wsfurlan

Investment Thesis

Latham Group (NASDAQ:SWIM) designs and manufactures pool and pool products. It was incorporated in 2018 and headquartered in Latham, New York. Recently they announced Q3 FY22 results. In this thesis, I will analyze their financial performance and future growth potential. In my view, their growth is limited, and demand for their products in FY23 will remain flat. So, I think there is no fresh buying opportunity in SWIM.

About SWIM

SWIM is the largest designer and manufacturer of inground residential pools in North America, New Zealand, and Australia. They also provide pool-related products like pool covers and pool liners. With an operating history of 60 years, they have over 2000 employees across over 30 facilities. They have the broadest portfolio in the industry of pool and pool-related products, and they are also the market leader in this segment in North America.

Financial Analysis

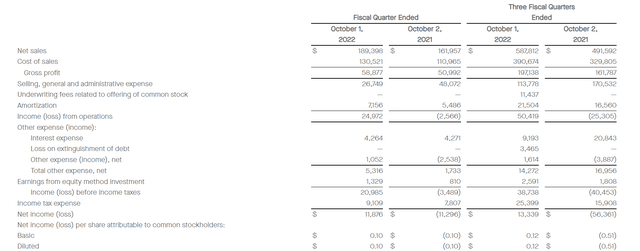

SWIM recently reported its Q3 FYY2 results. They missed the market EPS estimate by 17.6% and the market revenue estimate by 1.3%. They reported net sales of $189.3 million for the Q3 FY22, an increase of 17% compared to the Q3 FY21. I believe the main reason behind this increase was management’s better pricing policy to address inflation. The reported net income for the Q3 FY22 was $11.8 million compared to the net loss of $11.2 million for the Q3 FY21. I think there are three main reasons behind this profitable quarter; firstly, they tackled these times of inflation with a better pricing policy which led to an increase in their sales, another reason being the reduction in the non-cash stock-based compensation expense, and also the reduction in the workforce.

The reported Diluted EPS for the Q3 FY22 was $0.10, which was negative $0.10 in Q3 FY21. The adjusted EBITDA was $42.3 million for Q3FY22, an increase of 17% compared to Q3 FY21. Overall, the financial performance of the company in Q3 FY22 was decent. Looking at the efficient management, I think they will perform better in the upcoming quarters.

Technical Analysis

Currently, SWIM is trading at the level of $3.21. We can clearly see that the stock is in a downtrend, and it has corrected more than 88% in the last one year. Technically, the stock is looking weak; it has been forming lower highs and lower lows formation and the stock is well below its 200 ema, which is at $8.12. Now there is only one condition in which we can make a new position in this stock if the stock makes a double bottom pattern which is considered a very bullish pattern. The last support level from which the stock took support and bounced back is $2.75, and now the stock is consolidating; we can wait for the stock to reach the level of $2.75 again, and if the stock forms a strong bullish candle at that level in a daily timeframe, we can enter at that time by placing a stop loss of 10%. It can be a tremendous risk-to-reward trade because we can achieve a potential upside target of $8, which is 170% from current levels.

Should One Invest In SWIM?

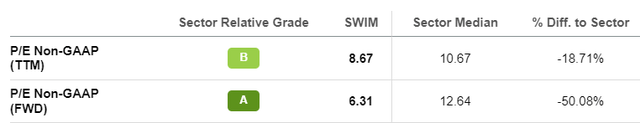

SWIM has a P/E (TTM) ratio of 8.67x compared to the sector P/E (TTM) ratio of 10.67x, which shows that they are currently undervalued. They have revenue (YOY) growth of 20.41% and a gross profit margin of 32.96%. Their revenue and gross profit margin look good.

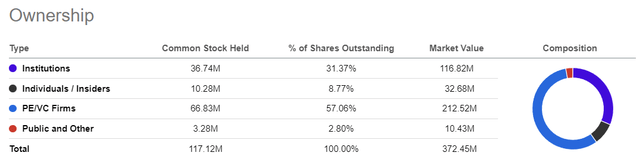

The shareholding pattern of SWIM looks decent. Institutions own 31% of the equity, while private equity firms and venture capital firms own 57% shares of the company. It shows Institutions and private firms are betting on SWIM for the future.

Recently, they acquired fiberglass pool manufacturing assets in Oklahoma. This new manufacturing facility will replace its old facility. According to the management, this facility will reduce their freight costs and enable them to provide better service to homeowners in the U.S. Southwest. They are expected to start manufacturing fiberglass pools in Oklahoma in early 2023. In addition, the management is taking several measures to reduce costs, like optimizing production and shift schedules and streamlining its cover. These cost reduction activities are expected to save costs up to $12 million beginning in fiscal 2023. These steps taken by the management show their efficiency and the efforts they are putting in for the betterment of the company. Good management can turn the current bad run of the company.

Risk

Consumer Spending Ability & Business Expenses

Various raw materials are required in the business to manufacture their products, like galvanized steel, aluminum, Kevlar fiber, and many more. The cost of raw materials like steel is subject to price volatility. Hike in the prices of raw materials could severely affect their cost of sales. The increased price of products could reduce the demand for their products.

Transportation plays a vital role in their business, and they are dependent on third parties for transportation of the raw materials as well as the finished goods to their customers. If there is the unavailability of transportation services, they might not be able to sell the products to their customers when requested by them, and an increase in the price of transportation services can happen due to various reasons like a hike in fuel prices, and work stoppages can affect their profitability.

The products that they manufacture can be expensive, so many people might not be able to afford them. So they have to mostly depend on big hotels, resorts, and rich individuals, which can limit their business growth. Also, various economic factors like inflation and recession can severely affect the demand for their products.

Bottom Line

After analyzing all the parameters of the company, In my opinion, there is no buying opportunity right now in SWIM. Although they posted decent quarterly results, are profitable, and are trading at a lower P/E ratio, their growth aspect still seems to be limited, and their FY23 annual revenue estimates are flat compared to FY22. So there could be slow growth in SWIM in FY23. So I recommend a hold rating on SWIM.

Be the first to comment