onurdongel

Brookfield Infrastructure Partners (NYSE:NYSE:BIP) is a company dedicated to the ownership and management of real assets all around the globe such as data centers, gas and oil infrastructure and power and electricity distribution networks. The business has grown well above the market average in recent years. Over the last years, the company has grown its revenues at rates higher than 20%, while the cash flows from operating activities have increased at annual rates of 23% in the same period. BIP is a well-managed company and has the advantage of having the Brookfield brand behind it. However, the company has some debt and its valuation is currently not a bargain. Nevertheless, the company has extraordinary assets to protect itself against inflation and I believe that the coming years will be particularly good for it.

Description

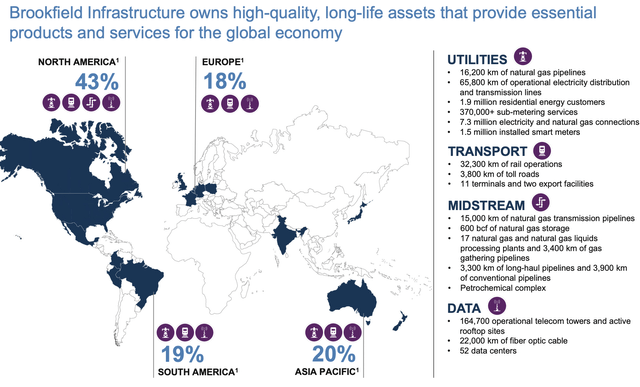

Brookfield Infrastructure Partners is a Canadian subsidiary of Brookfield Asset Management (NYSE: BAM) that owns and operates critical real assets in key economic sectors such as: electric utilities, transportation, midstream (transportation and distribution of oil and natural gas) and data centers for information processing and storage. The company currently focuses on managing regulated assets responsible for generating predictable cash flows over time. BAM currently controls 27.2% of BIP. The business segments are explained below.

- Electric Utilities: this segment focuses on the acquisition and management of assets related to electrical transmission lines , natural gas transmission as well as the distribution business, focused on providing heating and cooling systems to businesses and individuals. The company has signed long-term contracts with its customers by virtue of which it can increase the prices of the services it provides according to the general inflation level. The broad geographic diversification of the portfolio reduces regulatory risk and excessive dependence on a single country or jurisdiction. This segment represents 14% of BIP’s revenues.

- Transportation: Through this segment, the company operates various land transport infrastructures (highways, bridges and railway lines), as well as maritime transport infrastructures, mainly harbors. Revenues from this segment are somewhat more volatile, since the transportation market is heavily dependent on oil prices. However, the assets that BIP owns are critical and in a market in which entry barriers are very high due to the irreproducibility of the latter. Within this segment they manage: short-distance railroads, freight transportation, motorways and diversified cargo terminals focused on LNG exports. This segment represents 18% of the revenues of BIP.

- Midstream: This segment is another of BIP’s crown jewels. It focuses on owning systems in charge of providing natural gas transmission services, as well as other gas processing and storage services. In general, this segment is heavily regulated. Although this might seem like a disadvantage at first glance, it actually limits the entry of competitors and allows a few large-scale operators to prosper. This represents 8% of the revenues of the company.

- Data Centers: This segment is made up of critical infrastructure focused on the telecommunications, optic fiber and data storage sector. Currently, the sub-sectors that make up this segment focus on providing key infrastructure for the telecommunications and television industry, while the data part focuses on providing storage services, as well as cloud and engineering services. This represents around 4% of the revenues they generate.

Different business lines of BIP (Investor Relations)

Other revenues the company may generate come from the disposal of assets that generate cash flows that can be reinvested into the core businesses they have.

Business Strategy

Like other businesses, reading their annual letters, as well as their annual reports, makes it possible for investors to understand whether or not the long-term strategy is focused on generating value for shareholders. The main distinguishing features of the BIP brand are listed below.

