nastazia/iStock via Getty Images

Times are changing. The generalized market uptrend we experienced during the last years has given its place into increased uncertainty and market volatility. Whether it is geopolitical or economic uncertainty (or a combination of these two), investors need to be very wary of their investment picks. In my articles here in SA, I usually recommend two kinds of investment stock types: the first is fat dividend stocks which, at least in the foreseeable future, have the ability to provide investors with a nice dividend cushion against market risk. Obviously, Build-A-Bear Workshop, Inc. (NYSE:BBW) belongs to the second category. Let’s see its traits.

Strong cash position

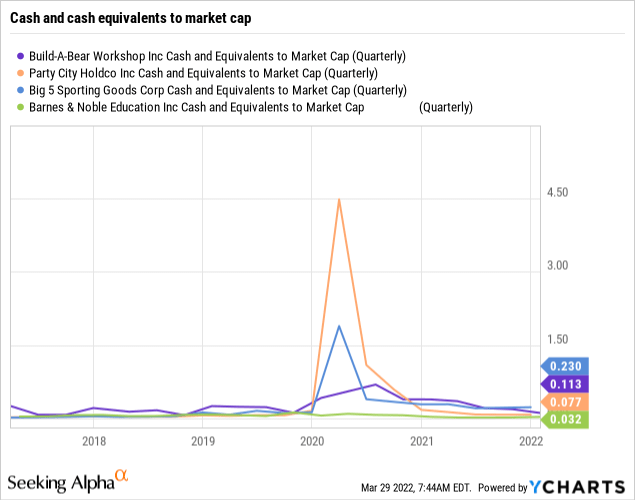

In January 2022, the company had a total cash and cash equivalents figure of $32.8 million, after repurchasing common stock of $4.4 million and providing a special dividend of $20 million to its shareholders. Currently, the company has additionally spent a total of $5 million in stock repurchases, with another $20 million left on its plan. To put these numbers into perspective, let me say that we’re talking about a company with a market cap of less than $300 million.

This leads us to a cash and cash equivalents to market cap ratio of 0.11 (or 11%), which is above the cutoff level of 10% to consider a company as financially stable. In the graph presented above, I tried to create a comp group for Build-A-Bear. As we can see the company’s ratio is only worse than that of Big 5 Sporting Goods, as the other two peers have significantly worse ratios.

Strong revenue growth and solid fundamentals

During the last year, the company saw its revenues increasing by 61%, as compared to 2020, reaching $411 million. Although this figure may be distorted from the special nature of the year 2020, when the pandemic broke out, still, the 2019-2020 increase in revenues exceeded 21%. These figures place the company in the upper part of its peer group.

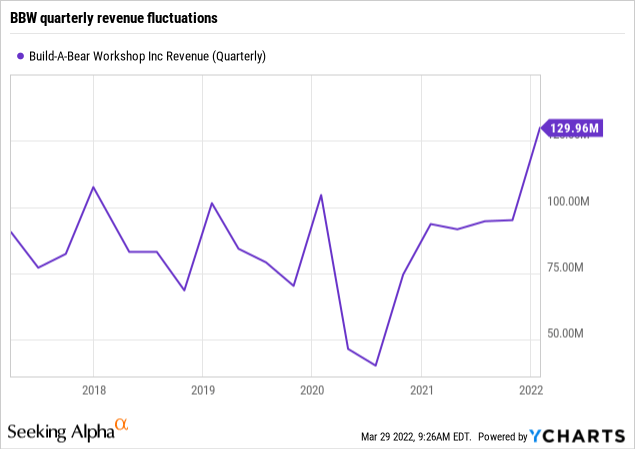

For this year, the company expects Q1 revenues to beat Q1 2021 revenues of $89 million. Note, however, that the first quarter is usually the weakest one. This is shown in the graph presented below. We can see that at the end of each year, revenues spike, just to fall in the subsequent quarters. If Q1 2022 is expected to be a record-breaker, then one could assume that things will get even better as we move forward in 2022.

Management didn’t provide full-year revenue guidance. Some may not be feeling quite comfortable with this. However, in the management’s defense, projections aren’t easy in this volatile market. Personally, I would like to see some wide range of a revenue estimate for this year.

