Kwarkot/iStock via Getty Images

This article was coproduced with Williams Equity Research (“WER”).

As many of my readers know, I have been writing on the Seeking Alpha platform for over 12 years. During that time, I have helped to educate tens of thousands of readers on the subject of REIT investing.

Perhaps my passion for real estate investing is directly correlated to my experience as a real estate developer for over twenty years, as well as my DNA (my grandfather was a motel tycoon in Myrtle Beach, SC).

Today, I wanted to get back to the basics and provide readers with a blueprint on REIT investing, something that I enjoy doing as I teach regularly at NYU, Penn State, Cornell, and other colleges and universities (coming soon: Clemson University).

Before getting started, I would like to credit one of my mentors, Ralph Block, who was the author of “Investing in REITs.” I was fortunate enough to read Mr. Block’s books, and after he passed away I decided to write The Intelligent REIT Investor Guide, which tributes Mr. Block.

I’m honored to be the most-followed writer on Seeking Alpha, and I’m inspired to see your comments each and every day.

Remember folks, the most durable education is self-education. Knowledge is power, and I hope this article empowers you to become an intelligent REIT investor.

Real Estate Investment Trusts (“REITs”)

REITs are many things, but they all start as a tax structure. They are companies that own, operate, and or finance real estate assets.

That used to be primarily office buildings, but now it incorporates Amazon (AMZN) warehouses, cellular towers supporting AT&T (T) telecommunications, self-storage properties all around the U.S., and shopping centers all around the world.

Companies elect to be treated as REITs for tax purposes, and voluntarily restricting the range of business activities they can engage in, because they are exempt from corporate taxation as long as they follow the rules. This is similar to Business Development Companies (“BDCs”) and Master Limited Partnerships (“MLPs”), which we’ll cover in upcoming publications in this series.

There is no free lunch, and for REITs it’s that they must distribute at least 90% of their taxable income to investors annually to maintain REIT status. Note the word taxable in that statement.

We’ll get into the specifics of dividend taxation in a different discussion, but to continue the targeted introduction to REITs, the industry is divided into equity and mortgage REITs. In part because the industry is always evolving, there is not a perfect definition to distinguish the two.

Equity REITs own and often operate commercial real estate but may legally acquire pipelines and other assets if it fits within the tax rules.

Does that profile look like a REIT to you?

If no, I don’t blame you.

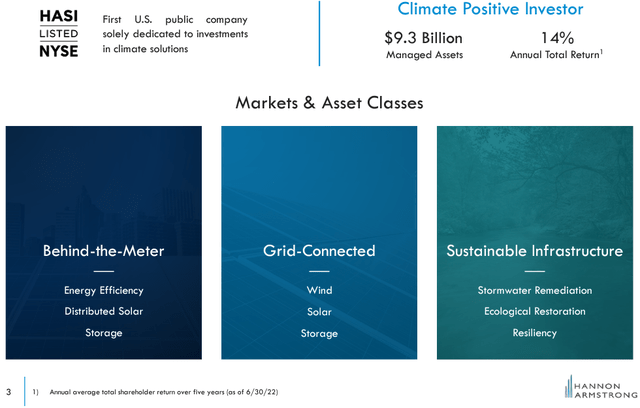

That’s art of what makes REITs interesting and attractive – just about any hard asset can earn the REIT badge if management is willing to abide by the rules. In this case, that company is Hannon Armstrong Sustainable Infrastructure Capital Inc (HASI).

HASI manages $9.3 billion in assets related to energy sustainability and renewable power. This includes solar farms, onshore wind, stormwater remediation facilities, and technology that improves energy efficiency. As any good engineer will tell you, it’s easier to save power than generate it.

HASI is a REIT, and despite a lot of headwinds and tailwinds since early 2020, it remains one of our better-performing investments long term. Most REITs aren’t as unique as HASI, but that doesn’t mean they are any less attractive depending on what you seek as an investor.

Whether it’s high current income, strong dividend growth, preservation of principal, or an inflation hedge, REITs can play a critical role. In some cases, one REIT can do several of those.

While equity REITs represent the equity in an asset, mortgage REITs provide financing. The underlying assets are the same, but what ends up on the REIT’s balance sheet is very different.