- Performing Good Acquisitions: Over the last few years, BIP has focused on expanding their operations in critical assets where, according to them, they can easily obtain returns of around 12-15% per year. It is important to note that, being a subsidiary of Brookfield, they use the brand name to acquire new assets in geographies where BAM has a presence. This allows them to get deals at lower prices than the competition. In their own words:

An integral part of our acquisition strategy is to participate along with institutional investors and Brookfield-sponsored private funds that target acquisitions that suit our profile. We will focus on consortiums and partnerships where Brookfield has sufficient influence or control to deploy our operations-oriented approach. Brookfield has a strong track record of leading such transactions.

- Capital Recycling Strategy: Another of the keys to the success of BIP, as well as that of other Brookfield subsidiaries, consists of the concept of “recycling capital”, which basically consists of the sale of mature assets to reinvest the cash flows generated by these disposals in higher-yielding assets. In addition to generating high returns for shareholders, these mature asset disposals make liquidity available for new investments. This reduces Brookfield’s dependence on the capital and debt markets, although they can complement the fundraising strategy together with institutional investors. In their own words:

Our partnership has established a strong track record of recycling capital through the full or partial divestment of 19 businesses since inception. These sales have generated approximately $7 billion of total proceeds which represents a significant premium to our partnership’s previously recorded carrying value.

Capital Recycling Strategy (Brookfield Infrastructure Partners)

Addressable market & Growth Opportunities

From a macro perspective, the secular trends that drive the need of more investment on infrastructure are key to understanding why BIP has an important role to play in the coming years. I believe that the main drivers of growth will be the following:

- Data infrastructure networks: Although the world is largely digitized, it is true that internet penetration is still low in many parts of the economy. In all the data infrastructure sectors in which Brookfield operates, considerable market growth is expected in all cases in the coming years. In relation to telecommunications towers, it is estimated that the market will grow at rates close to 4% in the next decade, due to saturation and the fact that most of the demand is already satisfied. The implementation of faster communication networks, such as 5G, will require a larger network of antennas to provide fast connections. Regarding fiber optic networks, it is estimated that they may grow at a rate of over 10% in the coming years, mainly driven by a greater demand for speed in telecommunications. Regarding data centers, it is estimated that growth could be close to 12% in the coming years, mainly due to the increasing cloud-based solutions across almost every economic sector.

- Energy transition: Another of the points that support the long-term BIP thesis is the objective of decarbonization of the economies promoted by the governments of Europe and the United States. BIP controls many natural gas distribution networks, as well as liquefaction plants in Canada, key to supplying Europe and Asia with natural gas through tankers. I believe that the conflict between Russia and the West will reduce the supply of gas from Russia to Europe and BIP’s assets will become more valuable in the coming years.

- Renewal of Infrastructure: the growing weight of debt in many countries and the expected increase in interest rates (necessary to fight inflation) will make it more difficult for governments to make the necessary investments in energy and transport infrastructure, among others. In order to maintain existing infrastructures, private agents (such as BIP) that can carry out the necessary maintenance will be needed. It is estimated that this market will grow at rates higher than GDP growth, which will result in higher cash flows for BIP.

The combination of these three sources of growth is quite likely to happen and it is certain that it could provide BIP with organic growth of over 6-7% in the coming years.

Financials

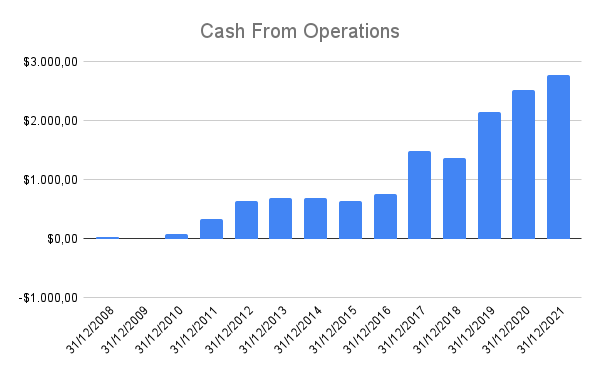

Over the last years, BIP has shown great financial performance across the different segments which operates. Revenues have grown at a rate of 30% per annum, due to the acquisition strategy and the price increases caused by a positive inflation rate over the last years. Cash Flows From Operations (which alongside EBITDA is a good key performance indicator of the business) have also grown at a rate of 23% per annum, a sign that shows both resilience and the ability to grow over 10 years.

