Vertigo3d/E+ via Getty Images

Investment Thesis

The Trade Desk, Inc. (TTD) stock has had a volatile ride over the past year. It has traded within a pretty wide consolidation range since the start of 2021. In addition, the momentum spike from its post-FQ3 earnings proved to be a potent bull trap. As a result, the stock is down more than 42% from its November highs. Furthermore, it’s also down close to 30% at writing since the start of 2022.

Nonetheless, it reported a decent F4 card and issued guidance above consensus estimates. However, we think the tepid reaction from the market suggested investors’ concerns with its valuation. TTD stock is still trading at 19.8x NTM revenue despite its steep compression. It’s also much higher than its high-growth SaaS peers that we track.

However, we think the opportunity to add exposure to TTD looks attractive. We believe that the company will continue to report robust topline growth to justify its premium valuation moving forward.

Why Has TTD Stock Dropped in 2022?

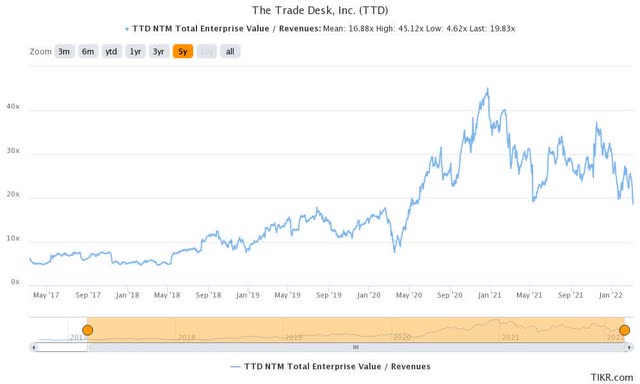

TTD stock EV/NTM Revenue trend (TIKR) TTD stock Vs. high-growth SaaS peers comps (Public Comps)

We can glean from the above charts that TTD stock has taken a significant tumble in line with the rest of its high-growth SaaS peers in 2022. Despite that, TTD stock is still trading at an NTM revenue multiple of 19.8x. It’s also markedly higher than its 5Y mean of 16.9x and above its peer median of 12x. Therefore, investors shouldn’t be surprised with the rotation out of high multiple stocks like TTD.

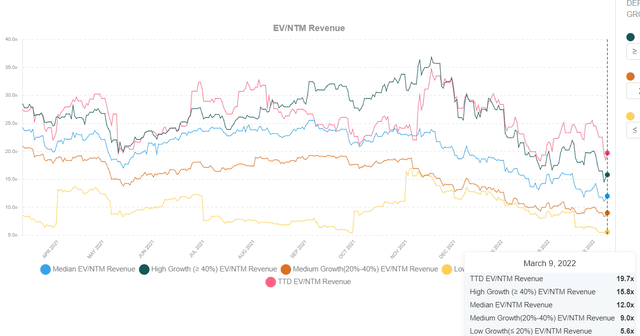

The Trade Desk revenue & YoY change % (S&P Capital IQ)

Furthermore, investors were also concerned with its relatively languid growth in FQ4, as revenue hit $396M, up 23.7% YoY. Besides the pandemic impacted FQ2’20, The Trade Desk has consistently registered above 30% growth. Therefore, even though the increase was above consensus estimates, some investors were still concerned. However, The Trade Desk assured investors with its FQ1’22 guidance, as it guided to revenue of $303M, up 38% YoY.

What Is TTD’s Stock Forecast?

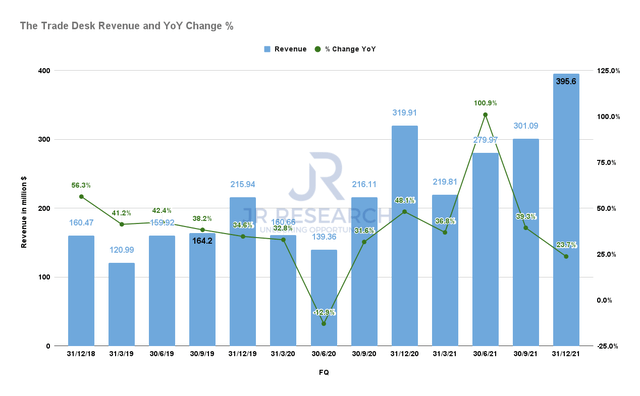

The Trade Desk financial metrics by FY (S&P Capital IQ)

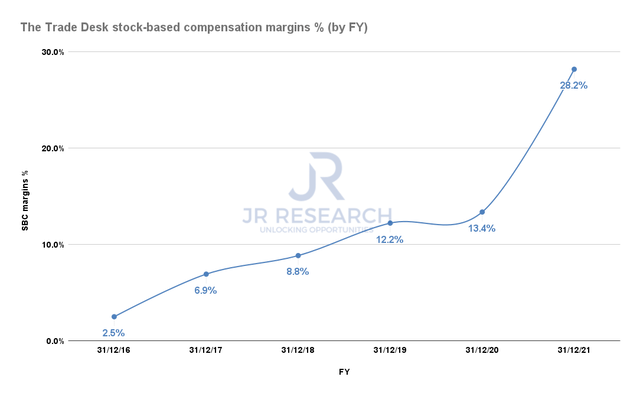

The Trade Desk stock-based compensation margins % (S&P Capital IQ)

Despite its solid topline guidance, some investors pointed out a potential red flag in The Trade Desk’s financial model. We noticed that its stock-based compensation (SBC) margins surged to 28.2% in FY21. Therefore, it has also impacted TTD’s EBIT margins over the years even as it scaled, as seen above. Its operating margins have followed a consistent declining trend, reaching 10.4% in FY21. Therefore, the operating leverage from a GAAP basis seems to have been impacted by The Trade Desk’s SBC policies. Notably, it’s related to CEO Jeff Green’s performance awards. The company also guided towards an elevated level of SBC in FY22. CFO Blake Grayson highlighted (edited):

