Morsa Images

Being born in a stable does not make one a horse. ” – Duke of Wellington

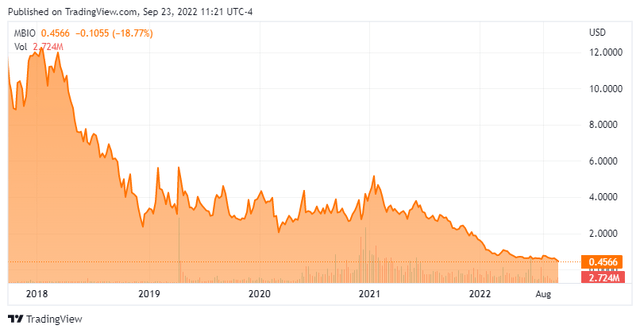

We put the spotlight on Mustang Bio, Inc. (NASDAQ:MBIO) today for the first time in nearly 18 months. When we last looked at this small biotech name in May of 2021, insiders were purchasing the shares and MBIO seems to merit a small covered call holding. Unfortunately, for shareholders and insiders, that bet has not paid off. So, is there any hope left for this developmental firm or is it a dead horse that deserves to be left alone? An analysis follows below.

Mustang Bio Overview:

Mustang Bio, Inc. is a clinical-stage biopharmaceutical company based in Massachusetts. Mustang is focused on translating today’s medical breakthroughs in cell and gene therapies into potential cures for hematologic cancers, solid tumors and rare genetic diseases. The stock currently sells for around a half a buck a share and sports an approximate market capitalization of $55 million.

