kali9/iStock via Getty Images

Lately, I have been drawn to the footwear and apparel market because of some attractive value opportunities that I have been spotting in that space. Unfortunately, this is not to say that every opportunity will represent a strong prospect for value-oriented investors who are focused on the long haul. One prospect that I found that seems to be mediocre compared to some of the other players is Wolverine World Wide (NYSE:WWW). Although shares of the company are priced at levels that might be considered fairly valued compared to similar firms, and they don’t look unreasonably priced on an absolute basis, the historical financial performance of the enterprise has been rather volatile. Even this year, we have seen some mixed results that suggest to me that the enterprise deserves to trade at a discount relative to its peers. All things considered, that discount is not there, leading me to take a more neutral stance on the business. At the end of the day, this has led me to rate the enterprise a ‘hold’, reflecting my belief that the company will generate returns that more or less match the broader market for the foreseeable future.

Trying Wolverine on for size

According to the management team at Wolverine, the company operates as a leading designer, marketer, and licensor of a vast portfolio of quality casual footwear and apparel, performance outdoor and athletic footwear and apparel, kids’ footwear, industrial work boots and apparel, and uniform shoes and boots. At present, the company truly could be considered a global player in the footwear space, with its products marketed in roughly 170 countries and territories across the globe. Although it is true that the company is a global player, it is important to note that 65.2% of its revenue does come from the US market. The next largest exposure is the EMEA (Europe, Middle East, and Africa) regions at 19.1%. The Asia Pacific region is responsible for 6.7% of revenue, while Canada makes up 4.8%. That leaves the remaining 4.2% of revenue to come from Latin America.

To best understand the enterprise, we should dig into the two key segments that the company has. The first of these is referred to as the Wolverine Michigan Group. This unit consists of footwear and apparel brands such as Merrell, Cat, Wolverine, Chaco, Hush Puppies, Bates, Harley-Davidson, and Hytest. During the company’s 2021 fiscal year, this segment was responsible for 53.8% of the firm’s revenue and 60% of its profits. Meanwhile, the Wolverine Boston Group consists of footwear and apparel under the Sperry, Saucony, Keds, and other related brands. In addition, it includes some licensed business, as well as kids’ offerings for some of the brands that would otherwise be included under the Wolverine Michigan Group segment. Last year, this unit was responsible for 38.8% of the company’s revenue and for 36.5% of its profits. The company also does have its ‘Other’ unit, which consists of the company’s Sweaty Betty activewear business, its leather marketing operations, sourcing operations that include third-party Commission revenues and multi-branded consumer direct retail stores, and more. This unit accounted for just 7.5% of revenue and for 3.5% of profits last year.

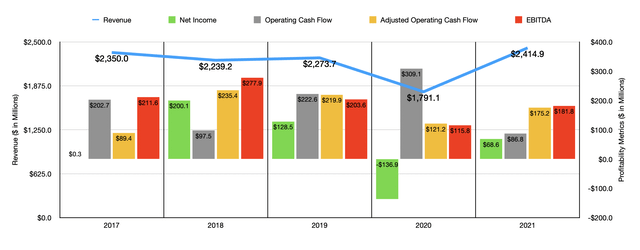

Over the past few years, the financial trajectory seen by Wolverine has not been particularly great. Revenue, for starters, has not really shown any clear trend. For instance, sales went from $2.35 billion in 2017 to $2.24 billion in 2018. In 2019, sales came in slightly higher at $2.27 billion before plummeting understandably during the pandemic to $1.79 billion. In 2021, sales hit a high of $2.41 billion. On the bottom line, we have seen similar volatility for the company. Net income has shown no real trend, shooting up from just $0.3 million in 2017 to $200.1 million in 2018. By 2020, the company had turned to generating a net loss of $136.9 million. But last year, the firm did see something of a recovery, with net profits hitting $68.6 million. Of course, there are other measures of profitability. But as you can see in the chart above, none of these really followed much of a trend either. Even if you ignore the 2020 fiscal year because of the pandemic, you would still see the absence of a trend and, by definition, instability.

