Gearstd

Year to date, iShares Expanded Tech-Software Sector ETF (BATS:IGV) suffered more losses than S&P 500 and NASDAQ index as software stocks were hit harder by rising rates, slowing economic growth, and lofty valuations. IGV has lost around 32% of its value so far in 2022 and is currently trading slightly above the mid-June levels. Despite the recent price drop, it’s not the right time to buy IGV due to bleak fundamentals. The market has already started experiencing the real impact of economic slowdown and high rates, with expectations that these headwinds will intensify in the next 3 to 9 months.

Interest Rate and the Recession

NASDAQ is already in a bear market and is currently trading slightly above its mid-June lows. In the first half of the year, the index fell into a bear market due to concerns over rising inflation, robust interest rate growth, and economic instability. However, those concerns became a reality in the second half as inflation and interest rates started to negatively impact corporate earnings and GDP growth quarter over quarter.

Bridgewater Associates founder Ray Dalio predicts that the Federal Reserve could almost double rates from the current level to around 4.5%, and the stock market will drop another 20% if that happens. He further added that it is highly likely the Fed will tighten monetary policy for the foreseeable future and it will take time for authorities to make a significant economic contraction to tame inflation. In the next year, he predicts high chances of a recession in the US economy.

Dalio’s prediction looks worth considering due to the bleak outlook and historical trends. The Federal Reserve Bank of Philadelphia expects annual GDP growth to be around 1.6% for 2022, which means that economic contraction will continue into the second half of the year. This also represents a significant contraction from GDP growth of 6% in 2021. The most concerning aspect is that several forecasts predict GDP growth for 2023 to stand in the range of 0.3% to 1%. Moreover, Fitch expects the US to enter recession by mid-2023 while prospects for global recession are also growing due to a slowdown in the US, Chinese and European economies.

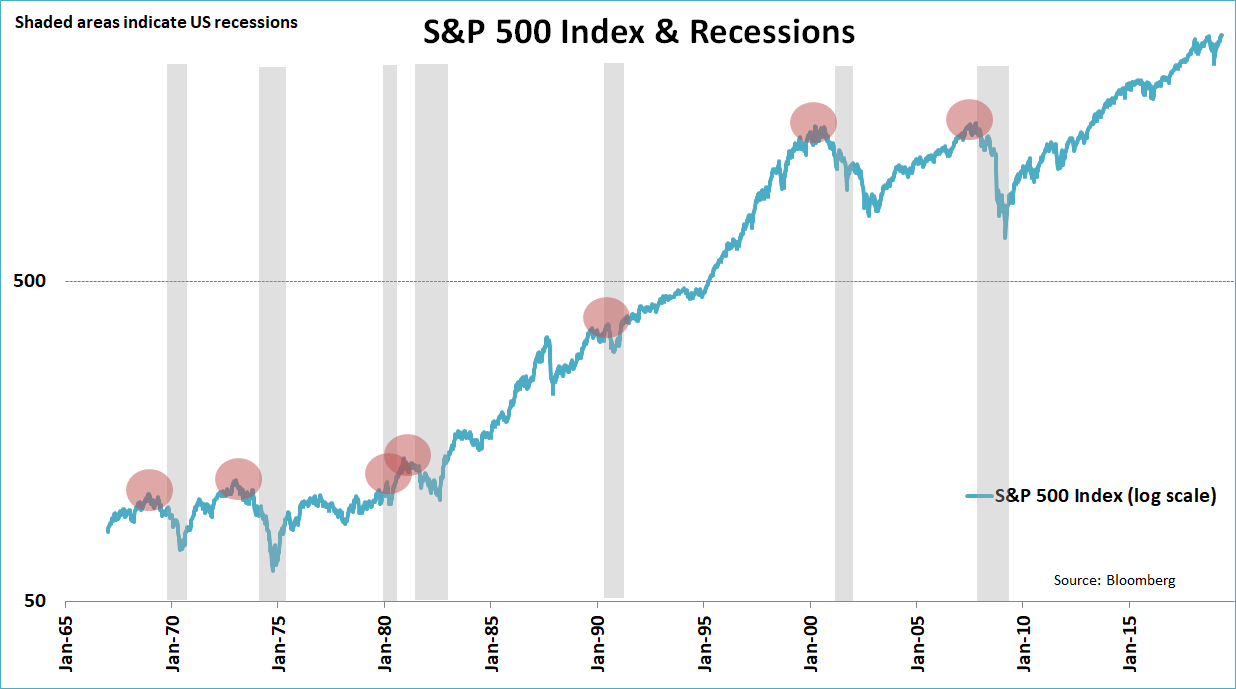

Bloomberg (Stock Performance in Recession))

The historical data also suggests that Dalio might be right about stock price movements. During each of the last 10 recessions, US stocks fell by an average of 29%. So far in 2022, the S&P 500 is down around 19%, and it needs to fall another 10% to reach the average level. On the other hand, high beta software-focused ETFs may experience higher volatility than the rest of the market if interest rate increase and the economy fall into a recession. As a result, software stocks may find it difficult to ride the economic uncertainty and higher rates in the near future.