Many investment-grade equity REITs can engage with banks or sell debt to investors, but in many cases real estate investors need the help of an mREIT. That’s particularly the case when the collateral is non-traditional like a transitional (e.g., renovating a building) or bridge loan.

mREITs often enjoy significantly higher current yields than equity REITs but have slower growing or static dividends. This makes sense as mREITs primarily own loans that don’t have much upside potential.

Three of our top mREITs, Starwood Property Trust (STWD), Blackstone Mortgage Trust (BXMT), and Arbor Realty Trust (ABR), all currently yield between 8.4% and 10.6% as of September 19, 2022. Before you say that’s too good to be true, all three held the line on their dividend during the pandemic and never missed a payment.

Their portfolios are well-suited to fight inflation, too. They own primarily floating rate loans, so as interest rates rise, so does their income (all things equal).

In aggregate, stock-exchange listed REITs own over $2 trillion in assets. Every member of the team allocates a portion of their own savings in this asset class for the same reason endowments and sovereign wealth funds consistently invest 7-10% of their permanent capital base into public and private REITs.

Private REITs are illiquid and fall under a less transparent regulatory structure than listed REITs. There are plusses to private REITs, however, as indicated by the over $1 trillion in capital invested in the segment.

Williams Equity Research studied these REITs professionally as a due diligence officer for many years, and our trusted colleague Christopher Volk knows them extremely well, too. He authored a great piece on public versus private REITs recently right here for subscribers.

While listed REITs’ values ebb and flow with the cash flow multiple applied by financial markets, private REITs are valued strictly on the value of their real estate assets (and cash /derivatives positions).

Public REITs, therefore, are more volatile by nature, but that isn’t as negative as it sounds. Skilled REIT investors can capitalize on the volatility by acquiring companies at highly attractive valuations during periods of distress or great uncertainty. As any of our analysts will tell you, they love the opportunities volatility brings.

Widemoat Research’s expertise is unique as we’ve spent approximately equal time evaluating private real estate opportunities, usually multi-billion dollar portfolios managed by the likes of Warburg Pincus or Brookfield (BAM), as we do listed REITs.

We also evaluate listed REIT opportunities globally rather than just in the U.S. By sheer number, most listed REITs are domiciled in Canada, the U.K., and U.S., but we assess opportunities across developed and developing markets.

(Did you see that we now cover Canadian REITs?)

Intimate knowledge of public and private real estate markets is required to fully understand either. That might seem strange until you realize they are actually one market.

If publicly traded self-storage stocks trade at a double-digit premium to book value, you can bet the farm that the private markets will be rapidly developing and aggregating self-storage properties to eventually sell to listed REITs. We’ve seen the greater supply of capital in private real estate ventures steadily buy out many publicly traded REITs.

Our keen understand and respect for both sides of the aisle allowed us position ourselves for success due to M&A. We certainly didn’t know STORE Capital (STOR) would receive a bid from Oak Street (part of Blue Owl (OWL)), but we did anticipate that one of several companies, including STOR, was likely to be acquired in the near term.

At the same time, if listed retail REITs fall tremendously out of favor with public investors, firms with substantial private capital, like Brookfield or Blackstone (BX), will enter the market to pick up bargains for their institutional funds and wait patiently, often up to 10 years, for what they believe is the perfect time to sell.

Fortunately for them, they don’t need perfection as the U.S. real estate market tends to rise in value steadily over time.

What Makes REITs Uniquely Attractive?

Individual investors, and particularly retirees, desire income. We don’t need to explain why; mortgages, kids’ college tuition, and electric bills can’t be paid with unrealized capital gains (much less losses) from a technology stock.

Because REITs are pass-through vehicles, a higher percentage of their profits are ultimately passed on to their shareholders than other types of companies. That doesn’t automatically mean they are always better investments, rather that investors receive a greater share of profits instead of being reinvested or spent on buybacks. There are just fewer surprises.

Whether lodging, cell tower, or retail focused, all REITs exchange rights to property for cash rents through lease agreements. In addition to the lack of taxation at the corporate level, REITs benefit from GAAP accounting rules in other ways.

