bjdlzx

(Note: This article was in the newsletter on July 24, 2022, and was updated as needed)

Aker BP (OTCPK:DETNF) is a Norwegian independent company that is now a lot larger from the merger with Lundin Energy (OTCPK:LNDNF)(OTCPK:LNEGY). Norway has a robust industry that is likely to benefit from the current European situation. A company this size is far more likely to provide higher returns than would be the case of a giant company like Equinor (EQNR).

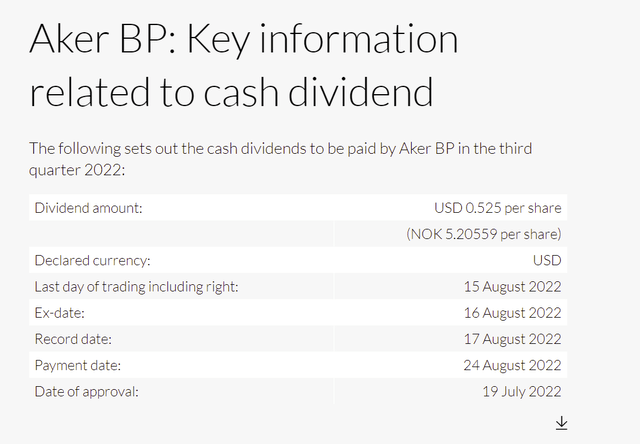

Aker BP’s Dividend

Like many companies, this one will vary the dividend based upon industry conditions.

Aker BP Second Quarter Dividend Presentation (Aker BP Second Quarter Dividend Press Release)

(Note that the various press releases have at least one currency mentioned, and United States dollars are mentioned throughout the various presentations.)

The current environment has allowed the company to raise the dividend rapidly. The European petroleum and natural gas situation will make for a very encouraging environment to raise production. Therefore, this variable distribution entity appears to have a very bright future for both income and capital appreciation shareholders.

There is a heavy emphasis to move away from Russian deliveries of these products. This company is in a position to offer at least a partial solution to current issues. The currently strong commodity price market appears to offer a fast payback for many projects. That fast payback should limit some of the risk of political gyrations on the continuing charged discussions involving this industry.

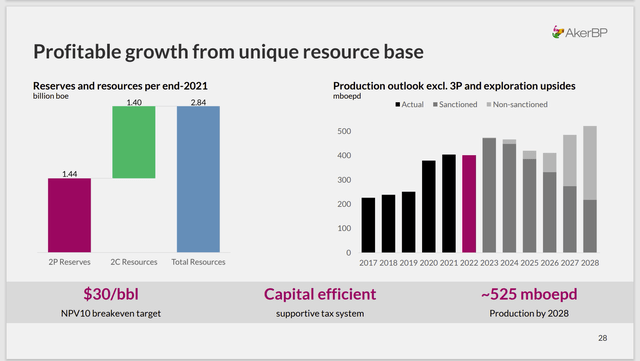

Company Breakeven

The company production, as is the case for much of the Norway industry, is very profitable even at far lower prices.

Aker BP Corporate Breakeven Target (Aker BP July 20, 2022, Post Merger Strategy Update)

The company has a history of growing resources. The projects and exploration anticipated make that growth slightly on the lumpy side as shown above. But that growth is expected to persist for a long time to come. Unlike much of Europe, Norway does realize that this industry is an asset and therefore very much supports the industry.

However, the last five years ending with the 2020 fiscal year, were very trying for this industry. Many companies do not show a lot of growth. Nor have their stock prices appreciated much during that time period. Fiscal year 2020 for many companies was especially damaging to a lot of company finances.

Now, the future picture appears to be much more pleasant than was the case before. That means that an industry recovery has been viewed much more favorably than was the case in the past. Whatever this company ends up producing in the future, that production can easily be sold to an energy hungry Europe that wants a dependable supplier of its energy needs.