August Company Presentation

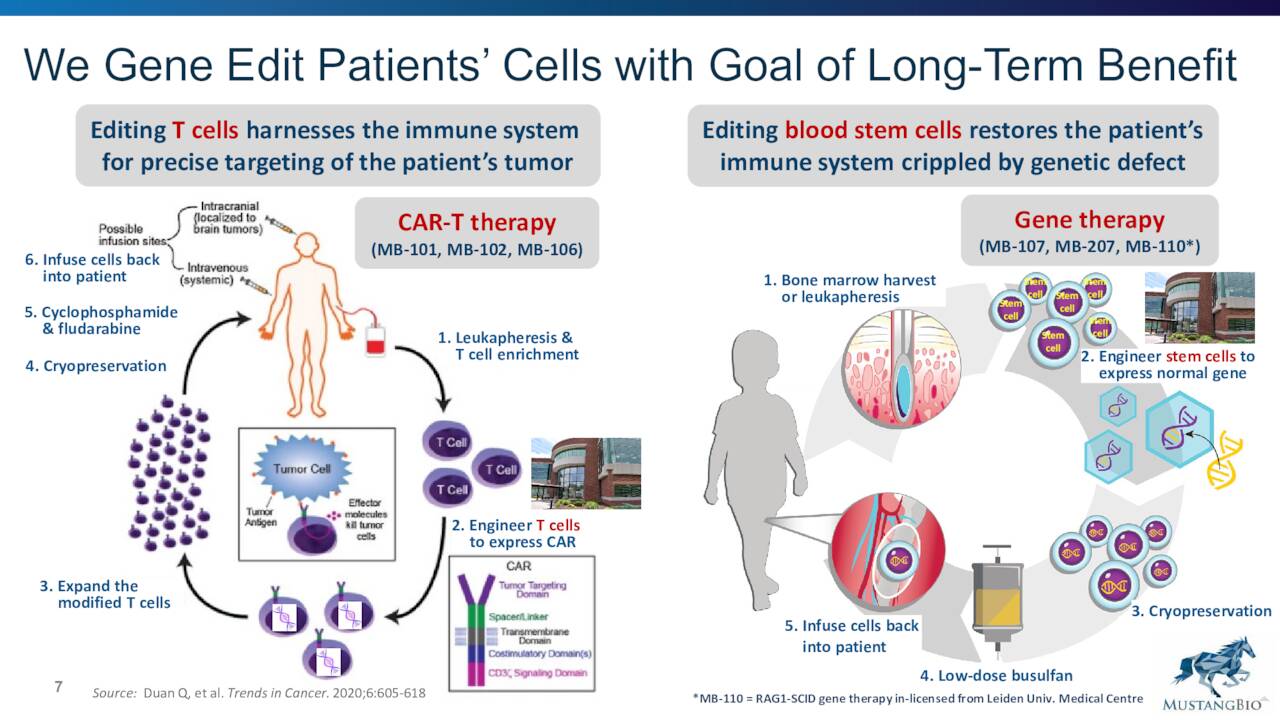

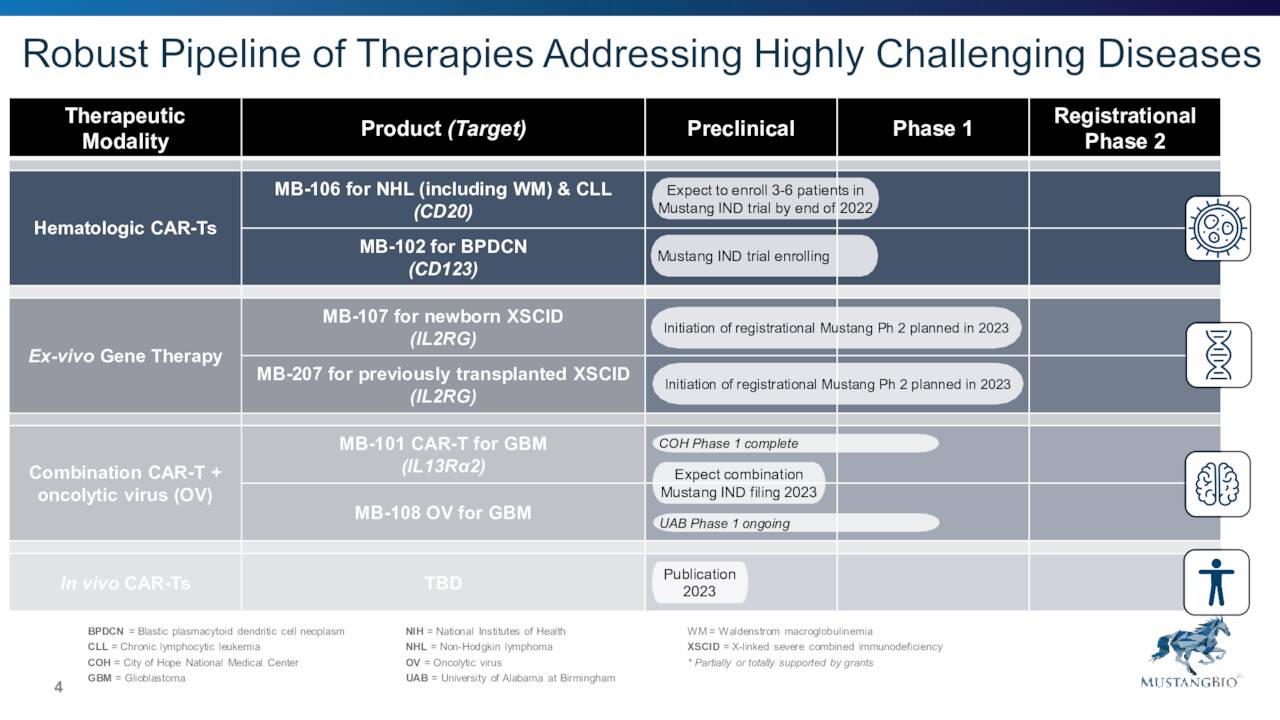

The company is developing CAR-T therapies designed to be effective against multiple cancer types as well as lentiviral gene therapies for severe combined immunodeficiency.

August Company Presentation

As you can see above, the company has several efforts underway within its pipeline. We will focus on Mustang’s two Ex-vivo Gene Therapies (MB-107 and MB-207) for the purposes of this article given they are the farthest along in development.

