lakshmiprasad S

Burford Capital (NYSE:BUR) shares have fallen over 30% thus far in 2022. Shares have struggled along with the stock market in general as well as investors have likely grown impatient waiting for a resolution to the potential giant windfall from a favorable YPF decision. At today’s price, I estimate that investors are paying only for Burford’s existing case portfolio and getting significant positive optionality for free.

Overview

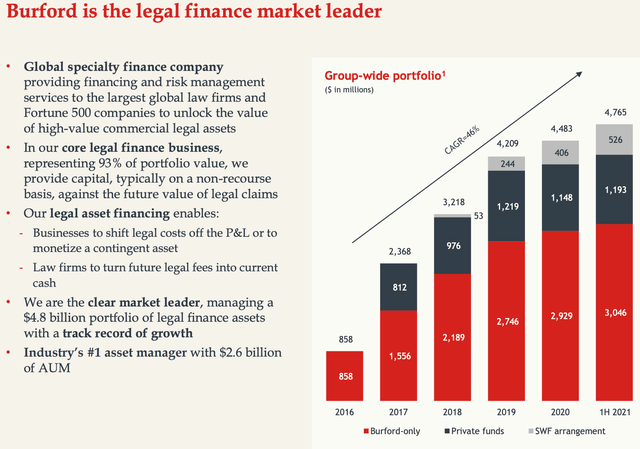

Burford Overview (Burford 2021 Investor Day Presentation)

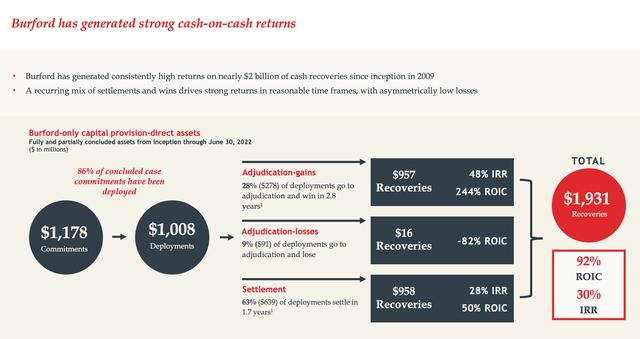

Burford Capital is the leading global provider of litigation finance to corporations and law firms. Simplistically, Burford advances its clients the cost of litigation in return for a share of successful settlements (60% of cases settle out of court) or legal judgments. As shown below, historically the company has been very successful, generating 30% IRRs on concluded cases.

Burford Historical Returns (Burford 1H22 Investor Presentation)

Burford has several key competitive advantages which allow it to generate such attractive returns, including:

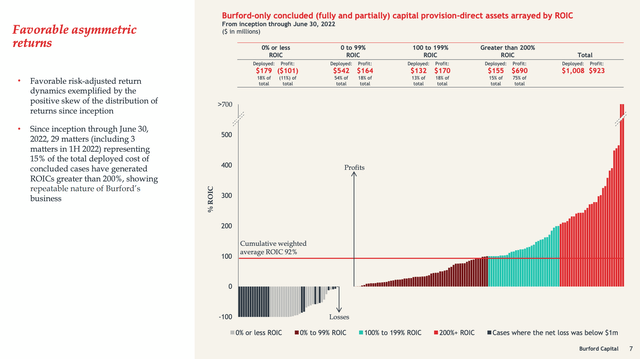

– Large data set of concluded cases- importantly this includes cases settled via legal judgment and settlements. While competitors may be able to dig through historical case documents and compile a database of judicial awards, most cases are settled out of court and the vast majority of settlements are confidential. Burford is able to use its extensive data of case settlements to make informed decisions when allocating capital to new cases. This allows Burford to pick winners and avoid losers (see below):

Burford Asymmetry of Concluded Cases (Burford 1H22 Investor Presentation)

– As the leading global provider of litigation finance, Burford is well known and well regarded in the industry. Because of the confidential nature of corporate legal matters, corporations do not auction or shop extensively for the most favorable split (allocation of proceeds upon settlement). Burford’s leading market position and the fundamental nature of legal finance limit competition.

– As the industry leader, Burford has scale advantages relative to other litigation finance firms – because it sees the most ‘case flow’ and is the leading provider of finance to corporations/law firms, Burford is able to spread its fixed costs across a larger number of cases. Similarly, Burford is able to invest more in IT tools to improve and streamline its workflow.