For instance, REITs depreciate buildings over time, further reducing their tax liabilities. Unlike most businesses, REITs don’t own much except hard assets that can be depreciated. This means it often makes more sense to lease a building to a REIT than it does for the company to own it themselves. That’s a powerful tailwind for REITs that isn’t going anywhere.

It boils down to a simple equation:

Cash flow heavy business + preferential tax treatment + requirement to pass most cash flow to shareholders = above average yield for investors

There are two other historical benefits to owning real estate that many investors appreciate – and the first is appreciation. The increase in real estate’s value over time has outpaced inflation by 1.5-3.0% annually depending on the asset class. That’s the polar opposite of many other income categories like corporate and government bonds, which decline in value as interest rates rise, all other things equal.

Due to higher energy and raw material costs over time, which most of us are keenly aware of in today’s environment, mean replacement costs are higher too. This makes property values more durable than many other types of investments.

The second historical benefit is related to the first: inflation hedge. Depending on the time horizon, either the S&P 500 (think diversified equities) or real estate has been the best performing asset class throughout inflationary periods.

Not only do the buildings (or cell towers or pipelines or data centers) naturally rise in value with inflation, but so do rents. Investors need to be diversified to avoid unpredictable challenges (e.g. rent forgiveness for tenants in multifamily in certain cities), and some lease structures are more adaptable to others. We recommend a basket of all types, and investors can tilt their REIT exposures toward safety, dividend growth, or a higher current yield as they see fit.

REIT Sectors

It’s easy to get lost in the sheer number of publicly traded REITs. There are now well over 200 to choose from and it’s no easy task to determine which are best, but breaking them down by sector is a great start.

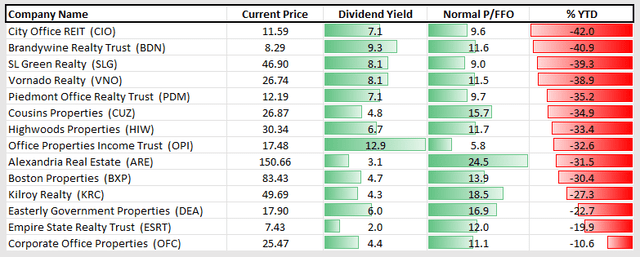

Office properties located in the downtown of large cities are often the first building people think of when they hear “commercial real estate.” Office REITs own and usually manage the buildings ranging from small strip center-like complexes to some of the largest skyscrapers in the world. The keys here are location and tenant quality. The leases are longer term, perhaps 10 years, and rent is usually indexed to inflation or a schedule of small annual increases like 2-3%.

In today’s environment, many high quality office REITs, like Vornado (VNO) and SL Green Realty (SLG), trade at unusually low earnings multiples. While their yields are among the highest we’ve ever seen with these names, investors need to use caution as the office market isn’t what it used to be. We still think there is great value here for those that are selective and are comfortable with the risks.

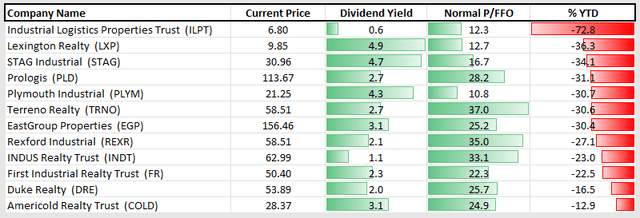

Industrial REITs concentrate on warehouses and distribution centers. A location well outside of a major city with easy access to a large highway isn’t ideal for a high-end retail establishment but could be perfect for an industrial REIT looking to rent a massive warehouse to a furniture chain. E-commerce and other tailwinds have made the once boring industrial real estate sector red hot. The same key factors apply to industrial REITs as office REITs but what is considered a good location or building setup (e.g., logistics-oriented technology) are very different.

