industryview/iStock via Getty Images

This is a potential merger that might be announced within the upcoming months. In late November, world’s second-largest chemical distributor of commodity and specialty chemicals/ingredients Univar Solutions (NYSE:NYSE:UNVR) has been approached by world’s largest chemical distributor Brenntag (OTCPK:BNTGY, further referred to as BNR in the write-up). UNVR has since confirmed sale talks. Recent reports suggest both sides might reach an agreement within a couple of months.

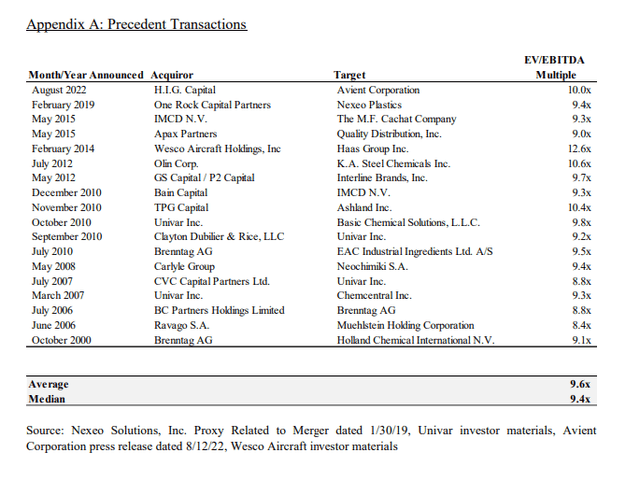

Shortly after the recent developments, activist Engine Capital (1% stake in UNVR) sent an open letter, noting that UNVR is undervalued and might be a “highly attractive acquisition target”. The activist is pushing for a full-fledged formal sales process. The activist says UNVR might be worth between $38/share and $44/share in a competitive bidding process. Engine Capital is basing its targets on valuation multiples in similar industry transactions which the activist highlighted in its previous letter to UNVR’s board sent in October. Engine notes that generally such acquisitions have been performed in the 8x to 10x EBITDA valuation range. Among other transactions, Engine notes AVNT’s recent divestiture of the distribution segment to H.I.G. Capital in Aug’22 (10x LTM EBITDA) and UNVR’s acquisition of Nexeo in 2018 (9.4x EBITDA). Meanwhile, UNVR currently trades at 7.0x TTM EBITDA. BNR is valued at 6.4x.

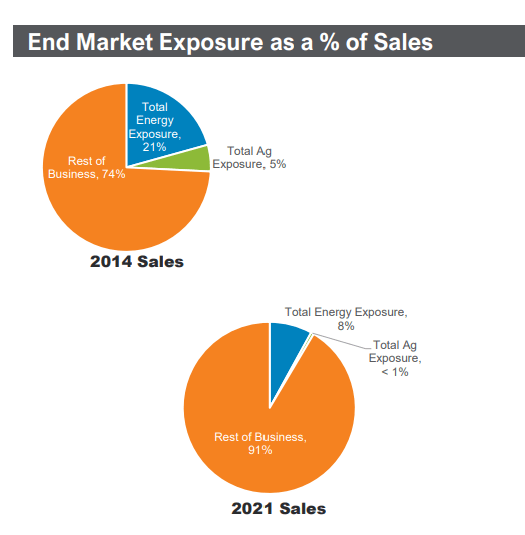

The merger with UNVR would allow BNR to diversify away from the seemingly problematic European markets. The continent’s chemical producers – whose products BNR distributes – have been materially impacted by soaring gas prices. The transaction would thus allow the buyer to shift its exposure from EMEA region (41% of BNR’s gross profits) to the significantly less impacted US market where UNVR is the leading player. Importantly, UNVR is a relatively stable business given the wide distributed-product portfolio and low exposure to highly cyclical end-markets, such as agriculture and energy. This bodes well with BNR’s strategy ahead of a potential economic downturn. Notably, just a few weeks ago BNR opened a new production and warehouse facility in Massachusetts, highlighting BNR’s plans to expand in North America.

