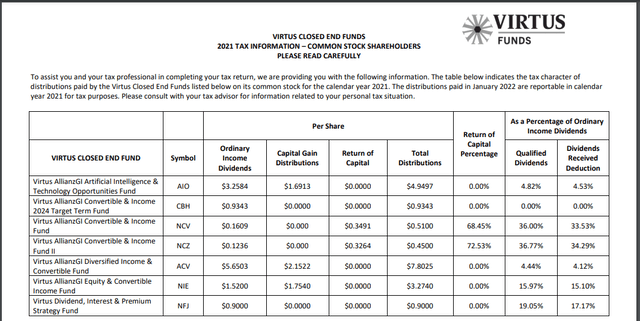

The funny thing is that if their assets continue to deteriorate, they will have to do the same thing again and again, to a point where running the CEF may do very little sense and they end up redeeming the preferred stock. There is absolutely no reason for the spread between JPM-D and NCZ-A to widen based on credibility issues. Even though NCZ management has been terrible in 2022 and the stock has lost a lot of value, this has nothing to do with the credibility of NCZ-A. The only advantage a bank-preferred stock has to NCZ-A is the fact that a bank-preferred stock dividend is fully qualified while NCZ-A’s dividend is only partially qualified. I have been a holder of NCZ-A in my long-term investment account, and last I checked around 37% of the distribution is qualified:

This might be a game changer for some U.S. investors, but taxation of NCZ-A has not changed since the IPO to justify such a spread widening compared to Bank preferreds.

Statistical comparison

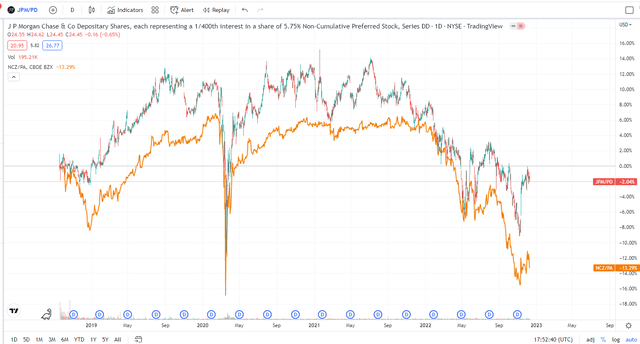

NCZ-A vs JPM-D (Tradingview.com)

The market has always loved JPM-D way more than NCZ-A, but the recent deviation is something extreme in the relation of the 2 stocks. I have always failed to understand why JPM-D has always been the overvalued one, and the only explanation was that with the market making high after high and with the endless printing of money, credit spreads were supposed to narrow. But I have never expected that the spread will widen in the current direction once the market starts to worry about credit risk. In fact, the JPM-D spread has narrowed while the NCZ-A spread has widened. This is very hard to justify knowing the simplicity of the NCZ structure.

Why does a 0.75% spread widening matter?

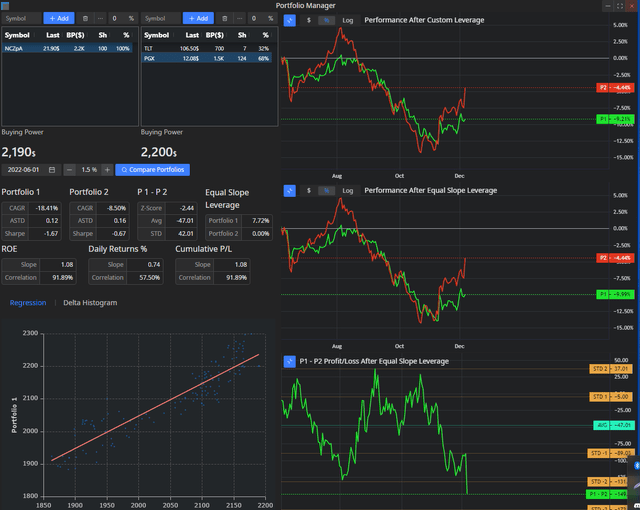

The answer is pretty simple here. A return to IPO spreads means that NCZ-A has to trade around $24.50. This is an enormous 14% capital appreciation potential for an A-rated CEF preferred stock that has very limited credit risk and is lagging a sharp rally in TLT and related preferred stocks:

NCZ-A lagging TLT and PGX lately (Proprietary Software)

The statistical potential, of course, is lower than the 14% stated above, but as a long-term fixed-income investor one should really take a closer look at alternatives

Fair Value of NCZ-A

I would say that in no way NCZ-A is supposed to trade lower than JPM-D. On a relative basis, I would say that NCZ-A has at least a 10% capital appreciation potential compared to the average investment-grade preferred stock (qualified or not). My personal price target is for NCZ-A to trade at around $24, all else being equal.

Conclusion

NCZ-A seems to suffer based on the ugly chart of NCZ and the mess NCZ management has done by not being proactive in keeping up with the regulatory leverage limit. At the time of writing, the problem is gone and NCZ-A has no reason to trade at such a large spread to investment grade preferreds.

Be the first to comment