NoSystem images/E+ via Getty Images

Investment Thesis – 2 Different Companies, 2 Similar Drugs, 2 Very Different Investment Opportunities

There is an old saying that “a bird in the hand is worth 2 in the bush”, which, when applied to investing, essentially means that you are better off making a single sure bet than 2 speculative ones.

This sentiment helps to explain why, when given the option of investing in the US’ sixth largest Pharmaceutical organization by market cap, Bristol Myers Squibb (NYSE:BMY), whose market cap valuation presently stands at $152bn, or the aspirational clinical stage biotech Ventyx Biosciences (NASDAQ:VTYX), whose market cap sits at $1.6bn at the time of writing, most investors would buy the former. But is there an investment case for buying both?

It may sound odd to even compare these 2 opportunities but there is arguably a good reason for doing so. On September 9th, the Food and Drug Administration (“FDA”) approved one of BMY’s drug candidates, deucravacatinib, as a therapy for adults with moderate-to-severe plaque psoriasis.

In 2 Phase 3 studies Deucravacatinib – which will be marketed and sold under the brand name Sotyktu – a once daily therapy, demonstrated superior efficacy to rival Pharma Amgen’s (AMGN) current standard-of-care in plaque psoriasis Otezla, which is administered twice daily.

The co-primary endpoints were the percentage of patients who achieved Psoriasis Area and Severity Index 75 (“PASI 75”) and the percentage of patients who achieved static Physician’s Global Assessment score (“sPGA”) of 0 or 1 at Week 16 versus placebo. At week 16, Sotyktu had a 58% pass rate, and Otezla a 25% pass rate for PASI 75, and a 54% pass rate for sPGA versus Otezla’s 32%. At week 24, Sotyktu’s pass rate for PASI 75 increased to 69%, and pass rate for sPGA to 59%, versus Otezla’s respective scores were 38% and 31%.

It seems to be a resounding victory and better still for BMY – who opted to keep the drug candidate Deucravacatinib, and sell Otezla to Amgen, when completing its $77bn acquisition of Celgene in 2019 – the FDA opted not to give Deucravacatinib/Sotyktu a Black Box Warning for safety concerns, meaning the drug may well become a more attractive option for prescribing physicians than $2.25bn per annum selling Otezla. BMY’s internal estimates suggest Sotyktu could generate peak sales of >$4bn per annum.

What does this have to do with Ventyx Biosciences? Ventyx is currently developing a drug candidate, VTX958 that blocks a protein known as TYK2, which is involved in inflammatory activities and is part of the Janus Kinase (“JAK”) family. As such, VTX958 has the same mechanism of action (“MoA”) as BMY’s Sotyktu.

There are several approved JAK inhibitors indicated for various autoimmune conditions – AbbVie’s (ABBV) Rinvoq, Eli Lilly’s (LLY) Olumiant, Pfizer’s (PFE) Xeljanz, for example, which had combined sales >$6.5bn in 2012 – but JAKi’s are associated with safety concerns and tend to come with black box warnings. Not only could BMY’s Sotyktu therefore supplant Otezla in Plaque Psoriasis, it may be able to challenge for standard of care in indications such as Rheumatoid Arthritis, Atopic Dermatitis, Ulcerative Colitis, Crohn’s Disease – markets worth billions in annual sales, if not tens of billions.

Early data from Ventyx’ VTX958 however suggests that this drug candidate may be superior even to Sotyktu, in terms of its therapeutic window (dose range that provides a safe and effective therapy), safety profile (in healthy volunteers) and TYK2 suppression. That explains why, although BMY’s stock price increased from $70, to $74 on the day Sotyktu was approved – a gain of 6% – Ventyx’ stock price increased from $22, to $38 – a gain of 73%.

For good measure, Ventyx is also developing another drug candidate – VTX002 – which targets Sphingosine-1-phosphate receptor 1 (“S1P1R”), and is in Phase 2 studies as a potential therapy for Ulcerative Colitis. That just happens to be the same mechanism of action as BMY’s Zeposia, approved to treat Multiple Sclerosis (“MS”) in 2020. The drug made sales of just $134m in 2021, but has been pegged by analysts for peak sales of ~$1.6bn, whilst BMY itself believes it could peak at $5bn sales per annum.

Ventyx Needs Drug Approvals, BMY Needs Commercial Success

To summarize the investment thesis, Ventyx has 2 candidates of note – VTX958, which will enter a Phase 2 clinical trial before the end of the year, and VTX002 which will report Phase 2 data in Ulcerative Colitis (“UC”) sometime in 2023. Both candidates’ mechanisms of action are similar to candidates developed by BMY that have been approved and are expected to become blockbuster (>$1bn per annum) selling drugs.

