BING-JHEN HONG

Summary

The bull case of Taiwan Semiconductor Manufacturing Company (NYSE:NYSE:NYSE:TSM) has been well discussed in the forum. 1) Technology leadership over Samsung and Intel translate into pricing power2) Long-term sustainable demand growth 3) TSMC is trading at below 15x P/E which is the valuation of the last trough cycle

The stock is significantly undervalued as Market has two main concerns: geopolitical risk and semiconductor downcycle risk. I am going to address each of the two concerns below.

Semiconductor Downcycle

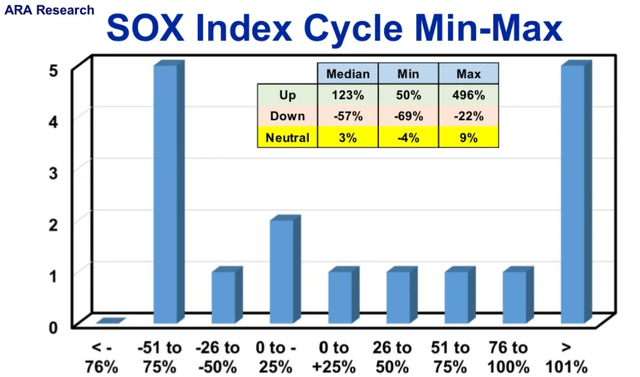

The semiconductor industry has been growing at 6.7% from 2001-2021. The semiconductor industry is a cyclical with every upcycle lasting 1-3 years and downcycle lasting 1-2 years. According to ARA research, the median downcycle of SOX index is -57%. TSMC has traded down -43% from its peak in Jan 2022.

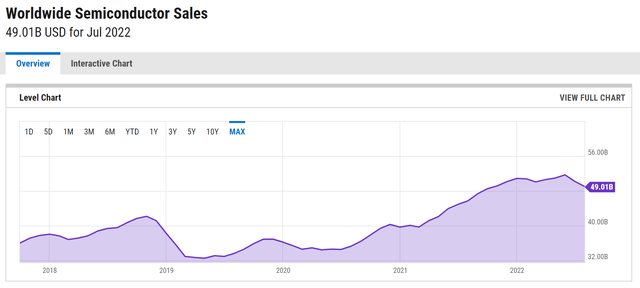

There are several factors have indicated semiconductor downcycle has started. The most obvious one is worldwide semiconductor revenue. As illustrated below, worldwide semiconductor revenue has peaked in mid-2022.

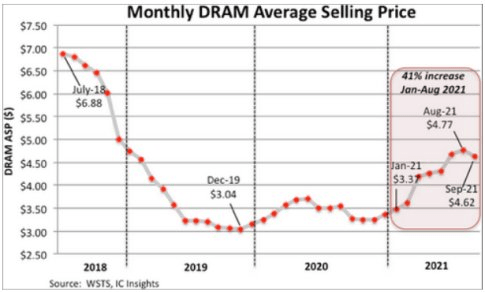

Another strong indicator is DRAM price. DRAM price has peaked in 2021 and has continued to trend downward since then.

IC Insights

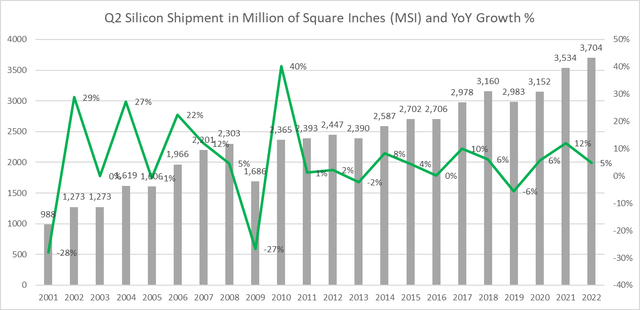

In a semiconductor upcycle, silicon shipment increased yoy as foundries purchase more raw materials. In a downcycle, silicon shipment growth slow down or even turn negative. As illustrated in the chart below, global silicon shipment growth has slowed down since 2021.

Geopolitical risks

While a peaceful reunification is everyone’s hope, the odds are getting low as more and more older generations of Taiwanese who identified themselves as Chinese passed away. If we closely studied Xi’s speech, Xi constantly stressed that “Taiwan issue could not be passed from generation to generation”. I believe it means the issue needs to be resolved under his watch. The Chinese Communist Party has passed a “historical resolution”, cementing Xi Jinping’s status and achievement to be on par with Mao who created the new China in 1949 and Deng who led one of the most successful economic reforms in China. To achieve the same recognition as the first two Chinese leaders, Xi has to resolve the Taiwan issue. But it won’t be a top priority for CCP in the next five years unless Taiwan declared independence. According to CNBCTV, Chinese Premier Li Keqiang recently disclosed a staggering statistic that 43% of Chinese or 600M people are still making less than $140 salary per month. China has many more pressing internal issues such as lifting people out of poverty to address before getting Taiwan issue resolved. I believe the geopolitical risk is significant in the medium-term has been exaggerated in the short-term.

Valuation

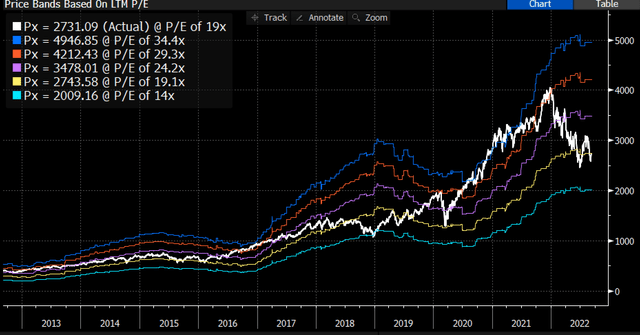

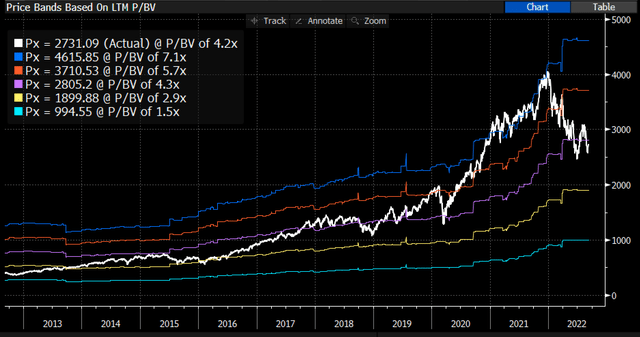

TSMC is trading at 13x 2022 earning and is expected to grow 15-20% in the next few years. Valuation looks attractive if we look at the P/E and P/B band of the Philadelphia Semiconductor Index.

Conclusion

TSMC is trading at below its trough cycle valuation as market is concerned about geopolitical risk and cyclical risk. It is true that a few indicators have signaled we has entered a semiconductor downcycle. The geopolitical risk is significant in the medium term but has been overly exaggerated in the short term.

Be the first to comment