August Company Presentation

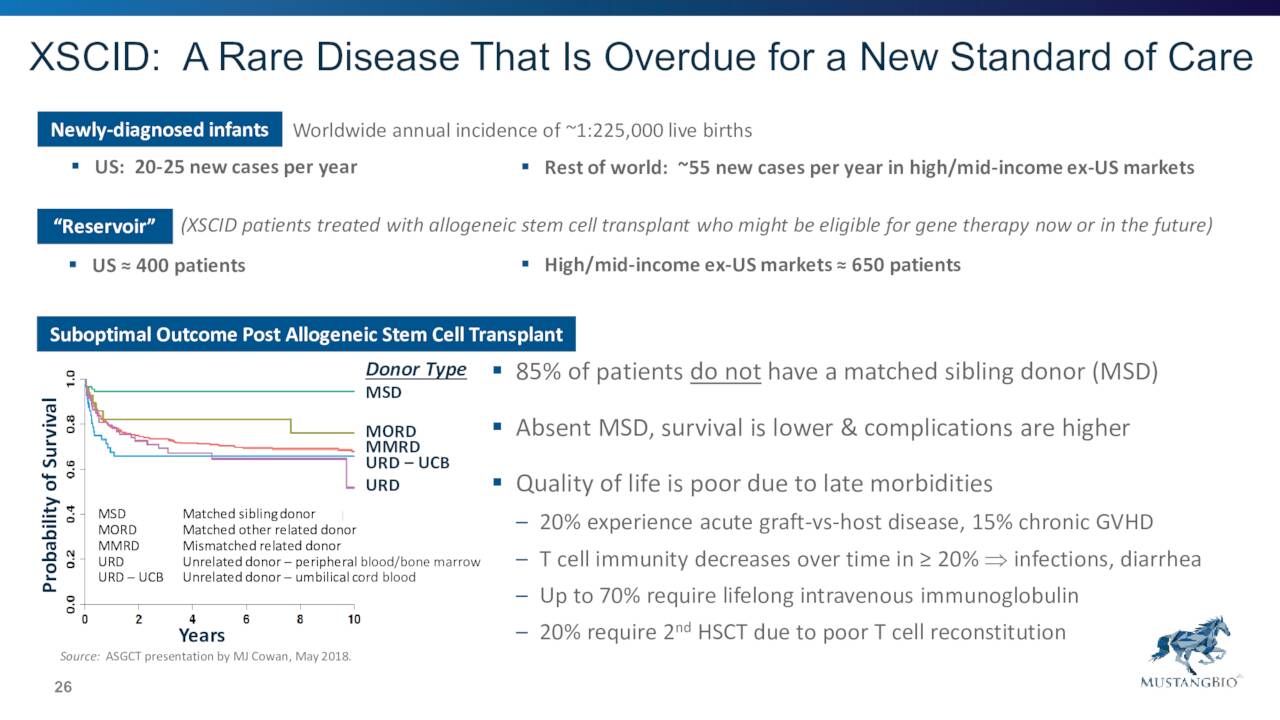

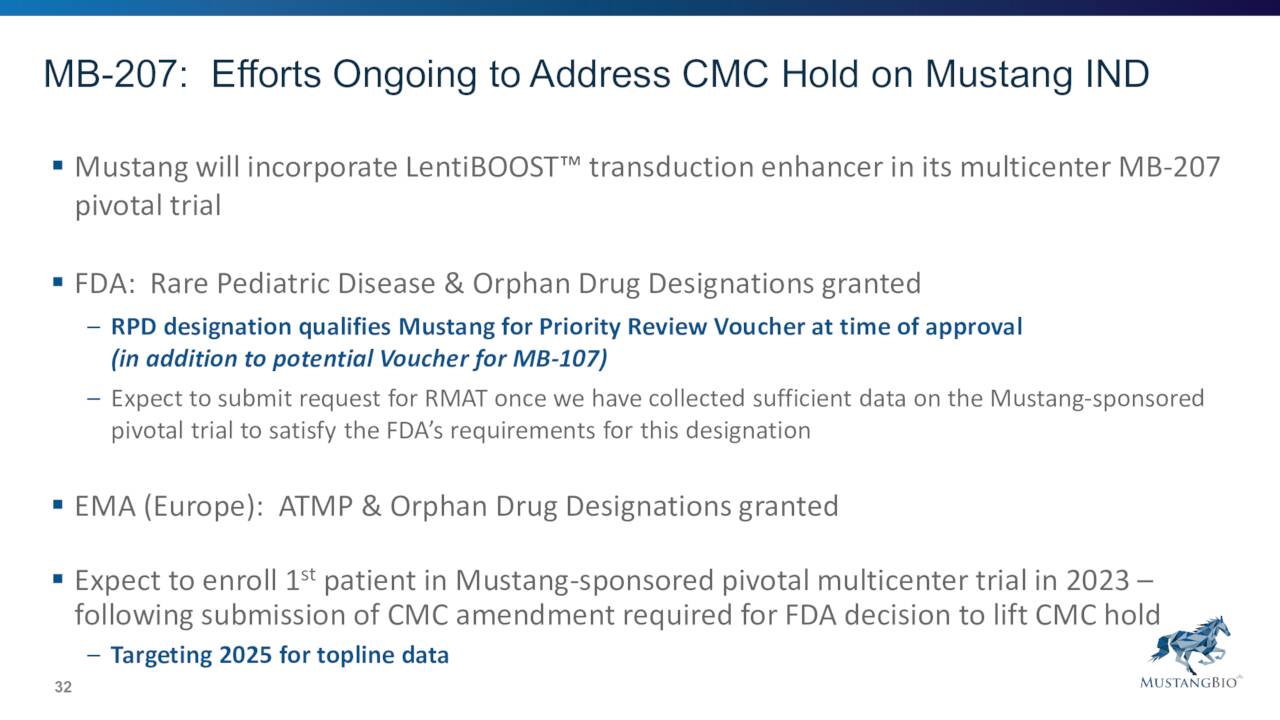

MB-207 is targeting a very rare affliction called X-linked severe combined immunodeficiency, or XSCID, and is a lentiviral gene therapy. This candidate has garnered both Orphan Drug and Rare Pediatric Disease Designations.