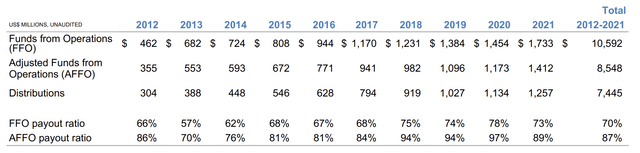

Even though these numbers may look appealing to the reader, BIP indicates that its financial performance should not be measured with general GAAP principles, but with metrics such as FFO (stands for Funds From Operations), due to the asset-oriented strategy that they follow. FFO is defined as:

FFO = Net Income + Depreciation + Amortization + Losses on Property Sales – Gains on Property Sales – Interest Income

The evolution of FFO and other distribution metrics are shown in the following table:

Evolution of FFO, AFFO and Payout Ratio of BIP (BIP Investor Relations)

In their own words:

We determine our distributions to shareholders based primarily on an assessment of our operating performance. FFO is used to assess our operating performance and can be used on a per unit basis as a proxy for future distribution growth over the long-term.

Another important ratio used when analyzing BIP is AFFO, which is defined as FFO – Capital Expenditures, serves as a proxy to analyze the returns of their operations once the maintenance is taken into consideration.

Cash From Operations (Own Models)

It is important to understand that the cash flow from activities is a good measure of the profit that BIP generates, once the capital expenses necessary to maintain the business are deducted. In the words of the management team itself:

We typically retain approximately 15-20% of AFFO that we utilize to fund some or all of our recurring growth capital expenditures.

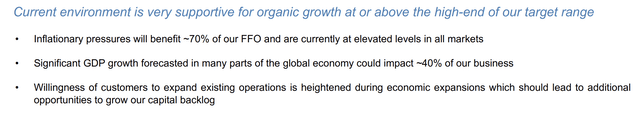

In general, the contracts that BIP signs for the management of infrastructures are protected against inflation, since they can increase the price of their services as the price level increases in the economy in general. This means that they always have growing cash flows over time that allow them to finance many of their previously mentioned operating activities.

BIP is hedged against inflation (BIP Investor Relations)

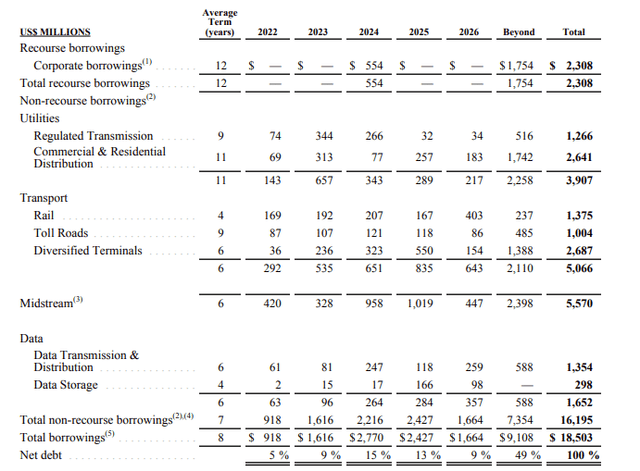

Apart from FFO, BIP’s debt must also be scrutinized. Generally, these types of companies that operate large infrastructures are highly indebted to finance part of the maintenance operations, as well as new acquisitions. Currently, BIP holds $26,329 million in long-term debt, and a large amount of the debt is arranged at fixed rates. Hence, the company is protected from the volatility of variable interest rates, which are currently increasing.

In addition to this, BIP has widely spaced maturities of issued bonds, which prevents the company from having short-term liquidity problems. The following table shows the distribution of maturities in the coming years.

Maturities of BIP (Brookfield’s Webpage)

Almost 50% of the maturities are to be paid beyond 2026. This wise temporal diversification of maturities, coupled with strong cash flow (much higher than the interest it has to pay) puts BIP in a strong financial position, rated Bbb by credit agencies such as S&P (NYSE: SPGI) and Moody’s (NYSE: MCO).