Moreover, BNR’s net debt-to-EBITDA is at 1.3x – below 2x+ for peers – allowing the company to finance the potential acquisition by debt without raising the market’s eyebrows over increased leverage. Brenntag has been on an M&A spree over the recent years – including this year’s acquisitions in the US, UK, and Australia/New Zealand. UNVR would be Brenntag’s largest transaction to date.

Meanwhile, UNVR management might be willing sellers here. A potential transaction would come at an all-time high share price and likely peak cyclical earnings. Coupled with pressure from a reputable activist, this suggests UNVR leadership might agree to a company sale.

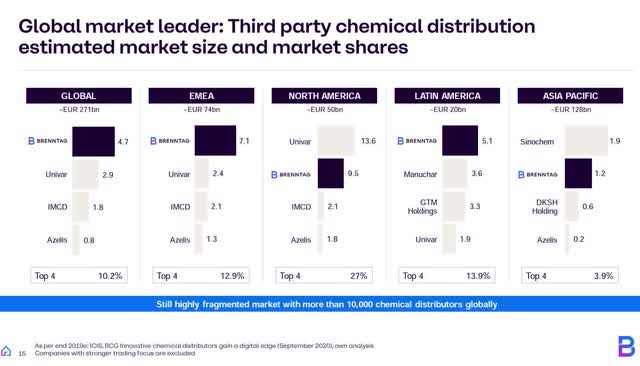

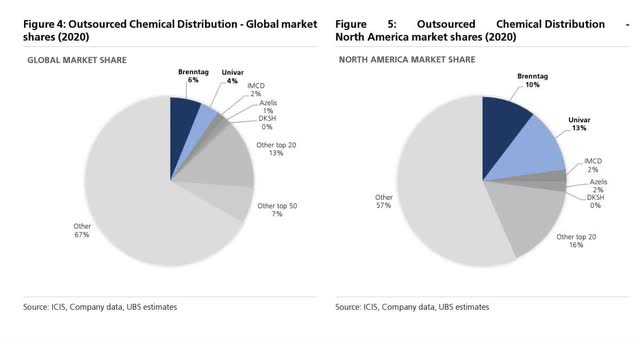

The potential merger would require antitrust approvals in numerous jurisdictions, primarily the EU and the US. In EMEA and North America, the combined market shares would stand at 10% and 23% respectively. These markets, however, are highly fragmented beyond the largest four players which hold 13% and 27% combined market share in these regions. Moreover, in 2018 UNVR successfully acquired Nexeo, in a deal that combined #1 and #3 NA industry players at the time. The transaction closed in seven months. Having said that, given the large BNR-UNVR merger size, the regulatory risk would likely still be prominent and the closing might take longer.

Note: the ICIS survey does not include all distributors in North America, suggesting real market shares might be lower.

Univar Solutions

UNVR is a commodity chemical and specialty chemical/ingredient distributor. Commodity chemical distribution has made 60% of revenues whereas specialty chemicals have accounted for the remaining 40%. The company’s business involves purchasing chemicals/ingredients from large chemical companies and repackaging them for smaller customers. UNVR also handles logistics. 63% of revenues are generated in the US. The company has one of the chemical distribution industry’s largest private transportation fleets.

Since 2018, UNVR has pursued a strategic transformation, involving acquisition and subsequent integration of Nexeo Solutions under a single ERP system. The Nexeo acquisition has allowed it to increase its exposure to the higher-value added specialty chemicals segment. Moreover, as part of the strategic transformation, UNVR has successfully delevered – net debt-to-EBITDA is down from 3.3x in 2019 to 2.1x as of Q3’22 – and optimized the company’s assets in Europe. Importantly, in recent years UNVR has also managed to reduce exposure to cyclical end markets. As noted by UNVR’s CEO:

Look, we are a much more resilient, robust business today than we were during the last 1, 2, 3 downturns. If you think about energy, energy was probably something like 15%, 18% of our business way back. Now it’s less than 8%. Ag was 5%, 6% of our business. Today, it’s 0. And so we are now — over 1/3 of our business is in that Life Sciences, Industrial Solutions space.

[…]

We rationalized our assets in Europe some years ago. It’s something I did when I was there, and it’s something that’s carried on. And since then, we have a pretty good, tight, efficient network of assets. It’s a very high-performing business, our European business. More than half our business there — or about half of our business there is in that kind of Life Sciences specialty space. So that’s pretty asset-light. So I don’t think we’re thinking about major restructuring in our European footprint. We’ve continued to manage that footprint over the several years, and we’ll continue to do so.