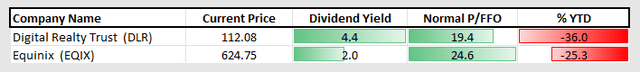

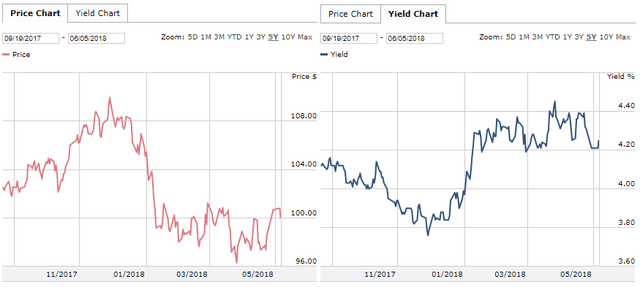

This remains a favorite for REIT investors of all types. Amazon is still king, but investors need to use a little more caution here as well. Cap rates, or the yield on each dollar invested, are still low and can be extra sensitive to changes in interest rates. There are good deals in the market today, which wasn’t the case in much of 2021. STAG Industrial (STAG), for example, now trades at a 14.2x funds from operations (“FFO”) multiple versus over 20x less than a year ago. FFO is a good proxy for cash flow for REITs.

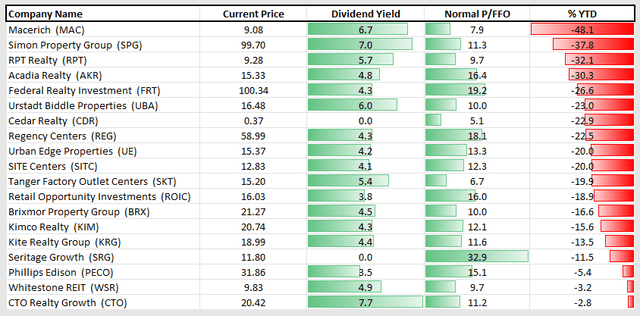

Retail REITs likely own the building that many of your favorite clothing retailers, fast food restaurants, and home improvement stores reside in. This is among the most diverse segments in commercial real estate and includes very low risk (e.g., a long-term triple-net lease to The Home Depot, Inc. (HD)) and high risk (e.g., an unoccupied shopping center in a declining part of the country) opportunities. Retail REITs arguably require the most skill and knowledge to navigate in the current environment as every situation is unique.

A couple of our favorite investment grade rated retail REITs are currently on sale. Simon Property Group (SPG) is the obvious standout, and currently trades with a mere 8.6x FFO multiple, but attractive 7.0% dividend yield.

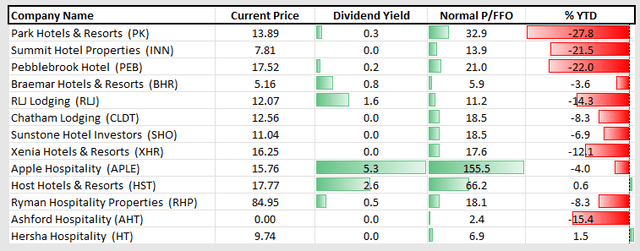

Lodging REITs typically own hotels, resorts, and other properties with “one day leases” to individuals rather than companies. This segment is highly cyclical and sensitive to business and consumer travel, both of which are discretionary at the end of the day as illuminated by the coronavirus crisis.

Understanding the supply and demand of buildings, including projects under development, is critical for all types of REITs but especially so for lodging. The value of the brand behind the hotel or resort cannot be ignored and is closely tied to the durability of their business in tough times.

We are cautious on this subsector as many players never got their house fully in order after suffering through the pandemic. Investors must do their homework on lodging REITs, and that’s especially the case with a recession on the horizon and many balance sheets still bleeding from 2020.

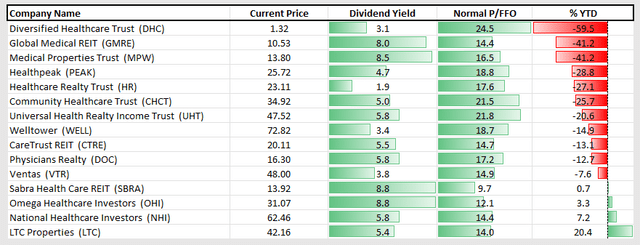

Health care REITs own everything from senior living facilities to hospitals. These REITs must be extremely well versed in the regulatory environment and the nuances of Medicaid and Medicare. While private-pay facilities are common, change could occur at any time and we must plan for the unexpected.

