Michael M. Santiago/Getty Images News

Thesis

The global economy is struggling and investment banking activity is one of the hardest hit activities within the financial services industry. Notably, JPMorgan (JPM) has recently warned that fees for investment banking may fall by 50% year over year. But while other banks are still reflecting on how to respond – and arguably hoping that things do not turn out as bad as hoped – Goldman Sachs (NYSE:GS) is moving first and fast. Although GS’s Q2 was not too bad; already in July, Goldman Sachs communicated a significant number of job cuts.

Goldman Sachs is not the most popular bank, but arguably the best managed. Responding to the dire global economic outlook, GS management is proactively taking decisions. And accordingly, trust the bank’s ability to navigate any temporary headwinds. As long as GS stock is trading below 1x P/B, I am confident recommending the bank as a ‘Buy’.

For reference, GS stock has performed in line with the broad market YTD, both the S&P 500 (SPX) and Goldman Sachs stock are down by approximately 23%.

Managing The Downturn

Daniel Pinto, a leading executive of the world’s largest investment bank JPMorgan, has warned that investment banking fees for Q3 are expected to be down approximately 50% year over year. This is a continuation of a trend that has already materialized in Q2, when JPMorgan reported a 61% fall in investment banking fees and Morgan Stanley reported a 55% fall respectively. With investment banking revenues contraction of only 41%, Goldman Sachs has outperformed competitors, but the drawdown is nevertheless notable.

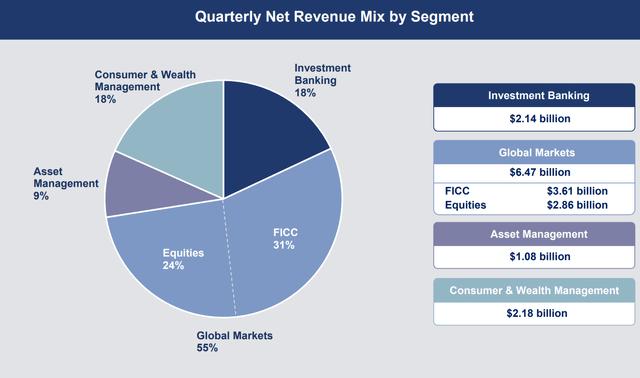

Investors should consider, however, that in the past decade investment banking has been consistently less than one quarter of GS’s total revenue exposure (18% in Q2 2022). The lion’s share of topline and profitability comes from global markets activities such as securities trading. And given volatile markets, trading has been very strong in 2022. For the June quarter, Goldman’s fixed income trading revenue was up by about 55% versus the same period one year prior. Trading revenue for equities increased by approximately 11%.

Thus, overall GS managed to deliver strong Q2 results and could even afford to increase quarterly dividends by 25% to $2.5/share. CEO David Solomon commented (emphasis added):

We delivered solid results in the second quarter as clients turned to us for our expertise and execution in these challenging markets. Despite increased volatility and uncertainty, I remain confident in our ability to navigate the environment, dynamically manage our resources and drive long-term, accretive returns for shareholders.

Notably, despite the relatively strong results, Goldman Sachs was the first bank to announce job cuts and lay-offs of underperforming staff. This decision is certainly not easy, but necessary in light of the challenging macroeconomic backdrop. Given how fast and consequently, GS has started to adapt to the challenging economy, I am confident to trust GS management’s ability to navigate these turbulent times.

Q3 Preview

Goldman Sachs is expected to report earnings for the September quarter on October 15, four days after JPMorgan is scheduled to announce results. Notably, analyst consensus expects that GS will generate $11.55 billion of revenues and $8.02 of EPS. This compares to $11.86 billion of revenues in Q2 and $7.73 of EPS respectively.

In my opinion, expectations are reasonable and there should be no major surprise to the upside or downside. Investors should consider that although investment banking revenues will continue to lag materially versus the 2021 performance, Goldman will likely report strong trading results. Markets have been volatile throughout Q3 and trading volume across asset classes has been very strong in late August.

Very Attractive Valuation

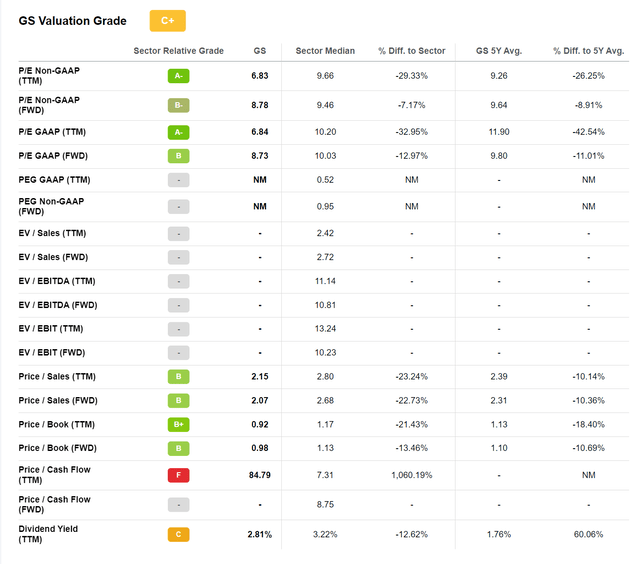

Goldman Sachs stock is trading cheaply. Trading at one-year forward P/E ratio of less than x9, the bank is valued at a 13% discount to the sector median. Goldman Sachs P/B of x0.9 is priced at a 13% discount respectively.

Now, if an investor assumes that Goldman Sachs is one of the best managed and most competitive banks – which I do, a discount to the sector median is not justified.

In my opinion, even assuming a recession, Goldman Sachs stock should trade at minimum 1x P/B and/or in line with the sector median.

Risks

Like all financial institutions, Goldman Sachs’s business profitability is strongly correlated to the health of the global economy. Consequently, investors should monitor macroeconomic developments, including the ongoing global geopolitical tension.

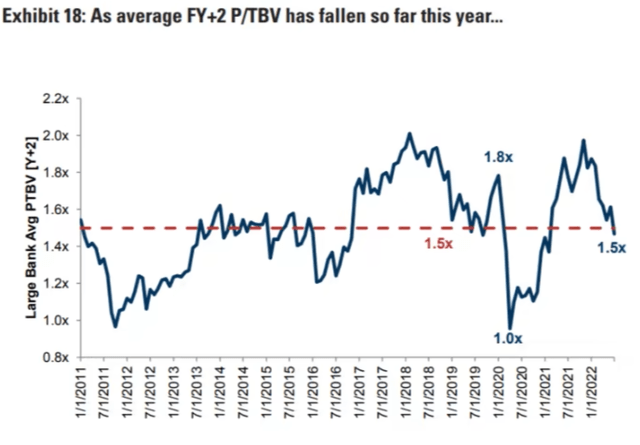

In any case, a lot of negativity has been priced into GS’s valuation already. Notably, for the past 10 years, a valuation of 1x P/B has been a strong buying signal for investors.

Finally, GS’s 13.3% CET1 ratio should protect the firm relatively well from any shock to the bank’s balance sheet.

Conclusion

There are two major reasons why I recommend investing in Goldman Sachs. First, GS’s strong exposure to securities trading should protect the bank’s profitability relatively well from any slowdown in investment banking activity. Secondly, GS was the first major bank to proactively respond to the slowing economy with job cuts. While cutting jobs in a drawdown is never a popular decision, from an investor’s perspective it is laudable. The decision also communicates that Goldman Sachs management is prepared and capable to act fast, when circumstances indicate to do so (Remember the Archegos Capital collapse, when Goldman Sachs was leading the fire-sale in order to protect the bank’s capital).

Be the first to comment