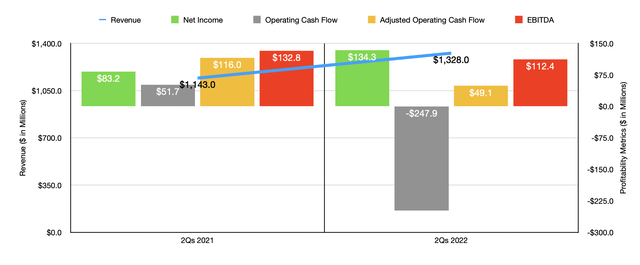

When it comes to the 2022 fiscal year, we have seen this same volatility impact the company. Revenue in the first half of the year came in at $1.33 billion. This 16.3% increase over the $1.14 billion was driven by a combination of factors. For instance, the Wolverine Michigan Group saw revenue climb by 10.3%, due in large part to a $22.7 million rise from the Merrell brand name and increases from the Chaco and Wolverine brand names of $14.6 million and $14.5 million, respectively. Growth under the Wolverine Boston Group where is much more limited at 1.6%, with foreign currency impacting the company’s top line tremendously during the quarter. A big portion of the increase in revenue, however, involved the company’s acquisition of Sweaty Betty, with $100.9 million of the company’s sales increase coming from that.

Although it’s nice to see revenue continue to improve, profitability has been very mixed. Net income rose from $83.2 million in the first half of the 2021 fiscal year to $134.3 million the same time this year. On the other hand, operating cash flow went from $51.7 million to negative $247.9 million. If we adjust for changes in working capital, it still would have fallen, dropping from $116 million to $49.1 million. Finally, EBITDA for the company also worsened, declining from $132.8 million to $112.4 million.

For the 2022 fiscal year as a whole, management expects revenue to climb by between 14% and 16%, ultimately told line between $2.74 billion and $2.79 billion. This increase will be driven in part by the aforementioned acquisition of Sweaty Betty and will come even as foreign currency fluctuations should negatively affect the company’s revenue to the tune of $72 million. Earnings per share should be between $2.62 and $2.72. On an adjusted basis, this should be between $2.10 and $2.20. Using the midpoint guidance for the adjusted earnings, we get net income of $172 million. No guidance was given when it came to other profitability metrics. But if we were to annualize those using data from the first half of the year, we would get adjusted operating cash flow of $74.2 million and EBITDA of $153.9 million.

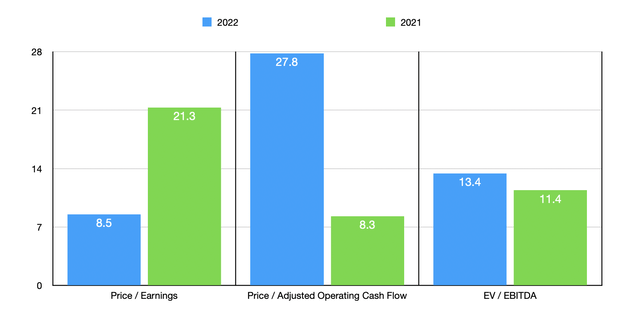

Using these figures, we can see that the company is trading at a forward price-to-earnings multiple of 8.5. The forward price to adjusted operating cash flow multiple should be 27.8, while the EV to EBITDA multiple should come in around 13.4. Two of the three metrics look to be more expensive than if we used data from the 2021 fiscal year. But because of the uncertainty in the space, I do think that using the data from 2021 is more appropriate. Using this, I was able to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 9.2 to a high of 24.5. In this case, four of the five were cheaper than Wolverine. Using the price to operating cash flow approach, the range was between 9.7 and 34.1. In this scenario, our prospect was the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was between 8.1 and 15.4, with three of the five companies being cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Wolverine World Wide | 21.3 | 8.3 | 11.4 |

| Steven Madden (SHOO) | 12.1 | 9.7 | 8.1 |

| Rocky Brands (RCKY) | 14.4 | 15.7 | 11.7 |

| Crocs (CROX) | 11.3 | 14.4 | 11.2 |

| Skechers U.S.A. (SKX) | 9.2 | 32.1 | 8.8 |

| Deckers Outdoor Corporation (DECK) | 24.5 | 34.1 | 15.4 |

Takeaway

The data we have today suggests to me that while Wolverine may be cheap on an absolute basis, shares are more or less fairly valued compared to similar firms. On top of that, the company is experiencing mixed financial results as it often has, which adds to the uncertainty of the picture. Putting all of these factors together, we end up with a picture that does not look all that optimistic, but it also does not look awful either. Because of this, I do believe that a ‘hold’ rating is most appropriate for the enterprise at this time.

Be the first to comment