Health care REITs deal with an array of providers and tenants causing an unusually wide dispersion in rent coverage and other “safety” ratios. We prefer medical office building (“MOB”) REITs all other things equal, but value in skilled nursing and other areas has warranted investment as sub-categories of health care REITs fall out of favor.

Like lodging, this sector has had it rough since 2020. There are a few great deals within healthcare in our view, including Medical Properties Trust (MPW). Healthcare is a broad category, and a nuanced understanding of a healthcare REIT’s balance sheet, tenant quality, dependency on private versus public funds, and regulatory environment are all critical.

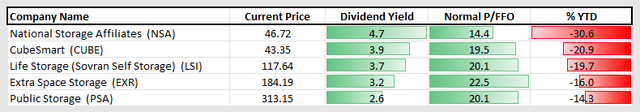

Self-storage REITs are among the strongest performers of any category of commercial real estate in the past 20 years. You can’t go into any major city in the U.S. or Canada without seeing a Public Storage (PSA), Extra Space (EXR), or CubeSmart (CUBE) property. In fact, odds are you’ll see at least two of those names many times in a 10-minute drive around town.

Operator efficiency and building optimization are two of the chief concerns for this property type. Some facilities offer heated or cooled facilities with the ability to rent a unit without ever communicating with a human. The ability to size and configure a building to maximize profit in a given market is what separates a top tier REIT like Public Storage from the small, local competitors they win business from.

Self-storage was a darling sector coming out of 2020’s market collapse. Public Storage, for example, one of the highest REITs with an A- credit rating, rose from approximately $160 per share at 2020’s lows to over $400 by early 2022.

That compares with a pre-pandemic high around $250. Thanks to recent volatility, PSA now trades closer to $300 and has a sub-20x FFO price tag. There aren’t any screaming deals in self-storage, but they are excellent vehicles to fight inflation and preserve capital in just about any environment.

Data center REITs are a new and very popular category. Several of our highest conviction picks in the crisis, such as CyrusOne, were acquired in recent quarters. This has made for slim pickings, but fortunately the largest remaining publicly traded survivor is a great company: Digital Realty Trust (DLR).

These REITs separate themselves by offering the most attractive services and economics related to customers safely storing data in their properties. The physical security and environmental elements (e.g., air-cooled chillers to keep the servers working at optimal and safe levels) are more complicated than they might seem, and the boom in internet utilization globally is a great tailwind for data center REITs.

DLR went from over $175 per share in Q4 2021 to below $115 today. We believe it’s a great value at only 16.5x forward FFO estimates. The 4.4% dividend yield is also attractive given the company’s growth trajectory.

Infrastructure REITs include Cell tower and energy-related REITs. Cell tower consistently earn the highest allocations in actively managed REIT portfolios. Their complete immunity from lockdowns and the “retail apocalypse” is bolstered by accelerating demand for cell tower capacity for 5G and other applications.

This category has dominated the broader equity markets year after year but their current cash flow multiples are higher than REIT averages. Infrastructure REITs don’t necessarily follow many of the rules associated with traditional real estate asset classes so specialized industry knowledge is a prerequisite.

Like their cell tower cousins, it hasn’t been easy to get a great deal on cell tower REITs in recent years. American Tower (AMT) is the largest and best known and has a market capitalization of over $110 billion. It’s not a terrific bargain today around $250 per share, but we are avid buyers closer to $225. It has bounced off that level, which coincides with 17-18x forward FFO estimates, several times in the past 12 months.

Other types of REITs include farmland, billboard, and diversified (multiple types in one REIT, like W. P. Carey (WPC)). Each sub-type has its own supply and demand characteristics and other considerations.

International REITs fall into one of the above categories but deserve a special mention. Canada and the U.K. have many listed REITs and have the potential to add geographic and currency diversification to a portfolio. Additional geopolitical and economic risks due to the invasion of Ukraine are especially relevant for European markets and should be paid attention to.

Tax laws have a big impact on investors’ real returns and should be taken into account. A solid understanding of international REITs is a great way to take advantage of dislocations in other markets, such as London currently, and improve portfolio diversification.