Valuation

Burford Capital can be thought of as three distinct parts:

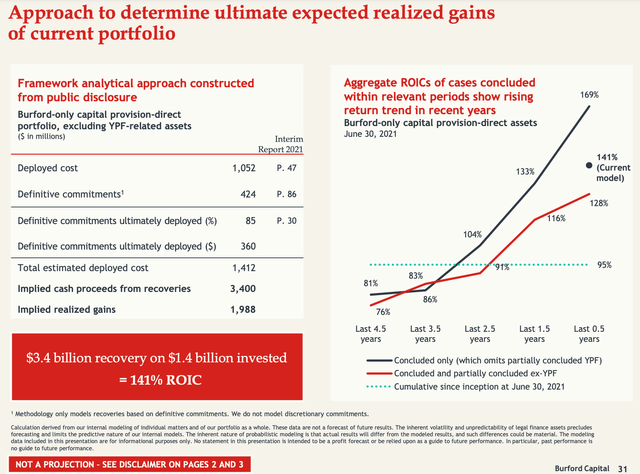

1) Existing portfolio of cases (ex YPF). This valuation effectively assumes that Burford is put into run-off meaning it stops investing in new cases and merely looks to resolve its existing case portfolio. By definition this is a very conservative way to evaluate the company given its competitive advantages and successful track record.

Burford has invested over $1 billion to secure an interest in a global portfolio of litigation. There is a wide variance in the amount of time it takes to resolve a given case. Some cases are resolved in mere months whereas others can drag on for up to a decade. In addition to case assets held on Burford’s balance sheet, it also has a partner program whereby it allows outside investors to participate in a fund that invests in litigation portfolios for which it earns incentive fees (akin to a private equity fund focused on litigation). There is an expected value to the incentive fees expected to be earned.

Existing Portfolio Framework (Burford 2021 Investor Day Presentation)

From here, I estimate the net value of the cash flow to investors by deducting net debt, operating expenses (assuming a 5-year weighted average case-life), and taxes due:

|

Receipts |

3400 |

Owned Portfolio |

|

Receipts |

350 |

Fees earned from management business |

|

Opex |

-550 |

5 years |

|

Interest Expense |

-200 |

|

|

Taxes |

-172.5 |

|

|

Total Net Debt |

-1000 |

includes $360 million funding requirement |

|

So Return to Equity |

1827.5 |

|

|

shares o/s |

220 |

|

|

Per Share |

8.3 |

|

|

Current Price |

7.2 |

|

|

Upside without YPF |

15.4% |

As you can see, at today’s price, Burford appears to trade at a slight discount to the valuation of its existing portfolio of cases. The key assumption embedded here is that Burford’s current case portfolio resolves in a manner roughly consistent with its historical experience.

2) YPF – YPF is an Argentinian oil & gas company which was nationalized in 2012. Burford’s case represents the interests of two minority shareholders (Peterson & Eton Park) which were effectively deprived of their property in the nationalization of the NYSE listed YPF.

Burford’s involvement in YPF dates back to 2014 when it secured an interest in the litigation for an investment of less than $50 million. Following favorable case milestones in 2017, Burford increased the carrying value of its interest in the YPF case. The logic for increasing the valuation of Burford’s interest in YPF is because Burford sold a portion of its interest in the YPF case to investors for over $200 million. At this stage, Burford is effectively ‘playing with house money’ as it has already earned greater than a 4-fold return by selling a portion of potential YPF proceeds.

While the YPF case has dragged on longer than most would have expected (exacerbated by COVID delays), Burford remains optimistic that it will reap an outsized reward for its patience. I am not a lawyer/legal expert, but the numbers sought on behalf of Burford’s clients in the YPF case are staggering. Should YPF resolve in a favorable manner Burford shareholders could be entitled to something on the order of $1-$5 billion which works out to a pre-tax value of $5-$22 per share. Should Burford receive such a windfall, I imagine shareholders might receive a sizable special dividend. This Seeking Alpha article from earlier this year provides more color and outlines the potential value of YPF.

What is the probability Burford wins? I have no idea. However, Burford’s track record in other matters has been excellent (only losing money in 20% of cases since inception).

3) Growth opportunity – the valuation of Burford’s existing portfolio shown above does not give Burford any credit for being a going concern. It assumes that Burford is effectively put into run-off. This is an unrealistic assumption given that Buford is a highly successful enterprise with numerous competitive advantages which has earned high returns on capital deployed. Realistically, Burford should be valued at a multiple of 1.5-2.0x (meaning the value of growth is $4-$8 per share) its run-off value as the company likely has decades of high-return growth opportunities ahead of it.

Putting it all together we end up with the following range of values:

|

Bear (existing portfolio only) |

Base – Low End of YPF outcome; some value for growth |

Moonshot – Big YPF Win; Market believes in Growth |

|

|

Existing Portfolio |

8 |

8 |

8 |

|

YPF |

0 |

5 |

20 |

|

Growth |

0 |

4 |

8 |

|

Total |

8 |

17 |

36 |

This is an exceptionally wide range of values. At today’s share price, I estimate that investors are only paying for Burford’s existing portfolio of cases and getting free upside optionality on the value of growth and a moonshot payout on its YPF claim.

Risks

1) Burford loses YPF case and stock sells off – though Burford shares will likely fall if it loses the YPF case, as I’ve attempted to illustrate above, I believe that Burford’s portfolio (ex-YPF) supports the current share price.

2) Burford does not achieve similar performance to historical results in its existing portfolio of cases. In such a scenario, Burford’s run-off value would be lower than I’ve estimated.

Be the first to comment