David Becker

A lot has happened since my last article on Alibaba (NYSE:BABA) and its closest competitor JD.com (JD). Both of the companies’ shares are not doing particularly well. But in this article, I would like to focus on Alibaba’s stock.

Chinese politics and investors’ panic

It was widely mentioned here Chinese President Xi’s third term as the country’s leader would be very bearish for the high-tech sector. Indeed, in 2021 there were some regulations and penalties imposed on large Chinese companies in an attempt to fight their monopolistic market positions. This did not just concern Alibaba. Tencent (OTCPK:TCEHY) also suffered substantially from these measures.

But investors are forgetting something important: Xi has been serving as China’s leader for 10 years already. So, it seems unlikely the Chinese authorities’ attitude towards high tech would change substantially, especially given the fact no new measures against Alibaba were taken in 2022. I would have understood this panic if a new leader with radically communist ideas had come to power and promised to nationalize all the listed companies in China.

But nothing like that is actually happening. What is more, it was mentioned the Chinese government would take the necessary measures to achieve economic growth. In order to achieve this, the Chinese authorities would probably move towards deregulation and provide support for businesses. This is obviously positive for Alibaba, one of the largest companies in China.

Alibaba’s recent earnings results

Alibaba reports its annual earnings results on 31 March each year.

We can say the 2022 earnings were, in some respects, better than they had been for 2021.

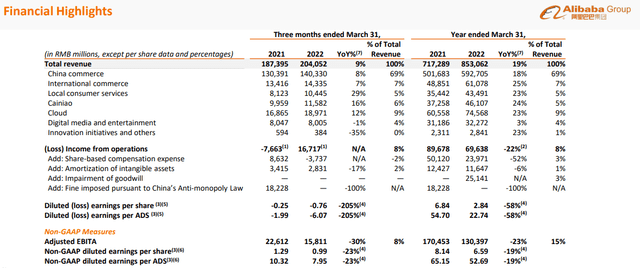

Alibaba’s earnings presentation

Source: Alibaba’s earnings presentation, slide 7

Although the net earnings were somewhat lower in 2022, the sales revenues figures increased between the two periods. Most of the revenue gains were not much due to Chinese and international commerce but due to the other revenue sources.

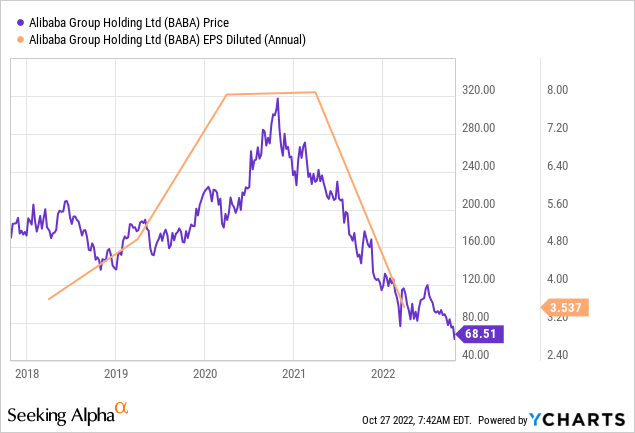

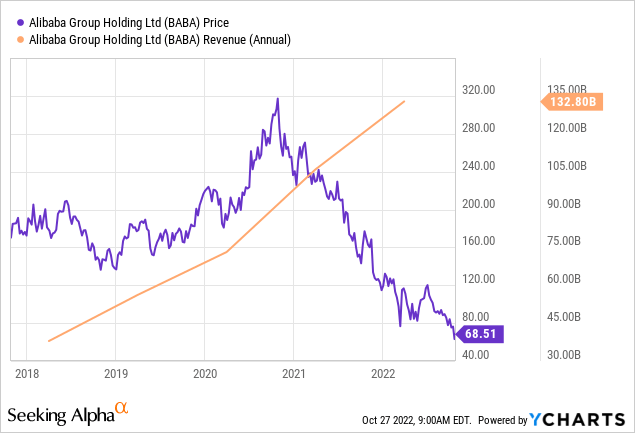

I uploaded two Y-Charts diagrams. The first one shows Alibaba’s diluted annual earnings-per-share (EPS) history and the second one shows its revenue track record over the period of five years.

We can see that BABA’s net earnings peaked in 2020. After that, they started declining. And so did the company’s stock price. In fact, it took the company’s earnings two years to halve. Its stock price, meanwhile, got more than 4 times cheaper over the period. In my view, this suggests the stock’s undervaluation. Just based on the diluted EPS, the company’s stock should cost around $140 per share and not about $70 as of the time of writing.

Surprisingly, Alibaba’s sales revenues have been rising at a very solid pace over the same time period.

The company’s management is highly ambitious when it comes to growth initiatives. There were several reasons why Alibaba’s revenues keep rising, whilst its net profits keep falling.

I took this information from Alibaba’s 2022 full-year earnings press release. The company’s operating income decreased due to its “increased investments in Taocaicai and Taobao Deals, the continued impact of COVID-19 as well as asset impairment and special provisions made by Sun Art.” But if we look at the general trend, Alibaba as a company makes increased investments in growth initiatives. One of the company’s priorities is user growth.

In my view, special provisions by Sun Art and lockdown-related expenses seem to be one-offs. The only worrying sign here might be that Alibaba’s top priority is growth and not profit maximization. However, the company still manages to buy back significant amounts of shares, which is a clear positive for its shareholders. It suggests the company has ample amounts of cash it can also spend this way.

