shapecharge/E+ via Getty Images

Intro

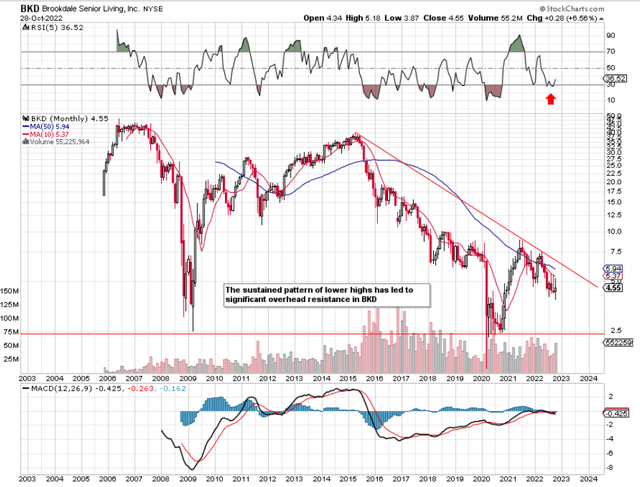

If we pull up a long-term Brookdale Senior Living Inc. (NYSE:BKD) chart, we see that shares remain rangebound between their 2020 lows and 2021 highs. Bulls will be hoping that the recent October lows this year of approximately $4 per share can hold here. This is the stock´s first objective with the second being a clear breakout above that multi-year downcycle trendline. Suffice it to say, because of the heavy overhead resistance above the prevailing share price of BKD at present, lower lows cannot be ruled out which is why investors need to remain cautious with this name.

BKD Long-Term Technical Chart (Stockcharts.com)

Growing Occupancy

In saying this, occupancy figures have been very bullish in recent months with occupancy in September once more coming in on an upward curve (78.4%). In fact, based on recent trends, we could easily see an occupancy rate of over 80% for the month of October which if maintained should meaningfully affect the bottom line in the long run.

Furthermore, with talks of a potential sale on the cards, investors are sizing up the financials of the stock to ascertain what is the approximate intrinsic value of this play. Initially, what stands out is that BKD is in fact not profitable from a net earnings standpoint over the past 12 months. In saying this, Brookdale is expected to be free-cash-flow positive this year and also its EBITDA trailing 12-month figure presently comes in at $189 million. These two areas and their associated trends (Free cash flow & EBITDA) are probably the most important metrics for a buyer for the following reason. Essentially, it is all about how much cash Brookdale is generating and where this cash flow is generally trending. EBITDA which does not include debt payments, for example, is an excellent read on how profitable Brookdale is. For example, a buyer could easily come in and decide to pay off the debt or refinance it through their own umbrella.

Positive EBITDA & Cheap Sales

Suffice it to say, given Brookdale´s EBITDA margin of almost 7.6% and sales multiple of 0.34, shares will undoubtedly grow in value if present trends persist. Yes, management has been disappointed with the fact that labor costs have remained stubbornly high (Slower pace than expected with respect to taking temporary workers off the books plus higher than anticipated overtime hours paid out) but labor trends going forward are expected to work in the company´s favor. If a buyout occurs, and investors remain out of this play, they indeed run the risk that a breakout above that downcycle trendline will take place once the details of the potential deal are announced. We though remain more concerned about the downside and here are probably the two most significant points which point to same.

Covid 19 Ramifications

Around this time last year, shares of BKD were trading at approximately the $7.60 mark but then subsequently dropped to the $5.30 mark by the end of the year. That was a 30% drop in the space of two months which almost wiped out the gains the share price experienced in 2021. Furthermore, what investors need to take into account here is that Brookdale reported 10 months of occupancy growth in calendar 2021. However, since the technical chart is essentially a predictive discounting mechanism, any bearish news, for example, with respect to another nasty Covid 19 variant would ultimately mean more associates would end up in quarantine. This obviously increases costs and decreases productivity as these workers cannot go about their daily duties. Suffice it to say, the market would begin to immediately price this in.

Interest Rates

This ties into the second point which is interest rates. Brookdale holds a significant amount of long-term debt on its balance sheet. With interest rates on the rise, the company´s interest expense automatically increases. Although recent funding has strengthened the company´s working capital, Brookdale will most likely have to refinance its near-term maturities in order to keep that payment as low as possible. Operational leverage will come with growing occupancy levels, manageable debt payments, and lower labor costs in the long run. Any deviation from the three points above will result in lower profitability on higher costs which is obviously not what the market wants to see.

Conclusion

Therefore, to sum up, although the potential for long-holders remains firmly on the cards here due to a possible buyout, we intend to remain on the sidelines until we see a notable change in the prevailing share price. We look forward to continued coverage.

Be the first to comment