Wide Moat has comprehensive coverage and recommendations on every single category of public REITs – even billboards and farmland. Now that we have a good grasp on the types and definitions, we’ll share a thought experiment that will likely be interesting to even the most sophisticated REIT investor.

An Underappreciated Arbitrage

One of Wide Moat’s core philosophies, and likely competitive advantages, is our “complete capital structure” approach. Even if interested strictly in a firm’s common stock, we invest considerable time and energy evaluating their fixed income and preferred issuances. Not only that, we perform the same lengthy exercise on several peers to ensure we have as comprehensive understanding as possible.

A lease obligation is just another layer in a company’s list of liabilities like bond interest and employee compensation. Without turning this into a legal dissertation, serious REIT investors are wise to familiarize themselves with the basics of commercial leases, particularly when the tenant defaults on the lease obligations (that or leave it up to professionals like us).

Though it varies slightly by state, commercial leases are largely governed by Section 365 of the Bankruptcy code. In the event of tenant bankruptcy, the worst-case scenario for the landlord, the tenant must, at minimum, pay past-due rent and is liable for any costs borne by the landlord to acquire a new tenant. There are caps involved but the landlord is in the driver’s seat.

What if a tenant isn’t facing bankruptcy and just decides they won’t want to pay rent?

The lease liability isn’t going anywhere. In the case of most leases made by the likes of quality REITs like W. P. Carey or STAG Industrial, the underwriting of the lease agreement includes a corporate guarantee or similarly valuable collateral.

Sticking with STAG, its largest tenant per for many years has been Amazon, with five leases generating 3.1% of its total annualized average base rental income (“ABR”) as of the last reporting period. That’s up from three leases and 1.9% of ABR as of the end of 2019. The exact details of STAG’s leases with Amazon aren’t disclosed in the 10-Q or quarterly supplemental, but there is sufficient market data to estimate accurately.

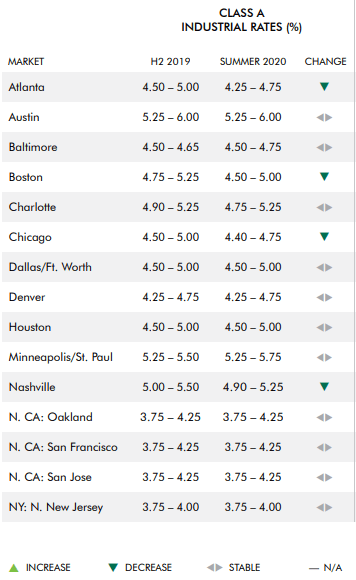

CBRE Q3 Market Survey

Despite plenty of headwinds, U.S. industrial market demand remained extremely strong in Q2 of 2022. Rents were at record highs and new development was limited. This results in record low vacancy of just 2.9%.

Record breaking new construction should ease supply issues in the medium term, but as of now, asking rents of $9.40 per sq. ft. set yet another record for this sector.

If a property costs $10 million and generates $500,000 in NOI, that’s a 5.0% cap rate. It’s safe to assume Amazon’s leases are on the lower end of the above ranges due to its strong credit rating and financial resources. Update this section too?

This is a good point to mention that there are nearly a dozen ways to measure a REIT’s cash flow, including Funds from operations (“FFO”), Adjusted FFO, Modified FFO, Core Earnings, and Funds Available for Distribution (“FAD”). We carefully evaluate each REIT’s business model and accounting practices to determine which measure is best. You’ll notice thus far we’ve mentioned FFO as it’s the most common and easiest to find.

All-in and including responsible leverage, we could reasonably expect to generate a 6-7% annualized return on an industrial building leased to Amazon.

Let’s take a quick detour to compare this risk and return profile to another option.

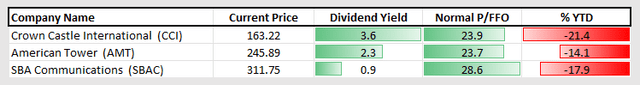

The two charts above relate to Amazon’s AA S&P Rated 4.250% bonds maturing in 8/22/2057 or in roughly 35 years. This real-time data puts the last trade at $99.98 for an effective yield of 4.251%. Without turning this into a legal dissertation, REIT investors are wise to familiarize themselves with the basics of commercial leases, particularly when the tenant defaults on the lease obligations.