The company finished 2021 with earnings per share of $2.93, in which the fourth quarter of the year contributed $1.48, which is just north of 50%. This also supports my argument regarding the seasonality of the business model. To put this into perspective, let’s see how the company did in the last quarters of the previous years. For example, in 2020, the Q4 earnings per share figure reached $0.67, while in 2019 it was surprisingly even lower, at $0.42. In my opinion, there are three reasons that have contributed in this earnings increase:

- Fiscal stimulus: Household disposable income was supported by fiscal stimulus acts. This is particularly important for businesses that aren’t selling “first need” goods.

- Online generated demand: This is one of the cases where the pandemic acted for the benefit of the company, in the sense that their online-generated demand gathered an increased share in its revenues. In 2021, almost 20% of the company’s net sales were done online, a 400% change since 2012.

- Spring effect: Let’s face it: all of us had some needs suppressed during the pandemic. This created a spring effect which exploded during this year and found its expression in the increased spending, supported by the fiscal stimulus mentioned above.

The question is which of these reasons will continue to exist in 2022. Well, we do know that the fiscal stimulus is over, and how could it continue with inflation eating up households’ disposable income? Also, assuming that the spring effect is completed, then we’re left with the online-generated demand and the company’s efforts to market its product in more innovative ways. These include such goods as the automatic Teddy machines or the bear builder 3D workshop, among others.

However, there’s another line of revenue for the company that has the potential to gain a larger share of the revenue pie. Commercial revenues of the company more than doubled in 2021, in relation to 2020, reaching $11.5 million. With some back-of-the-napkin calculations, this translates to a contribution to the overall EPS of $0.08, or 2.7%. The company has over 75 licensing agreements with cinema, sports and movie brand names, which I think is very important for the increasing market penetration of the firm. In that sense, I expect licensing revenues to gain traction in the following quarters and to be the rabbit in BAB’s hat.

Valuation and conclusions

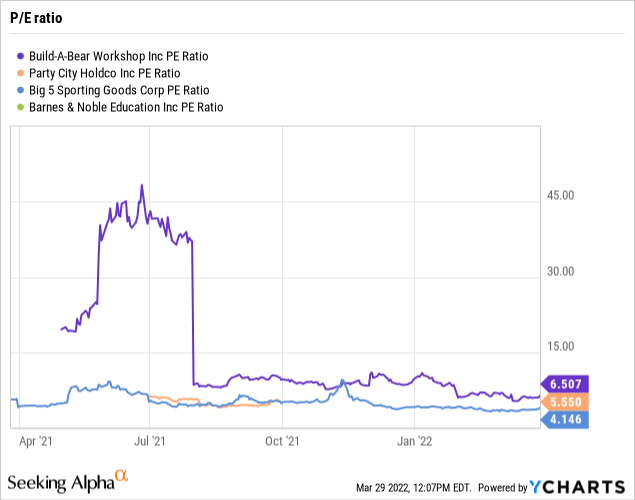

So, what should I pay for a debt-free, cash-rich company with a record growing revenue rate? If I knew the exact answer, I would be writing this article from the deck of my private yacht somewhere in the Bahamas. However, given that I’m writing this article from my modest desk, I would say that Build-A-Bear shouldn’t, by any means, trade for just 6.5 times its earnings. Full year 2022 revenues are expected to hit $452 million, which translates to an EPS figure in the ballpark of $3.2. This leads us to a forward P/E estimate of 5.9x.

On a P/E basis, Build-A-Bear Workshop may look overvalued in relation to its peers. However, the higher multiple assigned is due to its other qualitative characteristics I mentioned earlier. Moreover, the stock has an ongoing share repurchase plan, with $20 million left to go, and pays a nice 6% dividend yield.

While I’m not sure if this dividend level is sustainable, it still represents a nice cushion for shareholders. The main risk associated with this company is the overall economic outlook. In one of my previous articles I wrote that in times of stagflation, austerity measures do no good. I’m not sure if economic policymakers would agree.

In any case, it’s pretty obvious that a significant wave of economic downturn is approaching. Although I don’t think it’s going to be a systemic downturn, I believe that it has the potential to affect businesses that are not selling “first need” goods. However, with over $30 million in cash, no debt, and at an ongoing, rapid transformation towards a more digitized state, I believe that from a valuation perspective, Build-A-Bear is a long opportunity as it stands.

Be the first to comment