Earnings Cut Is Another Risk

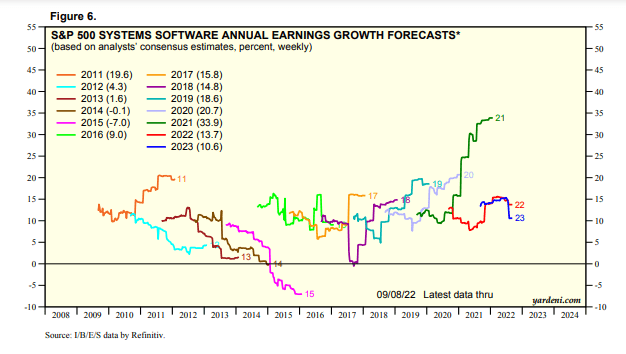

Yardeni.com (Earnings Forecast)

Economic uncertainty and high rates are directly impacting the growth trends of the software industry. Clearly, enterprise demand is softening, and estimates are declining rapidly. It is expected that software earnings could grow by 13.7% in 2022, a significant drop from around growth of 34% in the last year and 20% during the pandemic. In addition, the forecast shows that earnings are likely to decelerate in the next year from 2022. The future seems much bleaker if we look at the overall trend of the information technology sector. According to FactSet data, earnings of the information technology sector are expected to decline by a negative 4.1% rather than previous expectations for growth of over 5%. Moreover, Seeking Alpha quant data shows that 6 of IGV’s top 10 stock holdings received poor grades on earnings revisions. Oracle Corporation’s (ORCL) annual earnings estimates were dropped by 23 analysts in the past 90 days, while only one analyst looks upbeat. Additionally, 21 analysts lowered ServiceNow’s (NOW) earnings estimate and 32 analysts revised Microsoft’s (MSFT) outlook.

Valuations

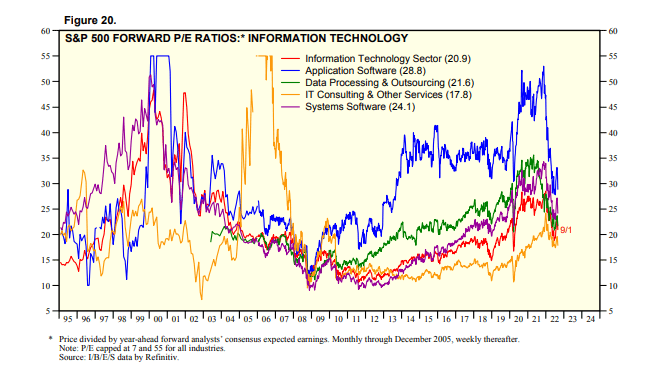

Yardeni.com (Forward PE Ratio)

The forward price-to-earnings ratio of software stocks has eased in the last two quarters and is now hovering close to its five and ten-year averages. Despite that, valuations limit stock upside amid declining earnings expectations. Any rally in stocks without earnings growth seems unsustainable because it could make stocks expensive based on the price-to-earnings ratio. The trend was also observed during the last bear market in mid-June through mid-August. After the price surge in mid-June, the price-to-earnings ratio of tech-heavy NASDAQ has jumped back to late 2021 levels of 28.6 from mid-June lows of 20x. As a result of lower earnings, economic headwinds, and increased volatility, I don’t think investors would pay a premium on tech and software stocks.

Quant Rating

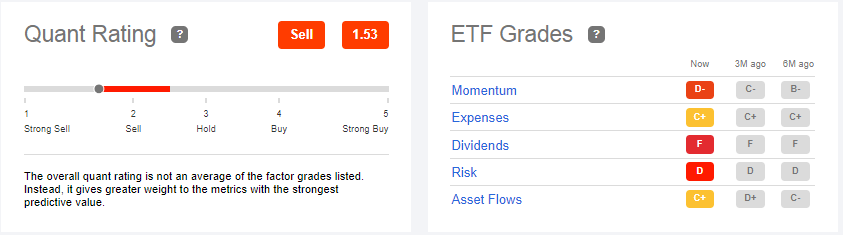

Seeking Alpha (Quant Rating)

IGV earned a sell rating from Seeking Alpha with a quant score of 1.53 out of 5. The ETF received a negative D grade on momentum, suggesting that technical factors are supporting the downward movement. D grade on risk factor also indicates challenging times are ahead. The ETF is vulnerable to various types of risks including economic uncertainty and high rates. A low asset flow grade also reflects a lack of investors’ confidence in the ETF.

In Conclusion

The fundamental principle of investing is to buy low and sell high. However, to avoid losses and maximize gains, it’s important to pick the right entry point. With a steep drop in valuations for software stocks, IGV looks attractive, but there is also the possibility of more volatility ahead due to the looming recession and high-interest rates. Therefore, the idea of buying IGV ETF ahead of potential broader market volatility doesn’t seem prudent.

Be the first to comment