Though it varies slightly by state, commercial leases are largely governed by Section 365 of the Bankruptcy code. In the event of tenant bankruptcy, the worst-case scenario for the landlord, the tenant must, at minimum, pay past-due rent and is liable for any costs borne by the landlord to acquire a new tenant. There are caps involved but the landlord is in the driver’s seat.

I know what you are thinking. What do Amazon’s bonds maturing in 2057 have to do with a REIT article? More than you think.

A 10-year industrial lease on a Class A building to Amazon pays the REIT a 6-7% cash yield as outlined previously. Backed by a corporate guarantee and outside of facing major litigation and reputation risk, Amazon cannot escape this lease term unless it becomes insolvent and is forced to.

Even then, as we already laid out, the landlord still has considerable power to cover missed rent payments. The normal lease also puts most ongoing costs associated with owning the building back to Amazon. Like the bond, it’s certainly possible that the building’s value will fluctuate over time, but the cash flows are similarly rock solid.

So this begs the question: Why on earth would you own a 35-year Amazon bond with a yield of 4.251% when you could sign a 10-year lease to Amazon on an industrial property generating a 6-7% yield with a similar corporate guarantee?

And don’t forget, STAG’s lease has rent bumps included – and the bonds don’t.

While there is no single answer, it’s related to the supply and demand for certain types of assets. There are hundreds of trillions of dollars looking for the best deal in fixed income and those managers don’t have the ability, nor the incentive, to switch to a triple-net commercial real estate lease to improve their risk-adjusted returns. In addition, regulations force many financial institutions to maintain high levels of bonds to satisfy compliance requirements.

As investors, it is ultimately our responsibility to ensure our investments are optimized.

REITs Versus Other Tax-sheltered Alternatives

The other most common companies with preferential tax treatment are Master Limited Partnerships (“MLPs”) and Business Development Companies (“BDCs”). Now that you know the fundamentals of REITs, their plusses and minuses compared to these alternatives are more meaningful. Like everything valued by man, the relative strengths and attractiveness of these three options shifts over time.

BDCs primarily make loans to, and to a lesser extent equity investments in, private U.S. companies. BDCs tend to specialize in the size of the companies they engage with ranging from the lower middle market, generally consisting of companies that earn $5 million to $50 million in revenue annually, to the upper middle market, where Uber (UBER) and other large private companies were prior to their initial public offering.

Due to the regulatory market and other variables, these loans tend to be high yield and in the range of 4% to 12.5% above LIBOR (now SOFR), a floating rate benchmark used by banks internationally. Like REITs, BDCs must pass through most of their taxable income, and coupled with the floating interest rates charged on their loans, means very high and somewhat inflation-protected yields for investors.

Top quality BDCs have the most investor friendly fee structures and stable loan portfolios but still yield nearly 10% in today’s environment. Like REITs, they can be internally or externally managed.

MLPs are like REITs but focus strictly on energy infrastructure and storage. Publicly traded MLPs own vast networks of thousands of miles of natural gas and crude oil pipelines. They also own and operate storage and processing facilities forming a nearly impenetrable competitive position.

Like a rent charges a tenant monthly rent on an office building, MLPs obtain tariffs and fees from customers using their pipelines and storage facilities. Their regulatory risk and tenant base are much different than both BDCs and REITs.

Both quality BDCs and MLPs have proven their staying power once again by navigating the pandemic with no dividend cuts, and in a few cases, dividend increases.

Final Takeaways

Used properly, REITs are a powerful tool to achieve attractive levels of income relative to the risk to an investor’s principal. REITs benefit from several structural advantages related to the U.S. tax code and GAAP accounting standards.

There is a reason that Essex Property Trust (ESS), Federal Realty Trust (FRT), W. P. Carey and Realty Income (O) are all included in the short list of Dividend Aristocrats, companies in the S&P 500 that have increased their dividends annually for at least 25 years: well-managed REITs can deliver consistent and growing dividends to investors over time.

Be the first to comment