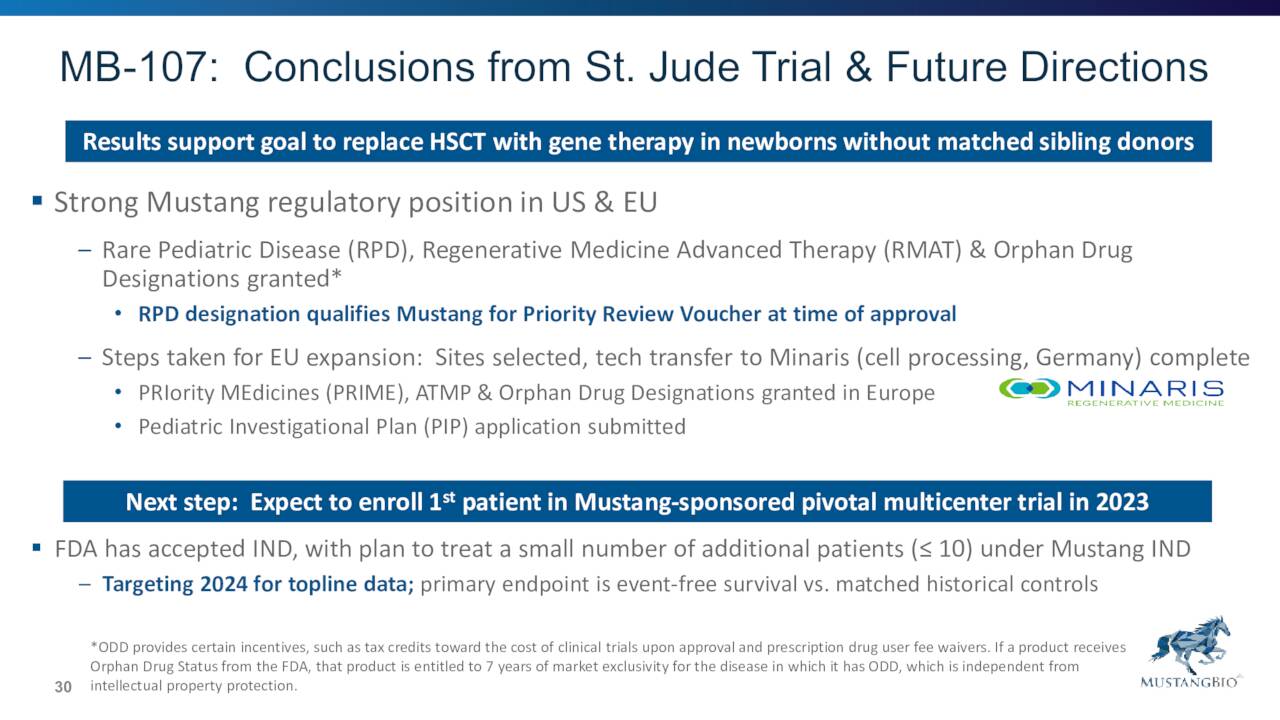

MB-107 is another ex vivo lentiviral gene therapy for X-linked SCID (“XSCID”) in newly diagnosed infants under the age of two. Management presented at the American Society of Gene & Cell Therapy 25th Annual Meeting in May. Data showed all 23 treated patients were alive at 2.6-year median follow-up without evidence of malignant transformation, and the treatment established a stable, functioning immune system in patients.

August Company Presentation

Mustang expects to enroll the first patient in a pivotal multicenter Phase 2 clinical trial under Mustang’s IND to evaluate MB-107 in 2023 and is targeting 2024 for topline data. The company filed an IND application in late 2021 for its pivotal multicenter Phase 2 clinical trial of MB-207. That trial is currently on hold pending CMC clearance from the FDA. Based on feedback, management expects to enroll the first patient in this pivotal study sometime in 2023.