Should these candidates be approved, therefore, given Ventyx’ market cap is currently just $1.7bn, investors might expect – based on (a relatively modest) peak sales expectation for both drugs of ~$2bn, that Ventyx’ share price could increase by as much as 500% – if we assume that a price to sales ratio of ~5x, which is the average of the “Big 8” US Pharma companies, is fair.

The bull case for BMY stock is much more modest. As I have discussed in other posts for Seeking Alpha, BMY faces the patent expiries of 2 of its best selling drugs – $12bn (in 2020) selling Revlimid, and $3.4bn (in 2021) selling Pomalyst, both indicated for blood cancers, and both without patent protection after 2023, whilst $11bn (in 2021) selling blood thinner Eliquis will lose patent protection in 2027.

Nevertheless, BMY has promised to keep growing its top line revenues – which were $46.4bn in 2021 – in the mid-single digits until 2028, whilst delivering $45 – $50bn of cash flow between 2022 and 2024. To achieve this, BMY is dependent on several recently approved drugs, such as cell therapies Abecma and Breyanzi, heart therapy Camzyos, leukemia therapy Onureg, blood cancer therapy Reblozyl, melanoma treatment Opdualog, and of course, Zeposia, and Sotyktu. Together, these assets are projected by management to achieve >$20bn of sales by 2028.

The good thing about BMY is that this is a huge Pharma paying a dividend of $0.54 per quarter, generating free cash flow of $10 – $15bn per annum, with 15 commercialized products, 8 of which achieve sales >$1bn per annum, 5 of which achieve sales >$3bn per annum, 3 of which achieve sales >$7bn per annum, and 2 of which achieve sales >$10bn per annum. 3 newly approved products are forecast to make >$4bn per annum peak sales, and 7 to make sales >$1bn, and there are 3 yet to be approved pipeline assets that could generate another $6bn of revenues per annum.

In other words, if you are investing in BMY, your downside risk is low, being mitigated by the dividend, the portfolio diversification, and the promising pipeline – not to mention the cash flow, and a cash plus short term investment position of >$13bn. On the other hand, a company as large as BMY does not typically deliver share price spikes. BMY stock is +11% across the past 5 years, and +16% across the past 12 months. The share price is lower today than it was back in 2016. I think buying BMY stock is similar to buying a fixed income security.

In the case of Ventyx, the biotech’s exciting growth potential is only matched by the high risk of failure, and a collapsing share price. Ventyx only joined the Nasdaq in October last year, raising $152m at $16 per share, and shares had dipped below $10 in March this year, before the Sotyktu approval news sent them surging to nearly $40.

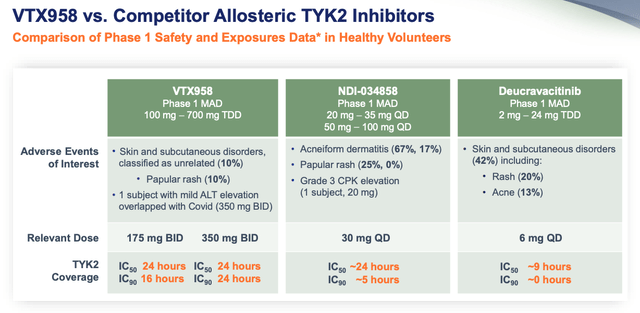

Whether it is a good idea to bet on one company’s drug because another company’s similar drug was approved is questionable, even if early data supports evidence of superiority, as per the below slide from a Ventyx investor presentation.

Early VTX958 data suggests superiority against Deucravacatinib. (presentation)

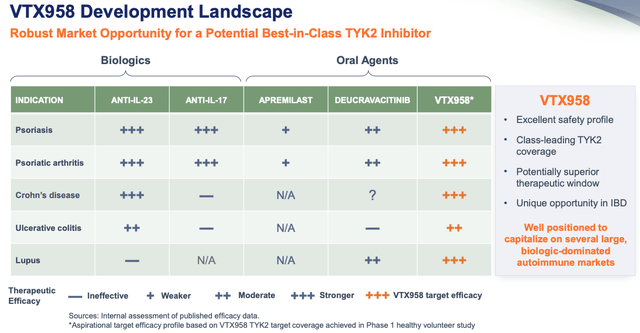

Ventyx says it will initiate a Phase 2 study before the end of the year, and the company is not just targeting Psoriasis, but Psoriatic Arthritis, Crohn’s Disease, Ulcerative Colitis, and even Lupus, believing that VTX958 has the edge in every market.

