Byjeng

By Rob Isbitts

Summary

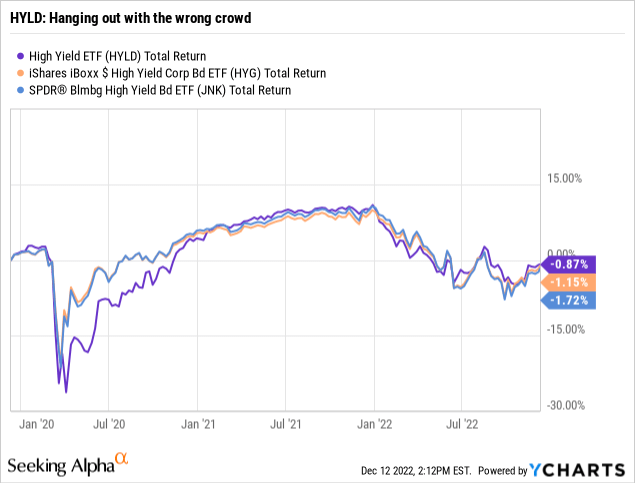

HYLD suffers from guilt by association. High yield a.k.a. junk bonds were decent relative performers in 2022. However, we encourage investors not to get too overconfident on junk debt heading into 2023. This is still a market segment that has yet to reckon with some risk-inducing features, following years of easy borrowing conditions. While HYLD is a slight outperformer this year, losing less is not a great end-goal. We rate it a Sell.

Strategy

As with most High Yield ETFs, High Yield ETF (NYSEARCA:HYLD) diversifies across a set of corporate bonds rated in the top two “junk” categories, BB and B-rated bonds. As an active ETF, unlike most in its category, HYLD’s bond selection is performed by experienced human managers.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Bonds

-

Sub-Segment: High Yield

-

Correlation (vs. S&P 500): Moderate

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

While 54% of HYLD’s investment allocation is to BB and B bonds, a hefty 25% is allocated to bonds that are not rated, or are rated below B. That means that investors are really putting high value on the bond-picking expertise of the active managers. 15% of the ETF is in non-U.S. bonds, so the rewards and risks of international investing are present here, to some degree. 88% of the assets mature in 10 years or less, but there is some longer-term exposure.

Strengths

High Yield ETF is an actively-managed fund run by Peritus, a Santa Barbara, CA-based investment firm started in 1995. It manages individual accounts, as well as HYLD, with the fund sitting with Asset Under Management (AUM) of about $87mm. That makes HYLD an “undiscovered ETF” to us, and made us curious about analyzing it.

According to the firm’s website Peritus “views credit as either “AAA” or “D” and places limited value on the rating agencies and their methodologies, which we see as backward looking, reactive, and lag the market perception of risk. Yet it seems that many fixed income investors continue to use ratings as one of their primary investment tools. To that we say, “right on!”. Rating agencies were unreliable and graded “on a curve” in the Global Financial Crisis.

However, when investing in ETFs, with their diverse holdings (especially in a fund like this that holds more than 200 bonds), and the fund occupying just a slice of a total portfolio (we assume), the rating agencies are about all most investors have. So, we like Peritus’s approach to High Yield. It is High Yield that makes us say “there have to be better ways to pursue yield and total return.”

Weaknesses

This is one of the long-term overhangs on the High Yield Bond segment, since it is clear to us that the risks of the financial crisis from 13 years ago have not been addressed. Sure, it appears that US money center banks are in much better position than at that time. But the corporate and junk markets, with bonds rated BBB, BB and BB (the latter two being the focus of this and most High Yield Funds) may still have plenty of “zombie” companies.

Those corporations have reached the point where re-financing their debt is the only way to stay solvent. They can’t survive without it. And many could eventually be forced to refinance at much higher rates than they got away with for the past decade. Maybe none of this will come to pass. But what we are saying is that element of risk remains. That makes it so that HYLD and its peer group will at best be tactical (short-term) investment opportunities until this structural problem is addressed and resolved.

As the chart above shows, HYLD has not distinguished itself in a major way from two of the larger, established High Yield Bond ETF players, HYG and JNK.

Opportunities

At some point, HYLD might make an interesting undiscovered ETF. However, that point is not close enough for us to keep it on our radar. Get us a High Yield bond market crash, and maybe that will change.

Threats

While there is some appeal to investing with active managers in an opaque space like High Yield, the fund is small, the trading volume is light at around $300,000 a day, and the High Yield space is just not something we look favorably at right now.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

Size of this ETF is the issue here, so we’ll look to revisit it for potential inclusion in our undiscovered ETF watchlist, should conditions arise that provide an opportunity to highlight it for niche High Yield ETF investor consideration.

ETF Investment Opinion

For now, HYLD gets a Sell rating from us, for the reasons outlined above.

Be the first to comment