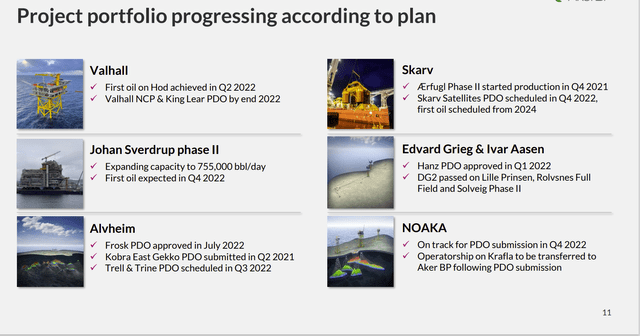

Current Portfolio Progress

Management has a fair amount of projects going in addition to optimizing operations after the merger.

Aker BP Post Project Portfolio Progress (Aker BP Post Merger July 20, 2022, Strategy Update)

The company has plenty to do just to maintain current production levels. Management has also announced a natural gas discovery that is particularly important to the European situation.

What is important to note with any company that participates in the offshore industry is that a sizable discovery can literally change the company outlook overnight. Investors need to look for a company that is hitting a lot of singles and doubles because such a company is far more likely to “hit a homerun”. This company appears to have a very good record of finding oil.

What the future holds is anyone’s guess. But the rapidly rising dividend alone makes it worth the while to wait to see what the future holds. Independents with low costs like this one and decent futures often become takeover candidates at some point.

Investors need to remember that any acquiring company wants “a deal” for their shareholders (and that goes for private companies as well as public ones). No one wants a company with a lot of expensive debt and cash flow issues. That kind of company often gets sold (if it does not go under first) at a considerable discount. A company like Aker BP promises few integration issues that many potential buyers want to see when they are “shopping”.

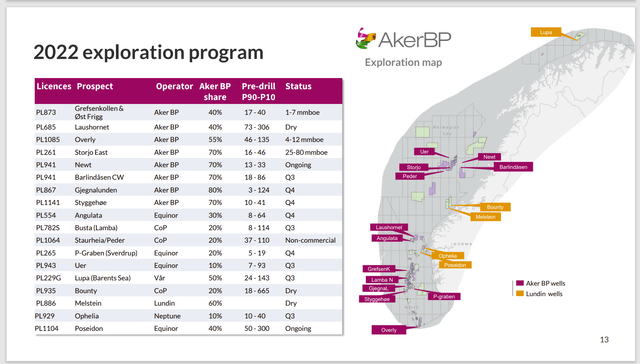

Aker’s Exploration Program

As would be expected, the company has an active exploration program.

Aker BP Map Of 2022 Exploration Wells (Aker BP Post Merge July 20, 2022, Strategy Update)

The company has mostly extensions of discoveries planned for drilling. These are comparatively lower risk wells when compared to a pure exploration well in an area with no known production but good geology. The results as shown above reflect this in the relatively lower percentage of non-commercial results.

The results imply that production can be maintained in the established areas for some time to come. Now whether the continuing improvement of technology will continue to open up more possibilities in these same areas is anyone’s guess. I tend to think that is highly likely but it is also definitely not assured.

A company like Aker BP can often afford some purely exploration wells mixed in with the lower risk extension exploration wells. That advantage makes this a much better long-term investment vehicle for investors that want that pure exploration risk. Established production and to some extent established production growth through extensions allows for continuing cash flow growth while investors wait for that “game changing” discovery.

The problem with players that are smaller is they often cannot afford to bid on the best acreage. So, the long-shot results of smaller players are often a longer-shot than many realize.

The Future

Aker BP has a decent financial strength rating. That rating could well improve in the future once the benefits of the merger become obvious to observers. The current environment combined with the situation in Europe should allow for dividend increases while the company benefits from a busy schedule that should allow for production increases in the future.

The combined company is unlikely to grow at the rate of growth that Lundin Energy shareholders are used to. However, the rate of return from the growing dividend and slower growing production should remain satisfactory for long term shareholders. A well-chosen acquisition periodically is likely as well.

This company is well positioned to take advantage of the current European situation as it is focused on the offshore business in Norway. Obviously, there is a lack of basin diversification. Then again, investors should love that European energy focus.

There is a possibility that this company could become a takeover candidate in the future because this company has a lot of characteristics that many buyers want to see (including low costs and a decent balance sheet). In the meantime, the dividend provides a decent return for those patient shareholders who don’t mind waiting for the future to unfold.

Be the first to comment