VTX958 Development landscape. (presentation)

If that were true, we would be talking about a drug capable of becoming the next Humira – AbbVie’s miraculous autoimmune drug that generated revenues >$20bn in 2021, and will likely do so again in 2022, before it finally loses patent exclusivity in 2023.

Realistically, however, VTX958 has not yet been tested thoroughly enough to make those kinds of claims. First, the drug needs to deliver not only in a Phase 2, but after that, a pivotal Phase 3 trial, likely in just 1 indication, and then seek approval, which could come, in a perfect scenario, perhaps as early as late 2024. Only then could the company start thinking about a label expansion.

Ventyx opted to raise ~$176m in an at-the-market share offering last week, after registering its share price gains, so the company is cash rich, with ~$425m cash at its disposal, expected by management to last until 2025. The company has burned through just $43m of cash in the first half of 2022, although costs will increase as clinical trials become larger in size, whilst the pressure to deliver and market scrutiny will also increase.

As for VTX002, management believes that the current Phase 2 trial could serve as one of two pivotal trials required in order to seek regulatory approval. This will be the first study with a key primary endpoint of genuine relevance, being in this case clinical remission from moderate-to-severe UC.

Finally, it would not be fair to say that Ventyx isn’t reasonably well-hedged against a study failure. Besides VTX958 and VTX002, there is also VTX2735, which as demonstrated “broad activity against multiple NLRP3 mutations” in a Phase 1 trial in patients with CAPS – a disease Ventyx describes as

An ultra-orphan auto-inflammatory disease caused by various mutations in NLRP3 and characterized by inappropriate release of IL-1β and symptoms of recurrent systemic inflammation

There is also a brain penetrant NLPR3 inhibitor candidate, VTX3232, which Ventyx believes could be adapted to target Parkinson’s Disease, Alzheimer’s and other CNS indications. The company hopes to complete Investigational New Drug (“IND”) enabling studies and gain FDA approval to initiate a Phase 1 trial in 2023, while progressing VTX2735 into a Phase 2 CAPS study before the end of this year.

Conclusion: BMY Brings 2 Best-in-Class Auto-Immune Therapies To Market – Ventyx May Follow Suit – Why Not Buy Both?

I have been bullish on BMY in several recent notes for Seeking Alpha, and I see the Deucravacatinib approval as a better-than-expected result, given the absence of a black box warning. The higher peak sales forecast of $4bn (I had previously modeled for $2bn) is impressive, although the performance of Zeposia to date has been underwhelming, so I would be tempted to lower my peak sales forecast for that drug from $5bn, to $3bn.

In other words, I would not change my price target from BMY stock of ~$93 – or a 44% premium to today’s price – based on the Sotyktu approval alone. I would also add a qualifier that $93 represents the target price in a near-perfect scenario – BMY stock has never traded that high, and whilst it is certainly not unthinkable, investors should probably content themselves with a dividend yielding ~3%, and a price target of $80 – $85 in the near (12-18 months) term, to avoid being disappointed, and to factor in risks including interest and inflation, recession, and an anticipated war on drug pricing (which admittedly never quite seems to materialize).

Regarding Ventyx, notwithstanding the early stage nature of data produced so far, and the recent price surge, I believe the risk reward profile here remains attractive. It is interesting to note, for example, that Pfizer (PFE) recently paid $6.7bn to acquire Arena Pharmaceuticals. Arena’s only asset of note was Etrasimod, another member of the S1P modulator class, which has recently returned Phase 3 data in UC that is likely good enough for an approval, and potentially, standard of care status. Today, Ventyx is valued at $1.7bn.

Buying Arena was a calculated gamble on Pfizer’s part that has paid off, with the drug achieving a 27% clinical remission rate in its pivotal trial in UC. Whilst Arena was bought out having already delivered some positive Phase 2 and 3 data, other Pharma’s looking to achieve similar success with an M&A deal may well be looking at Ventyx – perhaps even BMY.

As such, I would make both BMY and Ventyx potential buys, although whilst I would buy BMY today, I would be tempted to play a waiting game with Ventyx.

Biotech valuations almost inevitably fall during periods of light news flow, and that has already begun to happen with Ventyx – its stock has drifted from $39, immediately after the Sotyktu approval news, to $33 at the time of writing. The next major catalyst may be the VTX002 data due next year. I would anticipate being able to pick up Ventyx at a cheaper price in the run up to that release than today, when the hype cycle is at its peak.

Be the first to comment