In 2022, we anticipate our stock-based compensation to rise from our normal run rate. This is being driven by approximately $265M of stock-based compensation expense we expect to include in 2022 related to the long-term CEO performance award. At the end of 2021, the performance award had $616M in unrecognized stock-based compensation, which is expected to be included in our G&A expense over approximately 4 years but could be accelerated if the threshold criteria is met earlier than expected. (The Trade Desk’s FQ4’21 earnings call)

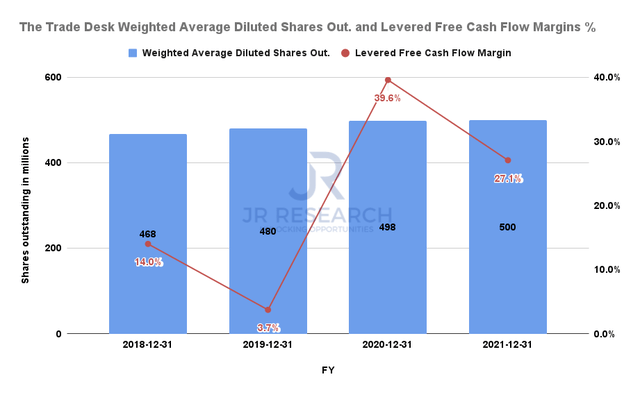

The Trade Desk shares outstanding & FCF margins % (S&P Capital IQ)

Despite that, we think The Trade Desk’s FCF margins remain robust. It reported an FCF margin of 27.1% in FY21, down from FY20’s 39.6%. Meanwhile, its weighted average shares outstanding has increased at a CAGR of just 2.2% over the last three years. Its CEO awards have undoubtedly impacted its GAAP EBIT margins. However, the company has also maintained its discipline with its stock dilution over time.

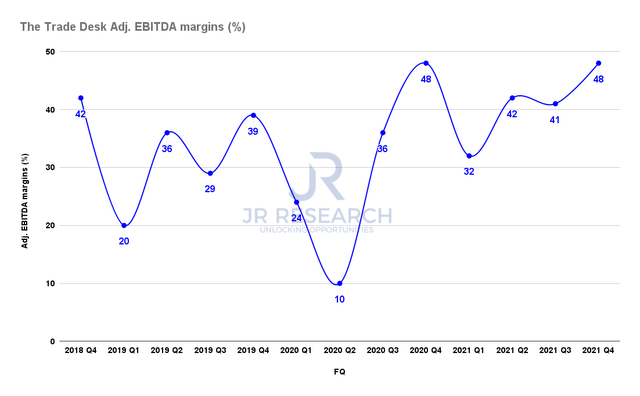

The Trade Desk adjusted EBITDA margins % (Company filings)

Furthermore, the company’s adjusted EBITDA margins remain robust, as it reported 48% in FQ4 and 42% for FY21. Therefore, we are not unduly concerned with the potential red flag we discussed earlier. The reason that such performance awards were accelerated was simply that Green had led the company remarkably well.

The company has also continued to expand rapidly in connected TV advertising. In addition, its latest endeavor through its Open Path model is to disrupt Google’s (GOOGL) (GOOG) Open Bidding. The Trade Desk has undoubtedly scaled its business model sufficiently to allow advertisers a direct pipe to the premium inventory from its participating publishers. Therefore, we are confident that TTD could gain tremendously from Open Path, given the amount it paid Google previously.

Insider reported that “The Trade Desk historically spent hundreds of millions of dollars on Open Bidding, according to a source.” Therefore, Open Path could offer massive value to publishers, and TTD could also earn itself a decent fee, which would be accretive to its topline.

Is TTD Stock A Buy, Sell, Or Hold?

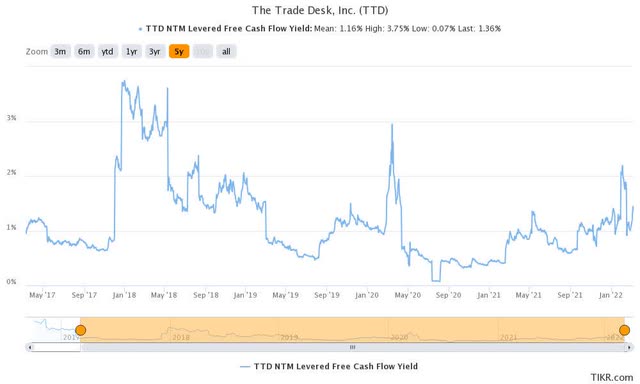

TTD stock NTM FCF yield % (TIKR)

TTD stock consensus price targets Vs. stock performance (TIKR)

Readers should understand that TTD stock is not for the faint-hearted. It’s inherently volatile and only suitable for long-term investors. In addition, despite its FCF profitability, its NTM FCF yield of 1.36% is still on the low side.

Therefore, you need to have a high conviction over its competitive moat that can help sustain its topline growth moving forward. We also believe that The Trade Desk is gaining clout as the Open Internet’s leading DSP. With Open Path, it has taken its leadership one notch higher.

Nevertheless, the average consensus price targets ((PTs)) have proved to be strong resistance levels for adding exposure over the past year. Hence, investors should avoid adding too near its average PTs.

Nevertheless, we think TTD stock has been beaten down sufficiently to consider adding. It’s also 37% below its average PT, giving the stock sufficient buffer from its resistance level.

As such, we reiterate our Buy rating on TTD stock.

Be the first to comment