August Company Presentation

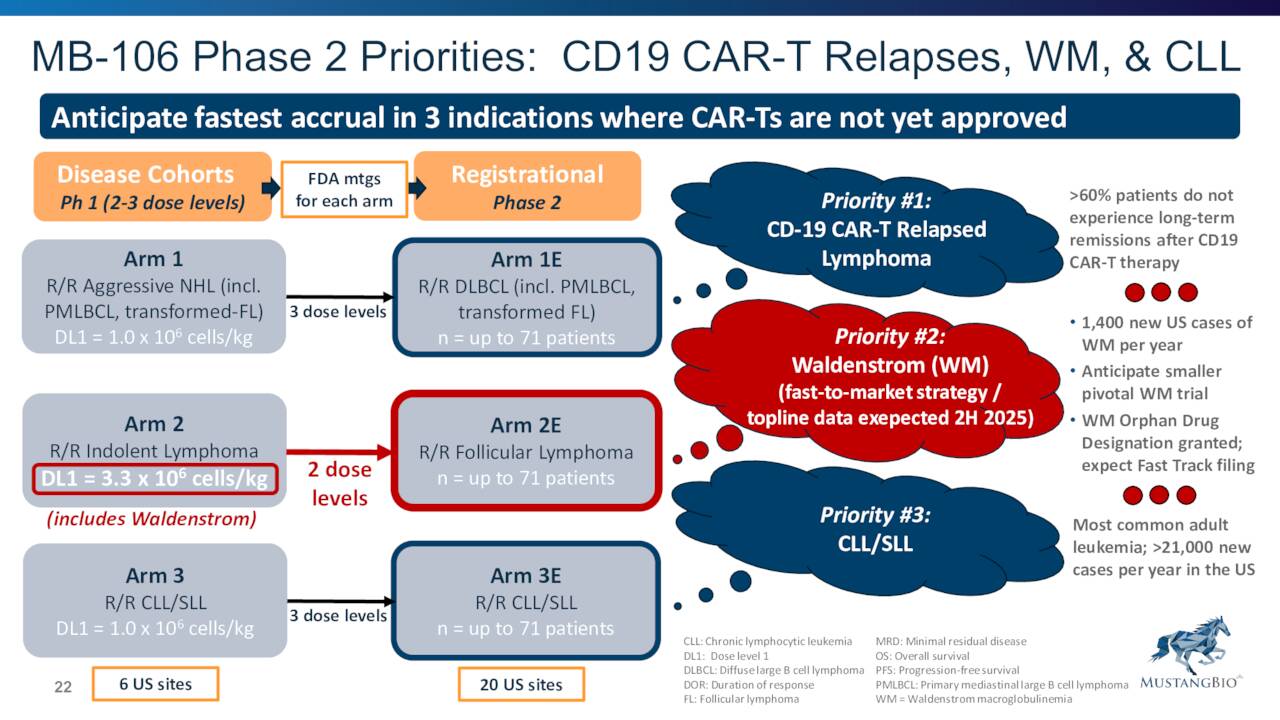

In addition, interim Phase 1/2 clinical trial data around Mustang’s drug candidate MB-106 were presented at several conferences during the Spring. MB-106 is a CD20-targeted, autologous CAR T cell therapy for patients with relapsed or refractory B-cell NHL and CLL. MB-106 has Orphan Drug designation for Waldenstrom macroglobulinemia [WM], a rare type of B-cell non-Hodgkin lymphomas [B-NHLs]. Data presented demonstrated high efficacy and a favorable safety profile across all patients with a wide range of hematologic malignancies with no cytokine release syndrome or immune effector cell-associated neurotoxicity syndrome greater than grade 2. The first patient in a multicenter Phase 1/2 clinical trial evaluating the safety and efficacy of MB-106 for relapsed or refractory B-NHL and CLL under Mustang’s IND should begin dosing shortly.

August Company Presentation

Analyst Commentary & Balance Sheet:

Since late April, four analyst firms including BTIG and B. Riley Financial have reissued Buy ratings on the stock. Price targets proffered range from $4 to $8 a share. Here is the view from Oppenheimer’s analyst who maintained his Outperform rating on MBIO with $8 price target on April 26th.

New data from an academic-sponsored trial of Mustang’s CD20 CAR-T program (MB-106) were presented at the 2022 Tandem Meetings in Transplantation & Cellular Therapy (TCT) on Sunday. The presentation included safety and efficacy data from 25 patients—including five new patients since the last update at ASH. In our view, the maturing data point to dose-dependent efficacy across a broad range of heavily-pretreated B-NHL and CLL patients. The ORR/CR rates across all tumor histologies were 96% and 72%, respectively (vs. 95% and 65% at ASH), with no ≥Grade 3 CRS or neurotox. Mustang plans to initiate a multicenter, company-sponsored Phase 1 trial in 2Q, and we continue to view MB-106 as an attractive potential alternative to currently approved CD19 CAR-T products“

Surprisingly, less than one percent of the outstanding float is currently held short given the high beta nature of the stock. There has been no insider activity in the stock so far in 2022. At the end of the first of this year, the company had cash and cash equivalents and restricted cash of just under $110 million. The company posted a net loss of $19.1 million in the second quarter. Mustang has just north of $25 million in long term debt and has $45 million available on a term loan facility

Verdict:

Like most CAR-T concerns targeting rare indications, development progress can seem like it is moving slower than molasses in the winter time. That said, the company has multiple “shots on goal.” Both MB-107 and MB-207 would be eligible for rare pediatric disease vouchers should they be approved. These vouchers go for north of $100 million a pop in the open market.

In addition, the stock is trading for less than the net cash on the balance sheet even as it is likely the company will raise additional capital, most likely in 2023. Insiders are not sellers of the stock despite the decline in the shares over the past year, and the analyst community still seems to be sanguine on Mustang’s long-term prospects.

Add it all up, and this developing story still appears to merit a small “watch item” holding while hoping this Mustang will one day gallop on the back of successful pipeline developments.

Some people regard private enterprise as a predatory tiger to be shot. Others look on it as a cow they can milk. Not enough people see it as a healthy horse, pulling a sturdy wagon.” – Winston Churchill

Be the first to comment