UNVR Investor Presentation, November 1, 2022

Notably, UNVR’s business is well-positioned for a potential economic downturn also given the company’s largely variable cost structure – from the latest earnings call:

A lot of our costs are very variable. We don’t have a big fixed asset base. We are relatively asset-light, which means that we can variabilize our cost in a downturn pretty quickly. That’s been our experience through the last several. And we have a management team here that have lived through several downturns. So it’s not a new thing for us.

Boosted by inflationary tailwinds, the company has displayed record-breaking financial performance this year, with revenues climbing 15% in 2021 and 26% YTD. The business generated $1.1bn in TTM EBITDA compared to $0.8bn in 2021 and $0.6bn in 2020.

Not surprisingly, the company has been pursuing share repurchases, with $205m worth of UNVR stock repurchased year-to-date. Interestingly, in early November, UNVR authorized an additional $1bn of share repurchases. The authorization came in October after the activist Engine urged the company to pursue additional share buybacks. This might suggest the activist’s pressure has been working and that management has been playing along thus far.

Brenntag

BNR is a Germany-listed world’s largest chemical distributor. The company generates 89% of its gross profit in EMEA and the Americas (as of 2021), the majority of which are from Europe and the US respectively. Similarly to UNVR, BNR distributes both commodity chemicals (61% of 2021 gross profits) and specialty chemicals/ingredients (38%). Specialty chemicals are sold to sectors such as nutrition, pharmaceuticals and water treatment.

Other Industry Transactions and Valuation

In its letter, the activist Engine Capital notes numerous distribution company acquisitions all of which have been completed at or above 8x EBITDA – see below:

Among the most recent acquisitions is H.I.G. Capital acquiring Avient Corporation’s distribution business for $950m or 10x EBITDA. Notably, Avient’s distribution business attracted numerous interested buyers which led to a “competitive process”. In its letter, Engine Capital has noted that Avient’s distribution business was primarily involved with distribution of plastics which is not subject to the same regulatory oversight as chemicals – UNVR’s area of focus. Another industry transaction worth highlighting is One Rock Capital Partner’s acquisition of Nexeo Plastics from UNVR (announced in Feb’19). The merger valued Nexeo Plastics at 9.4x EBITDA. UNVR previously acquired Nexeo in a $2bn transaction (announced in Sep’18) valuing Nexeo at 9.4x 2018 EBITDA.

In light of recent developments, the activist Engine Capital has also noted significant activity of private equity buyers in the space, including in the ownership of both UNVR and BNR in the past. BC Partners Holding acquired Brenntag in Jul’06. The PE buyer sold its stake in the company in 2012. Meanwhile, UNVR has been acquired by CVC Capital Partners in 2007 before CVC sold a 42.5% ownership interest in the company to CD&R in 2010. CDR eventually liquidated its stake in 2019.

From relative valuation perspective, UNVR trades materially below its closest peers IMCD (OTCPK:IMCDY) and Azelis (OTCPK:AZLGF) trading at 17.2x and 15.3x respectively. It has to be noted, however, that these peers are specialty-chemical focused distributors, suggesting they are not directly comparable and higher multiples might be warranted. EBITDA margins of these peers (12% each) have been slightly higher than those of UNVR (9%).

Engine Capital

Engine Capital is a value-oriented investment firm launched in Jul’13. As stated in the activist’s letter to UNVR’s board (sent in October), Engine has thus far negotiated either board nominees or settlements in 22 publicly-listed companies. The activist mentions numerous previous and current positions in distributors, such as Wesco Aircraft (eventually sold to Platinum Equity), Ferguson, SIG and Nexeo Solutions (before its sale to UNVR).

A notable ongoing campaign of Engine Capital that I recently highlighted – SCPL-LNW – can be found here.

Conclusion

At current price levels, UNVR presents an interesting investment setup. Given strategic rationale for the buyer, favorable valuation and the activist’s involvement, UNVR and BNR might eventually come to an acquisition agreement at a premium to the current UNVR share price.

Be the first to comment