Growth stimuli

The company is set to report its quarterly earnings on 17 November. Before this date the company will hold its Singles Day on 11 November. The Singles day is traditionally a time of really good sales and cash inflows for Alibaba.

However, this year the situation may be different. The problem is that the Singles Day hosts will not most probably be available this year. As most of you know, Singles Day is not just a one-day event but a festival that is two weeks long. For many years already BABA’s Singles Day has been headlined by two Chinese mega stars. It is highly likely that none of these stars will be able to attend, which makes the company’s management seriously wonder how well the company’s sales will do during this event. So, the actual figures might disappoint investors.

And yet, in my view, this event will still support Alibaba’s sales and profits in the short term.

Key risks

In my view, the key risk for Alibaba is the risk of a global recession. It gets mentioned here on Seeking Alpha that the Chinese economy is not going through the best of times. The country is dealing with Covid-19 lockdowns, the housing crisis and a very high level of debt. There are already many problems that the Communist Party and the Bank of China want to solve. But the problems do not end here. The central banks all over the world are aggressively hiking the interest rates due to inflationary pressures. There is no global full-scale recession just yet but it is highly likely there will be one soon enough.

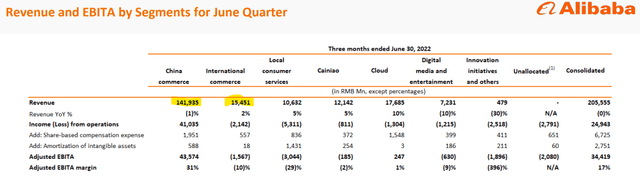

Alibaba is rather a company, focused on the Chinese domestic market. As can be seen from the excerpt below, revenues from Chinese commerce are almost 10 times greater than the international commerce ones.

Alibaba’s earnings presentation

Source: Alibaba’s web-site, earnings presentation, slide 18

So, BABA’s well-being depends on the aggregate demand in the domestic economy. But given the fact, China is an export-oriented economy, a global recession will make the conditions in this country much worse. This is obviously a risk for Alibaba.

In fact, it is the main reason why I say the brilliant company’s cheap stock might get even cheaper.

Valuations

As I have mentioned above, the company’s stock is really cheap for a high-tech company.

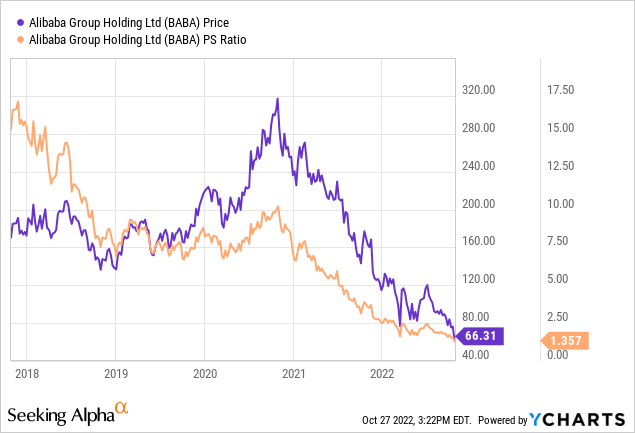

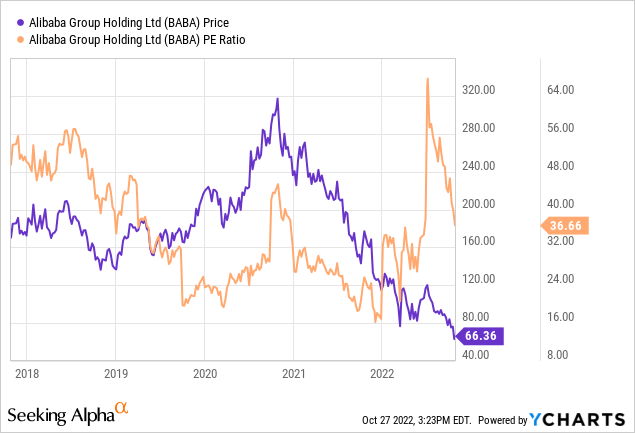

Even if we look at the history of the company’s valuation ratios, we will see they suggest Alibaba’s shares trade near their historical lows. I decided to use the price-to-sales (P/S) and price-to-earnings (P/E) ratios. The data are generated by Y-Charts.

A good P/S is usually between 1 and 3. According to Y-Charts, Alibaba’s P/S is around 1.4 as of the time of writing. This is delightfully cheap for a high-tech company like BABA, especially if we look at the company’s historical figures.

Along with the company’s P/S, I presented its stock price on the graph. It is now lingering near 5-year lows.

Not so obvious seems to be the situation with the P/E ratio. According to Y-Charts, it is near the 37 mark. This is relatively high for an average firm but tolerable for a high-tech company such as BABA. I would say this is neither too high nor too low for Alibaba if we see its P/E history below. At the same time, this is quite explainable since the company’s earnings have been pressurized for the last two years.

Overall, I would say that Alibaba’s stock is relatively cheap.

Conclusion

Alibaba is a sound and large company with outstanding market positions. Right now it is substantially undervalued. At the same time, there is still a possibility its stock might fall further due to the global recession. Yet, the regulatory pressures are fully taken into account, given the stock valuations. In my opinion, it is unlikely there will be further negative interventions from the Chinese authorities, given the economic situation the Chinese economy is in and given the fact Xi Jinping has stayed for the third term. Alibaba has growth potential but I would not get surprised the shares would plunge since a full-scale recession is near.

Be the first to comment