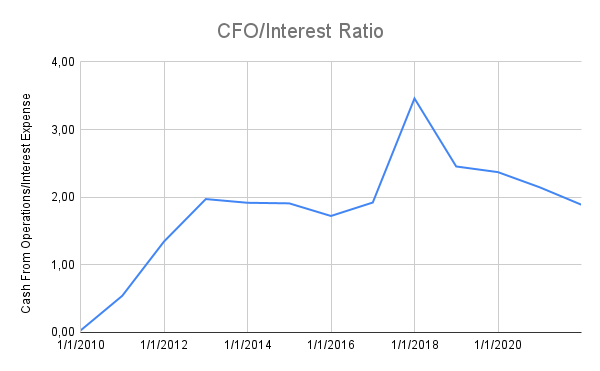

Interest Coverage (Own Models)

In addition to the fact that the maturities of the debt are well distributed over time, it is also true that the company has well covered its interests with the cash flow it generates. Something very positive that allows BIP to pay its debt and at the same time reinvest in fixed assets and in the acquisition of new assets that generate cash flows. I personally believe that even if the debt is high, it is not a long-term problem for the following reasons: maturities well distributed over time, fixed-rate debt that makes them insensitive to the movements of interest rates and a Cash Flow From Operations that sufficiently covers the interest payments they have to make each year.

Valuation

One of the key points in the analysis of any company is always the valuation. Although in the long term it is the quality of the business -along with its reinvestment capacity- that determines growth, in the medium term the valuation at which a business is acquired plays a determining role on future returns.

BIP is a company that distributes most of the cash flows it generates, since a part (approximately 15-20% of the AFFO) is used to maintain the assets held by the holding company. To correctly value BIP, I will assume two scenarios that I believe are highly probable based on the expected macroeconomic situation for the coming years.

Conservative scenario: In this situation, BIP manages to increase its FFO at lower rates, specifically in the low range of its estimates, close to 5%. With the current dividend yield of almost 4%, a return of close to 9% could be obtained in the most conservative scenario of all. To all this should be added a premium for the sale of mature assets at a premium. In a conservative scenario, the return could be 11% per annum.

Base scenario: In this scenario, which I consider more likely than the previous one, I estimate that the funds that BIP can distribute will grow at a rate of 7-8%, somewhat below the upper range that they give. BIP’s strategy, based on ‘recycling capital’, can generate a 2-3% premium if these mature asset sales strategies are carried out correctly. With the current dividend yield of almost 4%, BIP can yield in the coming years returns higher than 13%.

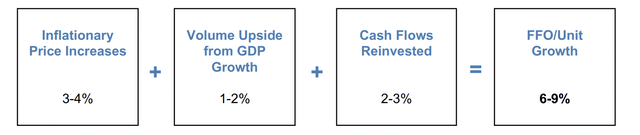

Naturally, the distribution policy can hold in the long term due to: long-term inflation-protected contracts, capital recycling strategy, economies of scale benefits from the Brookfield brand, and fixed-rate debt that prevents interest payments from skyrocketing. Indeed, a combination of price increases, together with increases in volume and better returns on investment can produce a growth of the funds to be distributed by around 6-9% in the coming years.

BIP’s FFO growth (BIP Investor Relations)

Risks

It is evident that any investment carries with it a series of risks that can negatively affect the expected returns. Clearly, this is minimized by looking for companies with reinvestment capacity and with controlled debt levels, among many other things. The main risks that every investor in BIP faces are the following.

- Valuation: Currently, BIP is not one of the biggest bargains on the market. It is currently trading below 15 times FFO, an amount higher than the historical average valuation in recent years. The increase in inflation, together with the need to invest in infrastructure, means that the market values BIP somewhat above the values at which it has historically traded. Although the price is not a bubble, it can be said that it is currently in the fair value zone.

- Bad execution strategy: Another risk of BIP is that the management team carries out a bad acquisition strategy. Personally, this would surprise me a lot, since its track record of acquisitions and generation of shareholder value is extraordinary. In addition, their partnership with Brookfield allow them to obtain investments that are not available from other types of real asset management peers.

Conclusions

BIP is a company focused on owning and operating real assets with inflation-protected contracts. The markets in which it operates have higher secular growth rates than the GDP growth. In addition, BIP is currently trading at normal valuation levels that make the company an interesting long-term investment.

Be the first to comment