Bitcoin Outlook: Neutral

- Bitcoin bullish momentum drives BTC/USD higher while Dollar strength subsides

- Ethereum posts double-digit gains – earning season and economic data provide mixed reactions

- Dogecoin skyrockets around 39% after Elon Musk completes Twitter deal

Recommended by Tammy Da Costa

Get Your Free Bitcoin Forecast

Bitcoin, Ethereum and their altcoin counterparts ripped through resistance, driving the cryptocurrency market capitalization back above $1 Trillion.

With earnings season and economic data driving both volatility and sentiment, BTC/USD pushed through $20000 while Ethereum held onto double-digit gains.

While fundamental factors continue to get priced in, Dogecoin was another altcoin that enjoyed an impressive rally this week. After Elon Musk successfully completed the highly anticipated Twitter deal, Doge rose by approximately 39% before peaking at a weekly high 0.08857.

Elon Musk Tweets: The Impact of social media on Markets

Meanwhile, after weeks of trading in a narrow range, a bullish breakout allowed BTC and ETH bulls to gain traction, prices higher.

Although USD strength and rising recession fears have been weighing on major cryptocurrency since November last year, a rejection of technical support has assisted in temporarily muting the downward move.

Recommended by Tammy Da Costa

Top Trading Lessons

While Bitcoin and Ethereum attempt to gain traction, the week ahead could pose additional threats to risk assets.

With a Fed rate decision, ISM manufacturing data and NFP (non-farm payrolls) on next week’s economic docket, any surprises by the Fed or Bank of England could provide an additional catalyst for price action.

DailyFX Economic Calendar

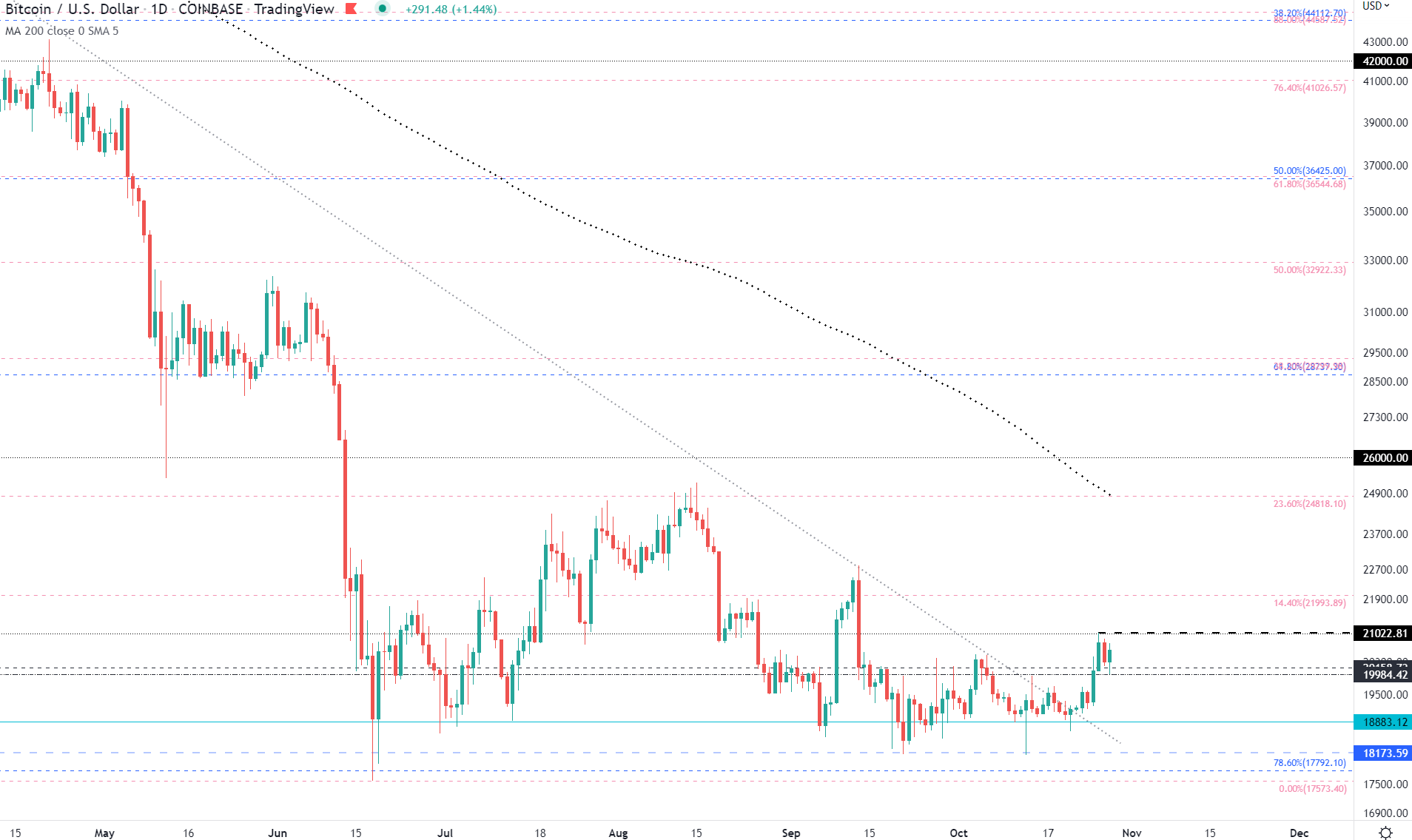

Bitcoin (BTC/USD) Daily Chart

Chart prepared byTammy Da Costausing TradingView

Bitcoin Key Levels

| Support | Resistance |

|---|---|

| S1: 19666 (Current monthly low) | R1: 21022 |

| S2: 18883 | R2: 22700 |

| S3: 17792.1 (78.6% Fib 2020 – 2021 move) | R3: 24000 |

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Be the first to comment